MPs Refuse to Pay Council Tax on Second Homes Amid Crisis!

MPs Exempt from New Council Tax Rises on Second Homes: A Controversial Policy

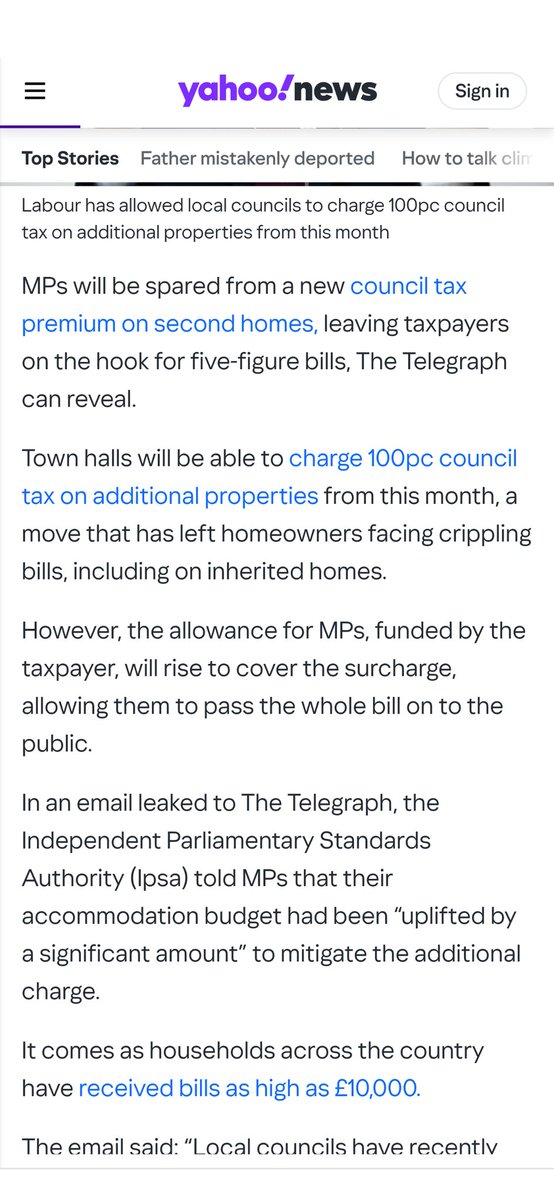

In recent news, a leaked email revealed that Members of Parliament (MPs) will not be subject to new council tax increases on their second homes. This revelation has sparked significant outrage and debate among the public and various stakeholders. The discussion is particularly relevant in the context of rising living costs and the ongoing financial challenges faced by many households across the United Kingdom.

Background of the Issue

The council tax is a local taxation system that helps fund local services such as education, waste collection, and emergency services. It is based on the estimated value of residential properties. Recently, local councils have faced increasing financial pressures, leading many to consider raising council tax rates. However, the decision to exempt MPs from these tax increases on their second homes raises questions about fairness and accountability.

The leaked email, initially shared by journalist June Slater on Twitter, indicates that MPs will not be required to pay the new council tax rates on properties they own apart from their primary residences. This has led to a public outcry, as many citizens are struggling to make ends meet while politicians appear to be insulated from the financial burdens that the average person faces.

Public Reaction and Criticism

Social media platforms have been abuzz with reactions to this news, with many users expressing their frustration and disbelief. Critics argue that this exemption reflects a disconnect between MPs and the realities faced by their constituents. The perception that lawmakers are living in a different financial world has fueled anger, particularly among those who are already feeling the strain of economic pressures.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Furthermore, the debate extends beyond mere tax policy. It raises broader questions about the integrity of the political system and the responsibilities of elected officials. Many believe that if MPs are to represent the interests of their constituents effectively, they should be subject to the same financial obligations as everyone else.

The Implications of Exemptions

The implications of exempting MPs from council tax rises on second homes are significant. For one, it sets a precedent that could encourage other sectors of the government to seek similar exemptions. This could lead to a widening gap in the perception of fairness within the taxation system. If lawmakers are seen as being above the law, it could diminish public trust in government institutions.

Moreover, the decision raises concerns about the financial burdens placed on local councils. With MPs exempt from these increases, local governments might face pressure to raise taxes on average citizens even higher to compensate for the lost revenue. This could lead to further financial strain on families already struggling to make ends meet.

The Political Landscape

This controversy is unfolding in a politically charged environment, where public sentiment towards politicians is already low. With the ongoing cost-of-living crisis affecting many households, the notion that MPs are not sharing in the sacrifices can exacerbate existing frustrations with the political elite.

Political commentators suggest that this issue could become a focal point in upcoming elections, with opposition parties likely to use it as a platform to criticize the ruling government. Voters may view the exemption as indicative of a broader failure to address economic inequality and social justice.

The Role of Media and Public Discourse

The role of media in uncovering such controversies is crucial. The leak to The Telegraph and its subsequent dissemination via social media platforms demonstrate the power of journalism in holding public officials accountable. As more people become aware of issues like this, public discourse can shift, prompting politicians to reconsider policies that may appear unjust.

The influence of social media cannot be understated. Platforms like Twitter provide a space for citizens to voice their opinions and share information rapidly. This has the potential to mobilize public opinion and create a groundswell of dissent that may force lawmakers to take action.

Possible Future Developments

In light of the backlash, it is possible that MPs will face pressure to reconsider their stance on council tax exemptions. Public outcry may lead to calls for greater transparency and accountability within government. Additionally, discussions surrounding tax reforms may gain traction, particularly if voters demand a more equitable taxation system.

