BREAKING: BLACKROCK’s SHOCKING XRP ETF Filing Rumors Ignite Controversy!

BlackRock Set to File for XRP ETF: Exciting Developments in Cryptocurrency

In a groundbreaking announcement that has sent shockwaves through the cryptocurrency community, financial giant BlackRock is reportedly preparing to file for an XRP Exchange Traded Fund (ETF) imminently. This news comes as a significant development in the ongoing evolution of cryptocurrency investment products and the regulatory landscape surrounding them. With sources indicating that regulatory discussions are actively taking place behind closed doors, investors and crypto enthusiasts are on the edge of their seats, eager to see how this will unfold.

Understanding the Significance of an XRP ETF

The concept of an ETF is crucial for investors and the broader financial market. An ETF is a type of investment fund that is traded on stock exchanges, much like stocks. It holds assets such as stocks, commodities, or cryptocurrencies and generally operates with a mechanism that allows investors to buy shares in a diversified portfolio.

The potential approval of an XRP ETF by BlackRock, one of the largest asset management firms in the world, could be a game changer for XRP and the cryptocurrency market as a whole. An ETF would provide a regulated avenue for institutional and retail investors to gain exposure to XRP without needing to directly purchase and manage the cryptocurrency themselves. This could lead to increased demand for XRP, potentially driving its price higher.

