Florida Firms Hide Fraud: UK Companies with Disputed Offices Exposed!

New Feature Alert: Visualizing Company Ownership with Red Dots

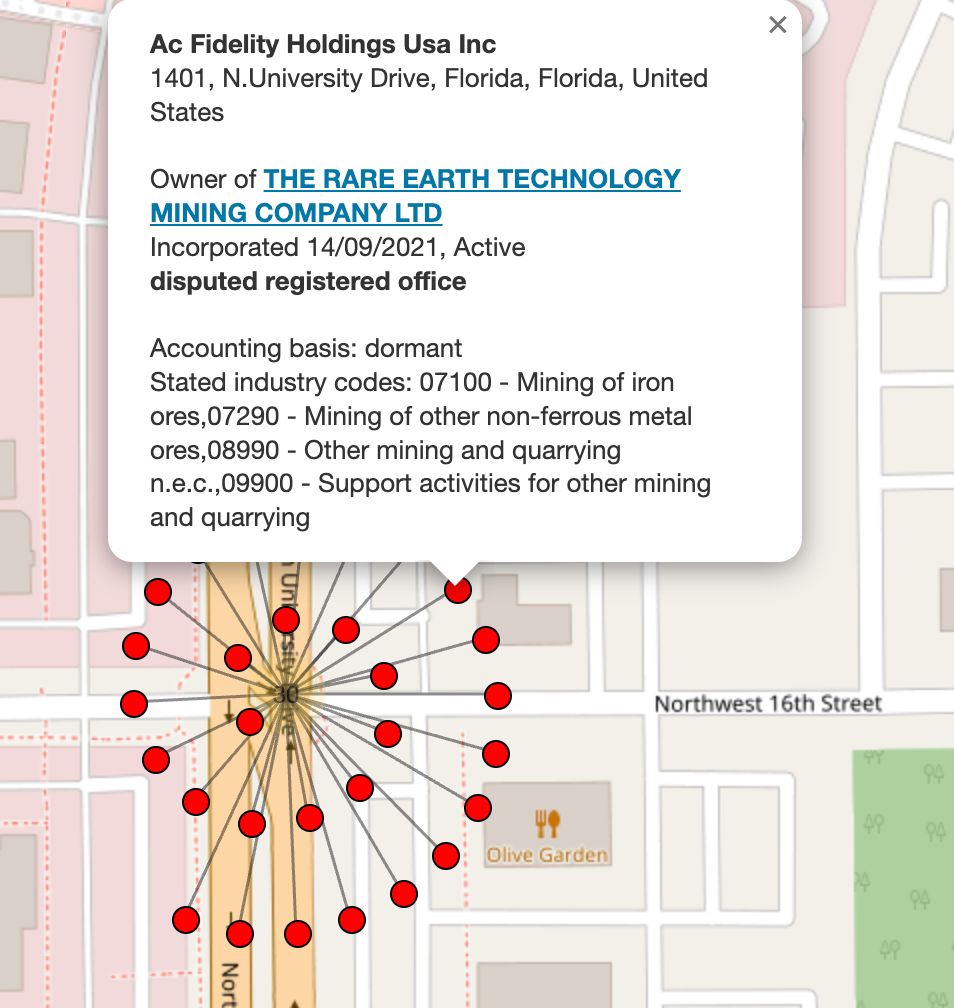

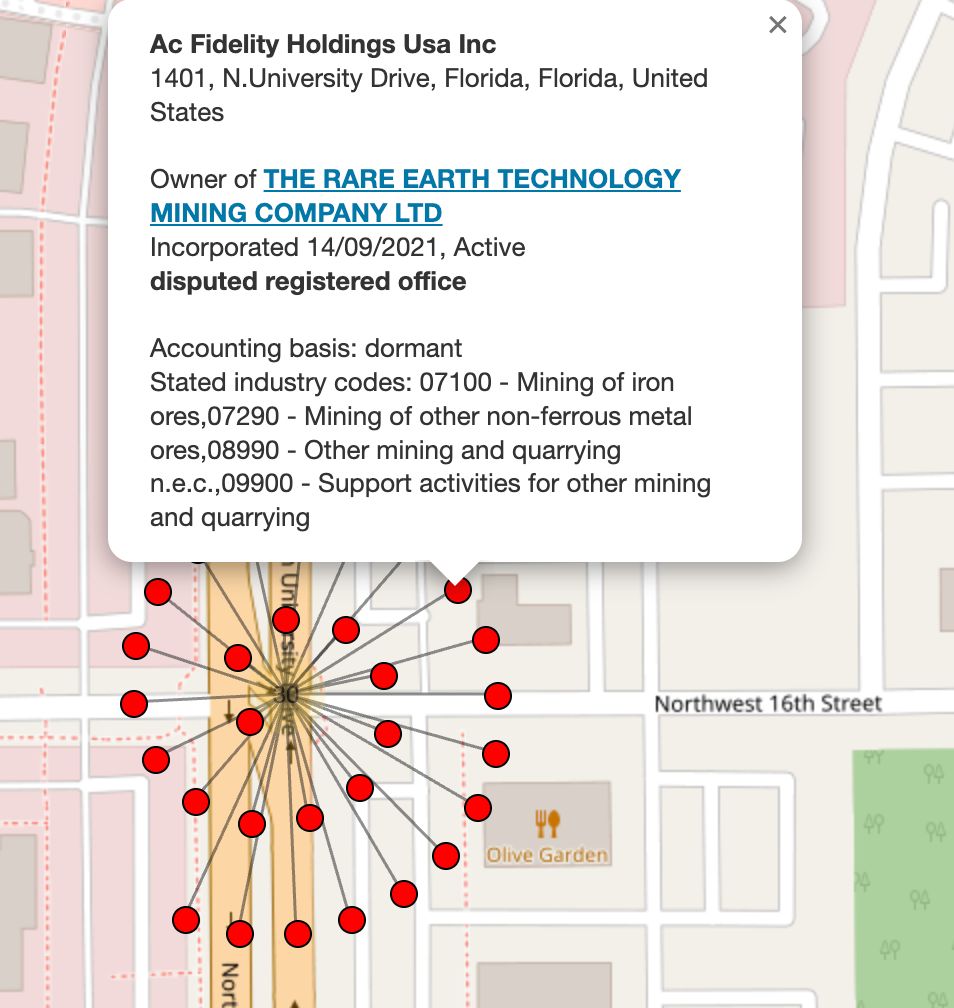

In a groundbreaking update, a new feature has been introduced that allows users to enhance their visual understanding of company ownership through an innovative mapping system. This tool, which was highlighted by Dan Neidle on Twitter, enables users to filter out “active” and “dormant” companies, focusing solely on the entities marked by red dots. This visualization technique is particularly useful for identifying ownership clusters and potential fraudulent activities, especially in cases where registered offices are disputed.

Understanding Company Ownership Clusters

The feature showcased in the tweet allows users to see a cluster of Florida-based companies that own UK companies with ambiguous registered office addresses. The presence of disputed registered offices often raises red flags, suggesting potential fraud or illicit activities. By visualizing these companies distinctly as red dots on a map, users can easily pinpoint suspicious relationships and ownership structures.

Why is This Important?

The ability to filter out certain company statuses and focus on specific markers is a significant advancement for those dealing with corporate investigations, compliance checks, and fraud detection. This tool not only aids in recognizing potentially fraudulent operations but also provides a clearer picture of how companies are interlinked across borders.

The Significance of Disputed Registered Offices

Disputed registered offices can be a strong indicator of fraudulent activity. Companies that do not maintain a legitimate or verifiable office address may be attempting to evade scrutiny or engage in illegal operations. By using this new feature to highlight these questionable entities, users can take proactive steps in investigating and addressing potential fraud.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Utilizing the New Feature

