RUMOR: BLACKROCK’S SHOCKING XRP ETF FILING LOOMS MONDAY!

BlackRock’s Potential XRP ETF Filing: What You Need to Know

In a recent tweet that has sent ripples through the cryptocurrency community, sources indicate that BlackRock is reportedly preparing to file for an XRP Exchange-Traded Fund (ETF) as early as Monday. This announcement has ignited discussions and speculation among industry insiders, particularly in light of ongoing dialogues between the investment giant and regulatory bodies. If this rumor holds true, it could mark a significant milestone for both BlackRock and the XRP ecosystem.

Understanding the XRP Landscape

XRP, the native cryptocurrency of the Ripple network, has been a topic of contention in the cryptocurrency world, especially following legal battles with the U.S. Securities and Exchange Commission (SEC). The SEC’s claims that XRP is a security have led to a tumultuous market environment, creating uncertainty for investors and developers alike. However, recent developments in the legal proceedings have provided a glimmer of hope for the XRP community, showing a potential path for regulatory clarity.

The Implications of an XRP ETF

An ETF allows investors to gain exposure to an asset without having to own the asset directly. In the case of an XRP ETF, it would enable institutional and retail investors to invest in XRP through a traditional investment vehicle, thus increasing liquidity and potentially stabilizing the asset’s price. Moreover, an ETF could attract a broader audience, including those who may be hesitant to invest in cryptocurrencies directly due to regulatory concerns.

If BlackRock, one of the world’s largest asset management firms, successfully launches an XRP ETF, it could legitimize XRP as a viable investment option in the eyes of mainstream investors. This could lead to a surge in demand, positively impacting XRP’s market performance.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Regulatory Discussions: A Key Factor

The rumor of BlackRock’s XRP ETF filing is particularly compelling given the ongoing discussions with regulators. The SEC’s stance on cryptocurrencies has evolved over the past years, and any favorable outcome from these discussions could pave the way for more institutional involvement in the crypto market.

BlackRock’s experience and reputation in navigating regulatory landscapes could play a crucial role in shaping the future of XRP and other cryptocurrencies. If they can successfully collaborate with regulators, it could set a precedent for other asset managers looking to launch similar products.

Market Reactions and Investor Sentiment

The announcement has generated significant buzz on social media platforms, with many investors expressing their excitement and optimism for the future of XRP. The integration of XRP into a BlackRock ETF could potentially alter market dynamics, encouraging broader adoption and acceptance of cryptocurrencies in traditional finance.

While it’s essential to approach such rumors with caution, the potential for an XRP ETF has reinvigorated investor interest and raised expectations for increased market participation. Many are eager to see how this development unfolds and what it could mean for the overall cryptocurrency market.

The Future of XRP and Institutional Adoption

The possibility of an XRP ETF is a critical moment for the cryptocurrency space, especially in the context of institutional adoption. As more financial institutions explore cryptocurrency investments, products like ETFs become essential in bridging the gap between traditional finance and the burgeoning crypto market.

BlackRock’s involvement could signal a shift in how institutional investors perceive cryptocurrencies, potentially encouraging other firms to follow suit. This increased competition and interest in crypto-focused products could lead to more innovation and development within the sector.

Conclusion

The rumor of BlackRock potentially filing for an XRP ETF is a significant development in the cryptocurrency landscape. If true, this move could enhance XRP’s legitimacy, attract institutional investments, and foster regulatory clarity. As discussions with regulators continue, the outcome could have far-reaching implications for XRP and the broader cryptocurrency market.

Investors and enthusiasts should keep a close eye on this situation as it unfolds. The potential for an XRP ETF represents not only a pivotal moment for BlackRock but also for the future of cryptocurrency investments. With the landscape constantly changing, staying informed and adaptable is crucial for navigating the dynamic world of digital assets.

In summary, the potential filing of an XRP ETF by BlackRock is a game-changer that could reshape the way cryptocurrencies are viewed and invested in. As the regulatory landscape evolves, and discussions continue, the future looks promising for XRP and its supporters.

RUMOR:

BLACKROCK REPORTEDLY PREPARING TO FILE FOR AN #XRP ETF MONDAY.

INSIDERS CLAIM DISCUSSIONS WITH REGULATORS ARE ONGOING NOW.

