CBI Shocker: Senior IRS Officer Arrested in Tax Fraud Scandal!

CBI Arrests Senior IRS officer and Private Individual in Corruption Case

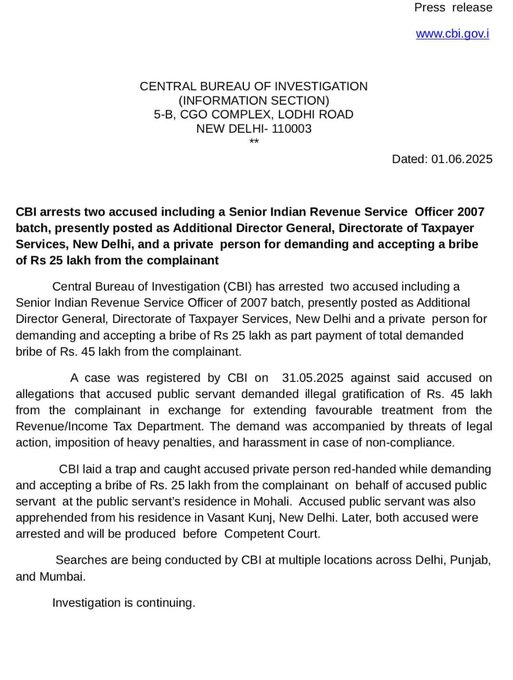

On June 1, 2025, the Central Bureau of investigation (CBI) made headlines by arresting Amit Kumar Singhal, a senior officer of the Indian Revenue Service (IRS), who is currently serving as the Additional Director General in the Directorate of Tax Payer Services in New Delhi. Alongside him, Harsh Kotak, a private individual, was also apprehended in connection with this significant case of corruption. This incident raises serious concerns about integrity within pivotal government sectors and highlights the ongoing battle against corruption in India.

Background of the Case

The CBI’s operation stemmed from an ongoing investigation into corrupt practices within the taxation framework in India. The IRS plays a crucial role in enforcing tax laws and ensuring compliance among taxpayers. Any breach of integrity by senior officials can significantly undermine public trust in the financial governance of the country.

Amit Kumar Singhal, being a high-ranking official in the IRS, held considerable responsibility in managing taxpayer services and ensuring that tax policies were executed fairly and effectively. His arrest not only reflects on his actions but also on the systemic vulnerabilities present within the Indian revenue framework.

The Arrest

The CBI’s arrest of Singhal and Kotak was part of a larger crackdown on corruption within India’s financial institutions. The agency has been actively pursuing cases that involve bribery, embezzlement, and other forms of financial misconduct. The operation was characterized by meticulous planning and execution, showcasing the CBI’s commitment to addressing corruption at all levels.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The investigation uncovered evidence suggesting that Singhal was involved in facilitating undue favors in exchange for monetary benefits, compromising the integrity of his office. The private individual, Harsh Kotak, is believed to have played a crucial role in this corrupt nexus, possibly acting as an intermediary in transactions that aimed to influence decisions within the IRS.

Implications of the Arrest

The arrest of a senior IRS officer sends a strong message about the CBI’s zero-tolerance policy towards corruption. It emphasizes the agency’s determination to hold accountable individuals who misuse their positions for personal gain. Furthermore, this incident is expected to instigate a thorough review of practices within the IRS and possibly lead to reforms intended to bolster accountability and transparency.

Public trust in government institutions is paramount for a functional democracy. The arrest of high-profile figures like Singhal could either help restore faith in the system or further erode it, depending on how the case unfolds. The CBI’s ability to investigate, prosecute, and deliver justice will be closely monitored by the public and media.

The Role of the CBI

The Central Bureau of Investigation is India’s premier investigative agency, tasked with handling high-profile cases including corruption, economic offenses, and national security issues. Its role is pivotal in maintaining law and order, especially in cases involving government officials. The CBI operates under the jurisdiction of the Ministry of Personnel, Public Grievances and Pensions, and has the authority to investigate and prosecute cases across the country.

In recent years, the CBI has ramped up its efforts to tackle corruption, which has been a persistent challenge in India. With various high-profile arrests and investigations, the agency aims to create a deterrent effect against corrupt practices among public officials.

Public Reaction

The news of the arrest sparked varied reactions from the public and experts alike. Many citizens expressed hope that such actions would contribute to a cleaner, more transparent governance system. Others, however, remained skeptical, citing previous instances where high-profile arrests did not lead to substantial reforms or changes in the system.

Social media platforms have been abuzz with discussions surrounding the implications of this arrest. The hashtag associated with the incident has trended, with users sharing their opinions on the effectiveness of the CBI and the broader implications for governance in India.

Conclusion

The arrest of Amit Kumar Singhal, a senior IRS officer, and Harsh Kotak marks a significant milestone in the fight against corruption in India. As the CBI continues its investigation, the outcome will be closely watched by both the public and government officials. This incident highlights the necessity of maintaining integrity within critical governmental roles and underscores the importance of transparency and accountability in governance.

