BREAKING Iran’s Currency Plummets: 1,039,000 Rials for $1!

Iran’s Currency Hits Record Low: A Comprehensive Overview

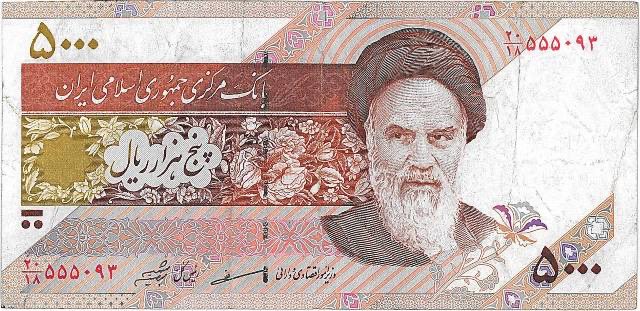

In a significant economic development, Iran’s currency has plunged to an unprecedented low, reaching 1,039,000 rials per U.S. dollar. This alarming statistic was reported by Open Source Intel on March 25, 2025, citing data from Bonbast, a well-known platform for tracking currency exchange rates. The record drop in the Iranian rial signifies a critical moment for the country’s economy, raising concerns about inflation, purchasing power, and overall economic stability.

The Current Economic Climate in Iran

Iran’s economy has been under immense pressure for several years due to a combination of factors, including international sanctions, domestic mismanagement, and fluctuating global oil prices. The latest decline in the value of the rial exacerbates the existing economic woes and poses significant challenges for the Iranian populace.

The Iranian government has struggled to stabilize the currency, which has been on a downward trajectory for some time. This latest drop can be attributed to a range of factors, including political instability, economic sanctions imposed by foreign governments, and decreased oil exports. The economic sanctions, particularly from the United States, have severely limited Iran’s ability to engage in international trade, leading to a scarcity of foreign currency and driving down the value of the rial.

Implications of the Currency Depreciation

The depreciation of the rial has far-reaching implications for the Iranian economy and its citizens. Here are some key areas affected:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Inflation and Cost of Living: As the value of the rial falls, the cost of imported goods rises dramatically. This leads to increased inflation rates, which, in turn, erode the purchasing power of average citizens. Essential goods, including food and medicine, become increasingly expensive, putting a strain on households struggling to make ends meet.

- Investment and Business Climate: A weak currency often deters foreign investment, as investors seek stable environments to safeguard their assets. The depreciation of the rial could lead to a further decline in foreign direct investment, hindering economic growth and development initiatives.

- Public Sentiment and Social Stability: The economic hardships brought on by currency depreciation can lead to public unrest. Citizens facing rising prices and declining living standards may express dissatisfaction with the government, potentially leading to protests and social unrest. The government may struggle to maintain order amid growing discontent.

- Impact on Imports and Exports: A weaker rial makes imports more expensive, affecting businesses that rely on foreign goods and materials. On the flip side, for exporters, a weaker currency can make Iranian products cheaper on the global market, potentially boosting export revenues. However, this is contingent on the ability of exporters to navigate the complex landscape of sanctions and trade restrictions.

Government Response and Economic Policy

In response to the currency crisis, the Iranian government may implement a variety of measures aimed at stabilizing the rial and restoring confidence in the economy. Potential strategies include:

- Monetary Policy Adjustments: The Central Bank of Iran may consider altering interest rates or implementing measures to control money supply to combat inflation and stabilize the currency.

- Engagement in Diplomacy: The Iranian government might seek diplomatic avenues to ease sanctions and improve international relations, particularly with Western nations. This could open up trade opportunities and strengthen the economy.

- Encouraging Domestic Production: To reduce reliance on imports, the government may encourage domestic production of goods. This could involve providing support to local manufacturers and incentivizing industries that can produce essential goods.

- Public Communication: Clear communication from government officials about economic plans and policies can help reassure the public and restore some level of confidence in the economy.

The Global Context

The decline of the Iranian rial cannot be viewed in isolation; it is part of a broader global economic landscape. The fluctuating value of currencies worldwide, trade tensions, and geopolitical developments can all influence Iran’s economic situation. Additionally, the ongoing impact of the COVID-19 pandemic continues to affect global supply chains and economic stability, further complicating Iran’s recovery efforts.

