Bitcoin Whale Doubles Down: $1.07B Long Position Sparks Fury!

Bitcoin Whale Increases Long Position to $1.07 Billion: What It Means for the Market

In a noteworthy development within the cryptocurrency landscape, a prominent Bitcoin whale has reportedly escalated their long position to a staggering $1.07 billion. This move has sparked considerable interest and speculation among investors and analysts alike, as it suggests a bullish sentiment towards Bitcoin’s future price trajectory.

Understanding Bitcoin Whales

Bitcoin whales are individuals or entities that hold large quantities of Bitcoin, often enough to influence market trends and prices. These players can significantly sway the market due to their substantial holdings, making their trading behavior closely monitored by other investors. The whale in question, often referred to in financial circles, has a reputation for making significant moves, which can serve as a barometer for market sentiment.

The Current Market Climate

As of May 2025, Bitcoin has been experiencing a volatile market environment, characterized by rapid price fluctuations and a mix of bullish and bearish trends. The increase in the whale’s long position comes at a time when many investors are weighing the potential risks and rewards of engaging with Bitcoin. This kind of investment indicates that the whale is betting on a future increase in Bitcoin’s price, which can be interpreted as a sign of confidence in the cryptocurrency’s long-term viability.

The Implications of a $1.07 Billion Long Position

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Market Sentiment: The decision by the whale to increase their long position to $1.07 billion can be seen as a strong indicator of bullish market sentiment. This move may encourage other investors to follow suit, potentially leading to increased buying pressure and driving Bitcoin’s price higher.

- Potential Price Impact: Large trades by whales can have a profound impact on market prices. The whale’s significant investment could signal to the market that a price rally is imminent, prompting other investors to enter the market, thus creating a self-fulfilling prophecy.

- Increased Volatility: While the whale’s long position could indicate bullish sentiment, it may also lead to increased volatility. If the market reacts strongly to this news, we could see rapid price movements, which can be both an opportunity and a risk for traders.

- Long-Term Perspective: The whale’s decision to increase their investment may reflect a long-term bullish outlook on Bitcoin. This could be driven by various factors, including macroeconomic trends, institutional adoption of Bitcoin, and the ongoing development of blockchain technology.

The Role of Institutional Investors

The involvement of institutional investors in the cryptocurrency market has been gaining momentum, and this whale’s actions may be indicative of a broader trend. As more institutions allocate funds to Bitcoin, the market may experience increased stability and maturity. Institutional investors often bring with them a level of scrutiny and analysis that can enhance market understanding and foster a more robust investment environment.

The Influence of Social Media and Public Perception

Social media platforms, particularly Twitter, have become vital channels for information dissemination in the cryptocurrency space. The tweet highlighting the whale’s increased long position has garnered attention, showcasing the role of social media in shaping public perception and influencing market dynamics. The phrase "May the bull gods have mercy on his soul" reflects the mixed emotions that often accompany large investments in a volatile market, encapsulating both excitement and caution.

Conclusion: The Future of Bitcoin and Investor Sentiment

The Bitcoin whale’s decision to increase their long position to $1.07 billion serves as a significant signal in the cryptocurrency market. It underscores a potential bullish trend while simultaneously highlighting the inherent risks associated with such large investments. As Bitcoin continues to evolve, the influence of whales, institutional investors, and social media will remain critical components in shaping market dynamics.

Investors should keep a close eye on these developments, as they could provide valuable insights into the future price movements of Bitcoin. While the current sentiment appears bullish, the market’s inherent volatility necessitates a cautious approach. The actions of whales like this one may help guide short-term trading strategies, but long-term investors should consider broader market trends and fundamentals when making decisions.

In summary, the recent increase in the Bitcoin whale’s long position is a noteworthy event that could shape market sentiment in the coming weeks and months. As always, staying informed and vigilant will be key for investors navigating the ever-changing landscape of cryptocurrency.

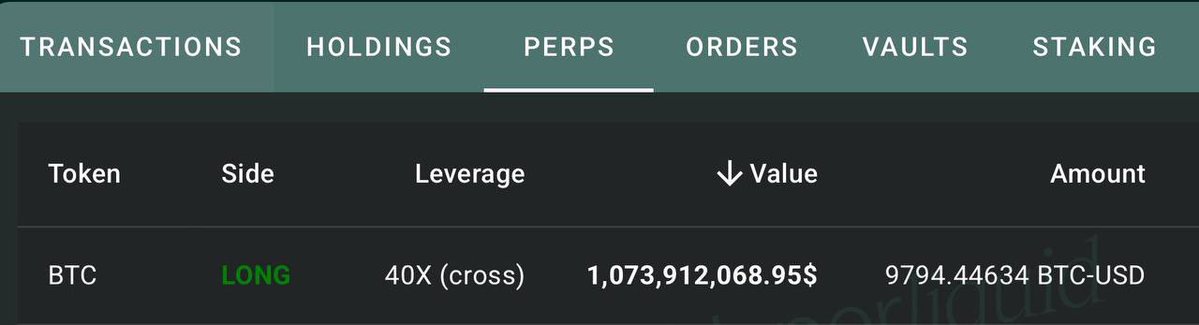

The 40x Bitcoin whale, has reportedly increased his long position to $1.07 billion

May the bull gods have mercy on his soul. pic.twitter.com/UUP0lpSkqx

— Gordon (@AltcoinGordon) May 23, 2025

The 40x Bitcoin whale, has reportedly increased his long position to $1.07 billion

If you’ve been paying attention to the cryptocurrency market, you might’ve come across some pretty jaw-dropping news recently. A Bitcoin whale—essentially an individual or entity that holds a massive amount of Bitcoin—has decided to up the ante significantly. Reports are swirling that this particular whale has boosted their long position to a staggering $1.07 billion! That’s right, a billion with a ‘B’. It’s one of those moments that leaves you wondering about the future of Bitcoin and what it might mean for the market.

