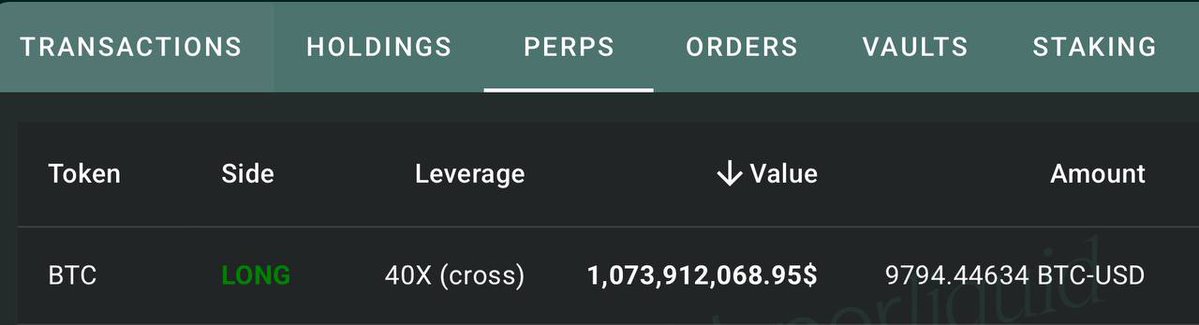

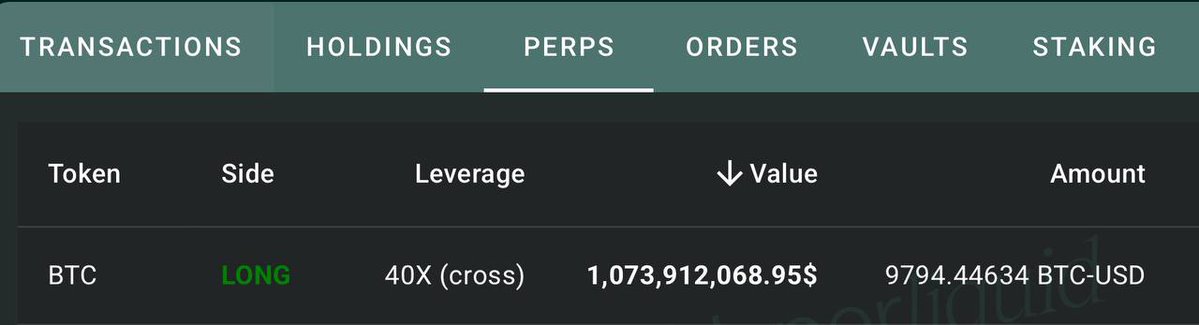

Shocking Move: Bitcoin Whale James Wynn Bets $1.07B on Crypto!

James Wynn, Bitcoin Whale Increases Long Position to $1.07 Billion

In an exciting development for the cryptocurrency market, James Wynn, a well-known figure in the Bitcoin community, has reportedly expanded his long position to an astounding $1.07 billion. As a 40x Bitcoin whale, Wynn’s trading activities are closely monitored by both investors and analysts alike, making this news particularly significant.

Who is James Wynn?

James Wynn has made a name for himself in the crypto space as a high-stakes investor. Known for his strategic trades and deep understanding of market dynamics, he has amassed a substantial Bitcoin portfolio, earning the title of "whale"—a term used to describe individuals or entities that hold large amounts of cryptocurrency. Wynn’s trading methodologies often involve leveraging, which allows him to amplify his investments significantly. With an impressive long position now at $1.07 billion, his actions could set the tone for market trends and investor sentiment moving forward.

The Impact of Increasing Long Positions

When a prominent figure like Wynn increases their long position, it can have several implications for the cryptocurrency market. A long position indicates that the investor believes the price of Bitcoin will rise in the future, which can instill confidence among other traders and potentially drive up demand. This could lead to a bullish trend in Bitcoin prices, as more investors may follow suit, hoping to capitalize on the anticipated price increase.

