Ripple’s Bold Move: Bank-Grade Custody Shakes Wall Street Crypto!

Ripple’s Advancements in Crypto Custody Solutions

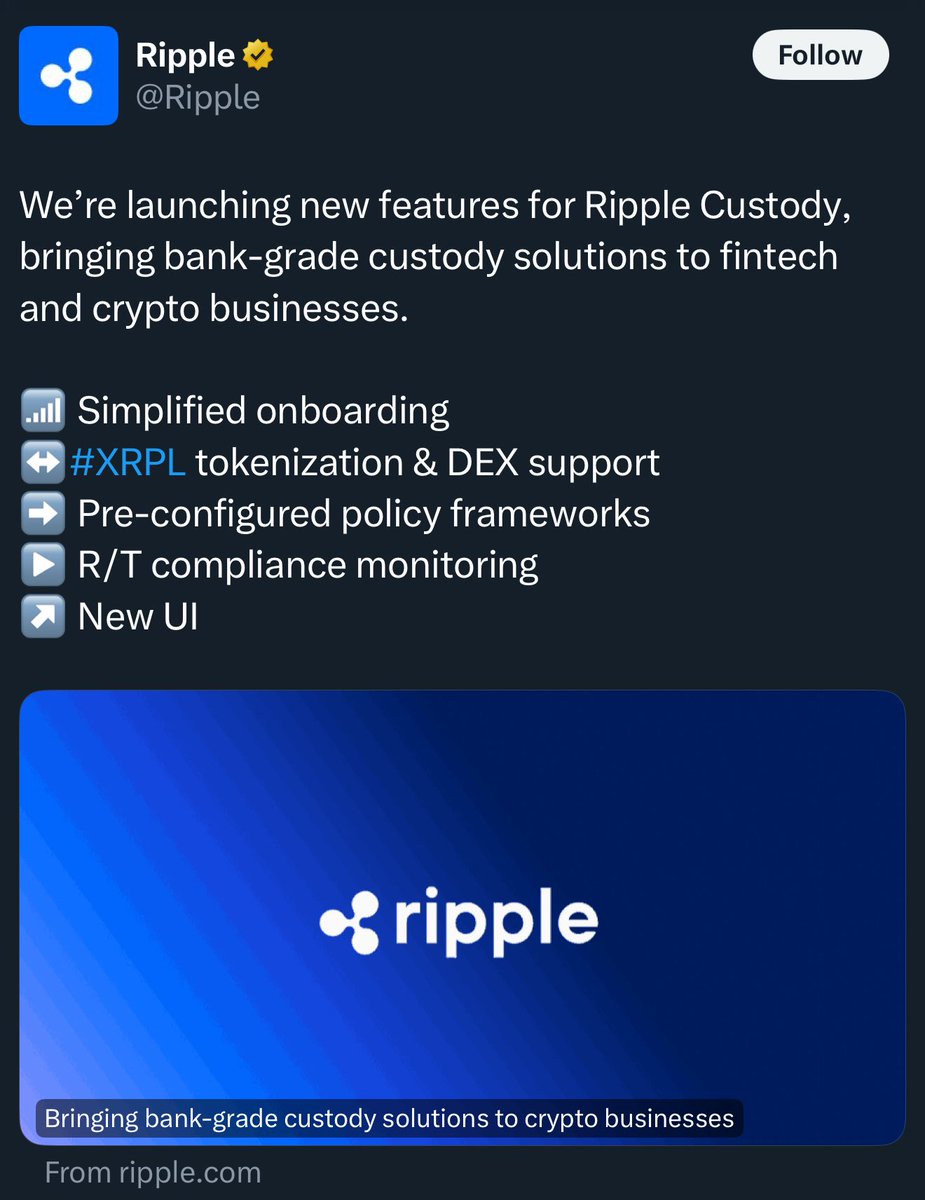

In recent developments within the cryptocurrency sector, Ripple has taken significant strides towards offering bank-grade custody solutions. This evolution comes at a time when Wall Street’s crypto custody services are also witnessing remarkable advancements. The tweet from SMQKE highlights these developments with a visual diagram, indicating a clear trend in the crypto custody landscape. This summary will delve into the implications of Ripple’s initiatives and the broader context of custody solutions in the cryptocurrency market.

Understanding Crypto Custody Solutions

Crypto custody refers to the service of holding and safeguarding digital assets on behalf of clients. This is crucial for institutional investors who require secure and compliant mechanisms to manage their cryptocurrency holdings. With the increasing adoption of cryptocurrencies, the need for reliable custody solutions has become paramount. Companies like Ripple are stepping up to meet this demand, ensuring that institutional players can enter the market with confidence.

