XRP Investors Slam SEC: Accusations of Ruined Lives and Conflict!

XRP Investors Express Outrage Over SEC Lawsuit Against Ripple

In a rapidly evolving financial landscape, the world of cryptocurrency often finds itself at the crossroads of innovation and regulation. One such instance is the ongoing saga involving the U.S. Securities and Exchange Commission (SEC) and Ripple Labs, the company behind the cryptocurrency XRP. The tweet shared by EDO FARINA highlights the plight of XRP investors who have been significantly impacted by the SEC’s legal actions against Ripple. This situation not only underscores the vulnerability of cryptocurrency markets but also raises questions about potential conflicts of interest within regulatory bodies.

The Ripple Effect: Investor Losses and Market Turmoil

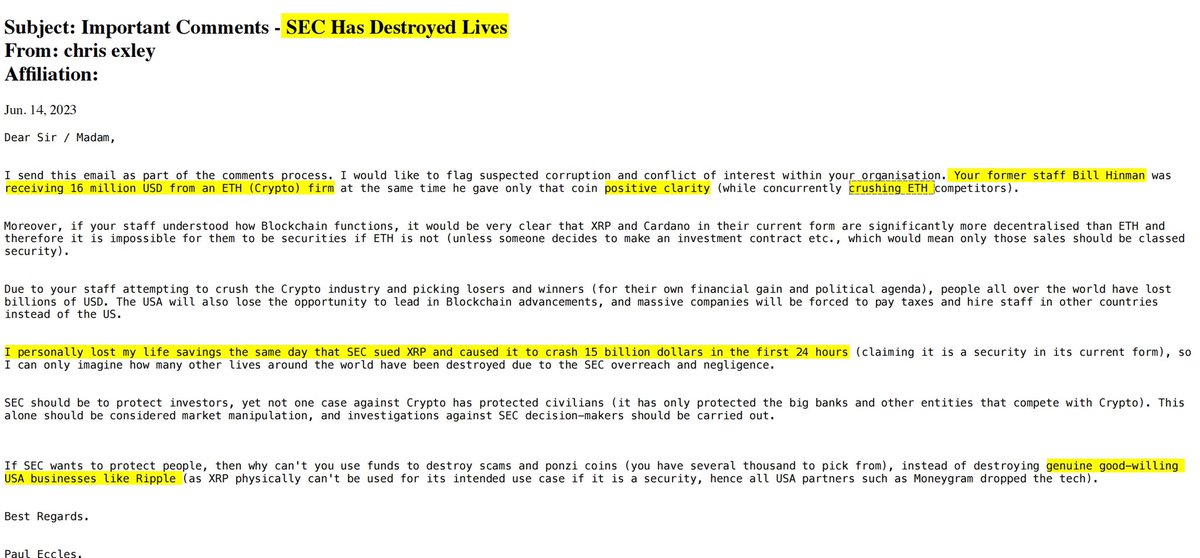

The SEC’s lawsuit against Ripple, initiated on December 22, 2020, sent shockwaves throughout the cryptocurrency market, leading to a sharp decline in the value of XRP. Many investors, some of whom had invested their life savings in XRP, experienced significant financial losses overnight. The SEC’s allegation that Ripple conducted an unregistered securities offering through the sale of XRP has been met with fierce opposition from both Ripple and its community of investors.

This legal battle has not only affected the market value of XRP but has also shaken investor confidence in the broader cryptocurrency space. The regulatory uncertainty surrounding XRP has led to its delisting from several major cryptocurrency exchanges, further compounding investor woes. As a result, XRP holders have taken to sending letters to the SEC, expressing their grievances and highlighting the detrimental impact of the lawsuit on their financial well-being.

Allegations of Conflict of Interest: The Bill Hinman Controversy

Adding another layer of complexity to this situation is the controversy surrounding former SEC official Bill Hinman. According to reports, Hinman allegedly received $16 million linked to Ethereum (ETH) while serving in office. This revelation has fueled speculation about a potential conflict of interest, as Hinman’s tenure at the SEC coincided with the agency’s decision not to pursue regulatory action against Ethereum, a cryptocurrency often seen as a competitor to XRP.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The XRP community has been vocal in questioning the impartiality of the SEC’s actions, suggesting that the agency may have unfairly targeted Ripple while overlooking similar issues with other cryptocurrencies. This perceived inconsistency in regulatory enforcement has sparked debates about the need for clearer guidelines and a more level playing field for all cryptocurrencies.

