Stocks Skyrocket: $AMD, $PLTR, $TSLA, $SOFI, $SHOP, $RVLV, $WYNN Surge!

Summary of Recent Stock Market Movements Featuring $AMD, $PLTR, $TSLA, $SOFI, $SHOP, $RVLV, and $WYNN

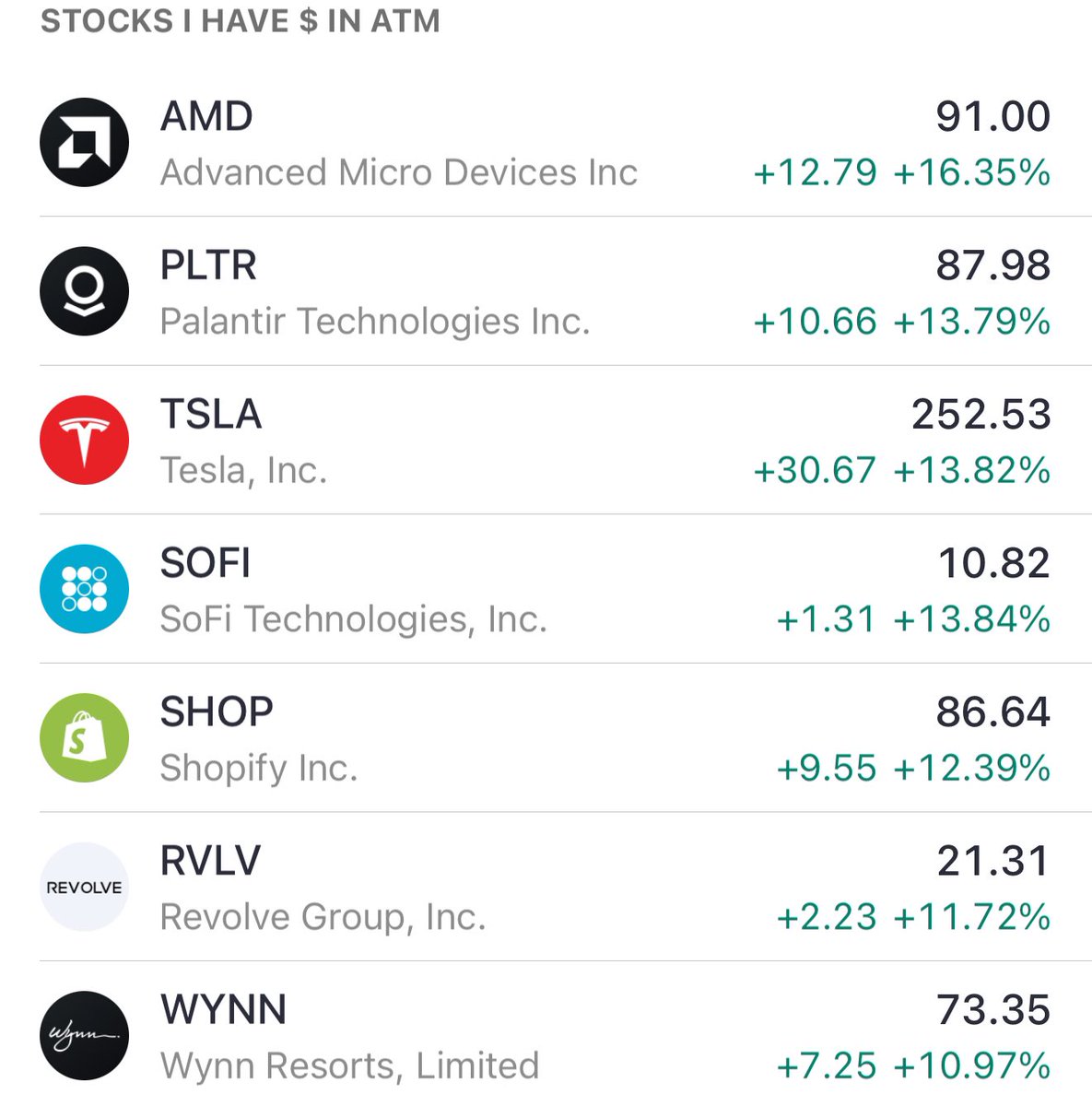

In a recent tweet by Jeremy Lefebvre, a notable figure in the investment community, stocks such as $AMD (Advanced Micro Devices), $PLTR (Palantir Technologies), $TSLA (Tesla), $SOFI (SoFi Technologies), $SHOP (Shopify), $RVLV (Revolve Group), and $WYNN (Wynn Resorts) witnessed remarkable double-digit gains in a short span of fifteen minutes. This sudden surge in stock prices has attracted the attention of investors and analysts alike, prompting discussions about the factors driving these movements and the overall direction of the stock market.

