Market Rallies: Are We Ignoring a Looming Financial Crisis?

Understanding Market Trends: Short-Term Rallies vs. Long-Term Downtrends

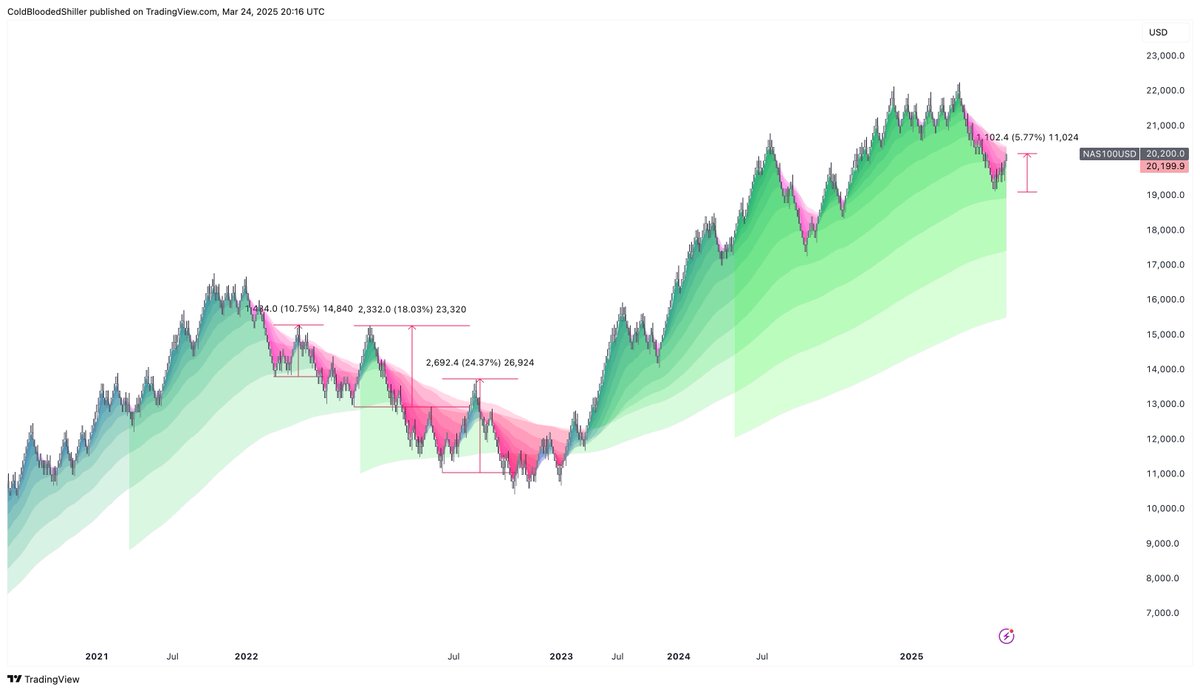

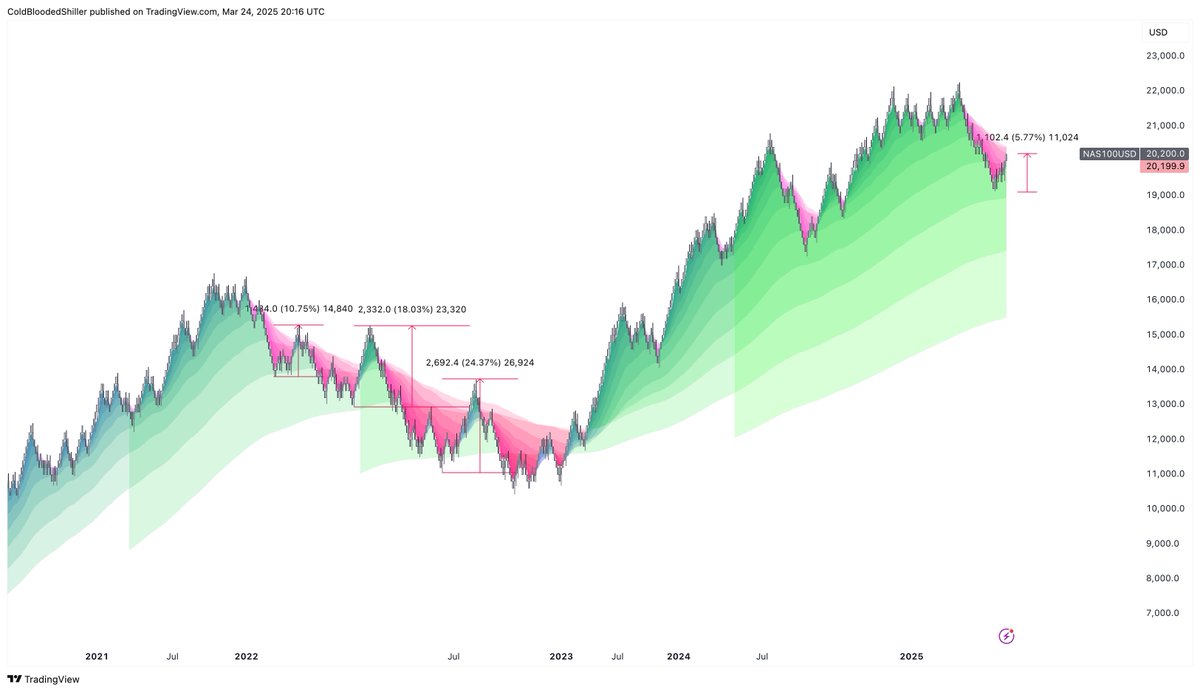

In the world of finance and investing, understanding market trends is crucial for making informed decisions. A recent tweet by Cold Blooded Shiller highlights an important perspective on market movements, particularly the dynamics between short-term rallies and long-term downtrends. This summary aims to break down the key takeaways from the tweet, providing insights for both seasoned investors and those new to the market.

The Context of Market Trends

Over a span of 14 months, various indexes have experienced significant downtrends, breaking their lows and indicating a bearish market sentiment. During this period, investors have often witnessed multiple rallies, which may give a sense of optimism. However, as the tweet suggests, these short-term rallies can be misleading, especially when viewed in the context of the overarching market structure.

Short-Term Rallies: A Double-Edged Sword

Short-term rallies can be enticing, offering opportunities for quick profits. Investors may capitalize on these movements through strategies such as day trading or swing trading. These tactics can be particularly effective in volatile markets where prices fluctuate significantly within a short time frame. However, the tweet emphasizes that while these rallies are great for generating immediate gains, they do not alter the long-term trend of the market.

For instance, an investor might experience a temporary upswing in stock prices which could prompt them to believe the market is recovering. Yet, if the broader market still shows signs of a downtrend, these rallies may simply be short-lived corrections rather than a sustained recovery. This scenario highlights the importance of differentiating between short-term opportunities and long-term market realities.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of High-Timeframe (HTF) Analysis

High-Timeframe (HTF) analysis refers to the examination of market trends over a longer period, which provides a more comprehensive view of market health. The tweet emphasizes that despite the potential for short-term gains, the HTF structure remains unchanged. This means that while traders can take advantage of temporary price movements, they must remain aware of the underlying long-term trends that could impact their investments.

Investors should prioritize HTF analysis as part of their investment strategy. By focusing on longer-term trends, investors can make more strategic decisions that align with the overall market direction, rather than getting caught up in the noise of short-term fluctuations.

