Long Island Widower Declared Dead Again in Tax Filing Mix-Up!

Long Island Widower Declared Dead Again: A Bizarre Tax Filing Incident

In a perplexing turn of events, a widower from Long Island found himself mistakenly declared dead for the second time while attempting to file his taxes. This unusual situation has drawn significant media attention and raised questions about the bureaucratic processes that can lead to such errors. This summary explores the details of the incident, the implications for the individual involved, and the broader context of tax filing complications.

The Incident

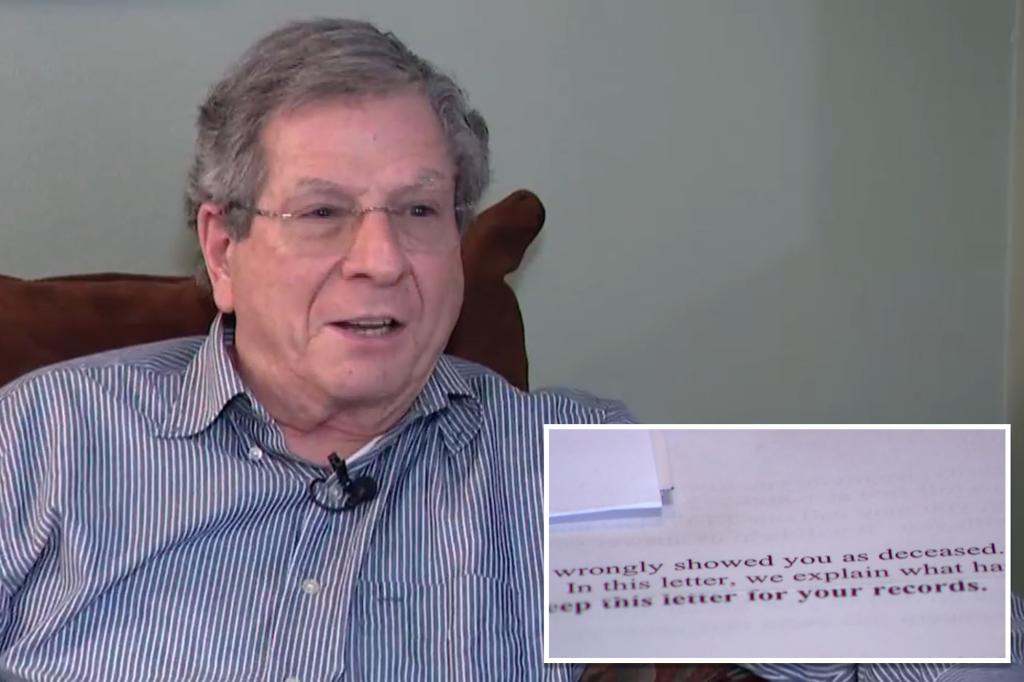

According to reports, the Long Island widower, whose identity has not been disclosed, faced an alarming situation when he attempted to file his tax returns for the year. Upon submitting his documents, he was informed by the IRS that he was, in fact, deceased. This was not the first time he had encountered such a bizarre situation, as he had previously been declared dead in a similar mix-up. The ramifications of being declared dead by the IRS can be severe, affecting an individual’s ability to access financial services, receive government benefits, and even conduct everyday transactions.

The Consequences of Being Declared Dead

For individuals who are mistakenly declared dead, the consequences can be far-reaching. In this case, the Long Island widower faced numerous challenges, including difficulties in filing his taxes and potential complications with his bank accounts and health insurance. Being listed as deceased can lead to the freezing of assets, loss of social security benefits, and other critical issues that can significantly disrupt a person’s life.

The process to correct a death declaration can be lengthy and fraught with bureaucratic obstacles. Individuals often need to produce extensive documentation to prove their living status, which can include identification, tax records, and proof of residency. The emotional toll of navigating such a process can be overwhelming, particularly for someone who has already experienced the loss of a spouse.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Technology in Tax Filing

The incident raises questions about the reliability of the systems used by the IRS and other tax authorities. As tax filing increasingly moves online, the chances of technical glitches or data entry errors also rise. In this case, it is unclear whether the mistake was due to a miscommunication, a clerical error, or an issue with data management. However, it highlights the importance of having robust verification systems in place to prevent similar situations from occurring in the future.