Understanding the Stocks on the Rise

$AMD (Advanced Micro Devices)

$AMD is a major player in the semiconductor industry, known for its innovative processors and graphics cards. The company has been experiencing a consistent upward trajectory thanks to its competitive edge against rivals like Intel and NVIDIA. Investors are particularly optimistic about AMD’s expansion into artificial intelligence (AI) and advanced computing, which are expected to drive future growth.

$PLTR (Palantir Technologies)

$PLTR provides software solutions for data analysis and has garnered significant attention for its partnerships with government agencies and large corporations. The recent spike in $PLTR’s stock price can be attributed to heightened interest in data-driven decision-making and the increasing demand for cybersecurity solutions. As companies continue to recognize the importance of data analytics, Palantir’s stock is likely to benefit.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

$TSLA (Tesla)

$TSLA, led by CEO Elon Musk, is a pioneer in electric vehicles (EVs) and renewable energy solutions. The company has consistently outperformed market expectations, and recent announcements about new vehicle models and production capabilities have fueled investor confidence. Tesla’s commitment to sustainability and innovation positions it well for future growth in the EV market.

$SOFI (SoFi Technologies)

$SOFI is an online personal finance company that offers a range of financial services, including student and personal loans, investing, and insurance. The rise in $SOFI’s stock can be linked to the increasing acceptance of digital banking solutions and the growing trend of consumers seeking flexible financial services. With its user-friendly platform and diverse offerings, SoFi is well-positioned to capture a larger market share.

$SHOP (Shopify)

$SHOP has revolutionized e-commerce by providing businesses with the tools they need to build and manage online stores. The surge in $SHOP’s stock price is reflective of the growing trend towards online shopping, which has been accelerated by the pandemic. As more businesses shift to e-commerce, Shopify’s comprehensive platform continues to attract new customers and drive revenue growth.

$RVLV (Revolve Group)

$RVLV is an online fashion retailer known for its influencer-driven marketing strategy. The recent uptick in $RVLV’s stock can be attributed to the resurgence of consumer spending in the fashion sector as the economy reopens. With a focus on millennial and Gen Z consumers, Revolve’s unique marketing approach positions it favorably in a competitive market.

$WYNN (Wynn Resorts)

$WYNN operates luxury resorts and casinos, primarily in Las Vegas and Macau. The rise in $WYNN’s stock price is indicative of a recovery in the travel and hospitality sector, as more travelers return to casinos and resorts post-pandemic. The company’s strong brand and commitment to offering premium experiences are likely to continue attracting customers.

Market Analysis and Future Trends

The recent surge in the stocks mentioned indicates a broader trend in the stock market, reflecting investor optimism about recovery and growth in various sectors. Jeremy Lefebvre has hinted at a more in-depth analysis of these movements in an upcoming video, where he plans to break down the underlying factors and predict the future trajectory of the stock market.

It is essential for investors to remain informed about macroeconomic indicators, such as interest rates and inflation, which can influence market performance. Additionally, sector-specific trends, like the growth of digital finance, e-commerce, and renewable energy, will play a pivotal role in shaping the investment landscape.

Conclusion

As we observe significant stock movements in companies like $AMD, $PLTR, $TSLA, $SOFI, $SHOP, $RVLV, and $WYNN, it’s crucial for investors to stay vigilant and informed. The stock market is inherently volatile, and understanding the forces at play can help investors make informed decisions. Jeremy Lefebvre’s insights and analyses serve as a valuable resource for those looking to navigate this complex landscape. Investors should keep an eye on these stocks and the overall market trends as they develop over the coming days and weeks. With the right information and strategies, there are ample opportunities for growth and success in the stock market.

Call to Action

For those interested in gaining deeper insights into market movements and stock analysis, following Jeremy Lefebvre on Twitter and subscribing to his channel for the upcoming video can provide valuable information. Stay updated on the latest trends and make informed investment decisions to capitalize on the opportunities presented by the dynamic stock market.

