The BearWhale’s Bold Bitcoin Short: A $520 Million Gamble

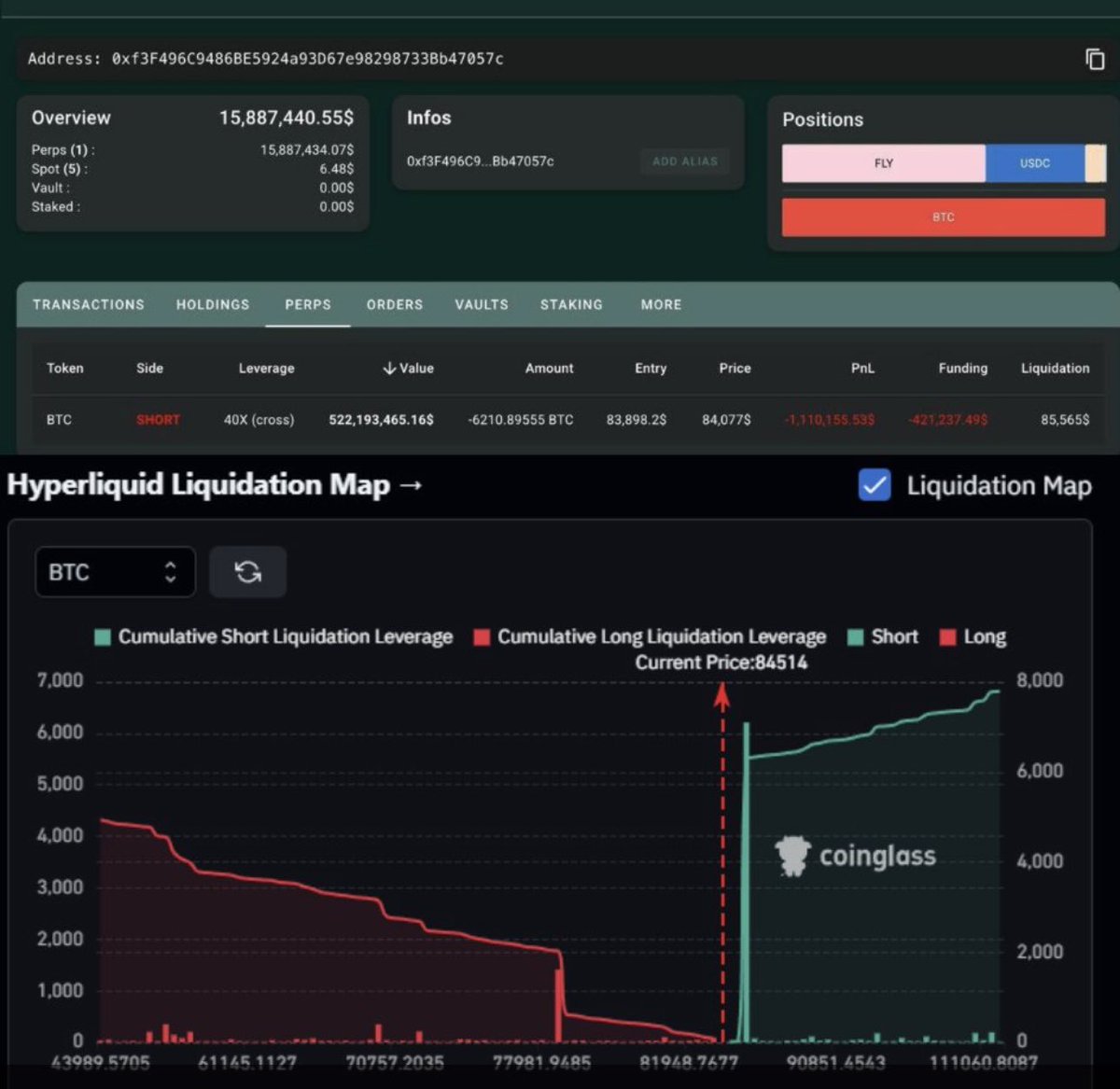

In a dramatic turn of events in the cryptocurrency market, the enigmatic BearWhale has made headlines by increasing their Bitcoin short position on Hyperliquid from a staggering $400 million to an even more audacious $520 million. This bold move has captured the attention of traders and investors alike, as it comes with significant implications for the Bitcoin market, especially given the precarious nature of such a large short position.

What is a Bitcoin Short?