With the rise of artificial intelligence and automated systems in tax preparation, there is a growing need for transparency and accuracy in the handling of sensitive information. Taxpayers must be assured that their data is safe and correctly processed to prevent incidents like this.

Public Reaction and Implications

The public reaction to this incident has been a mix of surprise and sympathy. Many people can relate to the frustrations of dealing with bureaucracy, especially regarding taxes. Social media platforms have seen an outpouring of comments from users sharing their own experiences with tax-related mishaps. This incident serves as a reminder of the human side of tax filing and the often-overlooked challenges that individuals face during this annual process.

Moreover, this case could prompt discussions about the need for reform in how tax authorities handle death declarations and identity verification. It raises essential questions about accountability and the measures that can be implemented to prevent such errors in the future.

Moving Forward: Steps for Affected Individuals

For individuals who find themselves in similar situations as the Long Island widower, it is crucial to take specific steps to rectify the situation. Here are some recommendations:

- Documentation: Gather all necessary documents that prove your identity and living status. This can include a government-issued ID, utility bills, and any correspondence from the IRS.

- Contact Authorities: Reach out to the IRS or your local tax authority to report the error. It may also be necessary to contact other institutions, such as banks or insurance providers, to inform them of the mistake.

- Follow Up: Stay persistent in following up with authorities until the issue is resolved. Bureaucratic processes can be slow, so regular communication is essential.

- Seek Legal Assistance: If the situation becomes particularly complicated, it may be beneficial to consult with a legal professional who specializes in tax law or identity issues.

- Monitor Your Accounts: Keep a close eye on your financial accounts and credit reports for any unusual activity that may arise as a result of the mistaken declaration.

Conclusion

The case of the Long Island widower mistakenly declared dead during tax filing serves as a cautionary tale about the complexities of tax administration and the potential pitfalls of modern technology. It underscores the importance of careful data management and the need for efficient processes to prevent such incidents. As individuals navigate the sometimes-treacherous waters of tax filing, awareness and preparedness can go a long way in mitigating the challenges that may arise.

In a world where technology continues to evolve, ensuring accurate identity verification and maintaining robust communication channels between taxpayers and authorities is essential. This incident not only highlights the personal struggles faced by individuals but also calls for systemic improvements to prevent similar occurrences in the future.

Long Island widower mistakenly declared dead — again — after attempting to file taxes: report https://t.co/7uXbaU0J7T pic.twitter.com/mOeWEXuicK

— New York Post (@nypost) March 31, 2025

Long Island Widower Mistakenly Declared Dead — Again — After Attempting to File Taxes: Report

When you think of tax season, you might picture people frantically gathering their documents, finding time to meet with accountants, or maybe even stressing over potential audits. But for one Long Island widower, tax season took a bizarre turn when he found himself mistakenly declared dead—not for the first time. This eye-catching incident has everyone talking, and it’s a classic example of just how complicated life can get when bureaucracy meets personal circumstances.

The Initial Confusion

Imagine sitting at your kitchen table, preparing your taxes, and suddenly receiving a notification that you are, in fact, deceased. That’s exactly what happened to this unfortunate Long Island widower. According to reports, when he attempted to file his taxes, he was met with the confusing—and frankly alarming—news that he was listed as dead in the system. This isn’t the first time he’s faced such a mix-up, which adds a layer of absurdity to the situation.

For many, the idea of being declared dead is an alarming prospect, but for this widower, it’s just another chapter in a series of unfortunate events. This incident highlights the often-overlooked complications that can arise in personal records, especially when it comes to vital statistics like death certificates.

Understanding the Bureaucratic Mix-Up

So, how does one end up being declared dead in the first place? The process usually involves the issuance of a death certificate, which is intended to notify various government agencies and institutions of an individual’s passing. Mistakes can occur at any stage of this process, whether through clerical errors, miscommunications, or incorrect data entry.

