Major Liquidations in the Crypto Market: $821 Million Lost in 24 Hours

In a shocking turn of events within the cryptocurrency market, over $821 million worth of leveraged positions have been liquidated in just 24 hours. This drastic decline has sent ripples through the trading community, with significant implications for both investors and the overall market sentiment.

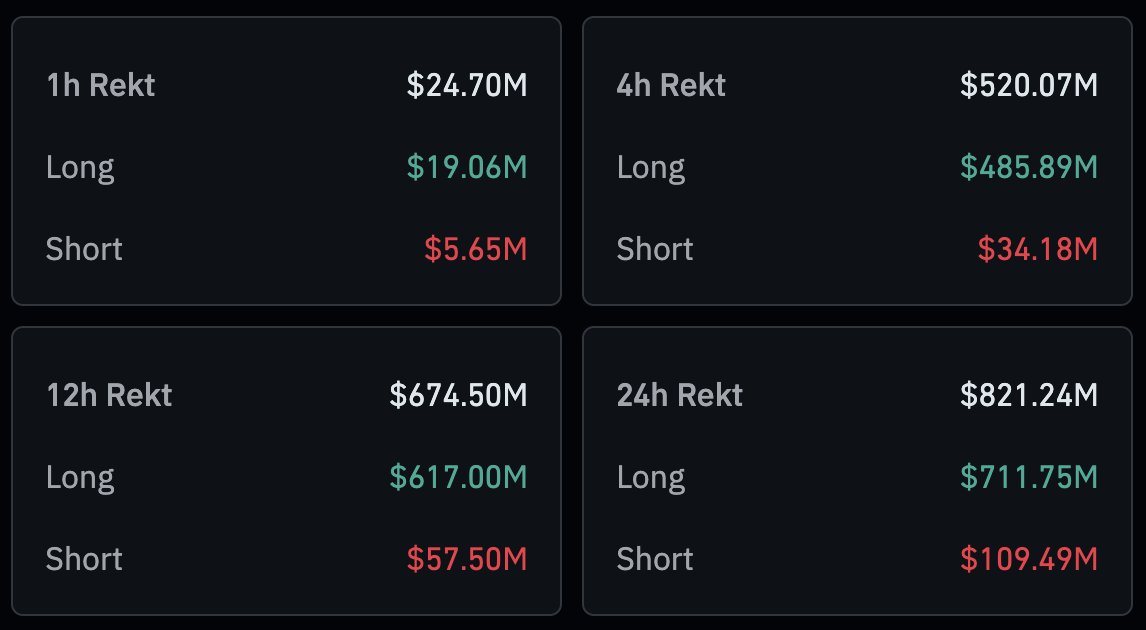

Breakdown of Liquidations

According to a recent tweet from @Ashcryptoreal, the breakdown of these liquidations reveals a stark disparity between long and short positions. The total liquidations comprised approximately $771.75 million in long positions and around $109.49 million in short positions. This data highlights a prevailing trend among traders who were heavily invested in long positions, signaling a potential bearish sentiment that has taken hold in the market.

Understanding Liquidations

Liquidations occur when a trader’s position is forcibly closed by a broker due to insufficient funds to maintain the required margin. In the world of leveraged trading, where traders borrow funds to amplify potential returns, the risk of liquidation is significantly higher. When market conditions turn against these positions, traders can experience devastating losses, which is exactly what transpired in this recent liquidation event.

Factors Contributing to the Liquidation

Several factors can contribute to such a massive liquidation event:

- Market Volatility: Cryptocurrencies are known for their extreme volatility. Sudden price swings can trigger stop-loss orders, leading to cascading liquidations, especially in a leveraged trading environment.

- Sentiment Shift: The market sentiment can shift rapidly based on news, regulatory developments, or macroeconomic trends. A negative sentiment can lead to panic selling, exacerbating liquidation events.