Additionally, large investments in Bitcoin can lead to increased volatility. While many investors may view Wynn’s move as a positive signal, others may worry about the effects of such concentrated investments on market stability. The cryptocurrency market is known for its rapid price fluctuations, and a significant long position could either bolster the market or contribute to sudden downturns, depending on how the broader market reacts.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Analysis of Current Market Conditions

As of late May 2025, Bitcoin has been experiencing significant price movements, influenced by various factors including economic indicators, regulatory developments, and market sentiment. Investors are on high alert, analyzing market trends and news to guide their trading decisions. In this environment, Wynn’s decision to boost his long position is particularly noteworthy.

The cryptocurrency market has seen a resurgence in interest, with institutional investors increasingly entering the space. Factors such as inflation concerns and economic uncertainty have made Bitcoin an attractive asset, viewed by many as a hedge against traditional market volatility. As more large investors like Wynn commit substantial resources to Bitcoin, it could signal a shift towards greater mainstream acceptance of cryptocurrency as a viable investment.

The Role of Social Media in Cryptocurrency Trading

In today’s digital age, platforms like Twitter play a crucial role in disseminating information and shaping market perceptions. Wynn’s announcement of his increased long position was shared by Cointelegraph, a reputable source of cryptocurrency news. Such endorsements can amplify the reach of significant trading moves and influence the actions of retail and institutional investors alike.

Social media has become an essential tool for traders, allowing them to share insights, predictions, and analyses in real-time. The immediacy of platforms like Twitter enables investors to react swiftly to developments, and news about major players like Wynn can quickly spread, impacting market dynamics.

Future Outlook for Bitcoin and Cryptocurrency

With James Wynn’s recent move to increase his long position, many are left wondering what the future holds for Bitcoin and the broader cryptocurrency market. While some analysts are optimistic, predicting that Wynn’s investment could lead to further price increases, others caution that market volatility remains a significant concern.

The current landscape is characterized by rapid change, with technological advancements, regulatory developments, and macroeconomic factors all playing a role in shaping the future of cryptocurrency. Investors should remain vigilant and informed, as market conditions can shift unexpectedly.

As Wynn and other investors continue to navigate the complexities of the cryptocurrency market, their actions will likely influence trading strategies and sentiment among the wider investing community. Keeping an eye on whale movements and understanding their motivations can offer valuable insights for both new and seasoned investors.

Conclusion

James Wynn’s decision to increase his long position to $1.07 billion is a notable event in the cryptocurrency space, highlighting the movements of prominent investors and their potential impact on market trends. As Bitcoin continues to capture the attention of both retail and institutional investors, understanding the dynamics of large positions and the role of social media in trading will be crucial for navigating this ever-evolving landscape.

As we look ahead, the implications of Wynn’s investment will unfold, providing opportunities and challenges alike for those involved in the cryptocurrency market. Whether you are a seasoned investor or new to the world of Bitcoin, staying informed about key figures and market movements will be essential in making strategic investment decisions.

NEW: James Wynn, the 40x Bitcoin whale, has reportedly increased his long position to $1.07 billion. pic.twitter.com/pG6VMGvbZn

— Cointelegraph (@Cointelegraph) May 23, 2025

NEW: James Wynn, the 40x Bitcoin whale, has reportedly increased his long position to $1.07 billion.

The world of cryptocurrency often brings surprises, and the latest news surrounding James Wynn, a prominent figure known as the 40x Bitcoin whale, is no exception. With reports indicating that he has ramped up his long position to a staggering $1.07 billion, the excitement in the crypto community is palpable. But what does this mean for the market and for investors? Let’s dive deeper into the implications of this development.

Who is James Wynn?

James Wynn isn’t just another name in the crypto space; he’s recognized for his significant influence and large-scale investments in Bitcoin. As a 40x Bitcoin whale, Wynn has made waves for his strategic moves within the market. His recent decision to increase his long position has sparked conversations about market trends and potential future movements. But why is this important?

Wynn’s actions can often be seen as a bellwether for market sentiment. When a major player like him makes a move, it usually sends ripples throughout the trading community. Investors often look to figures like Wynn for clues about the future direction of Bitcoin and the broader cryptocurrency market.

