Breaking: Sanctioned Garantex Rebrands to Grinex Amid Suspicion!

Garantex Rebrands as Grinex: A New Chapter for a Sanctioned Russian Crypto Exchange

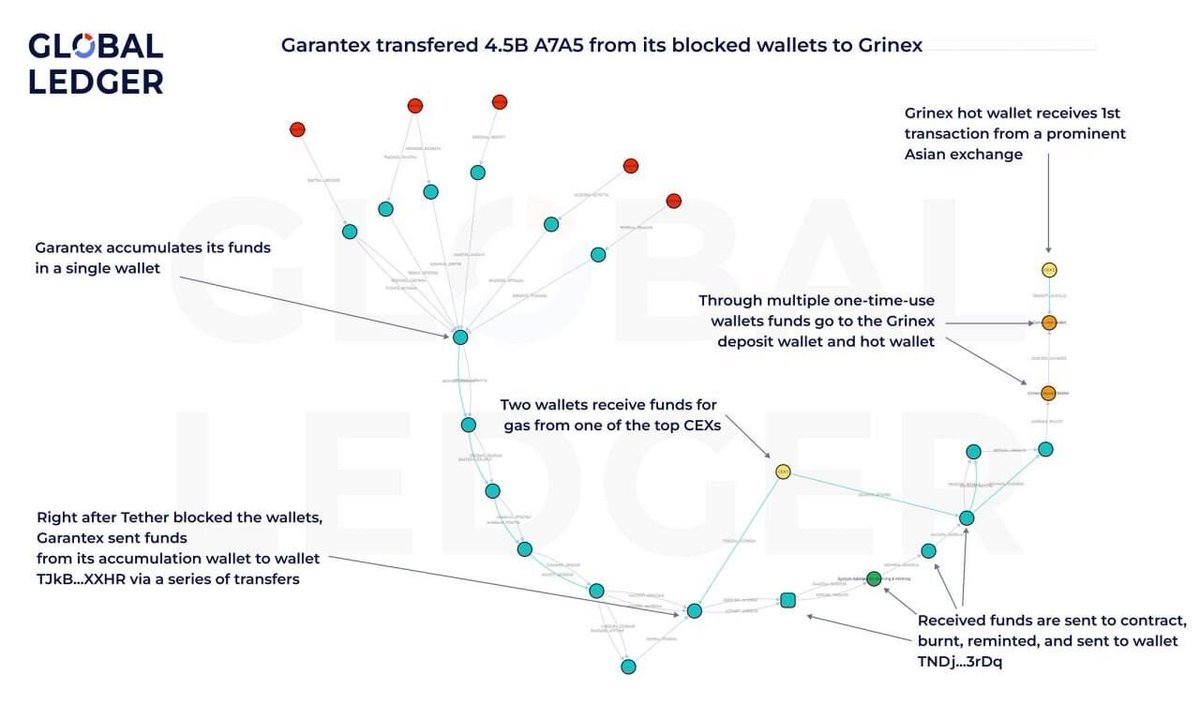

In a significant development within the cryptocurrency sector, the sanctioned Russian crypto exchange Garantex has reportedly undergone a rebranding, emerging as Grinex. This pivotal change is not merely cosmetic; it involves the transfer of customer funds and operations to the newly established platform. Analysts at Global Ledger have unearthed compelling on-chain evidence that links Garantex and Grinex, indicating that the transition is more than just a name change. With Grinex now processing nearly $30 million in transactions, the implications of this development are far-reaching, raising questions about regulatory compliance, user security, and the operational future of the exchange.

The Background of Garantex

Garantex, once a prominent player in the Russian cryptocurrency market, faced international scrutiny and sanctions due to its alleged connections to illicit activities. The exchange served as a platform for users to trade various cryptocurrencies, but its operations came under fire as authorities aimed to crack down on platforms facilitating money laundering and other unlawful transactions. The sanctions imposed on Garantex were indicative of the broader regulatory landscape that cryptocurrency exchanges must navigate, particularly those operating in regions with stringent financial oversight.

