Tesla’s Stock Soars 25% After Walz’s Controversial Remarks!

Tesla’s Stock Surge: The Impact of Political Commentary

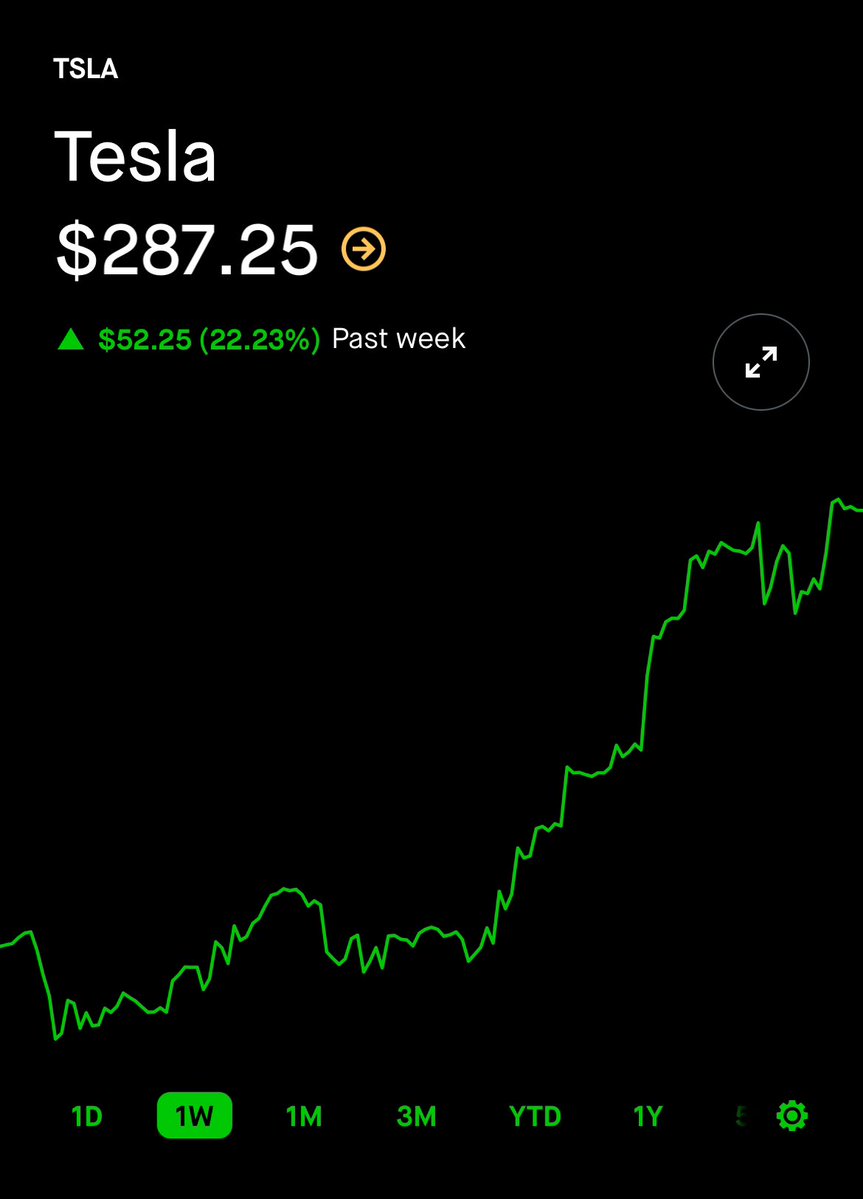

Tesla, the electric vehicle giant founded by Elon Musk, has been a focal point of market discussions, especially in relation to its stock performance. Recently, a tweet from the account @EndWokeness highlighted a notable increase in Tesla’s stock, specifically a 25% rise since Minnesota Governor Tim Walz expressed his delight over the stock’s decline. This tweet has ignited discussions about the interplay between political statements and market performance, particularly in the context of high-profile companies like Tesla.