- High Leverage: Many traders utilize high leverage to enhance their potential gains. However, this also increases the risk of liquidation, as even small price movements can lead to significant losses.

- News Events: Regulatory announcements, macroeconomic indicators, or significant events within the crypto ecosystem can dramatically influence market direction, leading to rapid price declines.

Implications for the Market

The liquidation of over $821 million in a single day is a stark reminder of the risks associated with leveraged trading in the cryptocurrency market. Here are some potential implications:

- Investor Confidence: Such large-scale liquidations can shake investor confidence, leading to a more cautious approach among traders. This may result in decreased trading volumes and liquidity in the market.

- Price Correction: The forced selling of positions can lead to further price corrections, as liquidated assets flood the market. This can create a downward spiral, pushing prices even lower.

- Regulatory Scrutiny: High-profile liquidation events may attract the attention of regulators, leading to discussions around the need for stricter oversight and regulations in the crypto trading landscape.

- Market Psychology: The psychological impact on traders can lead to a “fear of missing out” (FOMO) or “fear, uncertainty, and doubt” (FUD) cycle, influencing trading behavior and market trends.

Navigating the Crypto Market Post-Liquidation

For traders and investors looking to navigate the aftermath of such a significant liquidation event, several strategies can be employed:

- Risk Management: Implementing robust risk management strategies is essential in the volatile crypto market. This includes setting appropriate stop-loss orders and avoiding excessive leverage.

- Diversification: Diversifying one’s investment portfolio can mitigate risks. By spreading investments across different assets, traders can protect themselves from severe losses in any single position.

- Stay Informed: Keeping abreast of market news, regulatory changes, and macroeconomic indicators can provide traders with valuable insights to make informed decisions.

- Psychological Preparedness: Traders should be mentally prepared for market fluctuations and avoid making impulsive decisions based on fear or greed.

Conclusion

The recent liquidation of over $821 million in leveraged positions underscores the inherent risks of trading in the cryptocurrency market. As traders and investors digest the implications of this event, it serves as a crucial reminder of the importance of risk management, informed trading strategies, and psychological preparedness. The crypto landscape is ever-evolving, and navigating its challenges requires a disciplined approach and a keen awareness of market dynamics.

As the market attempts to recover from this significant setback, it will be interesting to observe how traders adapt their strategies and whether market sentiment shifts in the coming weeks. The resilience of the crypto market remains to be seen, but one thing is certain: the lessons learned from this liquidation event will resonate deeply within the trading community.

Stay Updated

For those interested in staying updated on cryptocurrency trends, price movements, and trading strategies, following credible sources and engaging with the community can provide valuable insights. The crypto landscape is fast-paced, and being informed can make all the difference in navigating its complexities.

By understanding the factors that lead to large-scale liquidations and implementing effective trading strategies, investors can better position themselves in the unpredictable world of cryptocurrency trading.

BREAKING

$821,240,000 WORTH OF LEVERAGED POSITIONS HAVE BEEN LIQUIDATED IN THE PAST 24 HOURS

TOTAL LONG LIQUIDATIONS: $771.75 MILLION

TOTAL SHORT LIQUIDATIONS: $109.49 MILLION pic.twitter.com/dcoKY9LfE2

— Ash Crypto (@Ashcryptoreal) February 28, 2025

BREAKING

In a stunning turn of events, the cryptocurrency market has seen a massive shakeup with $821,240,000 worth of leveraged positions liquidated in the past 24 hours. This news comes from a tweet by Ash Crypto, a prominent figure in the crypto community, highlighting just how volatile and unpredictable this market can be. For those who might be new to the concept, leveraged trading allows traders to borrow funds to increase their position size, which can amplify both gains and losses.

$821,240,000 WORTH OF LEVERAGED POSITIONS HAVE BEEN LIQUIDATED IN THE PAST 24 HOURS

When we talk about liquidations, we’re referring to the process where a trader’s position is automatically closed by the exchange due to insufficient margin. This usually happens when the market moves significantly against their position, resulting in a loss that exceeds the amount they had deposited. The figure of $821,240,000 is staggering, indicating that many traders were caught off guard by the recent market movements.