The Broader Implications for Cryptocurrency Regulation

The ongoing legal battle between the SEC and Ripple has far-reaching implications for the future of cryptocurrency regulation. As governments and regulatory bodies grapple with the challenge of overseeing a rapidly evolving digital asset landscape, the need for transparent and consistent regulatory frameworks becomes increasingly apparent.

The case underscores the importance of establishing clear definitions and guidelines for distinguishing between securities and cryptocurrencies. Without such clarity, both investors and cryptocurrency projects remain vulnerable to abrupt regulatory actions that can disrupt markets and erode investor trust.

Furthermore, the allegations of conflict of interest within regulatory bodies highlight the need for greater transparency and accountability. Ensuring that regulators operate without bias or undue influence is crucial for maintaining public confidence in the fairness and integrity of the regulatory process.

The Path Forward: Seeking Resolution and Clarity

For XRP investors and the broader cryptocurrency community, the resolution of the SEC’s lawsuit against Ripple is eagerly anticipated. A favorable outcome for Ripple could not only restore investor confidence in XRP but also set a precedent for how similar cases are handled in the future. Conversely, an unfavorable ruling could have ripple effects across the cryptocurrency industry, potentially leading to increased scrutiny and regulatory challenges for other digital assets.

In the meantime, stakeholders are advocating for open dialogue between regulators, cryptocurrency projects, and investors to foster a more collaborative approach to regulation. By engaging with industry experts and considering the unique characteristics of digital assets, regulators can develop frameworks that protect investors while allowing for innovation and growth within the cryptocurrency space.

Conclusion: Navigating the Complexities of Cryptocurrency Regulation

The situation involving XRP, Ripple, and the SEC serves as a stark reminder of the complexities and challenges inherent in regulating cryptocurrencies. As the digital asset landscape continues to evolve, finding a balanced approach to regulation will be key to unlocking the full potential of blockchain technology while safeguarding the interests of investors.

Ultimately, the goal should be to create an environment where innovation can thrive without compromising the security and stability of financial markets. By addressing concerns related to investor protection, conflicts of interest, and regulatory clarity, the cryptocurrency industry can move toward a more sustainable and equitable future. As the world watches the outcome of the Ripple case, the lessons learned will undoubtedly shape the path forward for cryptocurrency regulation in the years to come.

XRP investors are sending letters to @SECGov, stating the SEC has destroyed lives, with many losing their life savings on the same day the SEC sued @Ripple, crashing $XRP.

Conflict of interest also exposed: Bill Hinman reportedly received $16M linked to ETH while in office. pic.twitter.com/hy6eW21n96

— EDO FARINA 🅧 XRP (@edward_farina) March 20, 2025

XRP Investors Are Sending Letters to @SECGov

Hey there, crypto enthusiasts and curious readers alike! Today, we’re diving into a rather intense situation that’s been brewing in the world of cryptocurrency. If you’ve been anywhere near the crypto space, you’ve probably heard about the drama surrounding XRP and the SEC. Buckle up because it’s quite a ride!

So, what’s the buzz all about? Well, XRP investors are up in arms, and they’ve taken their grievances straight to the top. Letters are flying to the U.S. Securities and Exchange Commission (SEC), and people are not holding back. The heart of the matter? Many folks believe that the SEC has wrecked lives, with some investors losing their life savings on the very day the SEC decided to sue Ripple. This lawsuit sent XRP, Ripple’s native cryptocurrency, into a tailspin, and the fallout has been massive.

Stating the SEC Has Destroyed Lives

Imagine waking up one day only to find out that your investments have plummeted overnight. This is what happened to a number of XRP investors who felt the full force of the SEC’s lawsuit against Ripple. For many, it wasn’t just a financial loss; it was a personal crisis. People have shared stories of losing their life savings, and it’s heartbreaking to think about the impact on their families and futures.

The frustration is palpable, and it’s not just about the money. Investors feel betrayed by a system that was supposed to protect them. You see, the SEC’s role is to regulate and oversee the securities market, ensuring fair practices. But when they stepped in to sue Ripple, it caught everyone off guard. The timing and suddenness of it all left investors reeling and searching for answers. [Read more about the impact here](https://www.financemagnates.com/cryptocurrency/news/sec-lawsuit-wipes-out-billions-in-xrp-market-value/).

With Many Losing Their Life Savings on the Same Day the SEC Sued @Ripple

The day the SEC decided to drop the hammer on Ripple was catastrophic for XRP holders. The news spread like wildfire, and the market reacted with panic. XRP’s value plummeted, and investors watched helplessly as their portfolios took a nosedive. It was a classic case of being in the wrong place at the wrong time, and the financial losses were staggering.