Understanding Tesla’s Stock Performance

Tesla’s stock has been known for its volatility, influenced by various factors such as market trends, investor sentiment, and external commentary. The tweet referencing Governor Walz’s comments suggests a direct relationship between the governor’s remarks and the subsequent rise in Tesla’s stock. The tweet posits that despite Walz’s sentiments about the stock’s decline, the market reacted positively, showcasing the unpredictable nature of stock trading and investor behavior.

The Role of Political Figures in Market Trends

Political figures often influence market sentiments, intentionally or unintentionally. In this case, Governor Walz’s public enjoyment over Tesla’s stock drop may have sparked a counter-reaction among investors, leading them to buy shares in anticipation of recovery. This phenomenon underscores the impact of political rhetoric on financial markets, where statements made by influential figures can sway investor confidence and drive stock prices up or down.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Tesla’s Growth Trajectory

Tesla has been at the forefront of the electric vehicle revolution, consistently pushing boundaries in technology and sustainability. The company’s innovations and commitment to reducing carbon emissions have attracted a loyal customer base and a strong investor interest. This growth trajectory has led to significant fluctuations in its stock price, which is often viewed as a barometer for the health of the EV market.

The recent 25% increase in Tesla’s stock could also be reflective of broader market trends favoring renewable energy and electric vehicles. As more consumers and investors recognize the importance of sustainable practices, companies like Tesla that prioritize eco-friendly technology are likely to see increased stock valuations.

Investor Sentiment and Market Dynamics

Investor sentiment plays a crucial role in stock market dynamics. The reaction to Governor Walz’s comments illustrates how public perceptions can shift rapidly, especially in the tech and automotive sectors. Investors may have interpreted the remarks as an opportunity to purchase shares at a lower price, anticipating that Tesla’s stock would rebound. This buying frenzy can create a self-fulfilling prophecy, driving prices higher as demand surges.

Additionally, the volatility of Tesla’s stock can be attributed to its high-profile nature. As a company led by a charismatic and sometimes controversial figure like Elon Musk, Tesla is frequently in the news. This constant media presence can influence investor behavior, leading to rapid changes in stock prices based on news cycles and public sentiment.

The Broader Implications for the EV Market

The fluctuation of Tesla’s stock does not occur in a vacuum; it has broader implications for the entire electric vehicle market. As Tesla continues to lead in innovation and market share, its stock performance can set trends for other EV manufacturers. A rise in Tesla’s stock may signal investor confidence in the electric vehicle sector as a whole, encouraging investment in competing companies and emerging technologies.

Furthermore, Tesla’s success has prompted increased interest from traditional automakers, many of whom are pivoting towards electric vehicles in response to consumer demand and regulatory pressures. This shift in focus has the potential to reshape the automotive industry, with Tesla at the helm of this transformation.

Conclusion: The Intersection of Politics and Market Trends

The recent conversation surrounding Tesla’s stock and Governor Walz’s comments underscores the complex interplay between political discourse and market dynamics. As Tesla’s stock surged by 25% following the governor’s remarks, it serves as a reminder of how sensitive the stock market can be to external influences, including political figures’ statements.

Investors remain vigilant, navigating the unpredictable waters of the stock market while keeping an eye on influential figures and their potential impact on industry trends. As Tesla continues to innovate and lead the charge in the electric vehicle market, its stock will likely remain a topic of discussion among investors and political commentators alike.

In summary, Tesla’s recent stock performance reflects not only the company’s growth and the investor sentiment surrounding it but also the significant role that political commentary plays in shaping market trends. As we move forward, it will be essential for investors to consider the broader implications of such remarks and their potential influence on the electric vehicle market as a whole.

Tesla’s stock is up 25% since Gov. Walz said he gets joy from it falling pic.twitter.com/lpR9fpnuWq

— End Wokeness (@EndWokeness) March 26, 2025

Tesla’s Stock Is Up 25% Since Gov. Walz Said He Gets Joy From It Falling

It’s quite the rollercoaster in the stock market, especially when we talk about Tesla. Recent tweets and comments have stirred up quite a conversation about the electric vehicle giant. The buzz started when Governor Tim Walz of Minnesota made headlines expressing his delight at Tesla’s stock falling. Fast forward a few days, and it seems Tesla’s stock is up a whopping 25% since those remarks. What’s going on here? Let’s dive deeper into the implications of this situation and what it means for investors, fans, and the broader market.

