Overview of China’s Investment Restrictions in Response to U.S. Tariffs

In a significant move reflecting ongoing economic tensions between China and the United States, China has announced restrictions on its companies from investing in the U.S. This decision comes as a direct response to the tariffs imposed by former President Donald Trump, which have been a contentious focal point in U.S.-China trade relations. This summary will explore the implications of these restrictions, the context surrounding them, and the broader impact on global trade.

Background: U.S.-China Trade Tensions

The trade relationship between the United States and China has been fraught with challenges, particularly since the trade war initiated by the Trump administration. In 2018, the U.S. imposed tariffs on a range of Chinese goods, citing unfair trade practices and intellectual property theft. In retaliation, China responded with its own tariffs on American products, leading to a cycle of escalating measures that have affected both economies.

China’s Investment Restrictions

As reported by BRICS News, the Chinese government’s latest restrictions on investments in the U.S. signal a strategic shift in response to the tariffs. These restrictions are designed to limit the flow of Chinese capital into American markets, effectively curbing investments from Chinese companies that could help bolster the U.S. economy. This move is part of a broader strategy to protect China’s domestic industries and maintain economic sovereignty in the face of external pressures.

Implications for Chinese Companies

The new restrictions present several challenges for Chinese companies aiming to invest in the U.S. market. Many businesses that had previously sought opportunities in America now face increased scrutiny and regulatory hurdles. This could lead to a decrease in foreign direct investment (FDI) from China, which has historically been a significant contributor to the U.S. economy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Impact on U.S. Economy

The reduction in Chinese investment may have mixed implications for the U.S. economy. On one hand, it could protect certain industries from foreign competition; however, it may also lead to a decline in capital inflow, potentially stunting growth in sectors that benefit from foreign investment. Industries that rely heavily on Chinese investment, such as technology and real estate, may experience market volatility and reduced funding opportunities.

Global Trade Dynamics

China’s investment restrictions not only affect the U.S. but also have broader implications for global trade dynamics. As countries navigate the complexities of international relations, the shifting investment landscape may lead to changes in how businesses approach cross-border investments. Other nations may look to capitalize on the fallout from U.S.-China tensions, potentially reshaping global supply chains.

Future Considerations

Looking ahead, it is crucial for businesses and policymakers to monitor the evolving landscape of U.S.-China relations. The potential for further retaliatory measures could escalate tensions, making it imperative for companies to adapt their strategies in response to regulatory changes. The ongoing dialogue between the two nations will play a critical role in determining the future of trade and investment.

Conclusion

China’s restriction on investments in the U.S. marks a significant moment in the ongoing saga of U.S.-China trade tensions. As both countries navigate this complex relationship, the implications of these restrictions will reverberate throughout the global economy. Stakeholders must remain vigilant and adaptable as they respond to the changing dynamics of international trade and investment.

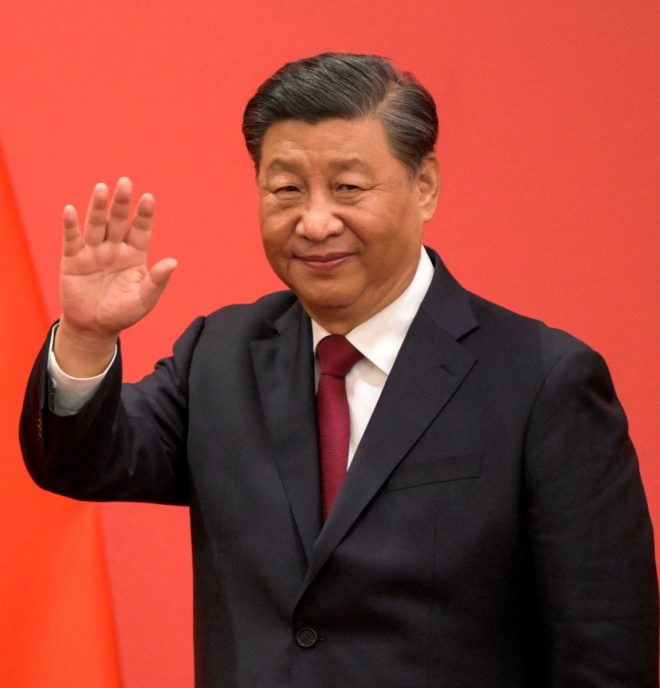

JUST IN: China restricts companies from investing in the United States in response to President Trump’s tariffs. pic.twitter.com/tyYOsqRrZG

— BRICS News (@BRICSinfo) April 2, 2025

JUST IN: China Restricts Companies from Investing in the United States in Response to President Trump’s Tariffs

In recent developments that have significant implications for global trade, China has announced restrictions on its companies from investing in the United States. This decision comes as a direct response to the tariffs imposed by President Donald Trump during his administration. The move underscores the ongoing tensions between the two economic giants, which have been shaped by trade disputes, tariffs, and geopolitical rivalries.

