U.S. Banks Secretly Ready to Dive into Crypto Custody in 2022!

Introduction to U.S. Commercial Banks Offering Crypto Custody Services

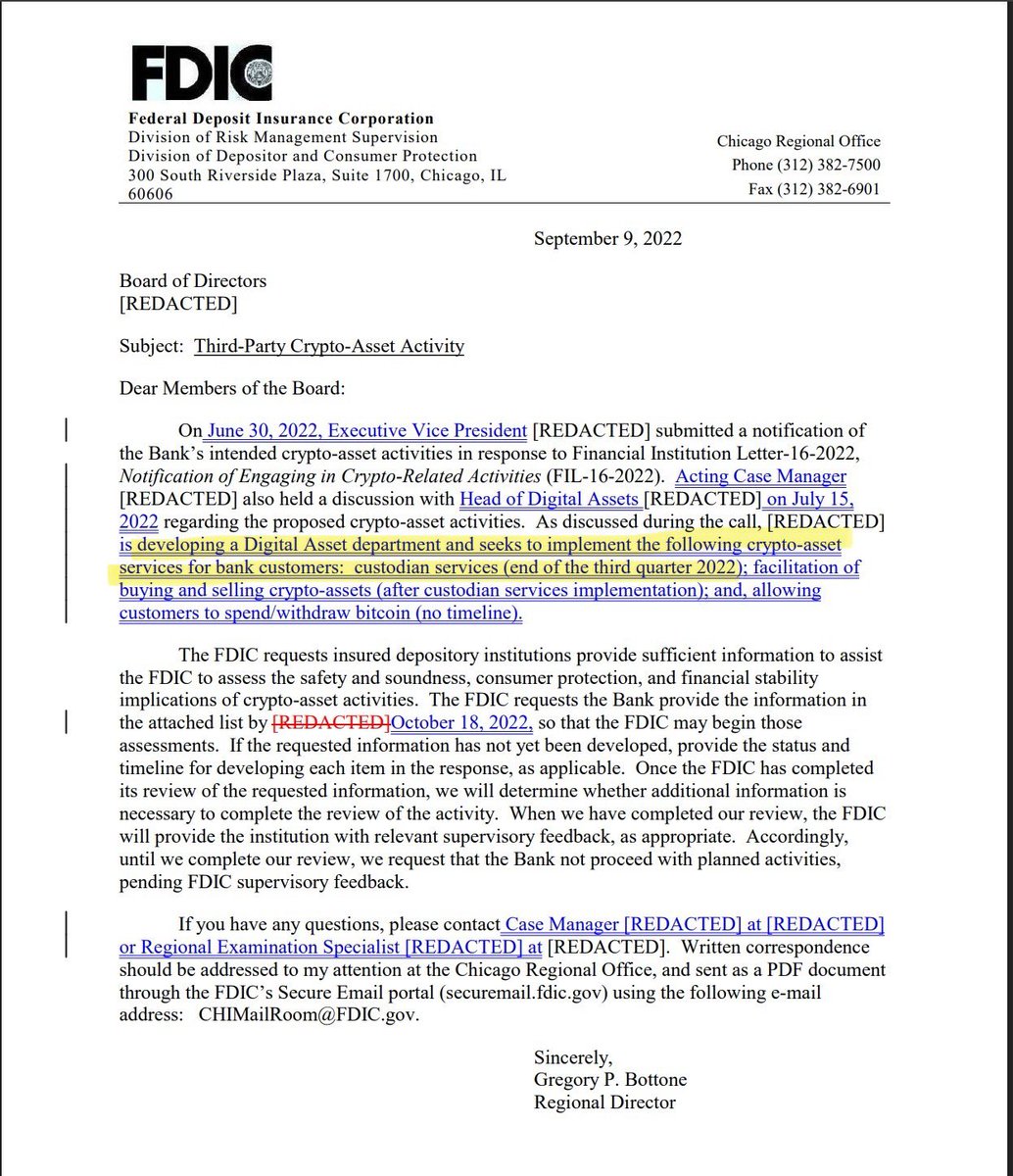

In the rapidly evolving financial landscape, the integration of cryptocurrency services by traditional banking institutions marks a significant milestone. As highlighted in a recent tweet by SMQKE, U.S. commercial banks were poised to introduce crypto custody services to their clientele in 2022. This development underscores an increasing acceptance of digital currencies in mainstream finance, a trend that has been gaining momentum over the past decade. This summary delves into the implications of this move, the benefits it offers, and the broader impact on the financial ecosystem.

