BREAKING: White House to Use Gold Reserves for Bitcoin Buy!

White House Considering Use of Gold Reserves to Purchase Bitcoin: A Game-Changer for Cryptocurrency

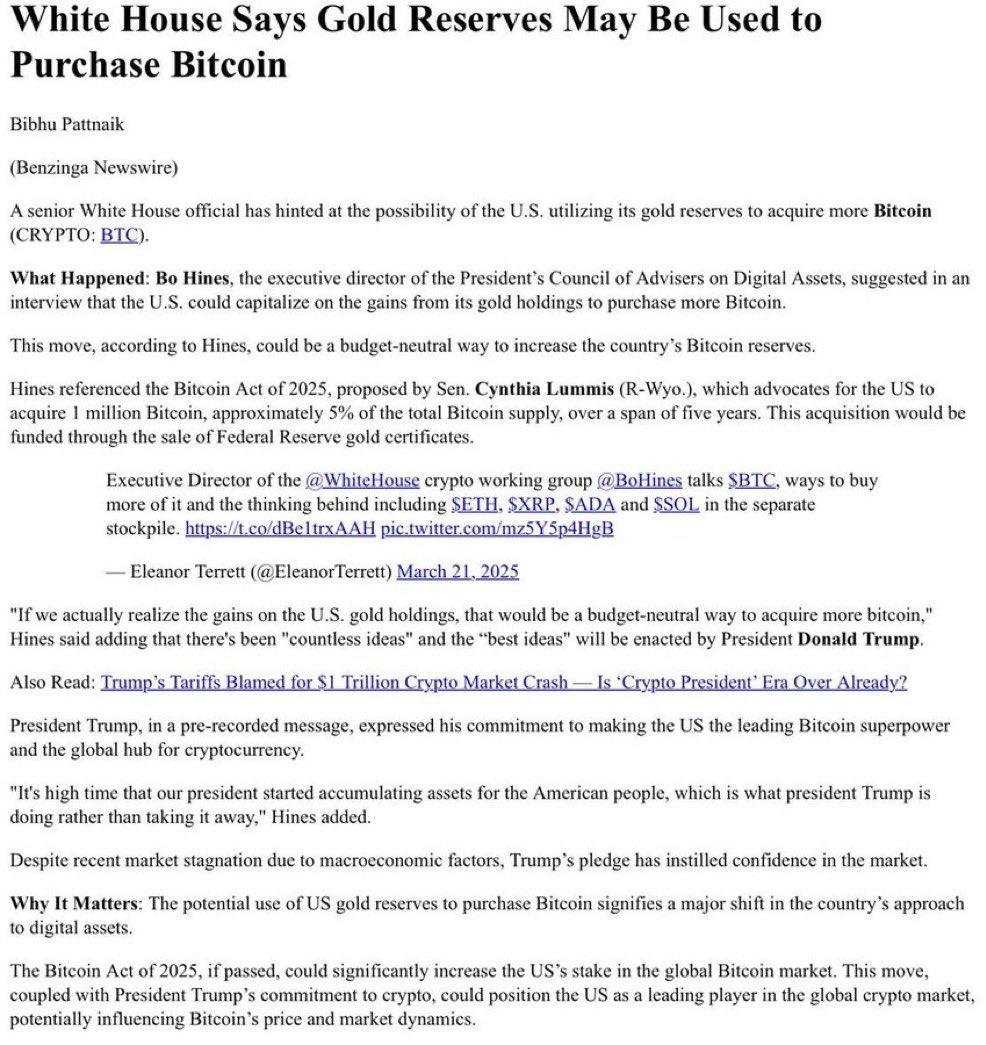

In a surprising turn of events, the White House has announced that it may consider utilizing gold reserves to purchase Bitcoin. This groundbreaking news, shared by Mario Nawfal’s Roundtable on Twitter, has sent ripples through both the traditional finance and cryptocurrency markets. The potential for gold reserves to be converted into Bitcoin signifies a monumental shift in how governments may approach digital currencies moving forward.

Understanding the Context

Bitcoin, the most well-known cryptocurrency, has gained significant traction over the past decade. Initially viewed with skepticism by traditional financial institutions, Bitcoin has increasingly been embraced as a legitimate asset class. Its decentralized nature, limited supply, and potential as a hedge against inflation have contributed to its growing popularity among investors and institutions alike.