Before delving into the specifics of this recent development, it’s essential to understand what a short position entails. Short selling, or shorting, is an investment strategy that allows traders to profit from a decline in the price of an asset—in this case, Bitcoin. When traders short Bitcoin, they borrow coins to sell them at the current market price, hoping to buy them back at a lower price in the future. If the price drops, they can return the borrowed coins and pocket the difference. However, if the price rises, they face potentially unlimited losses.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE.

The BearWhale: A Market Force

The term "BearWhale" refers to a trader or entity that holds a significant short position in the market, capable of influencing prices due to their sheer size. The BearWhale’s actions are closely monitored by market participants, as any major movements can lead to increased volatility. With the recent increase in their short position to $520 million, the BearWhale is asserting a strong bearish sentiment on Bitcoin’s future price.

Liquidation Price: A Ticking Clock

An intriguing aspect of this short position is the BearWhale’s liquidation price, set at $85,565. This figure is critical because it represents the price level at which the BearWhale’s position could be forcibly closed by the exchange due to margin requirements. With the current market hovering around this liquidation price, the BearWhale is teetering on the edge of a potentially catastrophic loss. If Bitcoin’s price rises above $85,565, the BearWhale could face liquidation, resulting in a significant financial blow.

Market Reactions and Implications

The news of the BearWhale’s increased short position has sent shockwaves through the cryptocurrency community. Traders are now left to speculate on the potential outcomes. Some are viewing this as a bearish signal, suggesting that the BearWhale expects Bitcoin prices to decline. On the other hand, others are concerned that the heightened short interest could lead to a short squeeze, where a rapid increase in price forces short sellers to cover their positions, driving prices even higher.

The Broader Bitcoin Market Context

To understand the significance of the BearWhale’s actions, it’s crucial to consider the broader context of the Bitcoin market. Bitcoin has seen significant price fluctuations over the past few years, influenced by various factors, including regulatory developments, macroeconomic trends, and shifts in investor sentiment. The cryptocurrency market is known for its volatility, and any major player like the BearWhale can significantly impact price movements.

The Role of Exchange Platforms

The BearWhale’s position is held on Hyperliquid, a decentralized exchange (DEX) that allows users to trade cryptocurrencies directly without intermediaries. DEXs have gained popularity as they offer more privacy and reduced counterparty risks. However, they also come with their own set of challenges, including potential liquidity issues and less user-friendly interfaces. The choice of platform can affect how traders manage their positions and react to market changes.

What Lies Ahead for the BearWhale?

As the market watches closely, the BearWhale’s future actions will be critical in determining Bitcoin’s trajectory. Should Bitcoin’s price dip below the liquidation price, the BearWhale may be forced to either close their position or risk massive losses. Conversely, if the market trends downward as the BearWhale anticipates, they could stand to gain significantly.

Conclusion: A Defining Moment for Bitcoin Traders

The BearWhale’s bold move to increase their Bitcoin short position to $520 million is a defining moment in the cryptocurrency market. With a precarious liquidation price of $85,565, traders and investors are on high alert, watching for signs of market movement. Whether this will lead to a bearish trend or a sudden price spike due to a short squeeze remains to be seen.

For those involved in the cryptocurrency market, this situation serves as a reminder of the inherent risks and rewards associated with trading. The actions of major players like the BearWhale can create waves that affect all traders, making it essential to stay informed and prepared for whatever the market may throw your way. As this story unfolds, it will undoubtedly continue to shape the narrative around Bitcoin and its future in the ever-evolving world of cryptocurrency.

JUST IN: The BearWhale just upped their Bitcoin short on Hyperliquid from $400M to $520M.

Their new liquidation price? $85,565 – less than $1,000 away from getting wiped out. pic.twitter.com/XOGSxFwkdU

— Jason Ai. Williams (@GoingParabolic) March 17, 2025

JUST IN: The BearWhale just upped their Bitcoin short on Hyperliquid from $400M to $520M

Bitcoin has been a hot topic lately, and for good reason. Recently, we saw a significant move in the crypto market involving a player known as the BearWhale. This entity has increased their short position on Hyperliquid from a staggering $400 million to an even more astonishing $520 million. What does this mean for the market and for Bitcoin enthusiasts? Let’s dive in.

The BearWhale is a nickname that’s been thrown around in the crypto community to describe a trader or a group of traders who hold a massive short position on Bitcoin. When we talk about a short position, we’re referring to a strategy where a trader bets that the price of an asset will go down. Essentially, the trader borrows Bitcoin, sells it at the current market price, and hopes to buy it back later at a lower price, pocketing the difference. The BearWhale’s move to up their short position indicates a strong bearish sentiment on the market, which could have ripple effects across the trading landscape.