For some, it meant more than just numbers on a screen. It was their kids’ college funds, their retirement savings, or even their emergency reserves. The emotional toll was immense, and the sense of injustice lingered. Many investors felt that the SEC’s actions were arbitrary and heavy-handed, leaving them with little recourse. [Find more insights on this here](https://cryptobriefing.com/xrp-investors-lose-life-savings-after-sec-lawsuit/).

Crashing $XRP

The term “crash” might be overused in the financial world, but in this case, it’s apt. XRP went from being a promising digital asset to a cautionary tale almost overnight. The crash didn’t just affect individual investors; it sent shockwaves across the entire crypto market. Other cryptocurrencies felt the ripple effect (pun intended), and the market experienced a period of volatility that left traders on edge.

What makes this crash particularly significant is its ripple effect on the broader crypto ecosystem. It highlighted the vulnerabilities within the market and raised questions about the stability and future of cryptocurrencies as a whole. [Explore the effects on the crypto market](https://www.coindesk.com/market-crash-follows-sec-ripple-lawsuit).

Conflict of Interest Also Exposed: Bill Hinman Reportedly Received $16M Linked to ETH While in Office

As if the XRP saga wasn’t enough, there’s another layer to this unfolding drama—a potential conflict of interest involving Bill Hinman, a former SEC official. Reports have surfaced that Hinman allegedly received $16 million linked to Ethereum (ETH) while he was in office. This revelation has sparked outrage and raised questions about the integrity of the SEC’s actions.

Critics argue that Hinman’s financial ties to Ethereum represent a clear conflict of interest, especially given the SEC’s favorable stance toward Ethereum compared to XRP. This has fueled speculation that the lawsuit against Ripple was not entirely above board. The crypto community is demanding transparency and accountability, and the pressure is mounting for the SEC to address these concerns. [Read more about the conflict of interest](https://www.forbes.com/sites/billybambrough/2025/03/20/ethereum-linked-payments-to-sec-official-under-scrutiny/).

Bill Hinman Reportedly Received $16M Linked to ETH While in Office

Let’s talk about the elephant in the room—Bill Hinman. The reports that he received $16 million tied to Ethereum while serving as an SEC official have added fuel to an already raging fire. For XRP investors, this revelation is a bitter pill to swallow. It calls into question the fairness and impartiality of the SEC’s decision-making process.

The crypto world is abuzz with theories and opinions. Some believe it’s a sign of systemic corruption, while others caution against jumping to conclusions. Regardless of where you stand, it’s clear that this development has complicated an already convoluted situation. Trust is a fragile thing, and once it’s broken, it’s hard to rebuild. [Learn more about Hinman’s involvement](https://decrypt.co/62541/sec-officials-16-million-eth-payments-spark-controversy).

The Ripple Effect on the Crypto Community

The fallout from the SEC’s lawsuit against Ripple and the subsequent XRP crash has reverberated throughout the crypto community. It’s a stark reminder of the risks and uncertainties inherent in the crypto space. For seasoned investors, it’s a familiar story, but for newcomers, it’s a harsh introduction to the volatile world of digital assets.

Despite the turmoil, the crypto community remains resilient. Forums and social media are buzzing with discussions and support for those affected. There’s a sense of camaraderie, as people share advice, commiserate, and strategize for the future. The collective experience has strengthened the resolve of many, and there’s a renewed focus on advocating for clearer regulations and fair practices. [Join the community conversation](https://www.reddit.com/r/CryptoCurrency/comments/mh3b4g/xrp_investors_discuss_sec_impact/).

Looking Ahead: What’s Next for XRP and Ripple?

So, where do we go from here? The XRP saga is far from over, and the road ahead is uncertain. Ripple is gearing up for a legal battle, and the stakes are high. The outcome of this case could set a precedent for how cryptocurrencies are regulated in the future.

For investors, it’s a waiting game. Many are holding onto their XRP, hoping for a favorable resolution, while others have cut their losses and moved on. The crypto landscape is ever-evolving, and adaptability is key. As we watch this drama unfold, one thing is certain—the world of cryptocurrency is never dull. [Get the latest updates](https://www.theblockcrypto.com/post/2025/03/20/ripple-prepares-for-sec-legal-battle).

And there you have it, folks! The XRP and SEC saga is a wild ride full of twists and turns. Whether you’re a seasoned investor or just a curious bystander, it’s a story worth following. Keep your eyes peeled for more developments, and stay tuned for what promises to be an intriguing chapter in the world of crypto.