BREAKING: BlackRock’s Shocking Push for Ethereum ETF Approval!

BlackRock’s Pressure on SEC for Ethereum Staking in Spot ETFs

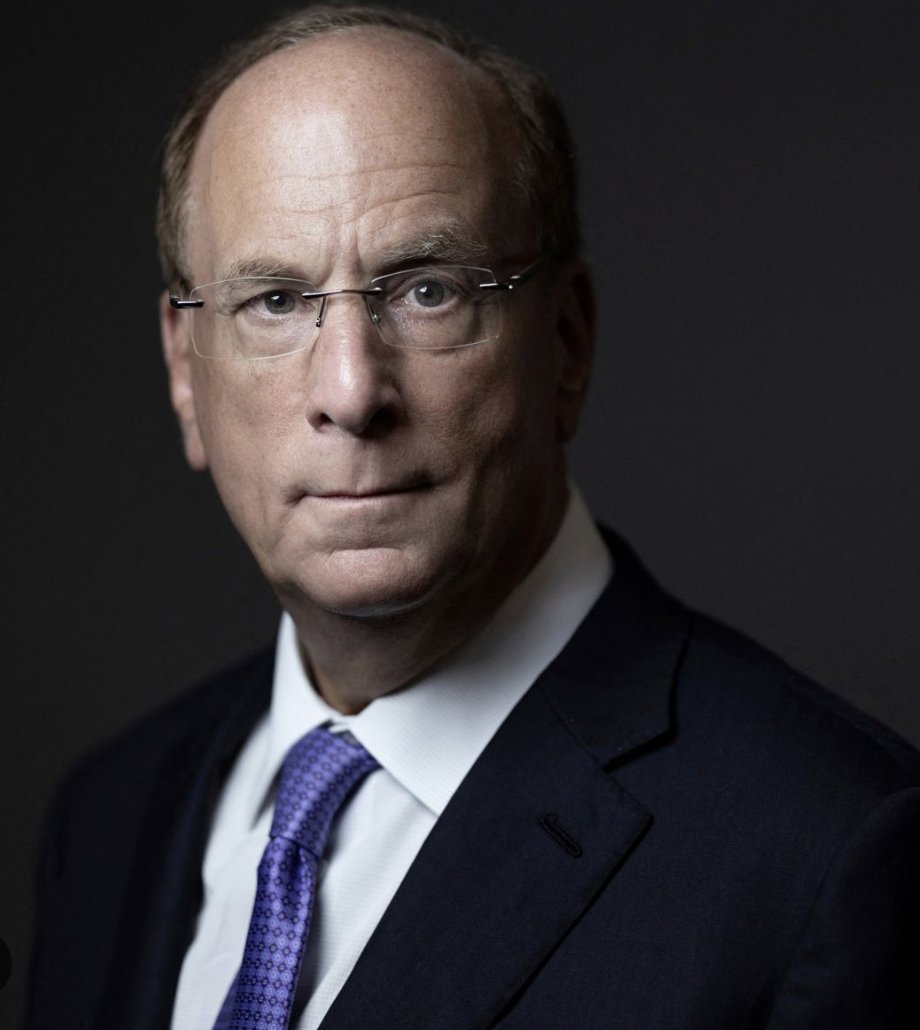

In recent developments within the financial and cryptocurrency sectors, a significant rumor has surfaced regarding BlackRock, the world’s largest asset manager. According to a tweet from Merlijn The Trader, BlackRock is reportedly intensifying its efforts to persuade the U.S. Securities and Exchange Commission (SEC) to approve the integration of Ethereum staking into spot exchange-traded funds (ETFs). This potential move could have profound implications for both Ethereum (ETH) and the broader cryptocurrency market.

Understanding the Context

BlackRock’s influence in the financial world is undeniable, and its interest in cryptocurrency, particularly Ethereum, showcases the growing acceptance of digital assets among traditional financial institutions. The integration of Ethereum staking into spot ETFs could mark a pivotal moment in the evolution of crypto investment products. The prospect of combining Ethereum yield with ETF flows has been described as a "nuclear combo," highlighting the potential for explosive growth and increased capital inflow into the Ethereum ecosystem.

The Significance of Ethereum Staking

Ethereum staking allows investors to earn rewards by participating in the network’s proof-of-stake (PoS) consensus mechanism. By staking their ETH, investors can contribute to network security and transaction validation while earning passive income. The integration of staking rewards into spot ETFs could make Ethereum investment more appealing to a broader audience, including institutional investors who are looking for yield-generating assets.

Implications for the Cryptocurrency Market

If BlackRock successfully influences the SEC to approve this integration, it could lead to a surge in interest and investment in Ethereum. The combination of staking yields and ETF flows could create a compelling investment narrative that attracts both retail and institutional investors. This could potentially drive up the price of Ethereum, enhancing its position in the cryptocurrency market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, the approval of Ethereum staking in spot ETFs could set a precedent for other cryptocurrencies. It may encourage additional asset managers to explore similar products, further legitimizing the cryptocurrency space in the eyes of traditional investors.

The Role of the SEC

The SEC has been cautious in its approach to cryptocurrency regulation, often taking a conservative stance on the approval of new financial products. The agency has yet to approve a spot ETF based on cryptocurrencies, focusing instead on futures-based products. However, the increasing pressure from major players like BlackRock may prompt the SEC to reevaluate its position.

The SEC’s decision on this matter will be closely watched by investors and market analysts alike. Should they approve the integration of Ethereum staking into spot ETFs, it could signal a significant shift in regulatory attitudes towards cryptocurrencies, fostering a more favorable environment for digital asset investment.