This isn’t just a minor tweak in trade policy; it has far-reaching consequences for businesses and investors on both sides. With China representing a massive market and the U.S. being a hub for innovation and technology, such restrictions can lead to ripples across various sectors. Let’s dive deeper into what this means for the global economy and what has led to this decision.

The Background of the Trade War

To understand the current situation, we need to look back at the trade war that escalated during Trump’s presidency. The U.S. government implemented tariffs on a wide range of Chinese goods, aiming to reduce the trade deficit and protect American industries. In retaliation, China imposed its own tariffs on U.S. products, leading to a cycle of escalating tensions.

This back-and-forth has not only affected the countries directly involved but has also created uncertainty in global markets. Businesses have found themselves navigating a complex landscape where costs are unpredictable and supply chains are strained. The new restrictions on investments from China into the U.S. are likely to exacerbate these challenges, making it vital for companies to reassess their strategies.

What Do the Restrictions Entail?

The specifics of the restrictions are still unfolding, but the core idea is that Chinese companies will face significant barriers to investing in U.S. markets. This includes anything from acquiring stakes in American firms to funding new ventures. Essentially, the Chinese government is signaling that, in light of U.S. tariffs, it’s no longer business as usual.

For instance, companies that were considering entering the U.S. market may now have to rethink their plans or even halt them altogether. This could particularly impact sectors like technology and manufacturing, where there has been significant Chinese interest. If you’re an investor or a business leader, this is a critical moment to evaluate your options.

The Impact on Chinese Companies

Chinese companies are facing a new reality under these restrictions. Many of them have relied on foreign investments to fuel their growth, especially in sectors like technology and real estate. Without the ability to invest in the U.S., they may find themselves at a disadvantage, especially if they were looking to expand their market reach or access advanced technologies.

Additionally, the restrictions could stifle innovation. For example, partnerships between Chinese and American firms have often led to groundbreaking advancements. By limiting these collaborations, both countries may miss out on opportunities for growth and development. This is especially crucial in industries like renewable energy and pharmaceuticals, where cross-border partnerships can lead to significant breakthroughs.

How Will the U.S. Economy Respond?

The U.S. economy isn’t immune to the repercussions of these restrictions. Many American companies have benefitted from Chinese investments, which can lead to job creation and economic growth. With these investments now curtailed, we may see a slowdown in certain sectors, particularly those that rely heavily on foreign capital.

Moreover, the American economy may face challenges in terms of innovation. Many startups and tech companies thrive on international investments to scale their operations. If Chinese companies can no longer invest in the U.S., these startups may struggle to find alternative funding sources, leading to a potential slowdown in technological advancement.

The Bigger Picture: Global Trade Dynamics

This development is a part of a larger narrative in global trade dynamics. Countries around the world are beginning to rethink their trade strategies, focusing more on self-sufficiency and protectionist policies. The restrictions imposed by China are indicative of a trend where nations prioritize their own economic interests over global collaboration.

As we move forward, it’s crucial to keep an eye on how other countries will react. Will they follow China’s lead in restricting investments, or will they seek to foster more open trade relationships? The balance of power in global trade is shifting, and how countries navigate these changes will have lasting impacts on the international economy.

The Future of U.S.-China Relations

Looking ahead, the relationship between the U.S. and China remains precarious. While both countries are economically intertwined, the recent restrictions signal that trust is at an all-time low. The question now is whether there is room for dialogue and negotiation to ease tensions.

For businesses and investors, this means staying informed and agile. Understanding the intricacies of U.S.-China relations will be key to navigating the future landscape of global trade. Monitoring government policies, tariffs, and international relations will be crucial for anyone involved in cross-border investments.

Conclusion: Navigating Uncertainty

The decision by China to restrict investments in the U.S. is a significant development that highlights the complexities of international trade. As businesses and investors, it’s essential to stay informed and be prepared to adapt to rapidly changing circumstances. The impact of these restrictions will unfold over time, but one thing is clear: the global economy is in for a bumpy ride.

As the world watches, the focus will be on how both nations respond to these challenges and whether they can find a path toward a more cooperative future. For now, the message is clear: in the world of international trade, the stakes are high, and the landscape is ever-changing.