DEBANK EXPOSED: Ignoring PULSECHAIN’s $31M for DEAD CHAINS!

Discovering the PulseChain Potential: A Wake-Up Call for DeBank

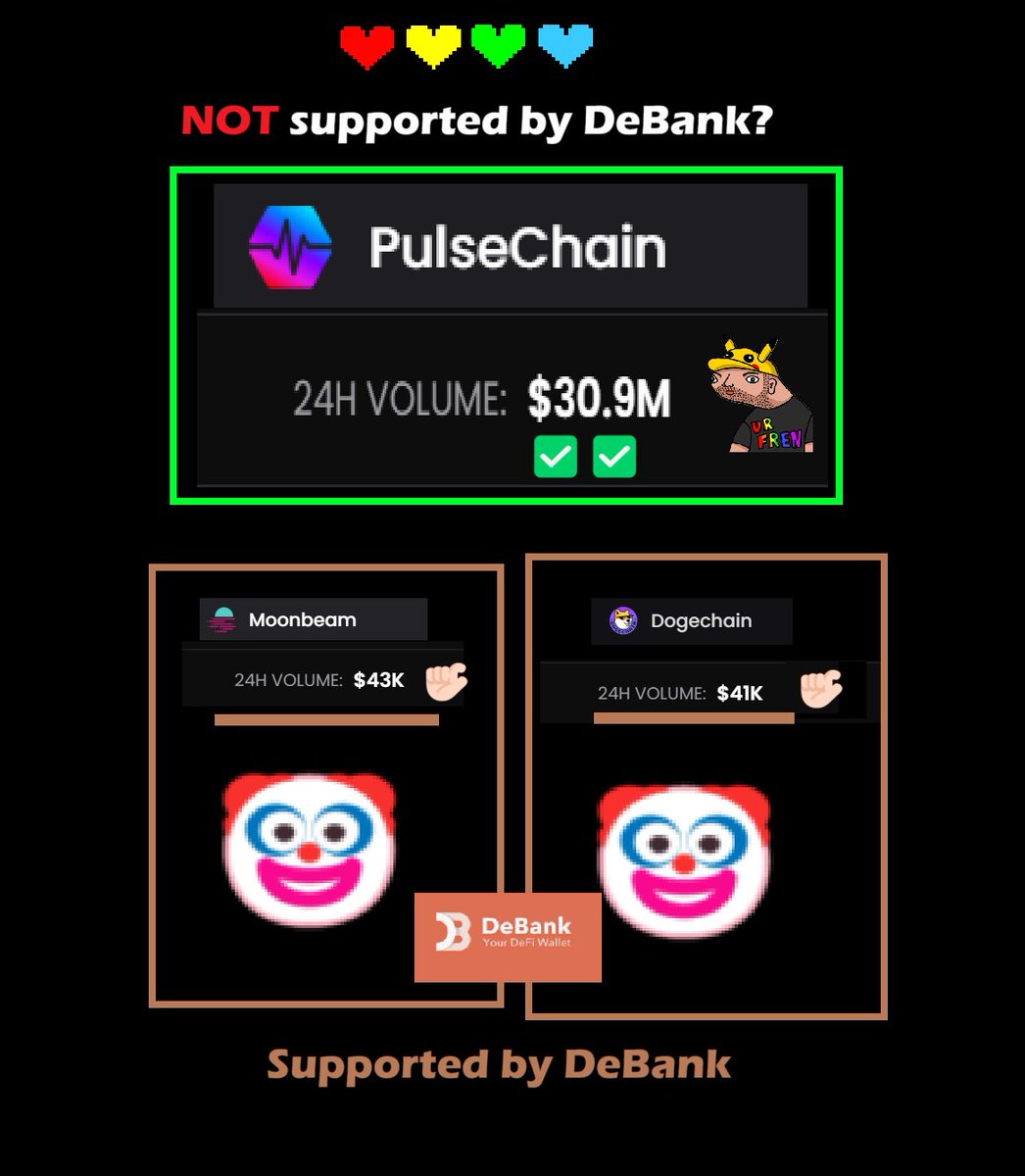

In the dynamic world of decentralized finance (DeFi), staying ahead of the curve is crucial for investors and platforms alike. Recently, a noteworthy conversation erupted on Twitter, spearheaded by the user @yourfriendSOMMI, highlighting a significant issue in the DeFi landscape. The tweet uncovers that DeBank, a prominent DeFi analytics platform, continues to support less active chains like MoonBeam and DogeChain, while neglecting the burgeoning PulseChain. This revelation has sparked discussions about the future of these platforms and the importance of recognizing and supporting thriving ecosystems.