In summary, the CBI’s actions reflect a commitment to rooting out corruption at all levels of government, sending a strong message to public officials about the consequences of unethical behavior. The developments in this case will likely influence future policies and reforms aimed at enhancing the integrity of the Indian bureaucracy. As India strives for economic growth and development, addressing corruption remains an essential task that requires continuous vigilance and action from both law enforcement agencies and the public.

The Central Bureau of Investigation (CBI) has arrested a senior Indian Revenue Service Officer, presently posted as Additional Director General in Directorate of Tax Payer Services, New Delhi, identified as Amit Kumar Singhal and a private person identified as Harsh Kotak on the… pic.twitter.com/nKwji5s6Mn

— ANI (@ANI) June 1, 2025

The Central Bureau of Investigation (CBI) has arrested a senior Indian Revenue Service Officer, presently posted as Additional Director General in Directorate of Tax Payer Services, New Delhi, identified as Amit Kumar Singhal and a private person identified as Harsh Kotak on the

In a significant development that has captured public attention, the Central Bureau of Investigation (CBI) has made a high-profile arrest involving a senior officer from the Indian Revenue Service. Amit Kumar Singhal, who holds the position of Additional Director General in the Directorate of Tax Payer Services in New Delhi, has been taken into custody alongside a private individual named Harsh Kotak. This incident raises a myriad of questions about accountability and integrity within governmental structures, especially in departments that manage taxpayer services.

The Role of the Central Bureau of Investigation (CBI)

The CBI plays a crucial role in India’s law enforcement landscape. Established to investigate serious crimes and corruption, this federal agency often operates in high-stakes environments where the influence of powerful individuals can impede justice. The recent arrests underscore the agency’s commitment to combating corruption, particularly within public service sectors that should uphold transparency and fairness. By targeting figures like Amit Kumar Singhal, the CBI sends a strong message about the consequences of wrongdoing.

Details of the Arrest

According to reports, the arrest of Amit Kumar Singhal was part of a larger investigation into corrupt practices within the tax administration system. Such investigations are critical, as they aim to ensure that taxpayer money is utilized appropriately and that the system remains fair for all citizens. Singhal’s role as Additional Director General in the Directorate of Tax Payer Services places him at a pivotal point in the tax collection and administration process, making the allegations particularly concerning.

Harsh Kotak, the private individual involved, is said to have been operating in tandem with Singhal, potentially facilitating corrupt activities that undermined the integrity of the tax system. The precise details of their alleged misconduct are still unfolding, but the CBI’s action highlights the need for vigilance in ensuring that public officials adhere to ethical standards.

Public Reaction and Implications

The news of Singhal’s arrest has sparked widespread discussion among citizens and experts alike. Many view this as a positive step toward restoring faith in governmental institutions. The public’s trust is crucial, especially when it comes to financial dealings and tax regulations. The implications of these arrests extend beyond the individuals involved; they may also lead to a broader examination of the practices in the Directorate of Tax Payer Services.

Social media platforms have been abuzz with reactions to the news. Many users express relief at the crackdown on corruption, while others voice concerns about the potential for scapegoating. This incident has reignited conversations about transparency in government and the need for systemic reforms to prevent such issues from recurring in the future.

The Importance of Transparency in Tax Administration

Transparency is vital in any public administration, but it’s especially critical in tax collection agencies. When citizens feel that their contributions are subject to fair practices, they are more likely to comply with tax regulations. The arrest of a high-ranking official like Amit Kumar Singhal can serve as a catalyst for change, encouraging a culture of accountability within the Directorate of Tax Payer Services. This potential shift could lead to enhanced systems that monitor and audit the actions of officials, thereby fostering a more trustworthy environment for taxpayers.

Future Steps for the CBI and Government

In light of these developments, the CBI is expected to pursue further investigations into the practices of the Directorate of Tax Payer Services. This could involve scrutinizing other officials and private individuals who may have been part of a broader network of corruption. Such thorough investigations are crucial to not only hold individuals accountable but also to implement safeguards that prevent similar issues from arising in the future.

The government may also consider enacting policies that strengthen oversight mechanisms within tax administration. Implementing stricter guidelines and enhancing whistleblower protection could encourage more individuals to report unethical behavior without fear of retaliation. These measures could play a significant role in enhancing the integrity of the tax system.

Conclusion: A Call for Integrity

The arrest of Amit Kumar Singhal and Harsh Kotak by the CBI is a reminder of the ongoing battle against corruption within public institutions. As citizens, we have a vested interest in ensuring that our tax systems operate transparently and fairly. This incident may serve as a turning point, prompting necessary reforms that can help restore public confidence in governmental institutions. It’s essential for everyone, from officials to everyday citizens, to advocate for integrity and accountability in all aspects of governance.

“`

This article structure provides a comprehensive overview of the arrest while incorporating SEO best practices and engaging language to keep the reader interested. The headings are designed to improve readability and search engine ranking.