On the other hand, gold has long been regarded as a safe haven asset. It has served as a store of value for centuries, especially during times of economic uncertainty. The juxtaposition of these two assets—gold and Bitcoin—highlights the evolving landscape of finance, where traditional assets may soon intertwine with their digital counterparts.

The Potential Implications of This Move

If the White House indeed moves forward with this initiative, the implications could be profound:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Legitimacy for Bitcoin: The endorsement of Bitcoin by a government entity could bolster its legitimacy. This could lead to greater public acceptance and trust in cryptocurrencies.

- Market Volatility: The announcement may trigger volatility in the cryptocurrency market. Investors could react positively or negatively to the news, affecting Bitcoin’s price significantly.

- Shift in Investment Strategies: Other governments may follow suit, contemplating similar strategies with their gold reserves. This could lead to a trend of state-backed cryptocurrency investments, altering how nations handle their financial assets.

- Impact on Gold Prices: The potential sale or conversion of gold reserves could affect gold prices. If multiple countries follow suit, we may witness a shift in the gold market dynamics.

- Increased Adoption of Cryptocurrencies: With a major government considering the purchase of Bitcoin, it may encourage other institutions and individuals to adopt cryptocurrencies as part of their portfolios.

The Current State of Bitcoin and Gold

Bitcoin has experienced significant price fluctuations over the years, characterized by rapid increases followed by corrections. Its decentralized nature and limited supply make it an attractive alternative to fiat currencies, especially in times of economic instability.

Gold, on the other hand, has maintained its status as a reliable store of value. Investors often turn to gold during inflationary periods or geopolitical uncertainties. The potential for a government to leverage its gold reserves for Bitcoin purchases suggests a blending of these two asset classes, which could redefine investment strategies globally.

The Role of Governments in Cryptocurrency

Governments have historically taken a cautious approach to cryptocurrencies. Regulatory concerns, potential for fraud, and the risk of financial instability have led many to adopt a wait-and-see approach. However, the increasing popularity of Bitcoin and other cryptocurrencies has forced governments to reconsider their stances.

The potential use of gold reserves to purchase Bitcoin could signify a paradigm shift in how governments view digital currencies. If governments begin to hold Bitcoin as part of their reserves, it could pave the way for a new era of monetary policy that incorporates cryptocurrencies.

Conclusion: A New Financial Era on the Horizon?

The possibility that the White House may use gold reserves to purchase Bitcoin marks a pivotal moment in the intersection of traditional finance and the digital currency world. This move could not only enhance Bitcoin’s legitimacy but also encourage other governments to explore similar strategies.

The implications of this decision may extend beyond the financial markets, potentially influencing how individuals and institutions view and interact with cryptocurrencies. As the landscape of finance continues to evolve, staying informed about such developments is crucial for investors, policymakers, and the general public alike.

This announcement serves as a reminder that the world of finance is ever-changing. With innovations in digital currencies gaining momentum, the potential for a hybrid financial model incorporating both traditional and digital assets may soon become a reality. As we move forward, the integration of gold reserves and Bitcoin could be just the beginning of a transformative journey in the global financial system.

In summary, the White House’s consideration of using gold reserves to purchase Bitcoin is not just a financial strategy. It is a reflection of the times, where traditional assets are increasingly being evaluated through the lens of digital innovation. Investors, analysts, and policymakers should keep a close eye on this evolving narrative, as it could shape the future of finance in unprecedented ways.

For those interested in following this story, keep an eye on credible news sources and official announcements to stay updated on any developments regarding this potential integration of gold and Bitcoin. As the financial landscape continues to evolve, being informed will be paramount for making educated investment decisions.

BREAKING: WHITE HOUSE SAYS GOLD RESERVES MAY BE USED TO PURCHASE BITCOIN

Source: Crypto Rover pic.twitter.com/lyvObZjBv1

— Mario Nawfal’s Roundtable (@RoundtableSpace) March 23, 2025

BREAKING: WHITE HOUSE SAYS GOLD RESERVES MAY BE USED TO PURCHASE BITCOIN

In a groundbreaking announcement, the White House has indicated a potential shift in economic strategy by suggesting that gold reserves may be used to purchase Bitcoin. This news, shared by Mario Nawfal’s Roundtable, has sent ripples through both traditional financial markets and the cryptocurrency world. The implications of this decision could be monumental, marking a significant intersection between established monetary policies and emerging digital currencies.