PulseChain’s Impressive Performance

In the tweet, @yourfriendSOMMI emphasizes that PulseChain has achieved an astonishing trading volume of $31 million in just 24 hours. This figure positions PulseChain as a formidable player in the DeFi market, showcasing its growing popularity and user engagement. The juxtaposition of PulseChain’s success against the backdrop of MoonBeam and DogeChain raises critical questions about the criteria used by platforms like DeBank to support specific blockchains.

The State of MoonBeam and DogeChain

While the tweet does not specify the volume figures for MoonBeam and DogeChain, there is an implicit understanding that these chains are underperforming compared to PulseChain. This discrepancy begs the question: why is DeBank prioritizing chains that are seemingly stagnant in their growth? The answer may lie in historical partnerships, user bases, or legacy systems that are slow to adapt. However, as the DeFi landscape evolves, it’s essential for analytics platforms to align their support with current market trends and user demands.

The Importance of Supporting Active Chains

The DeFi ecosystem is built on the principles of decentralization and user empowerment. As such, analytics platforms like DeBank play a pivotal role in shaping the narratives surrounding various blockchains. By choosing to support active chains like PulseChain over those with dwindling activity, DeBank could enhance its credibility and relevance in the industry. Supporting active chains not only benefits users but also helps foster a more vibrant and competitive market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Community Reactions and Implications

The tweet by @yourfriendSOMMI has ignited conversations within the crypto community, with many expressing their frustration over DeBank’s choices. The sentiment shared by the community reflects a desire for transparency and adaptability in the DeFi space. As users demand better representation for thriving platforms, it’s clear that the support of influential analytics tools like DeBank can significantly impact the trajectory of these chains.

Moreover, the backing of a robust analytics platform can lead to increased investment and user interest, creating a positive feedback loop that further drives growth. If DeBank were to reconsider its support structure, it could catalyze a broader recognition of PulseChain and other emerging chains, ultimately contributing to a more diverse and resilient DeFi ecosystem.

The Future of DeFi and Blockchain Support

As we look ahead, the importance of analytical support for emerging chains cannot be overstated. The DeFi landscape is rapidly evolving, with new protocols and technologies constantly emerging. For platforms like DeBank, adapting to these changes and aligning support with active and promising chains is essential for maintaining relevance.

Investors and users are increasingly seeking platforms that not only provide analytics but also champion the chains that are driving innovation and growth. As more individuals become aware of the potential of PulseChain and similar projects, the demand for accurate and representative support will only intensify.

Conclusion

In conclusion, the recent revelations regarding DeBank’s support for MoonBeam and DogeChain over PulseChain highlight a critical juncture in the DeFi landscape. With PulseChain demonstrating remarkable growth and trading volume, it is imperative for analytics platforms to reassess their support strategies. By prioritizing active and thriving chains, platforms like DeBank can enhance their relevance and contribute to a more vibrant DeFi ecosystem. The community’s reaction to @yourfriendSOMMI’s tweet underscores the collective desire for a more equitable representation of blockchain projects.

As the DeFi landscape continues to evolve, the choices made by analytics platforms will play a significant role in shaping the future of decentralized finance. Supporting active chains like PulseChain not only benefits users and investors but also fosters a more competitive and diverse market environment. The conversation initiated by @yourfriendSOMMI serves as a reminder that in the world of DeFi, staying attuned to market dynamics is crucial for success and sustainability.

BREAKING NEWS

Sommi discovers that DeBank (@DeBankDeFi) are still supporting dead chains like MoonBeam and Dogechain instead of PulseChain.

PulseChain did a WHOPPING $31 MILLION DOLLARS of volume in the past 24 hours.

How much did MoonBeam and DogeChain do?… pic.twitter.com/8GmlIEiHhq

— yourfriendSOMMI (@yourfriendSOMMI) April 1, 2025

BREAKING NEWS

Hey, everyone! Have you heard the buzz? Our friend Sommi has just dropped some major news, and it’s making waves in the crypto community. DeBank, the decentralized finance platform, is still supporting chains like MoonBeam and Dogechain, which many consider to be “dead chains.” The big question on everyone’s lips is why they’re ignoring the impressive surge of PulseChain.