Key Takeaways for Investors

- Capitalize on Short-Term Opportunities: Short-term rallies can provide lucrative opportunities for traders who are willing to engage with the market actively. Utilizing technical analysis and market indicators can help identify these movements.

- Stay Informed About Long-Term Trends: While engaging in short-term trading, investors should continuously monitor the long-term market structure. Understanding the direction of the market can help in making better investment choices, especially during uncertain times.

- Implement a Balanced Strategy: A well-rounded investment strategy should incorporate both short-term trading and long-term investment principles. This approach allows investors to benefit from immediate gains while maintaining a focus on the overall market trajectory.

- Avoid Emotional Decision-Making: The temptation to chase short-term gains can lead to emotional decision-making, which often results in poor investment choices. Staying disciplined and adhering to a set strategy can mitigate this risk.

- Utilize Risk Management: Proper risk management strategies are essential, particularly in volatile markets. Setting stop-loss orders and defining risk tolerance levels can protect investments from significant losses during market downturns.

Conclusion

In summary, the insights from Cold Blooded Shiller’s tweet serve as a reminder for investors to maintain a balanced perspective when navigating the complexities of market trends. While short-term rallies can present immediate profit opportunities, they should not overshadow the importance of understanding long-term market structures. By focusing on HTF analysis and employing a balanced investment strategy, investors can position themselves for success, regardless of market conditions.

By heeding these insights, both novice and experienced investors can enhance their ability to navigate the market effectively, making informed decisions that align with their financial goals. Always remember: in the world of investing, knowledge and strategy are your greatest allies.

I don’t want to be the one pissing on the parade here but during the 14 months of the indexes breaking their lows and downtrending we had multiple rallies that were of significant upside.

LTF it’s great to capitalise on.

But it doesn’t change the HTF structure.

Yet. pic.twitter.com/LShlPuo4SU

— Cold Blooded Shiller (@ColdBloodShill) March 24, 2025

I don’t want to be the one pissing on the parade here but during the 14 months of the indexes breaking their lows and downtrending we had multiple rallies that were of significant upside.