Understanding Crypto Custody Services

Crypto custody services refer to third-party storage and security solutions for cryptocurrencies. These services are crucial for both individual and institutional investors, offering a secure way to store digital assets. Given the rising incidents of cyber threats and hacking in the crypto space, custody solutions have become essential. Banks entering this space promise enhanced trust and security, leveraging their established infrastructure and regulatory compliance.

Why U.S. Banks Embraced Crypto Custody

Several factors contributed to the decision of U.S. commercial banks to offer crypto custody services:

Growing Demand for Cryptocurrencies

The surge in the popularity of cryptocurrencies has been undeniable. Bitcoin, Ethereum, and other digital currencies have seen substantial investment from both retail and institutional investors. This growing market demand prompted banks to explore crypto services to meet customer needs and stay competitive.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Regulatory Clarity and Support

In recent years, regulatory bodies in the U.S. have provided more clarity regarding the handling and custody of digital assets. This regulatory support has encouraged banks to venture into the crypto space, ensuring compliance and security in their offerings.

Diversification of Services

For banks, offering crypto custody services represents an opportunity to diversify their service portfolio. By integrating digital assets into their offerings, banks can attract a new segment of tech-savvy customers and retain existing ones looking to expand their investment horizons.

Benefits of Bank-Provided Crypto Custody Services

The introduction of crypto custody services by banks presents several benefits:

Enhanced Security

Banks are synonymous with security and trust. By offering crypto custody services, they provide a reliable option for investors wary of online hacks and security breaches associated with digital wallets.

Regulated Environment

Operating under stringent regulatory frameworks, banks offer a level of compliance and oversight that is often lacking in standalone crypto exchanges. This regulated environment provides an added layer of security and peace of mind for investors.

Seamless Integration with Traditional Services

Banks can integrate crypto custody with traditional banking services, offering customers a one-stop solution for all their financial needs. This seamless integration simplifies the process for clients managing both fiat and digital currencies.

Impact on the Financial Ecosystem

The move by U.S. commercial banks to offer crypto custody services has broader implications for the financial ecosystem:

Increased Adoption of Cryptocurrencies

By integrating crypto services, banks play a pivotal role in legitimizing digital currencies, potentially leading to increased adoption and acceptance among the general public.

Innovation in Financial Products

The blending of traditional finance with digital currencies could spur innovation in financial products, including crypto-backed loans, savings accounts, and investment portfolios.

Competitive Landscape

As more banks venture into the crypto space, the competitive landscape will evolve. Traditional financial institutions will need to innovate continuously to maintain their market position against new entrants and fintech companies.

Conclusion

The decision by U.S. commercial banks to offer crypto custody services in 2022 marks a significant step forward in the integration of digital currencies into mainstream finance. This move not only meets the growing demand for secure and regulated crypto services but also positions banks as key players in the evolving financial landscape. As the adoption of cryptocurrencies continues to rise, the role of banks in providing secure and compliant custody solutions will be instrumental in shaping the future of finance.

In summary, the integration of crypto custody services by U.S. commercial banks highlights a pivotal moment in financial history, paving the way for a more inclusive and innovative financial system. For investors and stakeholders, this development promises enhanced security, regulatory compliance, and a broader range of financial products, ultimately fostering a more robust and dynamic financial ecosystem.

U.S COMMERCIAL BANKS WERE PREPARED TO OFFER CRYPTO CUSTODY SERVICES TO THEIR CUSTOMERS IN 2022 https://t.co/lMpTIQ11gm pic.twitter.com/lJQDmYXwlR

— SMQKE (@SMQKEDQG) March 20, 2025

U.S COMMERCIAL BANKS WERE PREPARED TO OFFER CRYPTO CUSTODY SERVICES TO THEIR CUSTOMERS IN 2022

Let’s dive into the fascinating world of crypto custody services and how U.S commercial banks were gearing up to offer these services back in 2022. The financial landscape has been evolving rapidly, and the traditional banks had to keep up with the fast-paced changes that digital currencies brought to the table. In 2022, U.S commercial banks were not just bystanders but active players preparing to offer crypto custody services to their customers. This was a major shift that signaled the growing acceptance of cryptocurrencies in mainstream finance.