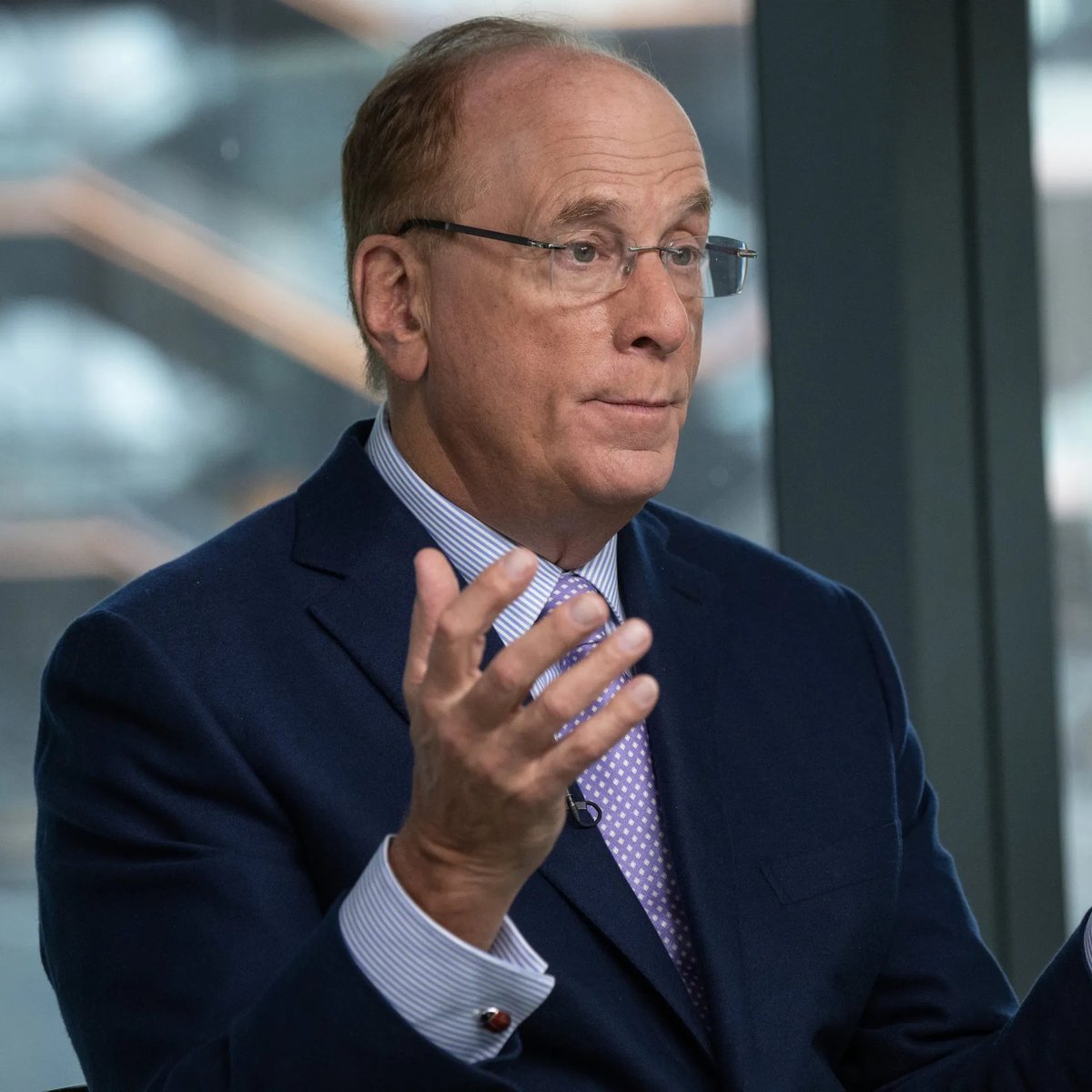

BlackRock’s Role in the Cryptocurrency Landscape

BlackRock has been a significant player in the financial sector, managing trillions in assets. The firm’s entry into the cryptocurrency space, particularly with an XRP ETF, underscores the growing acceptance of digital assets among traditional financial institutions. BlackRock’s involvement could also signal to other institutional investors that cryptocurrencies are a viable investment avenue, potentially leading to increased institutional participation in the crypto market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, BlackRock’s reputation and resources could help navigate the complex regulatory environment that has often posed challenges for cryptocurrency initiatives. Their expertise in compliance and risk management could pave the way for a smooth approval process for the XRP ETF.

Regulatory Discussions Behind Closed Doors

The mention of ongoing regulatory discussions is particularly noteworthy. The regulatory landscape surrounding cryptocurrencies has been fraught with uncertainty, and the approval of an ETF often hinges on regulatory compliance. With BlackRock engaging in discussions with regulators, it indicates a proactive approach to ensuring that the proposed ETF meets the necessary legal and compliance standards.

These discussions are critical as they could set precedents for future cryptocurrency ETFs. If BlackRock successfully launches the XRP ETF, it may encourage other firms to follow suit, further legitimizing the cryptocurrency market in the eyes of regulators and investors alike.

The Market’s Reaction

The news of BlackRock’s potential filing for an XRP ETF has generated significant excitement among crypto enthusiasts and investors. Social media platforms are buzzing with reactions, and the hashtag #XRP has been trending as users share their thoughts and predictions. This level of engagement demonstrates the strong community interest in XRP and the potential implications of an ETF for its future price movement.

Investors are particularly optimistic about the potential for increased liquidity and market stability that an ETF could bring. Many believe that institutional investment could lead to more mainstream adoption of XRP, further enhancing its value proposition as a digital asset.

Conclusion: What Lies Ahead for XRP and BlackRock

As we await further developments regarding BlackRock’s reported plans to file for an XRP ETF, the cryptocurrency community remains in a state of anticipation. The implications of such a move could be profound, not only for XRP but for the entire cryptocurrency market.

If regulatory discussions lead to a successful ETF launch, it could open the floodgates for institutional investment in cryptocurrencies, driving demand and potentially increasing prices. Additionally, it would mark a significant milestone for XRP, solidifying its position as a leading digital asset in the market.

Investors and enthusiasts alike should keep a close eye on the developments surrounding BlackRock and the XRP ETF. With the potential for significant changes in the cryptocurrency landscape, staying informed will be crucial for anyone looking to navigate this dynamic market.

In summary, BlackRock’s imminent filing for an XRP ETF represents a pivotal moment in the cryptocurrency industry. The confluence of traditional finance and digital assets is accelerating, and this development could be a catalyst for broader acceptance and growth of cryptocurrencies. Whether you’re a seasoned investor or a newcomer to the crypto space, the news is undoubtedly a reason to stay engaged and informed as the situation unfolds.

BREAKING:

BLACKROCK REPORTEDLY PREPARING TO FILE FOR AN #XRP ETF IMMINENTLY!

SOURCES CLAIM REGULATORY DISCUSSIONS ARE HAPPENING BEHIND CLOSED DOORS.

