Shock Audit: 298K Credit Cards Deactivated in 5 Weeks!

Weekly Credit Card Update: Audit Program Achieves Significant Progress

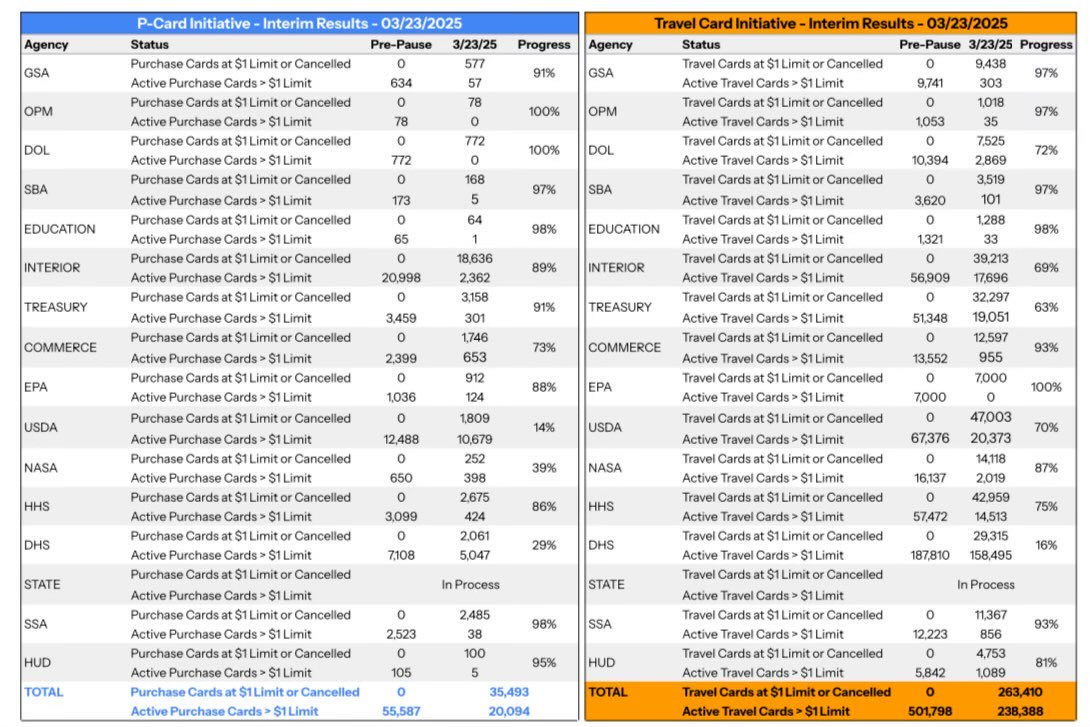

In a recent update from the Department of Government Efficiency (DOGE), a pilot program aimed at auditing unused and unneeded credit cards has shown remarkable results. Over the course of five weeks, approximately 298,000 credit cards have been deactivated as part of an initiative involving 16 agencies. This audit is essential for ensuring fiscal responsibility and efficient resource management within government entities.

The Context of the Audit Program

At the onset of this audit, there were around 4.6 million active credit cards and accounts circulating within government agencies. This staggering number highlights the potential for waste and misuse, making the audit program a critical step in promoting financial accountability. The pilot program not only targets the deactivation of dormant cards but also aims to streamline the use of government-issued credit, ensuring that taxpayer money is spent wisely.

Objectives of the Pilot Program

The primary objectives of the pilot program are twofold:

- Identify and Deactivate Unused Cards: The immediate goal is to identify credit cards that are no longer in use and deactivate them. This not only reduces the risk of fraud but also minimizes administrative costs associated with maintaining excess accounts.

- Enhance Oversight and Accountability: By auditing active accounts, the program seeks to establish better oversight mechanisms for government spending. This involves reviewing the necessity of each card and ensuring that they are being used for their intended purposes.

Progress and Results

After five weeks of diligent auditing, the results have been promising. The deactivation of approximately 298,000 cards represents a significant reduction in the total number of active credit cards within the participating agencies. This achievement is a testament to the effectiveness of the audit and its implementation across multiple departments.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Despite this progress, the DOGE acknowledges that further work is needed. With 4.6 million cards initially in circulation, the remaining active accounts still pose a considerable challenge. The agency is committed to continuing its efforts to assess the necessity of each card and further reduce the number of active accounts.

Importance of Financial Responsibility

The pilot program underscores the importance of financial responsibility within government agencies. By auditing credit cards, agencies can prevent misuse and ensure that funds are allocated effectively. This initiative not only protects taxpayer dollars but also promotes a culture of accountability within government operations.

Future Plans

Moving forward, the DOGE plans to expand the audit program to include additional agencies and departments. The goal is to create a comprehensive framework for ongoing credit card management that includes regular audits and assessments. By institutionalizing these practices, the government aims to foster a more transparent and efficient financial system.

Moreover, the DOGE is exploring the implementation of technology solutions that can automate parts of the audit process. By leveraging data analytics and reporting tools, agencies can gain deeper insights into credit card usage and identify patterns that may warrant further investigation.

Conclusion

The weekly credit card update from the Department of Government Efficiency highlights a significant step towards enhancing accountability and financial management within government agencies. The pilot program’s success in deactivating nearly 300,000 unused credit cards is a clear indication of the potential for improvement. As the program continues to evolve, it is likely to pave the way for more sustainable practices in public spending, ultimately benefiting taxpayers and fostering trust in government operations.

In summary, the ongoing efforts to audit and deactivate unnecessary credit cards demonstrate a commitment to fiscal responsibility and efficient resource allocation. With a focus on transparency and accountability, the DOGE is taking essential steps to ensure that government spending aligns with the needs of the public it serves.

Weekly Credit Card Update!

Pilot program with 16 agencies to audit unused/unneeded credit cards. After 5 weeks, ~298,000 cards have been de-activated.

As a reminder, at the start of the audit, there were ~4.6M active cards/accounts, so still more work to do. pic.twitter.com/GXPemQt5Db

— Department of Government Efficiency (@DOGE) March 24, 2025

Weekly Credit Card Update!

If you’ve been keeping an eye on government spending, you might have come across some interesting news recently. The Department of Government Efficiency (DOGE) announced a significant initiative aimed at streamlining credit card usage across various agencies. This pilot program, which involves 16 different agencies, is designed to audit unused or unneeded credit cards. After just five weeks, they’ve managed to deactivate around 298,000 cards! Now, that’s some serious spring cleaning in the world of government finances.

Pilot Program with 16 Agencies to Audit Unused/Unneeded Credit Cards

So, what exactly is this pilot program? Essentially, it’s a concerted effort by the government to assess where taxpayer money is going and determine if credit cards are being utilized effectively. With approximately 4.6 million active credit cards and accounts at the onset of the audit, the government realized there was a massive opportunity to cut down on wasteful spending. By targeting agencies that may have surplus or unused cards, they aim to promote greater efficiency and accountability.

The goal is to ensure that each card in use is necessary and serves a legitimate purpose. In an era where financial transparency is a growing demand from the public, this initiative is a step in the right direction. The fact that they’ve already deactivated nearly 300,000 cards in just a few weeks shows the program’s potential impact.

After 5 Weeks, ~298,000 Cards Have Been De-activated

You might be wondering how the government actually determines which cards to deactivate. The audit process involves reviewing spending patterns and usage reports. If a card hasn’t been used in a certain timeframe, it’s flagged for review. This method not only identifies cards that are no longer needed but also encourages agencies to be more mindful of their spending practices moving forward.

It’s a win-win situation for everyone involved. The government saves money by cutting down on unnecessary expenses, and agencies can better allocate their resources. The activation and deactivation of credit cards can be a cumbersome process, but with a structured approach, the government is on track to make informed decisions about its financial tools.

As a Reminder, at the Start of the Audit, There Were ~4.6M Active Cards/Accounts

Let’s take a moment to put those numbers into perspective. When you think about 4.6 million active cards, it’s clear that there’s room for improvement. Many of these cards may belong to government employees who no longer work for the agencies, or they could be part of outdated programs that no longer serve a purpose.

The ongoing audit is about more than just numbers; it’s about accountability. When citizens see their tax dollars at work, they want to know that those dollars are being spent wisely. Each deactivated card represents a step toward more responsible spending in government agencies. It’s an opportunity for the government to prove it can manage public funds effectively and efficiently.

Still More Work to Do

While the progress made so far is commendable, the journey doesn’t stop here. With nearly 4.6 million cards to start with, there’s still a significant amount of work ahead. The government is committed to continuing this audit and refining its approach to credit card management.

This pilot program could serve as a model for future initiatives aimed at improving financial practices not just in government but potentially in other sectors as well. It’s about fostering a culture of accountability and efficiency, which ultimately benefits the taxpayer.

As the program continues, it will be fascinating to see how many more cards can be deactivated and how this impacts overall government spending.

Why This Matters to You

You might be thinking, “What does this have to do with me?” Well, the answer is simple: transparency in government spending ultimately affects everyone. When agencies are more accountable for their finances, it can lead to better public services and programs.

Moreover, initiatives like this one can set a precedent for how organizations—both public and private—should manage their resources. If you’re a taxpayer, you have a vested interest in how your money is spent. This pilot program, with its high stakes and potential for savings, is a tangible example of how efficiency can make a difference.

The Bigger Picture: Government Efficiency

The Weekly Credit Card Update is just one piece of a larger puzzle. It reflects a broader movement towards government efficiency, where agencies are encouraged to do more with less. By auditing unused or unneeded credit cards, the government is sending a strong message that every dollar counts.

In a time when so many are questioning how public funds are utilized, this kind of transparency is vital. It builds trust between the government and the people it serves. When citizens feel confident that their money is being spent wisely, it fosters a sense of community and shared responsibility.

What Does the Future Hold?

Looking ahead, it will be interesting to see how the results of this pilot program influence future policies. Will other states or agencies adopt similar audits? Could this create a ripple effect that leads to more stringent financial management practices across the board?

As the government continues to evaluate the success of this initiative, it may lead to the development of new protocols for credit card issuance and management. It’s about creating a sustainable system that not only curbs waste but also enhances overall financial health.

The ongoing commitment to auditing unused or unneeded credit cards serves as a reminder that even small changes can lead to significant improvements. Each deactivated card is a step toward better financial stewardship, and in the grand scheme of things, it’s a positive move for all taxpayers.

In summary, the Weekly Credit Card Update from the Department of Government Efficiency is more than just numbers; it’s a reflection of a government striving to improve its financial practices. By focusing on accountability and transparency, this pilot program has the potential to inspire change that reverberates beyond just credit card usage. The path to efficiency is a continuous journey, and every step counts.