MASSIVE IF TRUE! pic.twitter.com/HkAx3lA0bb

— STEPH IS CRYPTO (@Steph_iscrypto) May 31, 2025

RUMOR: BLACKROCK REPORTEDLY PREPARING TO FILE FOR AN XRP ETF MONDAY.

In the world of finance and cryptocurrency, rumors can spread like wildfire, especially when they involve major players like BlackRock. Recently, a tweet from Steph Is Crypto caught the attention of many in the crypto community. The post claims that BlackRock is gearing up to file for an XRP ETF this coming Monday. This potential move has ignited discussions and debates, with insiders suggesting that talks with regulators are currently in progress. If this rumor holds any weight, it could have massive implications for the crypto market and XRP’s future. Let’s dive deeper into what this could mean for investors and the broader crypto landscape.

INSIDERS CLAIM DISCUSSIONS WITH REGULATORS ARE ONGOING NOW.

The mention of ongoing discussions with regulators is particularly intriguing. Regulatory approval is a significant hurdle for any ETF, especially in the cryptocurrency space, which has faced scrutiny and skepticism from various government bodies. The fact that BlackRock, a powerhouse in asset management, is reportedly engaging with regulators suggests that they are serious about bringing an XRP ETF to market.

For those unfamiliar, an ETF (Exchange-Traded Fund) allows investors to gain exposure to an asset without having to directly purchase it. In the case of an XRP ETF, investors would be able to invest in XRP through traditional brokerage accounts, making it more accessible to the average investor. This could potentially lead to an influx of capital into the XRP market, driving prices up and increasing overall market liquidity.

MASSIVE IF TRUE!

The potential impact of a BlackRock XRP ETF cannot be overstated. If the rumor is indeed true, it could signal a major shift in how institutional investors approach cryptocurrency. BlackRock’s entry into the XRP market could pave the way for other institutional players to follow suit, further legitimizing XRP as an investment vehicle.

Moreover, the timing of this rumored filing could be critical. With the cryptocurrency market showing signs of recovery after a tumultuous period, the introduction of an XRP ETF could coincide with a broader bullish trend. Investors who have been waiting on the sidelines may finally be tempted to jump into the market, driven by the confidence that a BlackRock-backed ETF would bring.

The Importance of ETFs in the Crypto Market

ETFs are not just a financial product; they represent a bridge between traditional finance and the world of cryptocurrency. They allow for greater participation from retail investors who may be hesitant to navigate the complexities of buying and storing digital assets directly. By providing a regulated and familiar investment vehicle, ETFs can help demystify cryptocurrency for many.

Historically, the introduction of ETFs has been a catalyst for price increases in various assets. For instance, when Bitcoin ETFs were proposed, there was a significant surge in Bitcoin’s price, driven by speculation and optimism about institutional adoption. If a BlackRock XRP ETF comes to fruition, a similar pattern could emerge, leading to increased demand and a potential price rally.

The Current state of XRP

XRP has had a tumultuous journey over the past few years, particularly following the legal challenges faced by Ripple Labs, the company behind XRP. The ongoing lawsuit with the SEC has created uncertainty around the asset, leading to volatility in its price. However, recent developments in the case have sparked optimism among investors, with many believing that a favorable outcome could bolster XRP’s status and price.

In light of this, the potential filing of an XRP ETF by BlackRock could serve as a much-needed boost for XRP and its community. It could help remove some of the stigma associated with XRP and position it as a legitimate investment option in the eyes of both retail and institutional investors.