I’M PUMPED AND READY!! pic.twitter.com/svl7rf1hGk

— STEPH IS CRYPTO (@Steph_iscrypto) March 20, 2025

BREAKING:

BLACKROCK REPORTEDLY PREPARING TO FILE FOR AN XRP ETF IMMINENTLY!

If you’re a crypto enthusiast like me, you’ve probably felt the buzz in the air lately. BlackRock, one of the biggest players in the investment world, is reportedly gearing up to file for an XRP ETF. If this news turns out to be true, it could be a game-changer for the crypto market. The excitement is palpable, and I’m here for it! Let’s dig into what this means and why it has everyone so pumped.

SOURCES CLAIM REGULATORY DISCUSSIONS ARE HAPPENING BEHIND CLOSED DOORS.

First off, let’s talk about the elephant in the room—regulatory discussions. You know how it goes in the crypto space; regulations can make or break the game. The fact that sources are claiming these discussions are happening behind closed doors means that there’s a lot going on that we might not be privy to just yet. It’s like a secret club, and we’re just outside the door, hoping to get a glimpse of what’s happening inside.

This is crucial because the regulatory landscape has been one of the most significant hurdles for cryptocurrencies. The approval of an ETF would signal a significant shift in how regulators view cryptocurrencies like XRP. It could pave the way for other digital assets to follow suit, leading to broader acceptance and adoption.

I’M PUMPED AND READY!!

Now, let’s get back to the excitement. I can’t be the only one who’s feeling pumped about this potential ETF. For those who might not know, an exchange-traded fund (ETF) is a type of investment fund that’s traded on stock exchanges, much like stocks. By filing for an XRP ETF, BlackRock would be allowing traditional investors to gain exposure to XRP without having to dive deep into the complexities of crypto wallets and exchanges.

Imagine a scenario where your average investor can easily buy XRP through their brokerage account—no need for crypto exchanges or digital wallets. This could open the floodgates for mainstream adoption, and trust me, that’s a big deal in the crypto world.

What Would an XRP ETF Mean for Investors?

For investors, this news is a beacon of hope. An XRP ETF would provide a regulated and safe avenue for investing in XRP. It would likely lead to increased liquidity in the market, which means that buying and selling XRP could become much easier. Plus, with BlackRock’s reputation, more institutional investors might feel comfortable entering the cryptocurrency space, which could drive prices up.

Furthermore, having an ETF would also bring more legitimacy to XRP as an investment vehicle. Right now, there’s still a lot of skepticism surrounding cryptocurrencies, but an ETF could help change that perception. It would be a significant step toward mainstream acceptance, and it’s hard not to get excited about that potential.

The Ripple Effect on the Crypto Market

If BlackRock moves forward with this ETF filing, it could create a ripple effect throughout the entire cryptocurrency market. Other companies might follow suit, filing for their own ETFs centered around different cryptocurrencies. This could lead to a wave of new investments flooding into the market, driving prices up across the board.

When large institutions like BlackRock enter the crypto space, it usually results in increased credibility for the industry as a whole. This could attract more traditional investors, further legitimizing cryptocurrencies and driving more innovation in the space. Think about it—if BlackRock can successfully launch an XRP ETF, it might encourage other financial giants to look more closely at cryptocurrencies, ultimately benefiting the entire ecosystem.

What’s Next for XRP?

So, what’s next for XRP and the potential ETF? Well, it’s hard to say for sure. We’re in a waiting game right now. If the rumors are true, we can expect to see some movement from BlackRock in the coming weeks. The regulatory discussions will be crucial, and how they unfold could determine the fate of this ETF filing.

For now, the best thing for XRP investors is to stay informed and keep an eye on the news. The crypto landscape can change overnight, and being up-to-date on the latest developments can help you make informed investment decisions.

Conclusion

The prospect of BlackRock filing for an XRP ETF is thrilling. It could open up new avenues for investment and significantly impact the cryptocurrency market. The excitement around this potential development is palpable, and it’s hard not to share in the enthusiasm.

As we await further news and updates, let’s keep our fingers crossed for a positive outcome. Whether you’re a seasoned investor or just dipping your toes into the crypto waters, now is the time to pay attention. The future of XRP could be on the brink of a major transformation, and I, for one, am here for it!

Stay tuned, stay informed, and let’s see where this rollercoaster ride takes us!