There may also be discussions about whether MPs should be required to disclose their financial interests more comprehensively, particularly concerning second homes and investment properties. Ensuring that lawmakers are held to the same financial standards as their constituents could restore some trust in the political system.

Conclusion

The revelation that MPs will not pay new council tax rises on their second homes has ignited a significant debate about fairness, accountability, and the responsibilities of elected officials. As public outrage grows, it is essential for lawmakers to consider the implications of their decisions on the electorate. The ongoing discourse surrounding this issue highlights the critical role of transparency in governance, and it may serve as a catalyst for change in how politicians engage with economic challenges faced by their constituents.

As the situation unfolds, it remains to be seen how MPs will respond to the mounting pressure and whether there will be any changes to the exemption policy. The outcome will likely shape public perception of the political class and influence the future of taxation policy in the UK.

MPs won’t pay new council tax rises on their second homes

Leaked email to The Telegraph pic.twitter.com/uIhxiQIHrX— June Slater (@juneslater17) April 2, 2025

MPs Won’t Pay New Council Tax Rises on Their Second Homes

There’s been quite a buzz lately regarding the news that **MPs won’t pay new council tax rises on their second homes**. This revelation came to light through a leaked email that made its way to The Telegraph, and it has stirred quite a bit of conversation among the public. Many are wondering how this decision affects taxpayers and what it means for the ongoing discussions around fairness in taxation.

The idea that Members of Parliament can sidestep increased council tax on their second residences raises eyebrows and ignites debate. It’s not just a question of financial implications, but also the ethics of such a move. It feels a bit like a double standard when regular citizens are grappling with rising living costs while those in power appear to have a cushion to fall back on.

Understanding the Context

To really get a grasp of this situation, we need to unpack what council tax actually is. In the UK, council tax is a local taxation system that helps fund local services like education, waste management, and emergency services. It’s something that every homeowner must pay, and it’s based on the estimated value of the property. So, when we hear that **MPs won’t pay new council tax rises on their second homes**, it feels like they’re getting special treatment, right?

This isn’t the first time council tax exemptions and special privileges for MPs have come under scrutiny. The question of fairness in taxation is always a hot topic, especially when it seems that the rules don’t apply equally to everyone. It’s that age-old sentiment of “one rule for them, another for us,” which really strikes a chord with the public.

The Leaked Email’s Implications

The leaked email that sparked this controversy revealed that MPs will be exempt from the new council tax hikes. This raises several concerns. For starters, what does this say about the government’s priorities? Taxation policies should ideally reflect the needs and realities of all citizens, not just a select few.

Moreover, it opens the door to questions about transparency and accountability. If MPs can avoid paying increased taxes, what message does this send about their commitment to the constituents they represent? Many feel that this decision undermines the trust between elected officials and the public they serve.

Public Reaction

Naturally, the public has had a lot to say about this issue. Social media has been buzzing with opinions, frustrations, and calls for change. People are expressing their disbelief that those in power can simply opt out of financial responsibilities that others have to face. It’s a conversation that is not just about finances but also about fairness and representation.

In fact, June Slater, who shared the information on Twitter, highlights the discontent that many feel. The tweet, along with the image of the email, has gone viral, and it’s clear that people are ready to voice their concerns. The sentiment is clear: the public feels that MPs should lead by example, particularly when it comes to financial responsibilities.

Why Does This Matter?

You might be wondering why this matters in the grand scheme of things. Well, taxation policies impact everyone, and when disparities arise, it can lead to significant societal issues. People want to feel that the system is fair and just. If those in power can evade certain financial responsibilities, it can foster a sense of resentment and disillusionment among the populace.

Furthermore, this situation could lead to calls for reform. If voters are unhappy with the way their representatives are managing tax policies, we could see a push for more stringent regulations regarding MPs’ financial obligations. This type of grassroots pressure can lead to meaningful change, and that’s something to keep an eye on.

The Bigger Picture

This isn’t just about a single email or one decision. It’s about the broader implications of how we view authority, accountability, and fairness in society. The incident serves as a reminder that transparency in governance is critical. When people feel they are being treated unfairly, it can erode trust in the political system.

Moreover, this case raises questions about how second homes are treated in taxation. Many people own second homes as investments or for holiday purposes, and they too face the burden of rising costs. If MPs are exempt from these increases, it could lead to a larger discussion about the taxation of second properties and whether or not special exemptions should exist at all.

Looking Forward

As the dust settles on this situation, it will be interesting to see how policymakers respond. Will there be changes made to ensure that MPs are held to the same standards as their constituents? Or will this be brushed under the rug, leaving the public feeling even more disenfranchised?

One thing is for sure: the conversation surrounding **MPs won’t pay new council tax rises on their second homes** isn’t going away anytime soon. It’s a topic that resonates with many, and as we move forward, it’s crucial for both politicians and the public to engage in open dialogue about these issues.

The leaked email has certainly opened a can of worms, and it may just be the catalyst for change that advocates have been waiting for. As citizens, it’s our responsibility to stay informed and demand accountability from those we elect to represent us.

In the end, fairness in taxation should be a priority for everyone, especially for those who make the laws. Whether this situation leads to reform or further discontent remains to be seen, but one thing’s for certain: the public is watching closely, and they won’t be silent.

Stay tuned for more updates on this unfolding story, and let’s keep the conversation going about what fair taxation should look like in our society.