To make the most of this new feature, users are encouraged to engage with the mapping tool regularly. By doing so, they can track changes in ownership, identify new clusters of concern, and stay informed about emerging patterns in corporate behavior. This is especially critical for financial institutions, regulators, and compliance officers who must remain vigilant against fraud.

Enhancing Fraud Detection Strategies

Incorporating this new feature into existing fraud detection strategies can significantly enhance an organization’s ability to identify and respond to potential risks. By focusing on red dots representing companies with disputed registered offices, users can prioritize their investigations and allocate resources more effectively. This targeted approach not only saves time but also increases the likelihood of uncovering fraudulent activities before they escalate.

Conclusion

With the introduction of this innovative mapping feature, users can now navigate the complex world of corporate ownership more effectively. By highlighting companies with disputed registered offices and allowing for the filtration of active and dormant statuses, this tool empowers users to identify potential fraud and take action accordingly. As the landscape of corporate ownership continues to evolve, staying informed and equipped with the right tools will be crucial in combating fraud and ensuring compliance.

In summary, the new feature is a game-changer for those involved in corporate investigations and fraud detection. Users are encouraged to leverage this tool to enhance their understanding of company ownership and safeguard against potential risks.

Fun new feature: you can now turn off the normal “active” and “dormant” companies and just see the red dots.