Conclusion

The record low of 1,039,000 rials per U.S. dollar marks a critical juncture in Iran’s economic trajectory. The ramifications of this currency depreciation are profound, affecting not only the economy but also the daily lives of Iranian citizens. As the government grapples with the challenges of stabilizing the currency and addressing the underlying issues, it remains to be seen how effective their response will be in alleviating the economic pressures faced by the nation.

The international community will undoubtedly be watching closely as Iran navigates this turbulent period, and the outcomes of the government’s strategies could have lasting implications for the country’s economic future. As events unfold, stakeholders—from policymakers to everyday citizens—will need to adapt to the rapidly changing economic landscape.

BREAKING

Iran’s currency drops to a record low of 1,039,000 rials per U.S. dollar, according to data from Bonbast. pic.twitter.com/Os3Abc3e6f

— Open Source Intel (@Osint613) March 25, 2025

BREAKING

In a startling development that has sent shockwaves through the global financial markets, Iran’s currency has plummeted to a record low of 1,039,000 rials per U.S. dollar. This dramatic decline reflects a myriad of economic challenges facing the country. According to data from Bonbast, this depreciation is the latest indication of the ongoing economic turmoil in Iran. In this article, we’ll dive into the implications of this currency drop, the factors behind it, and what it means for the average Iranian and the global economy.

Understanding the Currency Crisis

The Iranian rial has been on a downward trajectory for several years, but reaching this staggering low is unprecedented. To put it into perspective, just a few years ago, the exchange rate was significantly better for the rial. What has caused this rapid decline? A combination of factors including sanctions, economic mismanagement, and inflation has contributed to this dire situation.

Impact of Sanctions on Iran’s Economy

One of the most significant contributors to the rial’s depreciation has been the economic sanctions imposed on Iran, primarily by the United States. These sanctions have severely restricted the country’s ability to engage in international trade, leading to reduced foreign investment and a dwindling economy. As the sanctions continue to bite, the ripple effects are felt throughout the country, exacerbating the currency crisis.

Inflation Rates and Economic Mismanagement

Inflation in Iran has skyrocketed, making everyday goods more expensive for the average citizen. The rate of inflation has soared to levels that are hard to fathom, putting immense pressure on Iranian families. Coupled with economic mismanagement and corruption, the situation has only worsened. The Iranian government’s inability to stabilize the economy has left citizens to cope with soaring prices and diminished purchasing power.

Public Reaction to the Currency Decline

As the rial continues to lose value, public frustration is growing. Many Iranians are taking to social media to voice their concerns, sharing stories of how the economic situation has affected their daily lives. The depreciation has made it harder for families to afford basic necessities, leading to a rise in protests and demonstrations calling for government accountability and change.

Global Economic Implications

The plummeting of Iran’s currency isn’t just a local issue; it has global ramifications as well. Investors and markets around the world are closely monitoring the situation. A destabilized Iran could lead to increased tensions in an already volatile region, influencing oil prices and international relations. The interconnectedness of today’s economy means that the ripple effects of Iran’s currency crisis could be felt far beyond its borders.

Future Outlook: What Lies Ahead?

Looking ahead, many are left wondering what the future holds for Iran and its currency. Will the government take steps to stabilize the economy, or will the situation continue to deteriorate? Economists suggest that without significant reforms and a shift in policy, the rial may continue its downward spiral. The Iranian people deserve better, and it remains to be seen if the government can respond effectively to the pressing challenges at hand.

The Role of the International Community

As the situation unfolds, the role of the international community becomes increasingly important. Countries and organizations that have imposed sanctions on Iran will need to consider the humanitarian implications of their actions. While sanctions aim to pressure the Iranian government, they have also contributed to the suffering of ordinary citizens. A balanced approach that considers both security and humanitarian needs is essential.

Conclusion: The Need for Change

The record low of 1,039,000 rials per U.S. dollar serves as a wake-up call not just for Iran, but for the entire world. It emphasizes the importance of responsible economic governance, transparency, and accountability. As the Iranian people navigate these challenging times, the need for change becomes increasingly urgent. Whether that change will come from within or through international pressure remains to be seen. But one thing is clear: the economic future of Iran hangs in the balance.

Stay tuned for more updates on this evolving situation as we continue to monitor the developments in Iran’s economy.