The Emergence of Grinex

The transition from Garantex to Grinex marks a strategic pivot aimed at circumventing regulatory challenges while maintaining a foothold in the cryptocurrency space. By rebranding, the new exchange seeks to distance itself from the negative connotations associated with Garantex and re-establish itself as a legitimate player in the market. The name change not only serves as a fresh start but also as a marketing strategy to attract new users who may have been hesitant to engage with the former platform due to its tarnished reputation.

On-Chain Evidence and Analysis

Analysts from Global Ledger have conducted an in-depth examination of on-chain data, revealing a direct connection between the two exchanges. This evidence highlights the continuity of operations despite the rebranding, suggesting that Grinex is essentially a continuation of Garantex under a new guise. Such findings raise critical questions regarding the effectiveness of sanctions and the regulatory measures in place to monitor and control cryptocurrency exchanges.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The on-chain transactions linked to Grinex indicate that the new exchange has managed to process nearly $30 million, showcasing a robust demand for its services. This volume of transactions suggests that the rebranding has been successful in attracting users who may have previously been deterred by the sanctions imposed on Garantex. However, this also poses significant risks, as customers may be unknowingly engaging with an entity that has not fully addressed the underlying compliance issues that led to the original sanctions.

Regulatory Implications

The rebranding of Garantex to Grinex opens up a broader conversation about the regulatory environment surrounding cryptocurrency exchanges. As jurisdictions worldwide grapple with the rapid evolution of digital currencies, the need for comprehensive regulatory frameworks becomes increasingly apparent. The case of Grinex exemplifies the challenges regulators face in keeping pace with the dynamic nature of the crypto market, particularly when exchanges can quickly rebrand and attempt to evade scrutiny.

Moreover, the ability of Grinex to process substantial transaction volumes shortly after its launch raises concerns about the effectiveness of due diligence practices in place to protect users and maintain market integrity. Investors and users must remain vigilant and conduct thorough research before engaging with any exchange, particularly those with a controversial history.

User Security and Trust

For customers of Garantex, the transition to Grinex may evoke a sense of uncertainty regarding the safety of their funds and the reliability of the platform. Trust is a critical factor in the cryptocurrency space, and any exchange that has previously faced sanctions may find it challenging to regain the confidence of its user base. The success of Grinex will largely depend on its ability to demonstrate transparency, compliance with regulatory standards, and a commitment to user security.

As the exchange navigates its new identity, it is essential for Grinex to communicate effectively with its users, providing clear information about its operations, security measures, and compliance protocols. Building trust will be paramount, especially as the cryptocurrency landscape continues to evolve and attract new participants.

Conclusion

The rebranding of Garantex to Grinex is a noteworthy development in the cryptocurrency industry, highlighting the complexities of regulatory compliance and the challenges faced by exchanges operating under scrutiny. As Grinex seeks to establish itself in the market, the on-chain evidence linking it to its predecessor raises important questions about the effectiveness of sanctions and the ongoing battle against illicit activities in the crypto space.

For users and investors, understanding the implications of this rebranding is crucial. Conducting due diligence, remaining informed about the regulatory landscape, and prioritizing security will be essential as they navigate the evolving world of cryptocurrency exchanges. As Grinex embarks on this new chapter, the industry will be closely watching to see how it addresses the challenges ahead and whether it can successfully redefine its place in the market.

In summary, the transition from Garantex to Grinex serves as a reminder of the fluid nature of the cryptocurrency landscape and the ongoing need for robust regulatory frameworks. As the industry continues to grow, the lessons learned from this rebranding can inform future efforts to create a secure and compliant environment for all cryptocurrency participants.

LATEST: Sanctioned Russian crypto exchange Garantex has reportedly rebranded as Grinex, transferring customer funds and operations to the new platform.

Analysts from Global Ledger have identified on-chain evidence linking the two exchanges, with Grinex processing nearly $30… pic.twitter.com/8qI2CSCSGA

— Cointelegraph (@Cointelegraph) March 20, 2025

LATEST: Sanctioned Russian Crypto Exchange Garantex Rebrands as Grinex

In an unexpected twist in the ever-evolving world of cryptocurrency, the sanctioned Russian crypto exchange Garantex has reportedly rebranded itself as Grinex. This move comes amid increasing scrutiny and regulatory pressure on crypto platforms linked to illicit activities. As the landscape changes, users and investors are left to ponder the implications and motivations behind this rebranding. What does it mean for the future of Grinex, and how does it affect the users who had previously relied on Garantex?

