Whale Flips: Closes $400M Short, Now Betting Big on BTC!

Bitcoin Whale Takes Profits and Switches to Long Position

In an intriguing development for the cryptocurrency market, a prominent Bitcoin whale has made a significant move by closing a massive $400 million short position and opting to go long on Bitcoin. This remarkable shift in strategy has captured the attention of both seasoned investors and market enthusiasts, sparking discussions about the future trajectory of Bitcoin. Let’s delve into the details of this transaction and explore its implications for the broader cryptocurrency landscape.

Understanding the Whale’s Strategy

The term "whale" in the cryptocurrency world refers to an individual or entity that holds a substantial amount of cryptocurrency, often enough to influence market prices. In this case, the whale in question made headlines by opening a $400 million short position on Bitcoin. A short position is a bet that the price of an asset will decline, allowing investors to profit from falling prices. However, the whale has now decided to take profits and close this position, signaling a shift in sentiment.

This decision to transition from a bearish to a bullish stance is noteworthy. By closing the short position, the whale is effectively taking profits from the recent downturn in Bitcoin’s price. The decision to go long on Bitcoin, on the other hand, suggests a belief in the asset’s potential for future appreciation. This move is significant given the whale’s substantial influence on the market, and it may have far-reaching consequences for Bitcoin’s price dynamics.

The Impact on Bitcoin’s Price

The whale’s actions have the potential to impact Bitcoin’s price dynamics significantly. When a whale takes a long position, it typically involves buying a substantial amount of Bitcoin. This influx of demand can drive up the price, leading to a rally. As the whale prepares to go long, market participants will be closely watching for any signs of increased buying activity.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bitcoin’s price is notoriously volatile, and large trades by influential investors can exacerbate this volatility. The mere announcement of the whale’s shift from short to long has already generated considerable buzz within the cryptocurrency community. Traders and investors are likely to monitor the market closely, anticipating potential price movements and adjusting their strategies accordingly.

Insights from the Market Reaction

The market reaction to this news has been swift and varied. Some investors view the whale’s decision as a bullish signal, interpreting it as an endorsement of Bitcoin’s long-term potential. This sentiment is bolstered by the fact that the whale is taking profits from a successful short trade, indicating confidence in Bitcoin’s ability to rebound and appreciate in value.

Conversely, skeptics caution against reading too much into a single whale’s decision. While whales can influence market prices in the short term, the broader cryptocurrency market is driven by a multitude of factors, including macroeconomic trends, regulatory developments, and technological advancements. Therefore, while the whale’s actions are noteworthy, they are just one piece of the puzzle in understanding Bitcoin’s price trajectory.

Broader Implications for the Cryptocurrency Market

The whale’s decision to go long on Bitcoin raises important questions about the broader cryptocurrency market. It highlights the dynamic nature of trading strategies and the potential for rapid shifts in sentiment. Moreover, it underscores the role of influential investors in shaping market trends and influencing sentiment.

For retail investors, this development serves as a reminder of the importance of staying informed and adaptable in the face of market volatility. While whale activity can create opportunities for profit, it can also introduce risks, particularly for those who may be caught on the wrong side of a trade.

Conclusion: Navigating the Unpredictable Crypto Landscape

In conclusion, the decision by a Bitcoin whale to close a $400 million short position and transition to a long stance is a significant event in the cryptocurrency market. This strategic shift reflects changing sentiment and highlights the potential for price movements driven by influential investors. As the cryptocurrency market continues to evolve, market participants must remain vigilant and adaptable, staying informed about developments that can impact their investment strategies.

For those interested in the future of Bitcoin, this development serves as a reminder of the asset’s inherent volatility and the potential for both risks and rewards. As always, investors are encouraged to conduct thorough research and consider their risk tolerance before making investment decisions in the ever-changing world of cryptocurrencies.

