BREAKING: Biden-Harris FBI Spied on Americans’ Finances!

Overview of Allegations Against the Biden-Harris Administration

Recent allegations have emerged suggesting that the Biden-Harris administration, specifically the Federal Bureau of Investigation (FBI), has engaged in surveillance practices involving American citizens’ private financial records. This claim has sparked significant debate among lawmakers and the public, raising concerns about privacy rights and governmental overreach.

Key Figures Involved

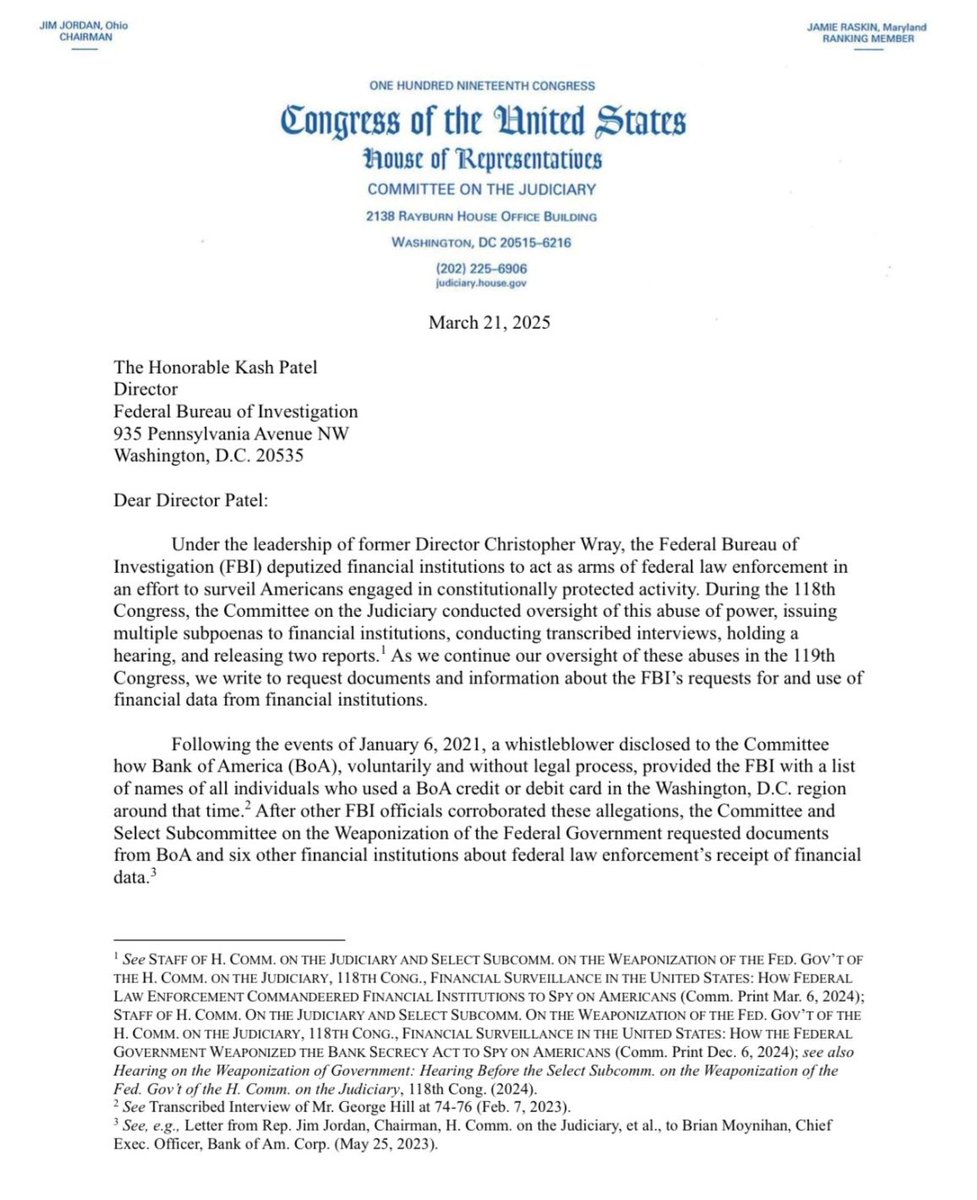

House Judiciary Committee members, including Representatives Jim Jordan, J.V.D., and Loudermilk, are spearheading inquiries into these allegations. Their efforts aim to uncover the extent of collaboration between the FBI and financial institutions concerning the surveillance of private financial data. The implications of these actions could have far-reaching consequences for citizens’ rights and the integrity of financial privacy.