When we look at the financial markets, it’s easy to get swept up in the excitement of a rally. After all, who doesn’t love seeing their investments go up? However, it’s essential to keep perspective, especially when the broader trend is downwards. For 14 months, we’ve witnessed indexes breaking their lows and entering a downtrend, which can be quite alarming. But here’s the kicker: during that same period, we also experienced several significant rallies that offered substantial upside potential.

These rallies can be incredibly tempting for traders and investors alike, as they present short-term opportunities to capitalize on price movements. It’s like finding a diamond in the rough; they shine bright amidst a sea of negativity. But we need to remember that short-term gains don’t change the overall market structure in the long run. In other words, while it’s great to make a quick profit, it doesn’t necessarily indicate a shift in the high-time-frame (HTF) market structure.

LTF it’s great to capitalise on.

Let’s talk about those lower-time-frame (LTF) opportunities. They are fantastic for day traders and swing traders who thrive on volatility. These traders often jump in and out of positions, looking to exploit short-term fluctuations for quick profits. If you’re someone who enjoys trading, these rallies can be a rollercoaster ride of excitement, with the potential for substantial returns.

However, it’s crucial to approach these rallies with caution. Just because a rally is occurring doesn’t mean it’s a sign of a sustainable trend change. Many traders get caught up in the thrill and forget to analyze the underlying trends. As a result, they might find themselves caught on the wrong side of the trade when the market turns against them. Understanding that LTF opportunities are just that—opportunities—can help mitigate risks.

But it doesn’t change the HTF structure.

Now, let’s dive deeper into what it means when we say that the HTF structure remains unchanged. The high-time-frame structure refers to the overall trend and market dynamics that govern longer-term price movements. If the HTF is in a downtrend, no amount of short-term rallies can alter that fundamental aspect of the market. It’s like trying to paddle upstream in a raging river; you may make some headway, but ultimately, the flow of the river dictates your path.

Many investors fall into the trap of thinking that if they can catch these short-lived rallies, they can ignore the broader market conditions. Unfortunately, this is often a recipe for disaster. Realizing that the HTF structure remains intact acts as a grounding principle for traders. It reminds them to keep the big picture in mind while navigating the short-term fluctuations.

Yet.

So, what does all this mean for you as an investor or trader? It means that while it’s perfectly okay to take advantage of those multiple rallies, you also need to be prudent about your overall strategy. The market is full of opportunities, but you should always approach it with a clear understanding of the broader trends at play. Waiting for the HTF structure to show signs of a reversal before making significant investment decisions can save you from unnecessary pitfalls.

Moreover, it’s essential to have a well-defined risk management strategy in place. Knowing when to exit a trade, especially during a rally, can make all the difference. Use stop-loss orders or trailing stops to protect your profits, and don’t hesitate to take your winnings when the market gives you a favorable opportunity. Remember, in trading, it’s not about how much you can make on a single trade, but rather how much you can keep.

Engaging with the Market Mindfully

Engaging with the market mindfully means being aware of your own emotions and biases. It’s easy to get swept up in the euphoria of a rally and convince yourself that this time is different. However, it’s vital to approach each trade with a clear and rational mindset. Doing so can help you avoid making impulsive decisions that could jeopardize your financial well-being.

Additionally, staying informed about market trends and economic indicators can provide valuable insights into future movements. Understanding the factors that drive the market can help you make more informed decisions about your trading strategy. Keep an eye on news events, earnings reports, and economic data releases that could impact the market. By staying informed, you’ll be better equipped to navigate the complexities of the financial landscape.

Building a Resilient Trading Strategy

To thrive in a market that’s experiencing significant ups and downs, it’s essential to build a resilient trading strategy. This involves being adaptable and willing to adjust your approach based on changing market conditions. Flexibility can be a trader’s best friend, allowing you to capitalize on opportunities while minimizing risks.

Consider diversifying your portfolio to spread risk across different assets. This can act as a buffer against market volatility and provide stability in uncertain times. Moreover, continuously educating yourself about trading strategies, market analysis, and technical indicators can give you an edge in making informed decisions.

Final Thoughts on Market Dynamics

Understanding market dynamics is crucial for anyone looking to invest or trade successfully. The interplay between short-term rallies and long-term trends dictates how we navigate the financial landscape. So, while it’s great to capitalize on those LTF opportunities, always keep an eye on the bigger picture. The market is a complex beast, and the more you understand its intricacies, the better equipped you’ll be to ride the waves of volatility.

In conclusion, remember that every trader faces the challenge of balancing short-term gains with long-term strategies. The key is to stay grounded, informed, and adaptable. Embrace the excitement of the market, but don’t lose sight of the bigger picture. By doing so, you’ll be better positioned to make the most of every trading opportunity that comes your way.

“`

This article is designed to engage readers with a conversational tone while providing valuable insights into trading strategies and market dynamics. The HTML format ensures that the content is well-structured and easily digestible for web readers.