The Significance of a $1.07 Billion Position

Now, let’s talk about that eye-popping figure of $1.07 billion. Increasing a long position to this magnitude signals a strong belief in Bitcoin’s future performance. Long positions are bets that the price of an asset will rise, and for someone with Wynn’s track record, this move could indicate confidence in an impending bullish trend.

The psychology behind such a large investment can be fascinating. When whales like Wynn buy in big, it can lead to increased interest from smaller investors who see this as a sign of confidence in Bitcoin’s potential. It’s like a domino effect; when one influential player takes a leap, others often follow suit.

What Does This Mean for Bitcoin Investors?

So, what should Bitcoin investors take away from Wynn’s massive long position? For starters, it’s a reminder of the volatility and unpredictability inherent in the cryptocurrency market. While Wynn’s investment could signal a bullish trend, it’s essential for investors to remember that the market can change quickly.

Investors should always do their due diligence and not solely rely on the moves of whales like Wynn. Engaging with the market actively and keeping an eye on external factors—such as regulatory changes, technological advancements, and market sentiment—is crucial for making informed decisions.

Additionally, this new development could act as a catalyst for Bitcoin’s price movement. If more investors start to see Wynn’s position as a positive signal, we might witness an influx of buying activity that could push prices higher.

Market Reactions and Sentiment

The news of James Wynn increasing his long position has already stirred the pot in the crypto community. Social media platforms are abuzz with discussions about what this could mean for Bitcoin’s future. Some analysts are optimistic, predicting that this could be the start of a new bullish phase for Bitcoin.

Market sentiment often hinges on such influential decisions. When news breaks about a significant player making a move, it can lead to increased trading volume and price fluctuations. Many traders are likely watching Wynn’s moves closely, ready to react based on how they perceive the market’s trajectory.

Moreover, increased interest from the media and discussions in forums may further amplify investor enthusiasm. It’s a reminder of how interconnected the crypto world is—news spreads fast, and the reactions can be instantaneous.

Understanding Long Positions in Cryptocurrency

For those new to the cryptocurrency scene, understanding what a long position means is crucial. Essentially, a long position is when an investor buys an asset, anticipating that its price will rise. In the case of Bitcoin, taking a long position reflects confidence in its long-term value appreciation.

Long positions are particularly common in the volatile world of cryptocurrencies, where price swings can happen in a matter of minutes. Investors who take long positions are often in it for the long haul, believing in the underlying technology and its potential to disrupt traditional financial systems.

If you’re considering entering a long position, it’s essential to have a strategy in place. Set clear goals and establish your risk tolerance. Cryptocurrency can be a thrilling ride, but it’s vital to stay grounded and informed.

The Future of Bitcoin: What Lies Ahead?

As James Wynn’s long position continues to make headlines, many are left wondering what lies ahead for Bitcoin. Will this be the catalyst for a significant price increase? Only time will tell, but it’s essential to keep an eye on market trends and news.

The cryptocurrency market is known for its unpredictability. While Wynn’s investment might suggest a bullish outlook, external factors such as regulatory changes, technological advancements, and macroeconomic indicators play a significant role in shaping Bitcoin’s future.

For instance, if regulatory bodies around the world start embracing cryptocurrencies, it could lead to increased adoption and a surge in prices. Conversely, negative news or regulatory crackdowns could have the opposite effect, leading to panic selling and price drops.

Keeping an Eye on Market Trends

In this fast-paced world of cryptocurrency, staying informed is crucial. Following news outlets like [Cointelegraph](https://www.cointelegraph.com) can keep you in the loop about significant developments like James Wynn’s latest moves. Analyzing trends, observing price movements, and understanding market sentiment can help you make more informed decisions.

Additionally, joining online communities and discussions can provide valuable insights. Engaging with other investors allows you to gain different perspectives and strategies, enhancing your understanding of the market.

In conclusion, while James Wynn’s increase to a $1.07 billion long position is certainly noteworthy, it’s just one piece of the larger puzzle that is the cryptocurrency market. By staying informed, keeping an eye on trends, and developing your investment strategy, you can navigate this exciting yet unpredictable landscape more effectively.