Ripple’s Commitment to Custody Solutions

Ripple, known for its innovative approach to blockchain technology and its digital payment network, is now positioning itself as a leader in the custody space. By offering bank-grade solutions, Ripple aims to provide the security and regulatory compliance that institutions seek. This move is not merely a reaction to market demand; it represents Ripple’s strategic vision to integrate traditional finance with the burgeoning cryptocurrency ecosystem.

Wall Street’s Advancements in Crypto Custody

The tweet emphasizes that Wall Street’s crypto custody services have seen significant advancements, underscoring a trend of institutional engagement in the cryptocurrency market. Major financial institutions are increasingly recognizing the importance of offering robust custody services to their clients. This shift is crucial for fostering trust and encouraging more institutional investment in cryptocurrencies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Bank-Grade Solutions

Bank-grade custody solutions are characterized by their adherence to stringent security protocols and regulatory standards. These solutions are designed to mitigate risks associated with the storage and management of digital assets. For institutions, the assurance of safety and compliance is vital, as it allows them to fulfill their fiduciary responsibilities to clients while participating in the crypto market.

The Diagram’s Insights

While the tweet references a diagram illustrating the advancements in crypto custody services, the specifics of the diagram are not provided in the text. However, it is reasonable to infer that the diagram showcases the evolution of custody solutions over time, highlighting key players in the industry, their offerings, and the technological advancements that have propelled this sector forward. Such visual aids are instrumental in conveying complex information succinctly, allowing stakeholders to grasp trends and make informed decisions.

Market Implications of Enhanced Custody Solutions

The advancements in custody solutions, particularly by Ripple and Wall Street institutions, have far-reaching implications for the cryptocurrency market. Enhanced custody services are likely to attract more institutional investors, which could lead to increased liquidity and stability in the market. As traditional financial institutions embrace cryptocurrencies, the lines between conventional finance and digital assets continue to blur, paving the way for a more integrated financial ecosystem.

The Role of Security in Crypto Custody

Security remains a top priority in the development of crypto custody solutions. As the market matures, so do the threats associated with digital asset management. High-profile hacks and security breaches have underscored the need for robust security measures. Ripple’s commitment to bank-grade solutions signals an understanding of these challenges and a proactive approach to mitigating risks. Institutions are more likely to invest in cryptocurrencies when they have confidence that their assets are secure.

Regulatory Compliance and Trust

Regulatory compliance is another critical aspect of crypto custody. As governments and regulatory bodies worldwide establish frameworks to govern the use of cryptocurrencies, compliance becomes essential for custody providers. Ripple’s focus on bank-grade solutions suggests a commitment to meeting regulatory standards, which is crucial for instilling trust among institutional investors. The more compliant a custody solution is, the more likely it is to attract institutional clients who must adhere to strict regulatory requirements.

Future Trends in Crypto Custody

Looking ahead, the landscape of crypto custody solutions is poised for further evolution. As technology advances, we can expect to see innovations such as multi-signature wallets, decentralized custody solutions, and improved insurance products for digital assets. Ripple’s ongoing developments in this space will likely influence the trajectory of custody solutions and could set new standards for security and compliance.

Conclusion

In summary, Ripple’s readiness to offer bank-grade custody solutions is a significant development in the cryptocurrency market, particularly as Wall Street’s custody services continue to evolve. The focus on enhanced security and regulatory compliance underscores the importance of trust in attracting institutional investors. As the crypto landscape matures, the interplay between traditional finance and digital assets will shape the future of custody solutions. The insights shared in the tweet by SMQKE serve as a reminder of the ongoing advancements in this critical area of the cryptocurrency ecosystem, highlighting the importance of staying informed about the latest trends and developments.

By understanding these dynamics, stakeholders can better navigate the evolving landscape of crypto custody and position themselves for success in the burgeoning digital asset market.

Ripple is ready to offer bank-grade custody solutions, while Wall Street crypto custody services have seen the most advancements, as shown in the diagram below.

No coincidences.

See for yourself. https://t.co/VMsCTSOOy3 pic.twitter.com/XWF0Wurl6y

— SMQKE (@SMQKEDQG) May 30, 2025

Ripple is Ready to Offer Bank-Grade Custody Solutions

When it comes to crypto custody solutions, Ripple is making waves—quite literally. They are gearing up to provide bank-grade custody solutions that could redefine how institutions handle digital assets. The significance of this move is monumental, especially as the financial world continues to pivot towards the integration of cryptocurrencies into mainstream finance. With Ripple stepping up, the landscape for crypto custody is about to get a whole lot more secure and efficient.

But what does “bank-grade custody” mean exactly? It signifies a level of security and regulatory compliance that is on par with traditional banking systems. For institutions holding significant amounts of cryptocurrency, this kind of assurance is crucial. It means that their assets are safeguarded by the highest standards, reducing the risk of theft or loss. Ripple’s entry into this space could very well address the concerns that many traditional financial institutions have regarding the security of digital assets.