In fact, PulseChain has recently reported a jaw-dropping $31 million in trading volume in just the past 24 hours! Can you believe that? It’s a significant number that highlights the growing interest and activity in the PulseChain ecosystem. But how do MoonBeam and DogeChain stack up against this powerhouse? That’s the million-dollar question!

What’s Happening with DeBank?

So, let’s break it down. DeBank has established itself as a go-to platform for tracking decentralized finance (DeFi) assets across multiple chains. You can think of it as your personal dashboard for everything DeFi-related. However, their decision to continue supporting chains with questionable futures, like MoonBeam and Dogechain, has left many scratching their heads. Why not focus on thriving ecosystems like PulseChain?

This situation raises eyebrows because the crypto community tends to favor projects that exhibit growth, utility, and user engagement. Supporting “dead chains” can feel like a step backward. For instance, MoonBeam and DogeChain have seen dwindling activity, while PulseChain is showing signs of life with its recent trading volume spike.

PulseChain: The Rising Star

Let’s delve into why PulseChain is attracting so much attention. For starters, PulseChain aims to improve Ethereum’s scalability and transaction speed. It’s designed to be a more efficient version of Ethereum, allowing users to carry out transactions with lower fees and faster confirmation times. With these advantages, it’s no wonder that PulseChain is raking in millions!

When you look at the figures, it’s clear that PulseChain is doing something right. The reported $31 million in volume is a testament to its growing user base and the trust that investors are placing in it. This level of activity showcases that PulseChain isn’t just a flash in the pan; it’s establishing itself as a serious player in the DeFi arena.

MoonBeam and DogeChain: What’s the Deal?

Now, let’s take a closer look at MoonBeam and Dogechain. Both projects had their moments in the limelight, but over time, they’ve faced challenges that have led to decreased user engagement and trading volume. For example, MoonBeam was initially celebrated for its compatibility with Ethereum, allowing developers to deploy their projects with relative ease. However, as the competition grew, it struggled to maintain its momentum.

On the other hand, DogeChain was seen as a fun project that capitalized on the popularity of Dogecoin. While it attracted attention, it didn’t translate into sustainable growth. As a result, both MoonBeam and Dogechain are now often referred to as “dead chains,” with many wondering if they can ever bounce back.

The Power of Community Support

One of the most critical factors in the success of any blockchain project is its community. In the case of PulseChain, the community is thriving. Enthusiastic supporters are rallying behind the project, sharing updates, and encouraging others to participate in the ecosystem. This grassroots support fosters a sense of belonging and loyalty, driving more users to explore and invest in PulseChain.

Conversely, the communities surrounding MoonBeam and DogeChain seem to be dwindling. With less engagement and fewer active participants, it’s challenging for these projects to generate the buzz and excitement necessary for growth. This stark contrast between the communities can significantly impact the long-term viability of these chains.

What’s Next for DeBank?

Given the current landscape, it’s crucial for DeBank to reassess its support for these “dead chains.” The crypto world is constantly evolving, and platforms that adapt to the changing tides will thrive. By focusing on live projects like PulseChain, DeBank could enhance its reputation and align itself with successful ecosystems.

As we’ve seen, PulseChain is on the rise, and ignoring it could mean missing out on significant opportunities. The trading volume indicates not just interest but also confidence in the project’s future. DeBank has a chance to be a part of this success story by embracing the chains that are actively engaging users and driving innovation.

Conclusion: The Future of Crypto Chains

In the ever-changing world of cryptocurrency, it’s essential to keep an eye on what’s working and what’s not. The recent developments highlighted by Sommi about DeBank’s choice to support MoonBeam and DogeChain while overlooking PulseChain raises important questions about sustainability and growth in the DeFi space.

PulseChain’s impressive trading volume shows that it is not just a passing trend; it represents a shift in how users perceive value in blockchain ecosystems. As we move forward, it will be fascinating to see how DeBank responds to this situation and whether it will realign its support to reflect the current crypto landscape.

So, what do you think? Are MoonBeam and DogeChain truly dead chains, or do they have the potential for revival? And will DeBank pivot to support the thriving PulseChain? Let us know your thoughts!