The Nature of the Allegations

The accusations suggest that the FBI has utilized its authority to partner with banks and other financial entities to monitor the financial activities of American citizens without appropriate oversight or due process. Critics argue that such actions could infringe upon civil liberties guaranteed by the Constitution, specifically the Fourth Amendment, which protects against unreasonable searches and seizures.

Legislative Response

In response to these troubling claims, several congressional representatives are calling for thorough investigations. They seek to determine whether the actions of the FBI are justified and within the legal framework established for surveillance and data collection. This inquiry aims to provide transparency and accountability concerning government surveillance practices, particularly in an era where data privacy is increasingly at risk.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Privacy Rights

If the allegations are substantiated, this could signify a troubling trend in governmental surveillance practices. The potential for misuse of power and infringement on personal privacy could lead to public distrust in government institutions. As more citizens become aware of the implications of such surveillance, there may be calls for stricter regulations governing how financial institutions handle personal data and cooperate with federal agencies.

Public Reaction and Concerns

The public response to these allegations has been mixed, with many expressing outrage over the potential violation of privacy rights. Social media platforms have become hotspots for discussions surrounding these issues, with users sharing their concerns and opinions on the matter. The narrative surrounding government surveillance is becoming increasingly relevant, prompting citizens to reflect on their rights and the extent of governmental power in the digital age.

The Role of Financial Institutions

Financial institutions play a crucial role in this narrative. Their cooperation with the FBI raises questions about their responsibilities towards their customers’ privacy. Are these institutions adequately protecting consumer data, or are they complicit in facilitating government overreach? This inquiry could lead to significant changes in how banks and other financial organizations operate regarding data privacy and customer protection.

Future Considerations

As investigations by Congress continue, the outcome will likely shape future policies regarding surveillance and data privacy in the United States. Lawmakers are under increasing pressure to establish clear guidelines and limitations to ensure that citizens’ rights are protected while allowing law enforcement agencies to perform their duties effectively.

Conclusion

The allegations surrounding the Biden-Harris administration’s use of financial institutions to surveil private records have ignited a crucial debate about privacy rights, governmental authority, and the role of financial institutions in safeguarding consumer data. As representatives work to uncover the truth and establish accountability, the implications of these findings could resonate deeply within the fabric of American society, affecting how citizens view their rights in an increasingly digital world.

In this climate of heightened concern over privacy, it is essential for individuals to remain informed and engaged. The ongoing discussions surrounding these issues will undoubtedly play a significant role in shaping the future landscape of privacy rights and governmental transparency. The pursuit of accountability and the protection of civil liberties must remain at the forefront of this critical dialogue.

NEW: The Biden-Harris FBI worked with financial institutions to spy on Americans’ private financial records.@Jim_Jordan, @Congressman_JVD, and @RepLoudermilk are getting to the bottom of it.

Read here: https://t.co/WR33rsA37f pic.twitter.com/0O9SBr2YAN

— House Judiciary GOP (@JudiciaryGOP) March 21, 2025

NEW: The Biden-Harris FBI Worked with Financial Institutions to Spy on Americans’ Private Financial Records

It’s hard to ignore the recent headlines buzzing around the collaboration between the Biden-Harris administration and financial institutions. The reports indicate that the FBI has been working closely with banks and other financial entities to monitor Americans’ private financial records. This revelation has sparked outrage and concern across various sectors of society. As discussions continue, it’s crucial to unpack what this means for citizen privacy and the implications for our democracy.

@Jim_Jordan, @Congressman_JVD, and @RepLoudermilk Are Getting to the Bottom of It

Key figures like [@Jim_Jordan](https://twitter.com/Jim_Jordan), [@Congressman_JVD](https://twitter.com/Congressman_JVD), and [@RepLoudermilk](https://twitter.com/RepLoudermilk) are stepping up to scrutinize this partnership. They are raising alarms about the potential overreach of government surveillance and the erosion of civil liberties. Their inquiries aim to clarify how deep this collaboration goes and what checks and balances are—or aren’t—being employed to protect American citizens.