Their new liquidation price? $85,565 – less than $1,000 away from getting wiped out

Now, here’s where it gets even more interesting. The BearWhale’s new liquidation price is set at $85,565, which is less than $1,000 away from their current position. This means that if Bitcoin’s price rises to this level, the BearWhale will face liquidation, forcing them to close their position at a loss. It’s a precarious situation that raises a lot of eyebrows in the trading community.

Liquidation prices are crucial in the world of trading. They serve as a safety net for traders, protecting them from catastrophic losses. However, in a volatile market like cryptocurrency, these prices can change rapidly. The fact that the BearWhale is so close to their liquidation point suggests a high level of risk, not just for them but for the market as a whole. If Bitcoin were to surge past $85,565, it could trigger a cascade of liquidations, potentially propelling the price even higher.

The Psychological Impact on Traders

The BearWhale’s actions have a psychological impact on traders. When a large player like this takes a significant short position, it creates a sense of fear among other traders. The market often reacts to the moves of large players, and this can lead to increased volatility. If traders see the BearWhale’s liquidation price creeping closer, they might panic and sell their positions, fearing a price spike that could wipe them out as well.

On the flip side, some traders might view this as an opportunity. They might think, “If the BearWhale is betting against Bitcoin, this could be a good time to buy in if I believe in its long-term potential.” This kind of sentiment can lead to increased buying pressure, which could ultimately influence Bitcoin’s price trajectory.

The Role of Hyperliquid in This Scenario

Hyperliquid is a relatively new player in the decentralized finance (DeFi) space, focusing on providing liquidity and trading services for cryptocurrencies like Bitcoin. The platform allows users to trade with minimal slippage, which is crucial in the highly volatile crypto market. The BearWhale’s decision to use Hyperliquid for their trades highlights the platform’s growing importance in the crypto ecosystem.

The fact that a trader can manage such a massive short position on Hyperliquid also points to the platform’s robustness. It supports high-volume trades and offers features that enable traders to react swiftly to market changes. In this case, the BearWhale is using Hyperliquid to leverage their position, which can amplify both gains and losses.

Market Reactions and Predictions

As soon as news of the BearWhale’s increased short position hit the airwaves, the market reacted swiftly. Traders began to speculate about the implications this move could have on Bitcoin’s price. Some analysts believe that this could lead to a bearish trend, while others argue that it could create buying opportunities for those looking to invest in Bitcoin at a lower price.

Many traders are closely watching the market, waiting to see if Bitcoin will breach the $85,000 mark. If it does, we could see a wave of liquidations that might push the price even higher. This kind of volatility is not uncommon in the crypto space, where prices can swing wildly based on market sentiment and trader behavior.

What This Means for Bitcoin Investors

For Bitcoin investors, the BearWhale’s actions serve as a reminder of the volatile nature of cryptocurrency trading. It’s crucial to stay informed about market movements and be prepared for sudden changes. If you’re a long-term holder, these short-term fluctuations may not concern you as much. However, if you’re actively trading, you’ll need to keep a close eye on developments and adjust your strategy accordingly.

Moreover, the situation highlights the importance of risk management. Whether you’re a seasoned trader or a newcomer to the crypto space, understanding your risk tolerance and having a plan in place is essential. The BearWhale’s position serves as a cautionary tale about the potential dangers of high-leverage trading.

Understanding the Broader Crypto Context

The BearWhale’s actions don’t happen in isolation. They’re part of a larger narrative within the cryptocurrency market, which is influenced by various factors, including regulatory changes, macroeconomic trends, and technological advancements.

For instance, regulatory scrutiny on cryptocurrencies has been intensifying in many countries, which can impact market sentiment. Additionally, macroeconomic factors such as inflation rates and interest rates can also play a significant role in shaping the crypto landscape. As these elements converge, they create a complex environment for traders and investors alike.

Conclusion: Navigating the Crypto Seas

As we continue to watch the developments surrounding the BearWhale’s position, it’s clear that the cryptocurrency market remains as dynamic and unpredictable as ever. Whether you’re a novice or a seasoned trader, it’s essential to stay informed, manage your risks, and remain adaptable in this ever-changing landscape. The BearWhale’s recent moves serve as a stark reminder of the potential for both opportunity and peril in the world of Bitcoin trading.

For the latest updates on Bitcoin and trading strategies, make sure to keep your eyes peeled on reliable crypto news sources. The landscape is always shifting, and being informed can make all the difference in your trading journey.