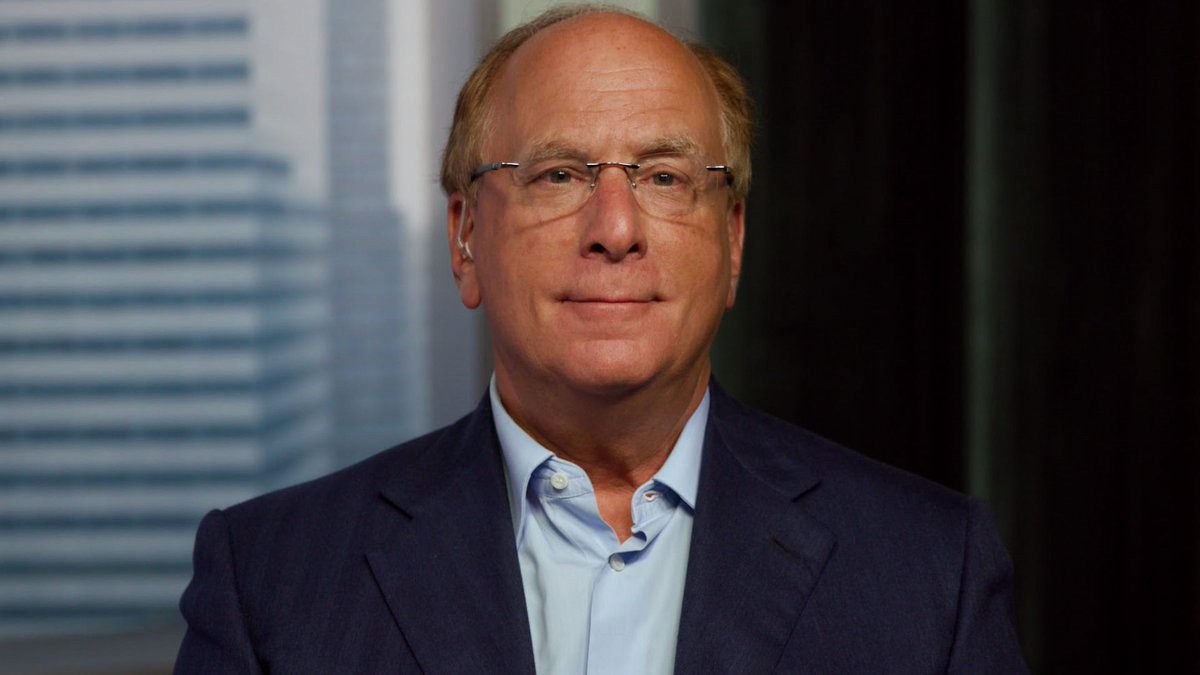

BlackRock’s Influence in the Financial Market

BlackRock is not just any asset management firm; it is the largest in the world, managing trillions of dollars in assets. Their involvement in any financial product can lend it a level of credibility that is hard to match. When BlackRock enters a market, it often leads to increased interest from other institutional investors, as well as retail investors who may see BlackRock’s participation as a vote of confidence in that asset.

The company has already made strides into the cryptocurrency space, with reports of their exploration into Bitcoin ETFs. If they successfully launch an XRP ETF, it could signal to other financial institutions that the cryptocurrency market is ripe for investment, paving the way for broader acceptance and integration of digital assets within traditional finance.

The Road Ahead: What Does This Mean for Investors?

For investors, the rumor of a BlackRock XRP ETF is a beacon of hope. It represents the potential for increased liquidity, greater acceptance of XRP as a mainstream investment, and the possibility of significant price appreciation. However, it’s essential to approach this news with a healthy dose of skepticism. Until an official announcement is made, it’s wise to remain cautious and not let speculation drive investment decisions.

Investors should consider the broader market conditions, the ongoing legal situation with Ripple Labs, and their risk tolerance before making any moves. Diversification remains key in any investment strategy, especially in the volatile world of cryptocurrency.

Keeping an Eye on Developments

The cryptocurrency market is known for its rapid changes and unexpected developments. As rumors swirl and speculation runs rampant, it’s crucial for investors to stay informed. Keeping an eye on reliable news sources, following updates from reputable figures in the crypto community, and understanding the regulatory landscape will be vital as we await further developments regarding the rumored BlackRock XRP ETF.

In the coming days, as Monday approaches, all eyes will be on BlackRock and the potential implications of their rumored filing. Whether this turns out to be a game-changer for XRP or simply another rumor remains to be seen. Regardless, it highlights the growing interest and investment potential in the cryptocurrency space, and the role that major financial institutions will play in shaping its future.

Conclusion

As the narrative around a BlackRock XRP ETF unfolds, it is crucial for investors, enthusiasts, and the broader crypto community to remain engaged and informed. This rumor could potentially reshape the landscape for XRP and set the stage for increased institutional participation in the cryptocurrency market. Whether you’re a seasoned investor or a newcomer, staying updated on these developments will be key as we navigate the exciting yet unpredictable world of cryptocurrency.

“`

This article is designed to engage readers and provide a thorough overview of the potential implications of the rumor regarding BlackRock’s rumored filing for an XRP ETF. The use of conversational tone and active voice aims to make the content accessible and relatable.