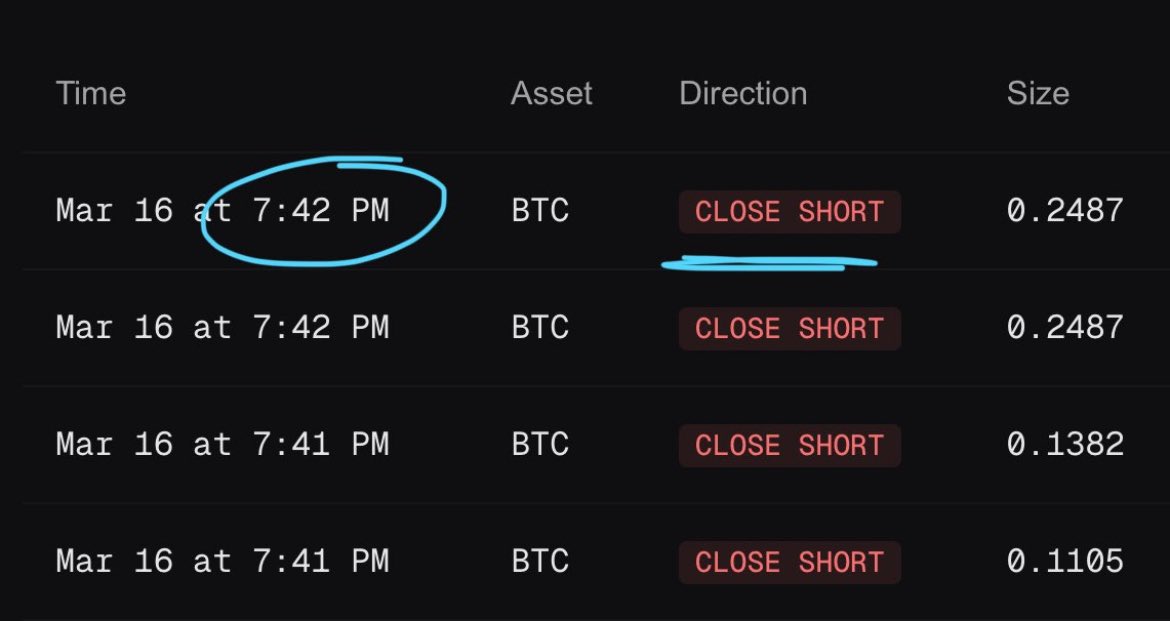

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

HE’S GOING LONG BTC pic.twitter.com/I8IrsQcymf

— The Bitcoin Historian (@pete_rizzo_) March 16, 2025

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

In the thrilling world of cryptocurrency, few events catch the attention of traders and enthusiasts like the moves of a Bitcoin whale. These are individuals or entities who hold massive amounts of Bitcoin, and their trades can make ripples—or tidal waves—throughout the market. Recently, the crypto community was buzzing with news that a whale who had previously opened a $400 million Bitcoin short has decided to take profits and close his trade. But that’s not all—he’s now going long on BTC. This decision has sparked a flurry of speculation and analysis across the industry.

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

When a whale like this makes a move, it’s like watching a chess grandmaster anticipate their opponent’s next five moves. You might be wondering why this whale initially decided to short Bitcoin. Shorting is essentially betting that the price of Bitcoin will fall, allowing you to buy it back at a lower price and pocket the difference. For those not familiar with [shorting Bitcoin](https://www.investopedia.com/terms/s/shortselling.asp), it’s a high-stakes game reserved for the bold—or those with deep pockets.

Now, with the whale closing their short position, it indicates they believe Bitcoin’s price has bottomed out, or at least that the risk of further decline is no longer worth it. This shift from shorting to going long suggests a bullish sentiment, hinting at potential upward momentum for Bitcoin.

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

So, what might have prompted this change of heart? Well, Bitcoin has always been a rollercoaster ride. Recent developments in the crypto space, such as regulatory news, technological advancements, or macroeconomic factors, could have influenced this whale’s decision. For instance, if major economies are adopting Bitcoin-friendly policies, it might signal a more favorable environment for Bitcoin growth.

Moreover, the cryptocurrency landscape is evolving rapidly, with more institutional investors entering the scene. This increased adoption can drive demand and, consequently, prices higher. The whale may have recognized these trends and adjusted their strategy accordingly, opting to ride the potential wave of Bitcoin’s resurgence.

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

But let’s talk about what this means for the average crypto enthusiast. If a whale with vast resources and presumably top-notch analytical tools is going long on Bitcoin, it could instill confidence in other traders and investors. This move can be seen as a vote of confidence in Bitcoin’s future, potentially encouraging others to follow suit.

However, it’s essential to remember that the crypto market is notoriously volatile. While the whale’s actions are undoubtedly significant, they are not a guaranteed predictor of future market movements. As always, it’s crucial for individual investors to conduct their own research and consider their risk tolerance before diving into the crypto waters.

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

Now, let’s dive into the mindset of this mysterious whale. Trading at this level requires not just financial acumen but also nerves of steel. Imagine watching the market fluctuate wildly, knowing that every shift could mean millions gained or lost. It’s not just about numbers; it’s about understanding market psychology, anticipating reactions, and making informed decisions under pressure.

The whale’s decision to go long on Bitcoin could be based on a combination of factors, including [market analysis](https://www.coindesk.com/markets/2023/10/01/bitcoin-price-analysis-market-trends/), historical trends, and perhaps even insider information. While we may never know the exact reasoning, it’s clear that this move is not made lightly.

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

For those of us watching from the sidelines, this event is a reminder of the dynamic nature of the crypto market. It’s a space where fortunes can be made or lost in the blink of an eye, and where strategic moves can set the stage for new market trends. As more details emerge about this whale’s motivations and the market’s response, the crypto community will be eagerly dissecting every bit of information.

In the meantime, whether you’re a seasoned trader or a curious onlooker, this development is a fascinating glimpse into the high-stakes world of Bitcoin trading. Keep your eyes peeled and your mind open, because in the world of crypto, change is the only constant.

BREAKING: THE WHALE WHO OPENED A $400 MILLION #BITCOIN SHORT IS TAKING PROFITS AND CLOSING HIS TRADE

In conclusion, this whale’s pivot from shorting to going long on Bitcoin is a significant event in the crypto world. It not only highlights the fluidity of market strategies but also serves as a potential indicator of Bitcoin’s future direction. As the community continues to analyze and react to this move, it will be interesting to see how it influences market sentiment and whether it sparks a new wave of Bitcoin enthusiasm. Whether you’re in it for the thrill or the potential gains, the crypto market never fails to keep us on our toes.

“`

This article is designed to be engaging and informative, using the specified keywords as headings and including contextual links to enrich the reader’s understanding of the topic.