$AMD $PLTR $TSLA $SOFI $SHOP $RVLV $WYNN all blasting double digit percent higher past 15 minutes

Be on the lookout for main channel video in a few hours breaking everything down and where stock market is headed from here. Have a great day! Jeremy pic.twitter.com/Fmsq5Gjj5M

— Jeremy Lefebvre (@HolySmokas) April 9, 2025

$AMD $PLTR $TSLA $SOFI $SHOP $RVLV $WYNN all blasting double digit percent higher past 15 minutes

Hey there, fellow investors! If you’ve been keeping an eye on the stock market lately, you might have noticed some exciting movements. Stocks like $AMD, $PLTR, $TSLA, $SOFI, $SHOP, $RVLV, and $WYNN have all been blasting double-digit percent higher in a matter of just 15 minutes. This surge has investors buzzing and looking for insights into what’s driving these gains.

Understanding the Surge

So, what’s behind this impressive rise? Let’s dive into each of these stocks and break down the factors contributing to this market movement. First up is $AMD. This semiconductor giant has been riding high due to strong demand in gaming and data centers. Their recent product launches have set the stage for a competitive edge, capturing the interest of tech enthusiasts and investors alike.

Next, we have $PLTR. Known for its data analytics prowess, Palantir has been making headlines with new contracts and strategic partnerships that underline its value in the defense and commercial sectors. As organizations increasingly turn to data-driven decision-making, Palantir is positioning itself as a key player.

Then there’s $TSLA. Tesla’s stock has been on a rollercoaster ride, but recent announcements regarding production targets and new model releases have investors feeling bullish. With the electric vehicle market growing rapidly, Tesla remains at the forefront, and its stock reflects that optimism.

Other Notable Players

Let’s not forget $SOFI, which has been gaining traction in the fintech space. With a focus on personal finance and investing tools, SoFi is appealing to a younger demographic that values technology and innovation. Recent product enhancements and a growing user base are contributing to its stock’s upward trend.

$SHOP has also been catching the eye of investors. As e-commerce continues to thrive, Shopify’s platform enables businesses to easily set up online shops. The company’s robust revenue growth and a series of new features have solidified its position in the market.

As for $RVLV, Revolve has been making waves in the fashion retail sector. With a successful business model that leverages social media for marketing, Revolve has seen impressive sales numbers. The trend towards online shopping, particularly in the fashion industry, has been a boon for this company.

Lastly, we have $WYNN. As the hospitality and gaming industries rebound post-pandemic, Wynn Resorts is benefitting from increased tourism and consumer spending. The company’s focus on high-end experiences has made it a go-to destination for travelers, further driving its stock price higher.

Market Sentiment and Future Outlook

With all these stocks experiencing significant gains, what does it mean for the broader market? Market sentiment plays a crucial role in stock performance. When investors see stocks like $AMD and $TSLA surging, it often creates a ripple effect. Bullish sentiment can lead to more buying, pushing prices even higher.

However, it’s essential to approach this excitement with caution. While short-term gains can be exhilarating, long-term investments require a keen eye on fundamentals and market conditions. As Jeremy Lefebvre mentioned in his tweet, there’s a lot to unpack regarding where the market is headed. Keeping an eye on economic indicators, earnings reports, and industry trends will be crucial.

Be on the lookout for main channel video in a few hours breaking everything down and where stock market is headed from here. Have a great day! Jeremy

As we continue to monitor these stocks, it’s worth noting that the investment landscape is ever-changing. Whether you’re a seasoned investor or new to the game, staying informed is key. Engaging with content that breaks down market movements, like Jeremy’s upcoming video, can provide valuable insights and guidance.

So, as you navigate your investment strategy, consider the factors driving stocks like $PLTR and $SOFI. Dive deep into the fundamentals and keep abreast of market news to make informed decisions. Remember, investing is a marathon, not a sprint!

In Conclusion

The recent surge in stocks like $SHOP and $RVLV is a reminder of the dynamic nature of the stock market. With the right information and strategies, you can navigate these fluctuations and potentially reap the rewards of your investments. Keep your eyes peeled for more updates and analyses, and here’s to your investing journey!

“`