Understanding the Market Reaction

When Governor Walz publicly stated he found joy in Tesla’s stock tumbling, it wasn’t just a casual comment. His words carried weight, stirring up reactions from both Tesla enthusiasts and critics. In the world of finance, sentiment can significantly impact stock prices. So, when Walz made his statement, it likely contributed to a negative sentiment around Tesla at first. But here’s the kicker: the stock rebounded sharply, indicating a disconnect between public sentiment and the actual performance or potential of the company.

Why Did Tesla’s Stock Surge?

There are a few reasons why Tesla’s stock could have surged by 25% after such comments. Firstly, Tesla has always been a company that operates under the spotlight. Any news, whether positive or negative, tends to create waves in its stock price. Investors often look for opportunities to buy low, and when they perceive that the stock has been undervalued, they jump in. The reaction to Governor Walz’s statement might have triggered a buying frenzy among investors who saw a chance to capitalize on a dip that they believed wouldn’t last long.

The Role of Social Media in Stock Performance

Social media plays a significant role in shaping public perception and investor behavior. Platforms like Twitter can amplify opinions and create trends almost overnight. In this case, the tweet from End Wokeness about Governor Walz’s comments reached a wide audience, influencing how people viewed Tesla’s stock. When people see discussions surrounding a stock, it can ignite fear of missing out (FOMO), leading to increased buying activity. This phenomenon is particularly evident in Tesla’s case, where enthusiasm and speculation often drive stock prices.

Investor Sentiment and Tesla

Investor sentiment is a crucial factor in stock market dynamics. In Tesla’s case, the combination of Walz’s comments and the subsequent stock price increase reflects how quickly sentiment can shift. Many investors remain bullish on Tesla due to its innovative technology, strong brand loyalty, and the growing demand for electric vehicles. As investors reassess the potential of Tesla in light of its recent performance, we see a classic case of how market sentiment can pivot dramatically.

The Bigger Picture: Market Trends

This episode with Tesla is not just about one company; it reflects broader market trends. The electric vehicle market is rapidly evolving, with various players vying for dominance. As governments worldwide push for greener alternatives, the demand for electric vehicles is set to rise. Tesla, being a pioneer in this space, stands to benefit significantly. Investors are increasingly aware of this trend, and as a result, they may have jumped back into Tesla stock, seeing it as a long-term investment rather than a short-term gamble.

What This Means for Tesla Going Forward

So what does this all mean for Tesla and its investors? The 25% surge in stock price might be a sign that investors are confident in Tesla’s long-term prospects. Despite the political rhetoric and the ups and downs of the stock market, Tesla’s fundamentals remain strong. The company continues to innovate, expand its market reach, and push the boundaries of technology in the automotive sector. As long as Tesla can maintain its growth trajectory and address any concerns regarding production and delivery, it is likely to remain a favorite among investors.

Conclusion: Navigating the Tesla Rollercoaster

Navigating the stock market can feel like a wild ride, and Tesla is certainly one of the most thrilling stocks to watch. With its recent surge following Governor Walz’s comments, it’s a reminder that sentiment can shift dramatically in a short time. Investors should keep an eye on the market trends, company performance, and broader economic factors that could influence Tesla’s future. Whether you’re a die-hard Tesla fan or a cautious investor, it’s essential to stay informed and be ready to adapt to the ever-changing landscape of the stock market.

Final Thoughts: Community Engagement and Investor Behavior

Reflecting on the community’s reactions to Tesla’s stock performance, it’s clear that this company evokes strong feelings. From passionate supporters to skeptical critics, everyone has an opinion. It’s this engagement that helps shape the stock’s journey. As we continue to watch Tesla navigate through its challenges and triumphs, one thing is certain: the conversation around it is far from over. So, whether you’re riding the highs or weathering the lows, keep your eyes peeled on this electric company – it’s bound to provide more twists and turns in the future.