Investors Shocked: $HIMS Defies Odds, Shorts Face Imminent Doom!

HIMS: A Company on the Rise

In the dynamic world of finance and investments, few companies capture the attention of investors like HIMS, a prominent player in the telehealth and wellness industry. The recent commentary from notable investor Oguz O. highlights the strong performance and potential of HIMS, making it a compelling subject for those interested in stock market trends, healthcare innovation, and investment strategies.

Unprecedented Growth

One of the most striking features of HIMS is its remarkable revenue growth. Over the last four years, the company has achieved a staggering tenfold increase in revenues. This exponential growth signals not only the effectiveness of HIMS’s business model but also its ability to meet the increasing demands of consumers seeking accessible and affordable healthcare solutions. Investors are always on the lookout for companies that demonstrate consistent growth, and HIMS has certainly delivered in this aspect.

Consistent Performance and Beating Expectations

Another highlight of HIMS is its consistent ability to beat revenue guidance each quarter. In the fast-paced world of business, many companies struggle to meet their forecasts, but HIMS has established a reputation for exceeding expectations. This consistent performance builds investor confidence, as it demonstrates that the company has a clear understanding of market dynamics and is adept at navigating challenges.

Stability in Sales

Contrary to many companies that experience fluctuations in sales due to market volatility or changing consumer preferences, HIMS has reported a continuous growth trajectory without any loss in sales. This stability is crucial for investors looking for reliable stocks that can weather economic downturns. The company’s ability to maintain sales growth amidst a competitive landscape is a testament to its strong brand, innovative services, and effective marketing strategies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Attractive Valuation Metrics

Despite its impressive growth and performance, HIMS is currently trading at a valuation of only six times forward sales. This low multiple presents a unique opportunity for investors. In the fast-evolving healthcare sector, companies often trade at much higher multiples, reflecting their growth potential. The relatively low valuation of HIMS suggests that the market may not yet fully appreciate its future growth prospects, making it an attractive investment for those willing to take a closer look.

Potential Catalysts for Growth

Looking ahead, there are several potential catalysts that could further boost HIMS’s stock price. The company is actively pursuing partnerships and collaborations that could expand its reach and enhance its service offerings. Each new partnership can unlock additional revenue streams and enhance brand recognition, which is crucial for sustained growth.

Moreover, with the ongoing trend of telehealth and digital health solutions gaining traction, HIMS is well-positioned to capitalize on this shift in consumer behavior. As more individuals seek convenient healthcare options, HIMS’s services are likely to become increasingly relevant, potentially driving further revenue growth.

