Wrapped BTC’s Custodian Exposed: Who Really Holds Your BTC?

Understanding the Role of Custody and Security in Digital Assets

In the rapidly evolving world of cryptocurrencies, the need for secure custody solutions has become increasingly critical. This summary focuses on a leading company specializing in the custody and security of digital assets, particularly its role as the official issuer of Wrapped Bitcoin (WBTC). Understanding this company’s functions and its significance in the crypto ecosystem is essential for anyone interested in digital assets.

Introduction to Digital Assets Custody

Digital assets, including cryptocurrencies like Bitcoin (BTC), require robust security measures to protect them from theft and loss. Custody services play a vital role in safeguarding these assets, particularly for institutional investors who are increasingly entering the crypto market. The company in focus has established itself as a leader in offering custody solutions, ensuring that investors can securely manage their digital holdings.

What is Wrapped Bitcoin (WBTC)?

Wrapped Bitcoin (WBTC) is an ERC-20 token that represents Bitcoin on the Ethereum blockchain. WBTC allows Bitcoin holders to leverage the benefits of the Ethereum ecosystem, including decentralized finance (DeFi) applications. Each WBTC is backed 1:1 by real Bitcoin, which means for every WBTC issued, there is an equivalent amount of BTC held in custody.

The Importance of Custody in WBTC

Given that WBTC serves as a bridge between Bitcoin and Ethereum, the security of the underlying Bitcoin is paramount. The company that issues WBTC is responsible for ensuring that the Bitcoin backing each token is securely held. This responsibility includes managing private keys, ensuring compliance with regulatory standards, and maintaining transparency in the process of minting and burning WBTC.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Company Behind WBTC

The company at the forefront of custody and security for digital assets is a recognized player in the crypto space. It provides institutional-grade custody solutions that are designed to meet the needs of both individual and institutional investors. With a focus on compliance, security, and transparency, this company has gained the trust of its clients and the broader crypto community.

Security Measures

To ensure the safety of digital assets, the company employs advanced security measures, including:

- Multi-Signature Wallets: By requiring multiple signatures for transactions, the risk of unauthorized access is significantly reduced.

- Cold Storage Solutions: Most of the Bitcoin held in custody is stored in cold wallets, which are not connected to the internet, minimizing the chances of hacking.

- Regular Audits: The company conducts regular audits to verify that the amount of BTC held in custody matches the amount of WBTC issued, ensuring transparency and trust in the system.

The Role of Transparency

Transparency is a crucial aspect of the cryptocurrency ecosystem, especially in custodial services. The company’s commitment to transparency involves regular reporting and audits, which provide assurance to investors that their assets are secure. This practice not only fosters trust but also enhances the overall credibility of WBTC as a stable and reliable asset.

The Impact of WBTC on the DeFi Ecosystem

Wrapped Bitcoin has significantly influenced the decentralized finance (DeFi) landscape. By allowing Bitcoin holders to participate in DeFi applications on the Ethereum network, WBTC has opened up new opportunities for earning yields, providing liquidity, and engaging in various financial services that were previously unavailable to Bitcoin holders.

Conclusion

As the demand for digital asset custody solutions continues to grow, the importance of secure and reliable custodians cannot be overstated. The company specializing in the custody and security of digital assets plays a crucial role in this evolving landscape, particularly as the official issuer of Wrapped Bitcoin (WBTC). Through advanced security measures, a commitment to transparency, and a focus on compliance, the company has established itself as a trusted partner for investors.

For anyone looking to understand the complexities of the cryptocurrency market, especially regarding digital asset custody and the significance of WBTC, it is essential to recognize the pivotal role played by this company. As cryptocurrencies continue to gain traction and acceptance, the need for secure custody solutions will only become more vital, underscoring the importance of companies that specialize in this field.

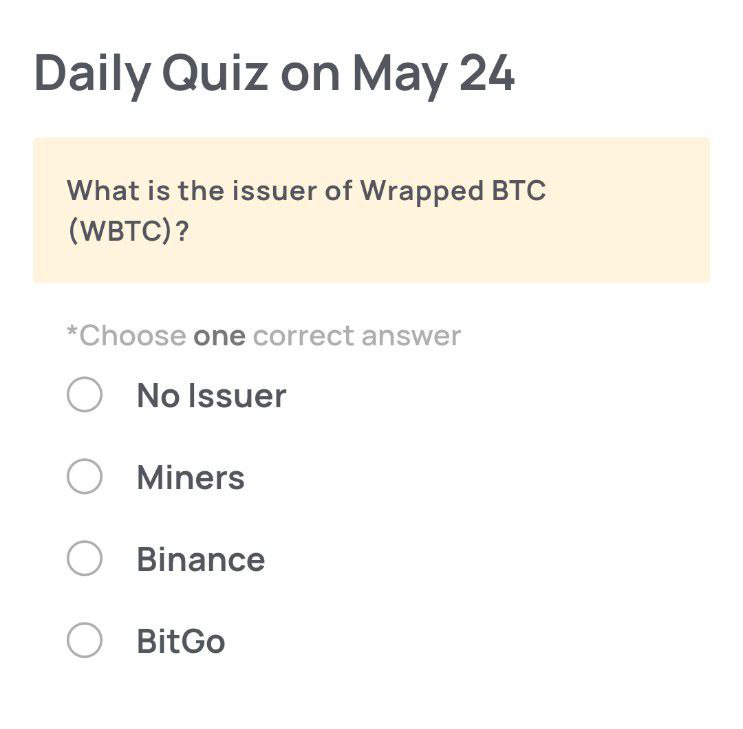

Need a Hint for Today’s Quiz?