Why Did Banks Want to Offer Crypto Custody Services?

You might be wondering why banks, traditionally known for their conservative nature, were interested in jumping on the crypto bandwagon. Well, the answer lies in the growing demand from customers who were increasingly investing in cryptocurrencies and needed a safe place to store their assets. Cryptocurrencies, unlike fiat currencies, are digital and require secure storage solutions. Banks saw an opportunity to offer these solutions by leveraging their existing infrastructure and reputation for security.

The move was also driven by the need to stay competitive. As more fintech companies and startups began offering crypto-related services, traditional banks faced the risk of losing customers to these new players. By offering crypto custody services, banks could retain their customer base while attracting new ones who were interested in digital currencies.

The Role of Regulations in Crypto Custody Services

Regulations played a pivotal role in shaping how banks approached crypto custody services. In 2020, the U.S Office of the Comptroller of the Currency (OCC) [granted permission](https://www.reuters.com/article/us-usa-banks-cryptocurrency-idUSKCN24K2W3) to national banks to offer crypto custody services. This was a significant milestone as it provided the necessary regulatory clarity for banks to enter the crypto space. With the green light from regulators, banks could now explore offering these services without fear of running afoul of the law.

However, entering the crypto space wasn’t without its challenges. Banks had to navigate complex regulatory requirements to ensure compliance while providing secure and efficient services. They also had to invest in new technologies and expertise to handle digital assets, which was a departure from their traditional operations.

How Crypto Custody Services Work

Crypto custody services are essentially secure storage solutions for digital assets. They involve safeguarding private keys, which are crucial for accessing and managing cryptocurrencies. Without these keys, you can’t access your digital assets, making them a prime target for hackers. Banks, with their robust security measures and infrastructure, were well-positioned to offer these services.

These services can take various forms, including hot storage (online) and cold storage (offline). Hot storage allows for quick access to assets but is more vulnerable to cyber threats. On the other hand, cold storage is more secure as it’s offline, but it can be less convenient for quick transactions. Banks offering crypto custody services tended to use a combination of both to provide a balance between security and accessibility.

Customer Trust in Banks’ Crypto Services

One of the biggest advantages banks had in offering crypto custody services was customer trust. Banks have long-standing reputations for safeguarding assets, and this trust extended to digital assets as well. Customers felt more comfortable storing their cryptocurrencies with established financial institutions rather than unknown entities.

Additionally, banks provided an added layer of security through insurance. Many banks offering crypto custody services [partnered with insurance companies](https://www.forbes.com/sites/ninabambysheva/2021/04/01/insurance-giant-axa-now-accepting-bitcoin-as-payment/?sh=1f4d7b762b5e) to insure digital assets against theft or loss. This insurance coverage further enhanced customer confidence in using banks’ crypto services.

Challenges Faced by Banks in Offering Crypto Custody Services

Despite the potential benefits, banks faced several challenges in offering crypto custody services. The volatility of cryptocurrencies was a significant concern. The value of digital assets could fluctuate wildly, impacting the perceived value of a bank’s assets under management. Banks had to develop strategies to mitigate these risks while providing reliable services.

Moreover, the technological infrastructure required for crypto custody services was another hurdle. Banks had to invest in new systems and hire experts skilled in blockchain technology to manage these services effectively. This required significant resources and time, and not all banks were ready to make this commitment.

The Future of Crypto Custody Services in U.S Banks

So, what’s next for crypto custody services in U.S banks? The future looks promising as more banks continue to explore and expand their crypto offerings. As the [crypto market matures](https://www.bloomberg.com/news/articles/2021-07-28/goldman-sachs-expands-crypto-trading-desk-with-ether-options), we can expect to see even more innovative solutions from banks to cater to the growing demand for digital asset services.

Banks may also collaborate with fintech companies to leverage their expertise and technology in the crypto space. These partnerships could lead to the development of new products and services that provide customers with more options for managing their digital assets.

In summary, U.S commercial banks were prepared to offer crypto custody services to their customers back in 2022, marking a significant shift in the financial landscape. While challenges remain, the potential benefits and opportunities for banks in the crypto space are undeniable. As the world of finance continues to evolve, it’s clear that cryptocurrencies are here to stay, and banks are positioning themselves to be key players in this exciting new frontier.