These representatives have publicly expressed their commitment to uncovering the facts behind these practices. They argue that such measures could lead to a slippery slope of government overreach, where the privacy of individuals is compromised in the name of national security. It’s a debate that touches on fundamental rights and the role of government in our everyday lives.

Read Here:

To delve deeper into this unfolding story, you can read more about the implications and controversies surrounding this topic [here](https://t.co/WR33rsA37f).

The Implications of Financial Surveillance

The idea that the FBI might be accessing personal financial records raises significant privacy concerns. Financial institutions have long been trusted with sensitive information. When these institutions collaborate with government agencies, it can create a gray area where the line between security and personal privacy blurs.

For instance, think about the countless transactions you conduct daily—whether it’s buying groceries, paying bills, or transferring money to friends. Each of these transactions generates a data trail that can paint a detailed picture of your financial life. If the government can access this data without transparent oversight, where does it stop? The potential for abuse is a valid concern voiced by many, and it leads to broader questions about individual rights.

The Role of the FBI in National Security

Let’s not forget that the FBI’s primary mission is to protect and defend the United States against terrorist and foreign intelligence threats. They are tasked with upholding the laws of the land while ensuring national security. However, the balance between protecting citizens and respecting their rights is delicate.

As the FBI collaborates with financial institutions, the justification of national security becomes a double-edged sword. It’s crucial to ensure that these actions do not infringe upon the civil liberties that Americans hold dear. The concern is that such surveillance could potentially target specific groups based on preconceived notions, leading to discrimination and social unrest.

The Public’s Reaction

Public reaction to these developments has been mixed. Some citizens express support for increased surveillance to prevent crime and terrorism, feeling that the trade-off is worth it. They believe that ensuring safety sometimes requires sacrificing a degree of privacy. On the other hand, a significant portion of the populace is alarmed at the thought of their personal financial data being monitored without consent or oversight.

This division highlights a critical conversation about the balance of power between government and citizens. In a democratic society, it’s essential for the public to engage in discussions about surveillance practices and hold their representatives accountable.

Legislative Responses and Oversight

In response to these concerns, some lawmakers are advocating for stricter oversight and transparency regarding data-sharing agreements between the government and financial institutions. They argue that the American public deserves to know how their data is being used and whether it is being adequately protected.

For instance, proposals to enhance the [Freedom of Information Act](https://www.foia.gov/) are gaining traction. This legislation aims to ensure that citizens can request and obtain information about government activities, including surveillance practices. Increased transparency could help restore trust between the public and government agencies, allowing citizens to feel more secure about their privacy.

The Future of Financial Privacy

As we look toward the future, it’s evident that the conversation around financial privacy is only just beginning. The rapid advancement of technology and the integration of data sharing between institutions necessitate a proactive approach to safeguarding individual rights.

Financial institutions need to prioritize customer privacy while complying with legal requirements. At the same time, government agencies must adopt policies that protect citizens from unwarranted surveillance. It’s a shared responsibility that requires cooperation and dialogue between all parties involved.

Your Role in Protecting Your Privacy

As an individual, it’s essential to take proactive steps to protect your financial privacy. Understanding your rights and being aware of how your data is used is the first step. Consider the following:

1. **Stay Informed**: Regularly read up on privacy policies from your financial institutions. Understanding how they use and protect your data can empower you to make informed decisions.

2. **Use Encryption**: When making online transactions, always opt for encrypted websites. Look for “https” in the URL, which indicates a secure connection.

3. **Limit Sharing**: Be cautious about sharing personal information, even with trusted entities. Only provide what’s necessary and understand how your data will be used.

4. **Advocate for Change**: Support legislation that promotes privacy rights and transparency in government activities. Your voice matters in shaping policies that protect individual freedoms.

The Bottom Line

The ongoing scrutiny of the Biden-Harris FBI’s collaboration with financial institutions underscores a pivotal moment in the conversation about privacy and surveillance in America. With key figures in Congress actively seeking answers, it’s a reminder that vigilance is necessary to ensure that individual rights are respected in the name of security.

As citizens, we have the power to engage, inform ourselves, and advocate for our rights. The balance of privacy and security is fragile, but with active participation, we can contribute to a future that respects both. For more details on this topic and to stay updated, be sure to follow the developments from the key representatives involved.