This company specializes in custody and security for digital assets—and it’s the official issuer of Wrapped BTC (WBTC). If you’re thinking about who holds the real BTC backing your WBTC. https://t.co/z1bZ5nlPya

Need a Hint for Today’s Quiz?

If you’re diving into the world of cryptocurrencies, you might have stumbled upon Wrapped Bitcoin, or WBTC, but do you know who’s behind this innovative digital asset? Let’s unravel the mystery together! This company specializes in custody and security for digital assets—and it’s the official issuer of Wrapped BTC (WBTC). If you’re thinking about who holds the real BTC backing your WBTC, you’re in the right place.

What is Wrapped Bitcoin (WBTC)?

First things first, let’s break down what Wrapped Bitcoin actually is. WBTC is an ERC-20 token that represents Bitcoin (BTC) on the Ethereum blockchain. What does that mean for you? Basically, it allows you to use Bitcoin in the Ethereum ecosystem, which opens up a whole new world of decentralized finance (DeFi) opportunities. Imagine being able to lend, borrow, or trade Bitcoin just like any other Ethereum token. Sounds cool, right?

The Importance of Custody in the Crypto World

Now, talking about custody and security, these are crucial components in the world of cryptocurrencies. With traditional assets, like stocks or bonds, you have established institutions keeping your investments safe. But in the crypto space, things can get a bit tricky. You want to make sure that your assets are not only secure but also that there’s transparency in how they are managed. This is where the company behind Wrapped Bitcoin steps in.

Who Issues WBTC?

So, who is this mystery company? The official issuer of Wrapped Bitcoin is BitGo. They are pioneers in digital asset custody and have built a reputation for being a reliable and secure platform. BitGo’s custody solutions are designed to safeguard your digital assets, ensuring that they are protected from hacks and other security threats.

The Role of BitGo in WBTC

BitGo plays a significant role in the WBTC ecosystem. They not only issue the tokens, but they also hold the actual Bitcoin that backs every WBTC in circulation. This means that for every WBTC token, there’s an equivalent amount of BTC securely stored by BitGo. This relationship adds a layer of trust for users who want to leverage Bitcoin in the Ethereum space.

How Does WBTC Work?

Understanding how WBTC works is key to grasping its significance. When users want to convert BTC to WBTC, they go through a process called minting. Here’s how it goes down: a user deposits Bitcoin with a WBTC merchant, and in return, they receive WBTC tokens. These tokens are then minted and sent to the user’s Ethereum wallet. Conversely, if you want to convert WBTC back to BTC, you can burn your WBTC tokens, and the corresponding amount of BTC is released back to you. It’s that simple!

The Benefits of Using WBTC

So why would someone want to use WBTC instead of just holding Bitcoin? Well, there are several benefits. For one, WBTC allows Bitcoin holders to participate in the booming DeFi space on Ethereum. With WBTC, you can engage in yield farming, liquidity provision, and other DeFi activities that may not be accessible with BTC alone. Plus, by using WBTC, you can benefit from lower transaction fees and faster confirmation times typical of Ethereum transactions.

Security and Transparency with BitGo

When dealing with digital assets, security is a top priority. BitGo employs advanced security measures, including multi-signature wallets and insurance coverage for digital assets, to ensure that your Bitcoin is safe. Their commitment to transparency means that users can verify the amount of Bitcoin backing the WBTC in circulation at any time. This transparency is crucial for building trust among users, especially in a market where confidence can easily waver.

Potential Risks to Consider

While WBTC offers many advantages, it’s important to be aware of potential risks. The fact that WBTC is a token on the Ethereum blockchain means that it’s subject to the same risks as any other Ethereum-based asset, such as smart contract vulnerabilities. Additionally, since BitGo is the custodian holding the actual Bitcoin, if something were to happen to them, it could impact WBTC holders. Always do your research and weigh the risks before diving in!

How to Get Started with WBTC

If all this sounds good and you’re ready to start using WBTC, the process is relatively straightforward. You’ll need to set up an Ethereum wallet that supports ERC-20 tokens. Popular options include MetaMask, Trust Wallet, and Ledger hardware wallets. Once you have your wallet, you can find a WBTC merchant to help you with the minting process. There are several platforms like Uniswap and 1Broker that facilitate WBTC transactions.

Conclusion: WBTC and the Future of Crypto

Wrapped Bitcoin is more than just a token; it’s a bridge between the Bitcoin and Ethereum ecosystems. With the backing of a reputable company like BitGo, WBTC provides a secure and efficient way for Bitcoin holders to participate in the DeFi revolution. As the crypto landscape continues to evolve, WBTC is likely to play a pivotal role in the future of digital finance.

“`