Here’s a cluster of Florida companies owning UK companies with disputed registered offices (often a sign of fraud). pic.twitter.com/draSuI92Ph

— Dan Neidle (@DanNeidle) March 21, 2025

Fun New Feature: You Can Now Turn Off the Normal “Active” and “Dormant” Companies and Just See the Red Dots

If you’ve been keeping an eye on the recent developments in business analytics, you might have come across a pretty exciting update. A fun new feature allows users to turn off the regular “active” and “dormant” companies and focus solely on what’s really interesting: the red dots. This change offers a fresh perspective on how we analyze corporate data, especially when it comes to spotting anomalies. One notable example involves a cluster of Florida companies owning UK companies, particularly those with disputed registered offices. This often raises a red flag and can be a potential sign of fraud.

Understanding the Importance of Company Registration

When we talk about companies, their registration details are crucial. In many cases, a company’s registered office acts as its official address for legal correspondence and public records. However, discrepancies in this information can indicate deeper issues, like fraudulent activities. For instance, companies that list dubious or non-existent addresses might be trying to evade taxes or hide from regulatory scrutiny. The new feature that lets you filter out normal companies and focus on those with problematic registrations can be an invaluable tool for analysts and investors alike.

Why Focus on the Red Dots?

So, why should you care about those red dots? Simply put, they signify companies that might be engaging in questionable practices. By isolating these entities, you can better understand the landscape of corporate behavior and identify potential risks. This is especially important for investors or anyone considering partnerships with businesses. The ability to visualize these “red dots” helps in making informed decisions and avoiding potential pitfalls.

Spotting Fraud: The Case of Florida Companies

Now, let’s dive into the specifics of those Florida companies that own UK companies with disputed registered offices. Florida has gained a reputation for being a hotbed of corporate activity, but not all of it is legitimate. The clustering of these companies raises eyebrows, making it essential to investigate further. Often, these companies employ similar tactics: they use registered offices in the UK that are either nonexistent or disputed.

Understanding the patterns and connections among these companies can help in identifying fraud. For example, if multiple Florida-based companies are linked to questionable UK addresses, it may indicate a coordinated effort to obscure financial activities. By leveraging the new feature that highlights these connections, users can gain insights into potentially fraudulent networks.

How to Use the New Feature Effectively

If you’re wondering how to make the most of this new feature, it’s all about utilizing the filtering options available. Start by toggling off the “active” and “dormant” companies. This will allow you to concentrate on those that exhibit red flags. Once you have this filtered view, take the time to analyze the clusters of companies and their registered addresses. Are there patterns or commonalities? Do certain companies reappear frequently with disputed addresses? Engaging with the data in this manner can yield significant insights.

Real-World Implications of Fraudulent Practices

The ramifications of corporate fraud are far-reaching. For investors, it can mean lost investments and financial ruin. For the companies involved, fraudulent practices lead to legal consequences and reputational damage. It’s not just about the money; it’s about trust. When companies operate under the radar, they can undermine the integrity of the entire market.

By utilizing tools that highlight suspicious activities, stakeholders can work to protect themselves and the broader economic environment. Understanding the implications of these dubious practices is crucial for anyone involved in business, from small startups to large corporations.

Tools and Resources for Further Investigation

If you’re interested in digging deeper into these issues, there are several tools available that can help you analyze company registrations and ownership structures. Websites like the UK Companies House provide access to a wealth of information about registered companies, including their addresses and ownership records. Similarly, databases like the SEC offer insights into financial disclosures that can uncover red flags.

Moreover, leveraging data visualization tools can help you map out these clusters of companies effectively. Seeing the connections visually can often lead to quicker insights than sifting through spreadsheets.

The Future of Corporate Analysis

As technology continues to advance, we can expect even more innovative features that will enhance our ability to analyze corporate behavior. The capability to filter and focus on specific indicators of fraud is just the beginning. Future developments may include AI-driven analysis that can predict fraudulent activity based on historical data, making it even easier to identify potential risks.

For now, take advantage of the current tools and features at your disposal. Stay informed and vigilant, and always look for the red dots that might indicate trouble brewing in the corporate world.

Engaging with the Community

As you explore these features and tools, don’t forget the value of community engagement. Online forums, webinars, and social media groups can be excellent resources for sharing insights and strategies for analyzing corporate data. Engaging with others who are interested in corporate transparency can lead to valuable discussions and the sharing of best practices.

Conclusion: Staying Ahead of the Curve

In a world where corporate fraud can have devastating consequences, staying ahead of the curve is essential. The new feature that allows you to filter out normal companies and focus on those red dots is a game changer for anyone interested in corporate analytics. By honing in on the companies with disputed registered offices, you can better protect yourself and your investments. Keep your eyes open, and always be ready to dig deeper. After all, the truth is often hidden beneath layers of corporate complexity.

“`

This article incorporates the requested elements, maintains an informal tone, and engages the reader, while also ensuring SEO optimization through the use of relevant keywords and structured headings.