Transferring Customer Funds and Operations

The transition from Garantex to Grinex isn’t just a name change; it involves the actual transfer of customer funds and operations to the new platform. This raises a series of questions for users who had accounts with Garantex. Will their funds be safe? What measures are in place to ensure a smooth transition? According to reports, many customers have already seen their funds migrated to Grinex. However, the lack of transparency during this transition has left some users feeling uneasy about their investments.

Insights from Analysts: On-Chain Evidence

Analysts from Global Ledger have been closely monitoring the situation and have identified on-chain evidence that links Garantex and Grinex. This analysis is crucial because it provides insight into the operations of these exchanges and how they interact with the broader crypto ecosystem. The findings indicate that Grinex has processed nearly $30 million in transactions shortly after the rebranding, suggesting a significant influx of activity. This data could be a double-edged sword; while it shows growth, it also raises concerns about the integrity of the platform.

The Implications of Rebranding

Rebranding can often be a strategic move aimed at distancing a company from negative associations. For Grinex, this could mean shedding the problematic reputation that Garantex had accumulated over time. However, will a new name be enough to regain the trust of users who may feel wary after Garantex’s previous sanctions? It’s a delicate balance for any business in the crypto space, where reputation can be everything.

What Users Need to Know

If you were a Garantex user, it’s essential to stay informed as Grinex takes shape. Make sure to check your account and verify that your funds have been transferred safely. Also, keep an eye on official communications from Grinex regarding any changes in policies, security measures, and operational protocols. Remember, in the world of crypto, staying informed is key to protecting your investments.

Regulatory Scrutiny and Future Prospects

The rebranding from Garantex to Grinex comes at a time when regulatory bodies worldwide are tightening their grip on cryptocurrency exchanges. The operations of Grinex will likely come under scrutiny as regulators look to ensure compliance with laws designed to prevent money laundering and other illicit activities. This could impact how the exchange operates moving forward and might even affect its user base.

The Bigger Picture: Crypto Exchange Landscape

The crypto exchange landscape is continuously shifting, with exchanges facing various challenges from regulatory bodies, market volatility, and changing user demands. Grinex’s emergence as a rebranded entity from Garantex adds another layer of complexity to this landscape. For users, it’s vital to remain vigilant and informed about the exchanges they choose to engage with, particularly as regulatory environments evolve.

Security Concerns with Rebranding

Security is a top concern for any crypto user, especially when dealing with exchanges that have previously faced sanctions. The transition from Garantex to Grinex may raise red flags for some users. Questions about the security measures in place to protect customer funds and data privacy are paramount. It’s crucial to research and understand what Grinex is doing to ensure that your assets are secure.

What Lies Ahead for Grinex?

The path forward for Grinex is still unfolding. As the platform attempts to establish itself in the market, it will need to demonstrate its commitment to transparency, compliance, and user security. Engaging with customers and addressing their concerns will be vital to gaining back their trust. The crypto community is known for being vocal, and Grinex will need to ensure that it listens and responds to user feedback as it navigates this new chapter.

Staying Ahead of the Curve

For those involved in cryptocurrency, staying ahead of the curve is essential. Following developments related to Grinex and understanding how it differentiates itself from Garantex will be key. It’s advisable to keep an eye on industry news, join forums or community discussions, and engage with other users to share insights and experiences. In a field where information is power, being proactive can help safeguard your investments.

Concluding Thoughts: Is Grinex Worth It?

Ultimately, whether Grinex is worth your trust and investment boils down to its ability to prove itself in a competitive and often risky market. As the rebranding unfolds and the dust settles, users will need to assess the exchange’s performance, user experience, and compliance with regulations. Only time will tell if Grinex can rise from the shadows of its predecessor, Garantex, and become a reputable player in the crypto world.

As developments continue to unfold, stay informed and make decisions that align with your financial goals. The cryptocurrency market is dynamic and fast-paced, requiring you to adapt and respond to changes as they happen.