The Future of Ethereum and ETFs

As the cryptocurrency market continues to evolve, the potential integration of Ethereum staking into spot ETFs represents a crucial development. Investors are always seeking innovative ways to generate returns, and the combination of staking rewards with the accessibility of ETFs could open new doors for investment strategies.

Moreover, this move could further legitimize Ethereum as a viable investment asset. As institutional adoption increases and traditional finance continues to embrace digital assets, Ethereum’s role as a foundational layer for decentralized finance (DeFi) and other applications will only strengthen.

Conclusion

In summary, BlackRock’s reported efforts to pressure the SEC for Ethereum staking integration in spot ETFs could have far-reaching implications for the cryptocurrency market. The potential for a yield-generating investment product that combines Ethereum’s staking rewards with the advantages of ETFs presents an enticing opportunity for investors. As the situation develops, market participants will be keenly observing the SEC’s response and the overall impact on Ethereum’s price and adoption.

The intersection of traditional finance and the cryptocurrency market is becoming increasingly pronounced, and BlackRock’s involvement is a testament to this trend. As we move forward, the approval of such investment products could pave the way for a new era of crypto investment, characterized by greater accessibility and institutional involvement.

Investors should stay informed about these developments, as the integration of Ethereum staking in spot ETFs could redefine how digital assets are perceived and utilized in the financial landscape. With the stakes high and the potential rewards substantial, this situation is one to watch closely in the coming months.

RUMOR: BLACKROCK IS TURNING UP THE HEAT

They’re reportedly pressuring the SEC to approve Ethereum staking integration in spot ETFs.$ETH yield + ETF flows = nuclear combo. pic.twitter.com/QtvVsDj5qZ

— Merlijn The Trader (@MerlijnTrader) May 25, 2025

RUMOR: BLACKROCK IS TURNING UP THE HEAT

When it comes to major players in the finance and cryptocurrency world, few names stand out quite like BlackRock. Recently, buzz has been circulating about BlackRock reportedly pressuring the SEC to approve Ethereum staking integration in spot ETFs. This development could potentially reshape the landscape of cryptocurrency investments. Let’s dive deeper into what this means and why it’s creating such a stir.

Understanding the Basics: Ethereum Staking and ETFs

If you’re not familiar with the terms, let’s break them down. Ethereum staking involves locking up your ETH tokens to support the network’s operations, particularly in its transition to Ethereum 2.0. In return, stakers earn rewards, creating a yield on their investment. On the other hand, ETFs, or Exchange-Traded Funds, are investment funds that are traded on stock exchanges, much like stocks.

The idea of integrating Ethereum staking into spot ETFs is a game-changer. It allows investors to gain exposure to Ethereum while also earning staking rewards. This combination could draw a lot of interest from both institutional and retail investors, especially in a market where yield is king.

Why Is BlackRock Pressuring the SEC?

BlackRock is not just any asset manager; it’s the largest in the world, managing over $9 trillion in assets. Their influence in the market is significant, and their push for Ethereum staking integration suggests they see a massive opportunity. The SEC’s approval would open the gates for a flood of investments into Ethereum-based ETFs, potentially leading to increased liquidity and price stability.

By advocating for this integration, BlackRock is positioning itself to capitalize on both the yield from Ethereum staking and the inflows from ETF investments. This strategy is not just about Ethereum; it’s about setting a precedent for how cryptocurrencies can be integrated into traditional financial systems.

The Potential Impact on $ETH Yield and ETF Flows

So, what does this mean for Ethereum and its price? If BlackRock’s pressure leads to SEC approval, we could see a significant increase in demand for Ethereum. The combination of $ETH yield plus ETF flows could create a “nuclear combo,” as mentioned in the rumor. This phrase encapsulates the explosive potential of such a development, as it could drive both price appreciation and institutional adoption.

Investors are always looking for ways to enhance their portfolios, and the idea of earning a yield while also having the potential for price appreciation is incredibly appealing. This could lead to a new wave of investment in Ethereum, pushing the price to new heights.

The Ripple Effects Throughout the Market

The potential approval of Ethereum staking in ETFs doesn’t just impact Ethereum; it could have ripple effects throughout the entire cryptocurrency market. Other cryptocurrencies could see increased interest as investors look for similar opportunities. This could lead to a more diverse crypto market where various assets gain traction.

Moreover, if the SEC approves this integration, it could signal a shift in how regulators view cryptocurrencies. A more favorable regulatory environment could pave the way for other innovative financial products based on blockchain technology, further legitimizing the crypto space.

What Should Investors Keep an Eye On?

As an investor, it’s crucial to stay updated on the developments surrounding BlackRock’s push and the SEC’s response. Keeping an eye on the broader regulatory landscape will also be essential, as any changes could have significant implications for your investments.

Additionally, monitoring Ethereum’s performance in the wake of this news will be vital. If you’re considering investing, be sure to research and understand the risks involved. The crypto market can be volatile, and while the potential for growth is significant, so are the risks.

Final Thoughts

As BlackRock reportedly turns up the heat in its efforts to pressure the SEC for Ethereum staking integration in spot ETFs, it’s essential to pay attention. The implications of such a move could be monumental not only for Ethereum but for the entire cryptocurrency ecosystem. This rumor has the potential to reshape how we view digital assets and their place in the investment world.

Keep those eyes peeled, because if this combo of $ETH yield and ETF flows comes to fruition, we could be looking at a new era for cryptocurrency investments.