May the bull gods have mercy on his soul.

Now, you might be asking, what does this mean for the cryptocurrency landscape? When you see a long position of this magnitude, it signals a deep level of confidence in Bitcoin’s price trajectory. This whale, who is often seen as a market mover, seems to believe that Bitcoin is heading for greener pastures. But why would anyone risk such an enormous sum? Let’s dive into the factors at play.

The Market Dynamics Behind a 40x Leverage Position

First off, let’s break down what a 40x leverage position means. When you leverage a position, you’re essentially borrowing funds to amplify your potential returns. In this case, a 40x position means that for every dollar the whale has, they are controlling $40 in Bitcoin. This kind of leverage can yield massive gains—or catastrophic losses—depending on market movements. So, when someone goes in with a $1.07 billion long position, you can bet they have a strategy in mind.

In the world of crypto, volatility is the name of the game. Prices can swing wildly in a matter of hours, and experienced traders know how to navigate these waters. However, the higher the leverage, the higher the risk; it’s a double-edged sword. If the market moves in the whale’s favor, it could lead to astronomical gains. But if it doesn’t, well, let’s just say that it could get ugly.

What Drives a Bitcoin Whale?

Now, you might wonder what drives someone to make such a bold move. A few factors could be at play here. For starters, there’s the long-term bullish outlook on Bitcoin. Many enthusiasts believe that Bitcoin is on the verge of a significant breakout, especially with recent trends showing an uptick in institutional investment. This influx of capital can create a positive feedback loop, where increased demand drives prices even higher.

Additionally, macroeconomic factors often play a role in these decisions. With inflation on the rise globally, many investors are looking for alternative assets to preserve their wealth. Bitcoin, often referred to as “digital gold,” has become a popular choice for those seeking a hedge against inflation. The whale may be betting on a scenario where more and more people flock to Bitcoin as a safe haven.

The Social Media Buzz Around the 40x Bitcoin Whale

Social media plays a significant role in the cryptocurrency market, and the buzz surrounding this whale has been palpable. When news broke that the whale had increased their long position, it sent ripples through platforms like Twitter, Reddit, and Telegram. You can feel the excitement in the air, with traders and enthusiasts speculating about what this means for the short- and long-term future of Bitcoin.

The tweet from Gordon (@AltcoinGordon) that sparked this discussion has garnered attention not just for the numbers but for the implications behind them. When someone stakes such a large amount, it creates a sense of FOMO—fear of missing out—among retail investors who might want to jump on the bandwagon. The phrase “May the bull gods have mercy on his soul” captures the mix of admiration and apprehension that comes with such high-stakes trading.

Understanding the Risks Involved

For those who are new to cryptocurrency trading, it’s essential to understand the risks involved, especially when leveraging positions. While the potential for significant returns is enticing, the possibility for devastating losses is equally real. The 40x Bitcoin whale is gambling on a bullish market, but the reality is that the market can turn on a dime.

For example, if Bitcoin’s price were to plummet suddenly, a position like this could be liquidated, resulting in a total loss of the initial investment. This is why many traders advocate for risk management strategies and only recommend leveraging funds you can afford to lose. The crypto world can be unforgiving, and a single wrong move can lead to disaster.

The Future of Bitcoin After This Bold Move

So, where does this leave the future of Bitcoin? It’s hard to predict, but one thing is for sure: the increase in long positions like this one typically indicates a bullish sentiment in the market. If the whale’s bet pays off, it could lead to a surge in Bitcoin’s price, encouraging even more investment and driving the narrative that Bitcoin is here to stay.

Moreover, this kind of activity draws attention from the broader financial community. As more institutional investors consider entering the market, the legitimacy of Bitcoin as a financial asset continues to grow. This could pave the way for further innovations in the crypto space, including new financial products and services that cater to a broader audience.

Keeping an Eye on Market Trends

As we follow the saga of the 40x Bitcoin whale, it’s crucial to keep an eye on market trends. The price of Bitcoin is influenced by a myriad of factors, including regulatory developments, technological advancements, and shifts in investor sentiment. It’s always a good idea to stay updated with the latest news and trends through reliable sources.

Websites like CoinDesk and CoinTelegraph offer valuable insights into market movements and can help you make informed decisions. Additionally, engaging with communities on platforms like Reddit can provide diverse perspectives that may enhance your understanding of the market.

In Conclusion

The crypto world is a whirlwind of excitement, especially when you hear about massive moves like the one made by the 40x Bitcoin whale. While the potential for profit is enticing, it’s essential to approach such high-leverage positions with caution. Remember, the market is as unpredictable as it is thrilling, so always do your homework before diving in.

Whether you’re a seasoned trader or just starting your cryptocurrency journey, watching how this situation unfolds could provide valuable lessons for everyone involved. So, strap in and keep an eye on this 40x Bitcoin whale—because whatever happens next could shape the future of Bitcoin and the broader cryptocurrency market!