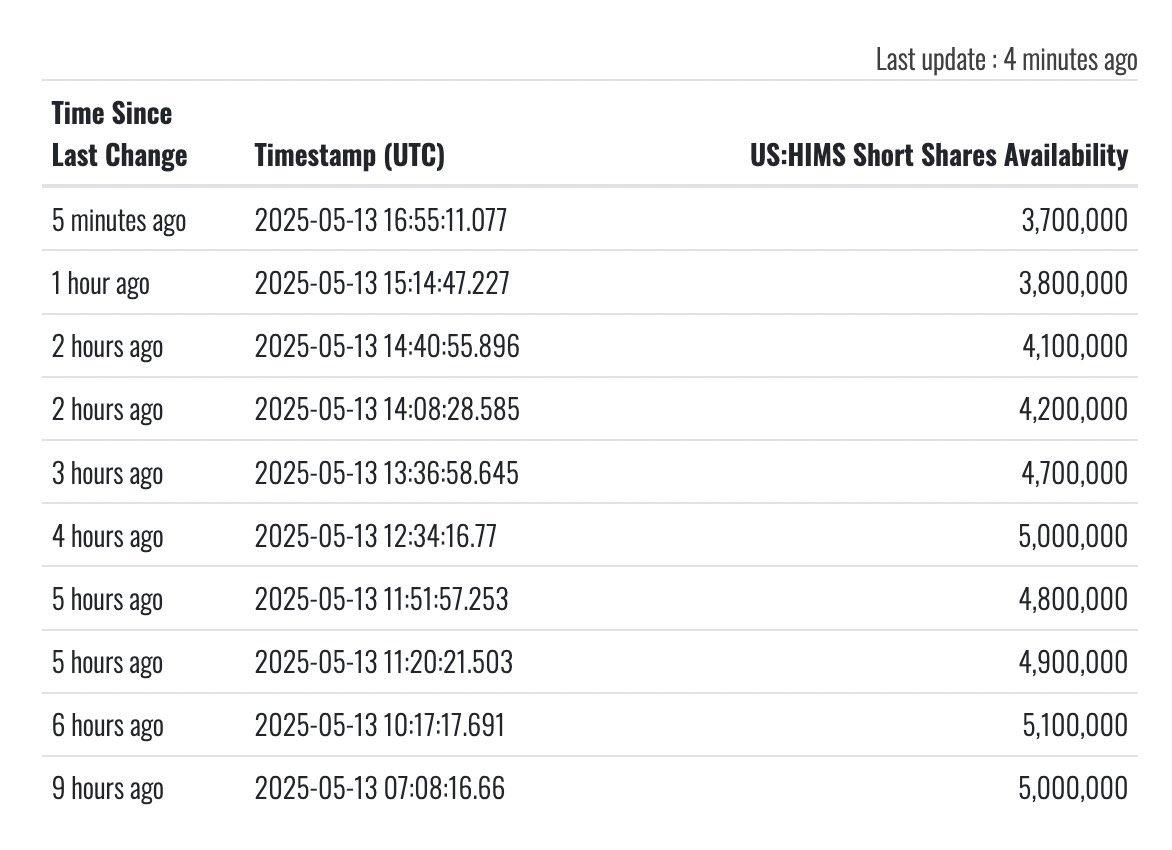

The Short Selling Narrative

Oguz O.’s commentary also touches on the narrative surrounding short selling in relation to HIMS. Short sellers often bet against companies, believing that their stock prices will decline. However, in the case of HIMS, the combination of strong fundamentals, consistent performance, and an attractive valuation presents a compelling argument against short selling. As the company continues to deliver positive news, such as new partnerships or strong earnings reports, the risks associated with short selling may grow, potentially leading to a short squeeze — a situation where short sellers are forced to buy back shares at higher prices, driving the stock price even higher.

Conclusion: An Investment Worth Watching

In summary, HIMS stands out as a compelling investment opportunity in the healthcare sector. With its extraordinary revenue growth, consistent performance, and attractive valuation, the company is well-positioned for continued success. Investors looking for growth stocks in the telehealth space should keep a close eye on HIMS as it navigates its growth journey.

As the market continues to evolve, the potential for HIMS to deliver strong returns remains high. With each new partnership and positive earnings report, the narrative surrounding HIMS will likely shift, attracting more investor attention and possibly leading to a significant rise in its stock price. The combination of strong fundamentals and market dynamics makes HIMS a company worth considering for any investment portfolio focused on growth and innovation in healthcare.

For those interested in staying updated on HIMS and its performance, following market analysts and financial news related to the company can provide valuable insights. Engaging with investment communities and platforms can also enhance understanding and facilitate informed decision-making regarding potential investments in HIMS.

Imagine going short on a company that:

– Increased revenues 10x in 4 years.

– Beat its guidance every quarter.

– Never reported loss of sales.And trading at 6x forward sales.

One more good news, one more partnership, one more solid beat and shorts will be dead. pic.twitter.com/uyOs1ee7eN

— Oguz O. | 𝕏 Capitalist (@thexcapitalist) May 13, 2025

$HIMS: A Company on the Rise

Imagine going short on a company like $HIMS that has experienced phenomenal growth over the past few years. This isn’t just any ordinary business; it’s a health-focused brand that’s redefining how people access wellness solutions. A staggering **10x increase in revenues over four years** is something that sparks interest among investors and analysts alike. So, what makes $HIMS stand out in a crowded marketplace? Let’s dig deeper into this remarkable company and its impressive trajectory.

Explosive Revenue Growth

When you hear that a company has increased its revenues **10x in just four years**, you can’t help but raise an eyebrow. That’s exactly what $HIMS has accomplished. From its early days, the company has been on a relentless quest to provide accessible health and wellness products directly to consumers. This approach has resonated with a growing audience that values convenience and transparency in healthcare.