In this case, it appears that the widower’s previous status—likely still tied to the loss of his spouse—was mismanaged in the system, leading to the erroneous declaration. It raises a crucial question about how efficiently our systems manage such sensitive information. After all, a simple error can lead to a myriad of complications, especially when it involves taxes and financial responsibilities.

Legal and Financial Implications

The implications of being mistakenly declared dead can be quite serious. For one, it can lead to complications in filing taxes. Being labeled as deceased can halt your ability to access bank accounts, apply for loans, or even make important health decisions. In this widower’s case, it meant facing potential financial repercussions when attempting to file his taxes.

Additionally, the legal ramifications can be staggering. If the IRS or other financial institutions are operating under the assumption that you’re deceased, it can lead to audits, penalties, and even legal challenges to reclaim your identity and financial standing. It’s a reminder of just how crucial it is to keep personal records up to date and to address any discrepancies as soon as they arise.

A Common Issue: More Than Just One Case

What’s fascinating about this case is that it’s not entirely unique. The mistaken declaration of death occurs more often than you might think. Various reports document instances where individuals have been declared dead due to clerical errors, often leading to lengthy legal battles to rectify the situation.

This specific incident shines a light on a broader issue in our bureaucratic systems. Whether it’s the IRS, Social Security Administration, or local government offices, the handling of sensitive data can sometimes fall short. This situation underscores the importance of vigilance in personal record-keeping and the need for systems that can quickly and efficiently address errors.

How to Navigate the System

If you ever find yourself in a situation similar to this Long Island widower, it’s essential to know how to navigate the system effectively. Start by gathering all relevant documents—this includes your birth certificate, Social Security card, and any previous tax filings. These documents will serve as proof of your identity and can help clarify any discrepancies.

Next, contact the relevant agencies immediately. In this case, the IRS would be the primary point of contact, but you may also need to reach out to local government offices or banks. Be prepared to explain your situation and provide documentation that supports your claim. The sooner you act, the better chance you have of resolving the issue quickly.

Lastly, consider seeking legal advice. If you encounter significant hurdles in correcting your status, consulting with a lawyer who specializes in tax law or estate planning can provide you with valuable guidance. They can help you navigate the complexities of the situation and may even assist you in communicating with government agencies.

Personal Reflections on the Situation

Reading about this Long Island widower’s experience certainly prompts some reflection. It’s easy to take for granted the systems we rely on for managing our identities and financial responsibilities. We often assume that these systems are infallible, but as this case shows, errors can and do happen.

It also brings to light the emotional toll that such bureaucratic mix-ups can have. Losing a spouse is already an incredibly challenging experience, and then to deal with the added stress of being declared dead yourself can be overwhelming. It’s a reminder to approach life’s challenges with a sense of humor when possible, even when faced with absurd situations. Sometimes, laughter is the best way to cope with life’s unexpected twists.

Community Reactions and Support

The community’s response to this peculiar situation has been varied. Some people have expressed empathy for the widower, recognizing the emotional and practical difficulties he faces. Others have taken to social media to share their own experiences with bureaucratic errors, creating a sense of solidarity among those who have faced similar challenges.

In times like these, community support can be invaluable. Friends and family can offer emotional support, while community resources may provide practical assistance in navigating the complexities of government systems. It serves as a reminder that we are not alone in our struggles, and that sharing our stories can foster connections and understanding.

Moving Forward: Lessons Learned

As this Long Island widower continues to navigate the aftermath of being mistakenly declared dead, there are important lessons to take away from this incident. First and foremost, it emphasizes the need for accuracy in record-keeping, both personally and within bureaucratic systems. Whether you’re filing taxes, updating personal information, or managing financial accounts, being proactive can save you from potential headaches down the road.

Moreover, it’s crucial to advocate for oneself in the face of errors. Don’t hesitate to reach out to agencies, ask questions, and seek clarification. Your identity and financial well-being are too important to leave to chance.

In the end, while this widower’s story is certainly unusual, it serves as a powerful reminder of the complexities of life, the importance of vigilance, and the necessity of community support. Whether it’s tax season or any other time of year, being informed and proactive can make all the difference.