Wall Street Crypto Custody Services Have Seen the Most Advancements

As Ripple prepares to launch its custody solutions, it’s essential to take a step back and look at the broader trends in the industry. Wall Street has been making significant advancements in crypto custody services. This isn’t just a trend; it’s a clear indication that traditional finance is recognizing the value and necessity of secure digital asset management.

Major players on Wall Street are investing heavily in crypto custody solutions. Firms like Fidelity and Coinbase have already established custodial services that cater to institutional investors. These services are designed to provide a level of security that meets the rigorous standards set by the financial industry. With Ripple’s upcoming offerings, we could be on the brink of a new era in crypto custody solutions—one where institutions feel confident enough to dive headfirst into the crypto market.

The advancements in Wall Street’s custody services reflect a growing acceptance of cryptocurrencies. It’s no longer seen as a fringe market but as a legitimate asset class that deserves serious attention. The diagram shared in the original tweet illustrates these advancements, showcasing the evolution of custody solutions and how they’ve become more sophisticated over time.

No Coincidences

Now, you might be wondering, is this all just a coincidence? Absolutely not. The timing of Ripple’s entry into the custody space aligns perfectly with the advancements being made by Wall Street. This synchronicity is a clear signal that both traditional finance and innovative blockchain solutions are recognizing the need for enhanced security in the digital asset domain.

Ripple’s experience in the blockchain space positions it uniquely to provide these bank-grade solutions. They’ve been at the forefront of blockchain technology and its applications in finance for years. Their transition into custody solutions is a natural progression that highlights their commitment to addressing the needs of institutional investors.

Moreover, the rise of institutional interest in cryptocurrencies cannot be understated. As more hedge funds, pension funds, and large asset managers look to diversify their portfolios with digital assets, the demand for secure custody solutions will only continue to grow. Ripple’s readiness to provide these solutions will likely play a crucial role in meeting that demand.

See for Yourself

If you’re still skeptical about the advancements in crypto custody solutions, take a closer look at the developments happening within the industry. The data and trends don’t lie. As noted in the original tweet, the advancements are clear and well-documented. For those interested in the specifics, you can [check out the diagram here](https://t.co/VMsCTSOOy3) which visually represents the current state of crypto custody services.

As we look ahead, it’s exciting to think about the potential Ripple brings to the table. Their commitment to security, compliance, and innovation could very well set new standards in the industry. With Wall Street making strides and Ripple ready to support them, we’re entering a new chapter in the world of digital assets.

The Importance of Trust in Crypto Custody

Trust is a pivotal element when it comes to managing digital assets. With the rise of cryptocurrencies, the need for secure custody solutions has never been more paramount. Institutions want assurances that their assets are safe, and they’re looking for partners who can provide that level of security.

Ripple’s entry into bank-grade custody solutions is designed to foster trust among institutional investors. By aligning its offerings with the standards set by traditional banking, Ripple is not only addressing concerns but also paving the way for broader adoption of cryptocurrencies in institutional portfolios.

In a world where data breaches and cyberattacks are all too common, the assurance that comes with bank-grade security can’t be overstated. Ripple understands this and is poised to deliver solutions that meet the high expectations of institutional clients.

Regulatory Compliance and Its Role in Custody Solutions

Another crucial aspect of custody solutions is regulatory compliance. As cryptocurrencies become more mainstream, regulatory bodies are stepping up their scrutiny of the space. Institutions need to ensure that their custody solutions comply with existing regulations to avoid potential legal issues.

Ripple’s commitment to compliance means that its custody solutions will be designed with these regulations in mind. This proactive approach not only protects the assets held but also builds confidence among institutional investors who are wary of the regulatory landscape.

The importance of compliance cannot be overstated. As more institutional players enter the crypto space, the need for transparent and compliant custody solutions will only increase. Ripple’s readiness to meet these needs positions it as a leader in the evolving landscape of crypto custody.

The Future of Crypto Custody Solutions

Looking ahead, the future of crypto custody solutions is bright, especially with Ripple entering the fray. Their focus on bank-grade security and compliance could set new benchmarks in the industry. As Wall Street continues to advance its own custody services, the competition will likely drive innovation and improvements across the board.

We can expect to see more robust security measures, enhanced regulatory compliance, and improved user experiences as companies like Ripple and traditional financial institutions work together to create a secure environment for digital assets.

For anyone involved in the cryptocurrency space, whether as an investor or a tech enthusiast, keeping an eye on these developments is crucial. The landscape is changing rapidly, and staying informed will help you navigate the future of finance.

Ripple’s readiness to offer bank-grade custody solutions signifies a critical moment in the evolution of crypto custody. With Wall Street making significant advancements, the stage is set for a more secure and compliant approach to digital asset management. As we continue to witness these changes unfold, one thing is clear: the future of crypto custody is not just promising; it’s poised for greatness.