Their model emphasizes telehealth and direct-to-consumer sales, making it easier for individuals to get the care they need without the hassle of traditional healthcare systems. As more people seek out alternative solutions, $HIMS has positioned itself as a go-to option, aligning perfectly with the shifting attitudes toward health and wellness.

Consistent Performance: Beating Guidance

One of the standout features of $HIMS is its ability to **beat its guidance every quarter**. This consistency is a hallmark of a well-managed company. Investors love to see a business that not only meets expectations but exceeds them. It builds trust and confidence in the company’s leadership and its strategic vision.

Beating guidance also indicates that the company is agile and responsive to market conditions. Whether it’s adapting to consumer preferences or capitalizing on new opportunities, $HIMS has demonstrated a keen ability to stay one step ahead of the competition. Regularly exceeding projections shows that they have a solid grasp of their market and are capable of leveraging their strengths effectively.

Never Reported Loss of Sales

Let’s talk about something that often sends shivers down the spines of investors: losses. Many companies face fluctuations in sales, particularly in industries as volatile as health and wellness. However, $HIMS has **never reported a loss of sales**. That’s a remarkable feat!

This strong performance indicates a solid business model and a loyal customer base. The products offered by $HIMS speak to a growing consumer demand for health solutions that are both affordable and convenient. With their focus on transparency and customer service, it’s no wonder that customers keep coming back for more.

Valuation: Trading at 6x Forward Sales

Now, let’s dive into the numbers. $HIMS is currently **trading at 6x forward sales**. For those who might not be familiar with this term, it essentially means that the company’s stock price reflects six times its expected sales over the next year. This valuation can be considered quite attractive, especially given the company’s growth trajectory.

Investors often look for companies that are undervalued or have the potential for significant appreciation. With consistent revenue growth and a solid market position, $HIMS may be a diamond in the rough. The combination of a reasonable valuation and strong performance metrics makes it an appealing choice for those looking to invest in the health and wellness sector.

The Power of Partnerships

As with any successful company, partnerships play a crucial role in the growth of $HIMS. Collaborations with other brands and healthcare providers can open new doors for innovation and market reach. Each partnership not only enhances their product offerings but also builds credibility in the eyes of consumers.

For instance, strategic partnerships can lead to new product lines, improved technology, or expanded distribution channels. The potential for **one more good news, one more partnership**, or another successful earnings beat could be the catalyst that sends this stock soaring. Investors are always on the lookout for signs of growth, and a new partnership could very well be the spark that ignites further enthusiasm for the stock.

Short Selling: A Risky Bet

With all this positive momentum, it’s hard to imagine why anyone would go short on $HIMS. Short selling is a strategy where investors bet against a stock, hoping to profit from a decline in its price. However, given the company’s robust performance metrics, going short on $HIMS seems like a risky move.

The tweet by [Oguz O.](https://twitter.com/thexcapitalist/status/1922370029846200783?ref_src=twsrc%5Etfw) highlights the precarious position of short sellers in this situation. If $HIMS continues to deliver strong results and positive news, those betting against the stock could find themselves in a precarious position. One more solid beat or announcement could send short sellers scrambling to cover their positions, resulting in a potential short squeeze that could drive the stock price up even further.

Future Outlook: What Lies Ahead for $HIMS

The future looks bright for $HIMS. With its innovative approach to healthcare and wellness, the company is well-positioned to capitalize on the growing demand for accessible health solutions. As they continue to expand their product offerings and forge new partnerships, there’s a strong likelihood that they will maintain their upward trajectory.

Moreover, as healthcare continues to evolve, companies that prioritize consumer needs and convenience will thrive. $HIMS is already ahead of the curve, and with ongoing strategic initiatives, they could see even greater success in the years to come.

Wrapping It Up

In summary, $HIMS presents a compelling case for investors looking to dive into the health and wellness market. With a track record of **10x revenue growth**, consistent performance, and a solid valuation, this company is worth keeping an eye on. The potential for further growth through partnerships and innovative offerings adds another layer of excitement.

So, whether you’re an experienced investor or just starting out, $HIMS might be a name to watch closely. With all the positive indicators and strong fundamentals, it’s clear that the future is looking bright for this health-focused brand. As they say, one more good news, one more partnership, one more solid beat, and those who bet against them might just find themselves on the wrong side of history.