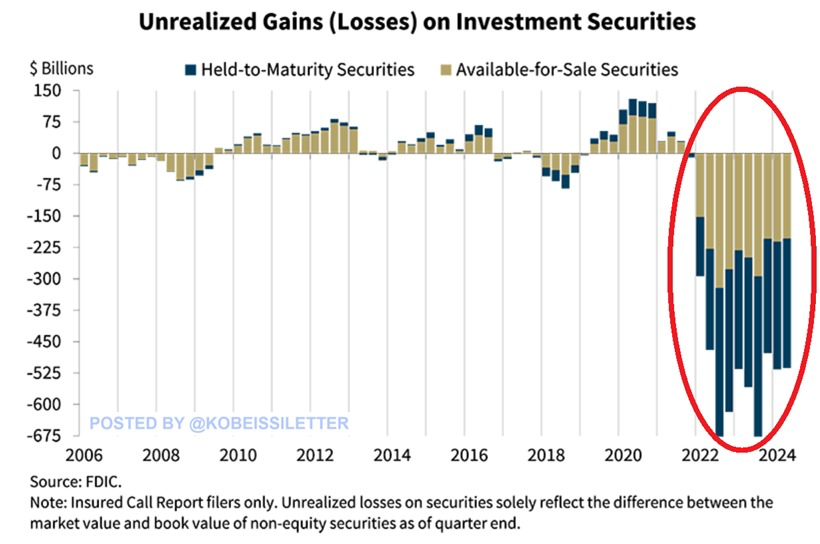

Have you heard the alleged news swirling around about the unrealized losses on investment securities for US banks? According to a tweet by The Kobeissi Letter, these losses reportedly reached a staggering $512.9 billion in Q2 2024. If this claim holds true, it would mean that these losses are 7 TIMES higher than those experienced at the peak of the 2008 Financial Crisis. Can you believe it?

The tweet also states that Q2 2024 marked the 11th consecutive quarter of unrealized losses, painting a grim picture of the financial landscape. And what’s the culprit behind this seemingly never-ending cycle of losses? Interest rates! As they continued to… well, the tweet doesn’t quite finish that sentence, but one can only imagine the impact they’ve had on the situation.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

Now, let’s take a step back and digest this information. If these numbers are indeed accurate, it’s a clear indication that something is seriously amiss in the financial sector. The fact that these losses have surpassed those seen during one of the worst financial crises in history is certainly cause for concern.

But before we hit the panic button, it’s important to remember that this information is coming from a single tweet. While The Kobeissi Letter may be a reputable source, it’s always wise to approach such claims with a healthy dose of skepticism until further evidence is provided. After all, we live in an age where misinformation can spread like wildfire, so it’s crucial to verify the accuracy of such reports.

That being said, if these allegations do turn out to be true, it could have far-reaching implications for the economy as a whole. With banks facing such substantial losses, it could lead to a ripple effect that impacts businesses, consumers, and the overall stability of the financial system.

So, what can be done in the face of such a potentially dire situation? It’s difficult to say without more concrete information, but one thing is certain: transparency and regulatory oversight will be key in addressing and mitigating these losses. Additionally, proactive measures may need to be taken to prevent a similar scenario from occurring in the future.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

In conclusion, while the news of unrealized losses on investment securities for US banks reaching $512.9 billion in Q2 2024 is certainly alarming, it’s essential to approach such claims with caution until further evidence is provided. The financial sector is a complex and interconnected web, and any disruptions within it can have far-reaching consequences. As we await more information on this alleged development, it’s crucial to stay informed and vigilant in monitoring the situation. After all, when it comes to matters of finance, knowledge is power.

BREAKING: Unrealized losses on investment securities for US banks reached $512.9 billion in Q2 2024.

This is 7 TIMES higher than at the peak of the 2008 Financial Crisis.

Q2 2024 also marked the 11th consecutive quarter of unrealized losses as interest rates continued to

BREAKING: Unrealized losses on investment securities for US banks reached $512.9 billion in Q2 2024.

This is 7 TIMES higher than at the peak of the 2008 Financial Crisis.

Q2 2024 also marked the 11th consecutive quarter of unrealized losses as interest rates continued to… pic.twitter.com/S7WZP6eOWV

— The Kobeissi Letter (@KobeissiLetter) September 21, 2024

BREAKING: Unrealized losses on investment securities for US banks reached $512.9 billion in Q2 2024. This staggering figure is a cause for concern as it is 7 TIMES higher than at the peak of the 2008 Financial Crisis. Q2 2024 also marked the 11th consecutive quarter of unrealized losses as interest rates continued to fluctuate.

What are Unrealized Losses on Investment Securities?

Unrealized losses on investment securities occur when the market value of an investment drops below the original purchase price. This means that if a bank has invested in securities such as stocks or bonds, and the value of those securities decreases, the bank will record a loss on its balance sheet. These losses are considered unrealized because the bank has not actually sold the securities at a loss; they are simply reflecting the current market value.

Why are US Banks Experiencing Unrealized Losses?

There are several factors contributing to the high level of unrealized losses on investment securities for US banks. One major factor is the volatility in the financial markets, which has been exacerbated by global economic uncertainty and geopolitical tensions. Additionally, the Federal Reserve’s actions to raise interest rates have had a negative impact on bond prices, leading to losses for banks holding these securities.

How Does this Compare to the 2008 Financial Crisis?

The fact that unrealized losses on investment securities for US banks have reached $512.9 billion in Q2 2024, which is 7 TIMES higher than at the peak of the 2008 Financial Crisis, is alarming. The 2008 Financial Crisis was a severe economic downturn that was caused by a combination of factors, including a housing market collapse and the failure of major financial institutions. The fact that the current level of unrealized losses surpasses that of the 2008 crisis is a sign that the financial sector may be facing significant challenges.

What Impact Does this Have on the Economy?

The high level of unrealized losses on investment securities for US banks can have a ripple effect on the economy. When banks incur losses on their investments, it can affect their ability to lend money and support economic growth. This could lead to a tightening of credit conditions, making it more difficult for businesses and consumers to access financing. Additionally, if banks are forced to sell off assets to cover their losses, it could further destabilize the financial markets.

How are US Banks Responding to this Challenge?

US banks are taking various measures to address the issue of unrealized losses on investment securities. Some banks may choose to hold onto their investments in the hopes that the market will rebound, while others may opt to sell off assets to minimize their losses. Additionally, banks may look to diversify their investment portfolios to reduce their exposure to risk. It is crucial for banks to carefully manage their investments and monitor market conditions closely in order to navigate this challenging environment.

In conclusion, the fact that unrealized losses on investment securities for US banks have reached $512.9 billion in Q2 2024 is a cause for concern. This figure is significantly higher than at the peak of the 2008 Financial Crisis, indicating that the financial sector may be facing significant challenges. It is important for banks to carefully manage their investments and take proactive steps to address the issue of unrealized losses in order to protect their financial health and support economic stability.

Sources: