Breaking news: Legislative Democrats Vote to Raise Business Taxes in Washington state

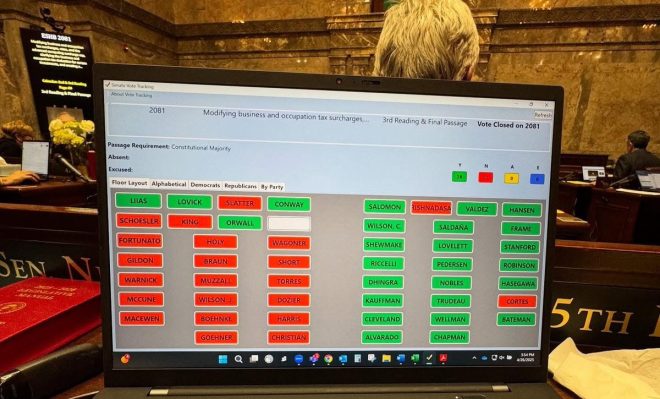

In a significant development for the economic landscape of Washington State, legislative Democrats have voted to implement substantial tax increases on businesses through house Bill 2081 (HB 2081). This decision has sparked considerable debate, particularly among small business owners, as it comes at a time when many are already grappling with financial challenges. Notably, all republican legislators opposed the bill, highlighting a deep partisan divide on economic policy in the state.

Overview of the Tax Increase

The newly passed legislation aims to raise taxes on businesses significantly, which is expected to have far-reaching implications for the state’s economic health, especially for small businesses. According to recent data, approximately 41% of small businesses fail within their first year in Washington. This alarming statistic raises concerns about the viability of new enterprises, and many existing small businesses have already exited the market due to the challenging economic environment. Critics argue that the new tax structure will exacerbate these issues, potentially leading to increased business closures and further job losses.

Implications for Small Businesses

The decision to raise taxes on businesses has drawn sharp criticism from various stakeholders, particularly within the small business community. Advocates for small businesses argue that the tax hike will hinder growth opportunities and impose additional financial burdens on entrepreneurs who are already struggling to maintain their operations. The fear is that the tax increase will deter potential business owners from starting new ventures in Washington, ultimately stifacing innovation and economic growth.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Many small business owners are already facing challenges related to rising operational costs, including labor, rent, and materials. The additional tax burden could lead to difficult decisions, such as reducing employee hours, cutting benefits, or even laying off staff. In a state where small businesses constitute a significant portion of the economy, the ramifications of this legislation could be profound.

The Political Landscape

The passage of HB 2081 reflects a broader ideological divide between Democrats and Republicans regarding fiscal policy and business regulation. While Democrats argue that the increased revenue from the tax hike is necessary to fund vital public services and infrastructure, Republicans contend that the legislation will drive businesses out of the state and hinder economic recovery. The unanimous opposition from Republican lawmakers underscores the contentious nature of this issue and points to a lack of bipartisan consensus on how best to support Washington’s economic landscape.

Response from Business Leaders

In response to the tax increase, many business leaders have voiced their concerns about the future of entrepreneurship in Washington. The Washington State senate Republicans have been vocal in their opposition, emphasizing that the legislation will only exacerbate the challenges small businesses face. They argue that rather than imposing higher taxes, the focus should be on creating a more favorable business environment that encourages growth and stability.

Business owners have expressed their fears that the tax hikes will force some to reconsider their operations in Washington, leading to potential job losses and economic downturns. The sentiment among many is that the state should prioritize policies that support small businesses rather than impose additional financial burdens.

The Broader Economic Context

The economic landscape in Washington State is complex, with various factors influencing the success and failure of businesses. With a high cost of living and intense competition in many sectors, small businesses often operate on thin margins. The additional tax burden introduced by HB 2081 may be the tipping point for some businesses that are already struggling to survive.

Moreover, the timing of this legislation raises questions about its impact on the post-pandemic recovery. Many businesses are still trying to rebound from the effects of COVID-19, and introducing higher taxes at this juncture may hinder their recovery efforts. Economic analysts warn that the cumulative impact of increased taxes, coupled with other challenges, could lead to a more challenging business climate in the state.

Conclusion

The passage of HB 2081 marks a pivotal moment in Washington State’s economic policy, with potential consequences that could ripple through the business community for years to come. As lawmakers grapple with the implications of this tax increase, the focus must shift to creating a supportive environment for small businesses that fosters growth and innovation.

For small business owners and potential entrepreneurs, the future may appear uncertain in light of these legislative changes. The concern is not only about the immediate impacts of the tax hikes but also about the long-term viability of small businesses in Washington State. As the state navigates these challenges, ongoing dialogue between lawmakers, business leaders, and community stakeholders will be essential to ensure a balanced approach to economic policy that supports growth and stability for all.

In conclusion, the recent tax hike on businesses in Washington State could have significant repercussions, particularly for small businesses already facing numerous challenges. The debate surrounding HB 2081 underscores the need for a collaborative approach to economic policy that prioritizes the needs of entrepreneurs while also addressing the state’s revenue requirements. As Washington moves forward, the focus should remain on fostering a business-friendly environment that encourages innovation and sustainability.

BREAKING: Legislative Democrats just voted to significantly raise taxes on businesses in our state (HB 2081). All Republicans voted NO. 41% of small businesses fail in the first year here and many have already left WA. This legislation will make both problems worse.

Tell… pic.twitter.com/pv3miwKG7v

— WA Senate Republicans (@WashingtonSRC) April 27, 2025

BREAKING: Legislative Democrats Just Voted to Significantly Raise Taxes on Businesses in Our State (HB 2081)

If you’ve been keeping an eye on the news lately, you might have caught wind of the recent legislative decision that’s sent shockwaves through the business community in Washington State. Yes, you guessed it – the Democrats have decided to significantly raise taxes on businesses through House Bill 2081. And just like that, many are left wondering: what does this mean for small businesses and the overall economy?

Who Supported This Legislation?

It’s crucial to note that all Republicans voted against this bill. That’s right, they stood united in opposition, raising their voices against what they see as a detrimental move for small businesses. It’s not just political posturing; the numbers back them up. The reality is that a staggering 41% of small businesses fail in their first year here in Washington, and many have already fled the state due to unfavorable conditions. This legislation, as highlighted by the WA Senate Republicans, threatens to exacerbate these issues further.

The Impact on Small Businesses

Raising taxes on businesses, particularly small ones, can have a ripple effect that affects everyone from employees to consumers. For small business owners, every dollar counts. Increased taxes mean less capital for hiring, expansion, and even keeping the lights on. Many small businesses operate on razor-thin margins, and when taxes rise, it can lead to tough decisions. Some might cut jobs, while others might choose to close their doors altogether.

Imagine a local café that’s been a community staple for years. With rising costs due to increased taxes, the owner might have to choose between raising prices, which could drive customers away, or reducing staff, which can hurt service quality. The consequences of these legislative decisions are far-reaching and affect not just business owners but the entire community.

What Does This Mean for Future Entrepreneurs?

If you’re thinking about starting a business in Washington, this decision raises some serious red flags. The tax landscape is a critical factor for entrepreneurs when deciding where to launch their dreams. With the news of this tax increase, potential business owners might think twice about setting up shop in Washington. After all, who wants to start a journey with an uphill battle against rising taxes?

Many entrepreneurs look for states that foster a business-friendly environment, and with the current trajectory in Washington, it seems like that environment is becoming less hospitable. If the trend continues, we could see a brain drain – a situation where talented individuals and innovative thinkers leave the state in search of better opportunities elsewhere.

Legislation and Its Long-Term Effects

When lawmakers pass bills like HB 2081, they often tout the benefits that come with increased tax revenue. However, what’s frequently overlooked are the long-term effects these policies can have on economic growth and job creation. Higher taxes can stifle innovation and entrepreneurship, which are vital for a thriving economy.

Consider the tech industry, which has been a significant driver of Washington’s economy. If smaller tech startups feel the pinch from increased taxes, we may see fewer new ideas and products making it to market. This could also impact larger companies that rely on startups for innovation and partnerships.

Voices of Concern

There’s a growing chorus of concern from business owners and industry leaders about the implications of this tax hike. Many are expressing fears that this could lead to a cycle of decline for small businesses. If businesses continue to close their doors, job losses will follow, and with fewer jobs, consumer spending will decrease. It’s a classic case of cause and effect that could spiral out of control if not addressed.

Business owners are not just sitting back and watching. Many are reaching out to their representatives, advocating for a reconsideration of the bill, and stressing the importance of creating a balanced approach to taxation that supports growth rather than stifling it. It’s about protecting the lifeblood of the economy – small businesses.

Community Reactions

The community is buzzing with opinions on this issue. Residents, consumers, and business owners alike are voicing their concerns on social media platforms and local forums. Many are worried about losing their favorite local spots and the unique character that small businesses bring to their neighborhoods.

People are starting to realize that this isn’t just a political issue; it’s a matter that affects their daily lives. When local businesses suffer, the community suffers. The vibrant culture of local markets, cafés, and shops that give neighborhoods their unique charm could be at risk if these tax policies are allowed to stand.

Looking Ahead: What Can Be Done?

So, what can be done? Advocacy and awareness are key. Business owners and community members must unite to communicate their concerns to lawmakers. Engaging in dialogue, attending town hall meetings, and utilizing social media platforms to share stories can help raise awareness about the implications of such legislation.

Additionally, supporting local businesses can send a message that the community values them. Whether it’s shopping at local stores or dining at neighborhood restaurants, every action counts. If enough voices join together, it can lead to a reconsideration of policies that are harmful to the local economy.

Final Thoughts

The recent vote to raise taxes on businesses in Washington State through HB 2081 has raised significant concerns among small business owners and community members. With a high failure rate for small businesses in the first year and many already leaving the state, this legislation could worsen an already troubling situation. It’s imperative for the community to rally together, advocate for change, and support local businesses to ensure a vibrant and prosperous economic future.