Understanding the Context

To fully grasp the weight of the White House’s statement, it’s essential to understand the backdrop of both gold and Bitcoin in our economy. For centuries, gold has been the cornerstone of wealth and stability. It’s a tangible asset, trusted by investors during times of economic uncertainty. On the other hand, Bitcoin represents the future of finance—a decentralized digital currency that challenges traditional banking systems. The idea of using gold reserves to buy Bitcoin is a fascinating convergence of these two worlds.

The Implications of Using Gold Reserves for Bitcoin

So, what exactly does it mean if the government starts using its gold reserves to purchase Bitcoin? Firstly, it signals a major endorsement of cryptocurrency. By tapping into these reserves, the government would be reinforcing Bitcoin’s legitimacy as a financial asset. This could lead to increased adoption among both investors and consumers, creating a more integrated financial landscape.

Moreover, this strategy could help stabilize Bitcoin’s often volatile market. The infusion of government-backed gold into the cryptocurrency space could potentially reduce price fluctuations, attracting more conservative investors who have traditionally shied away from the crypto market. It’s not just about buying Bitcoin; it’s about creating a more robust framework for its use in everyday transactions.

Potential Benefits of This Approach

One of the most significant benefits of using gold reserves to purchase Bitcoin is the diversification of assets. Governments typically hold gold as a safety net during economic downturns. By diversifying into Bitcoin, they are not only hedging against inflation but also embracing a new frontier in finance.

Additionally, this move could drive innovation within the technology sector. Increased government interest in cryptocurrencies may lead to more resources being allocated towards blockchain technology, fostering new startups and technological advancements. This could stimulate job growth and economic expansion, especially in tech-centric regions.

Critics and Concerns

Of course, this announcement is not without its critics. Many financial experts are wary of the government’s involvement in cryptocurrencies. There are concerns about the volatility of Bitcoin and the potential risk to public funds. Critics argue that the government should focus on stabilizing the economy through traditional means rather than diving into the unpredictable waters of cryptocurrency.

Moreover, the logistics of such a transaction raise questions. How would the government convert gold reserves into Bitcoin? Would this create a new standard for Bitcoin valuation? These are important considerations that need addressing to ensure that such a strategy is viable and beneficial.

The Future of Gold and Bitcoin

As we look ahead, the relationship between gold and Bitcoin could evolve in fascinating ways. If the government begins using gold reserves to purchase Bitcoin, it might set a precedent for other countries to follow suit. This could lead to a global shift in how we perceive and utilize both assets.

Furthermore, this action might encourage other nations to rethink their own gold reserves and consider investing in cryptocurrencies. It could ignite a race to adopt digital currencies at a national level, fundamentally changing international finance.

Investor Reaction

Investors are already reacting to this announcement. Many are optimistic, viewing the potential use of gold reserves to purchase Bitcoin as a bullish sign for the cryptocurrency market. This could lead to increased trading volumes and a surge in Bitcoin prices as more investors jump on board, believing in the legitimacy of Bitcoin as a government-backed asset.

On the flip side, some investors are taking a wait-and-see approach. They want to gauge how this announcement will actually play out before making any significant moves. It’s an understandable strategy, given the unpredictable nature of both gold and Bitcoin markets.

Conclusion: A New Era in Finance?

The White House’s announcement regarding the potential use of gold reserves for Bitcoin purchases has opened the door to numerous possibilities. While it’s still early days, the implications are vast, ranging from increased legitimacy for cryptocurrencies to potential economic growth through innovation.

As we navigate this new terrain, it’s crucial for investors, governments, and consumers alike to stay informed about these developments. The intersection of traditional finance and cryptocurrency could very well mark the beginning of a new era in finance, one where the lines between the old and new are increasingly blurred. Whether this will be a smooth transition or a turbulent ride remains to be seen, but one thing is clear: the world of finance is evolving at a rapid pace, and it’s an exciting time to be a part of it.

For more details, you can check the source of this news from Mario Nawfal’s Roundtable and Crypto Rover.