TOTAL LONG LIQUIDATIONS: $771.75 MILLION

The bulk of the liquidations came from long positions, amounting to a whopping $771.75 million. For those unfamiliar, a long position means that traders bet on the price of an asset rising. When the opposite occurs, as it has in this case, it can lead to significant financial pain. Many traders likely thought they were making a safe bet, but the market’s unpredictability can lead to unforeseen circumstances. The emotional rollercoaster that comes with trading cryptocurrencies can be intense, and losses of this magnitude can be devastating.

TOTAL SHORT LIQUIDATIONS: $109.49 MILLION

On the flip side, there were also $109.49 million in short liquidations. A short position is when traders bet that the price of an asset will fall. While a good strategy in a declining market, unexpected price spikes can lead to quick liquidations for these traders as well. In this case, both long and short traders faced significant challenges, illustrating the chaotic nature of crypto trading.

The Impact of Liquidations on the Market

So, what does this mean for the broader cryptocurrency market? Massive liquidations often lead to increased volatility. When a significant number of positions are liquidated, it can cause a cascading effect, leading to further price drops and more liquidations. This cycle can create a turbulent environment, making it tough for traders to navigate. It’s essential to keep an eye on the market trends and be aware that such events can happen swiftly.

Why Are Liquidations Happening?

Liquidations like the one we’re witnessing can be attributed to several factors. Market sentiment plays a crucial role; if traders are bearish, it can create a snowball effect. Additionally, external factors such as regulatory news, economic indicators, or even social media trends can sway market dynamics dramatically. The cryptocurrency space is notorious for its rapid shifts, and it’s essential to stay informed.

Understanding the Risks of Leveraged Trading

Leveraged trading can seem appealing due to the potential for high returns. However, the risks are equally significant. It’s crucial for traders to understand their risk tolerance and to only trade with funds they can afford to lose. Setting stop-loss orders can help manage risk, but even those can fail in volatile markets. The high stakes of leveraged positions mean that traders must have a solid strategy in place.

What Should Traders Do Now?

For those currently trading or considering entering the market, now is a critical time to evaluate your strategies. With the recent $821,240,000 worth of leveraged positions liquidated, it’s vital to reassess your risk management tactics. Keep abreast of market news and trends, and consider diversifying your investments to mitigate risk. Whether you’re a seasoned trader or a newcomer, knowledge is your best asset in navigating these turbulent waters.

The Role of Emotional Management in Trading

Trading is not just about numbers; it’s also about managing your emotions. The fear of loss can lead to panic selling, while greed can result in holding onto losing positions for too long. Understanding your emotional responses to market changes can help you make better decisions. Some traders find it helpful to step back and take a break during high-stress situations. This can provide clarity and prevent impulsive decisions that could lead to further losses.

Learning from the Liquidation Events

Every liquidation event can serve as a learning opportunity. Analyzing what went wrong, understanding market patterns, and applying those lessons to future trades can enhance your trading skills. Participate in discussions within trading communities to share experiences and learn from others. The cryptocurrency world is vast, and the more insights you gather, the better prepared you’ll be for future challenges.

Conclusion: Stay Informed and Prepared

The recent announcement of $821,240,000 worth of leveraged positions liquidated serves as a stark reminder of the volatility inherent in the cryptocurrency market. Whether you’re holding long or short positions, being aware of market conditions and managing your risk effectively can help you navigate these unpredictable times. Always stay informed, adapt your strategies, and remember that trading is as much about discipline and psychology as it is about numbers.

“`

This article is crafted to be engaging and informative while incorporating the specified keywords and structure. It emphasizes the recent liquidation event and provides insights into the broader implications for traders in the cryptocurrency market.