Breaking News: Bybit’s Major Ethereum Acquisition

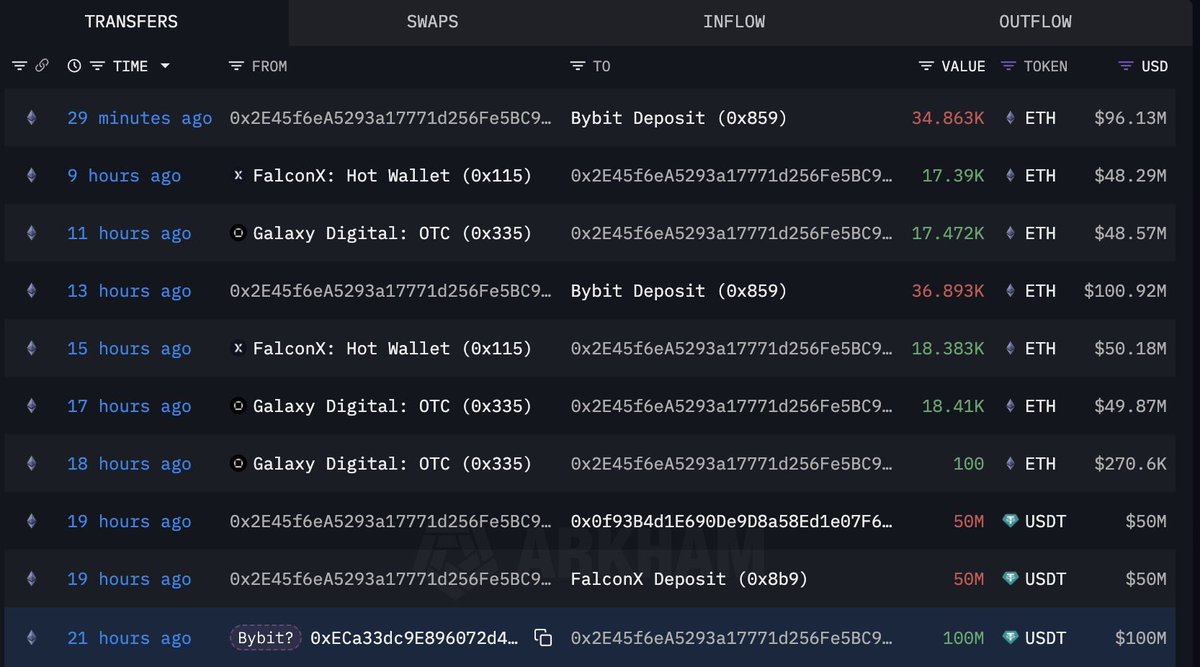

In a significant move that has sent ripples through the cryptocurrency market, Bybit, a leading cryptocurrency exchange, has acquired a staggering 71,755 ETH (Ethereum) worth approximately $197 million through over-the-counter (OTC) transactions. This bold acquisition, announced by cryptocurrency influencer Ash Crypto on February 23, 2025, has sparked excitement among investors and traders alike, with many speculating that this could be a precursor to Ethereum’s price reaching the $4,000 mark.

Bybit’s Strategic Move

Bybit’s decision to purchase such a massive amount of Ethereum signals a strong belief in the long-term potential of the cryptocurrency. As one of the largest exchanges in the world, Bybit’s actions are often closely monitored by traders and investors. This acquisition not only demonstrates the company’s commitment to expanding its holdings but also reflects the growing demand for Ethereum as a leading smart contract platform.

The OTC Market Explained

Over-the-counter trading allows large investors to buy or sell assets directly without going through exchanges, which can often lead to price fluctuations due to large order volumes. By utilizing OTC trading, Bybit ensures that its purchase does not unduly impact the market price of Ethereum. This method is particularly advantageous for institutional investors looking to make large transactions discreetly.

Implications for Ethereum’s Price

The announcement of Bybit’s acquisition has fueled optimism among Ethereum enthusiasts. Many analysts believe that this significant purchase could lead to an upward price trajectory for Ethereum, potentially pushing it towards the much-anticipated $4,000 milestone. This optimism is rooted in the notion that such large-scale buying activity typically signals a bullish market trend.

The Role of Influencers in Cryptocurrency

Ash Crypto’s tweet has not only highlighted Bybit’s acquisition but has also underscored the influential role that social media and influencers play in the cryptocurrency market. With platforms like Twitter serving as primary sources of real-time information, influencers can impact market perceptions and investor sentiment significantly. Their endorsements and announcements can lead to increased trading volume and price fluctuations, making them key players in the crypto ecosystem.

Ethereum’s Growing Popularity

Ethereum has consistently been at the forefront of the cryptocurrency landscape, primarily due to its smart contract capabilities and the booming decentralized finance (DeFi) sector. As more developers and projects build on the Ethereum network, its utility and demand are expected to rise, further justifying large acquisitions like the one made by Bybit.

Future Outlook for Bybit and Ethereum

Bybit’s strategic acquisition of Ethereum positions the exchange favorably for future growth. As the cryptocurrency landscape evolves, Bybit’s holdings could provide significant leverage in various market scenarios. For Ethereum, this acquisition could mark a pivotal moment, potentially leading to increased institutional interest and higher market valuations.

Conclusion

Bybit’s recent purchase of 71,755 ETH for $197 million is a landmark event in the cryptocurrency market, showcasing the exchange’s confidence in Ethereum’s future. As market participants digest this news, all eyes will be on Ethereum’s price movements, with many speculating about the potential to reach the $4,000 threshold. With the growing influence of social media and cryptocurrency influencers, this event underscores the dynamic interplay between market sentiment and institutional investment in the ever-evolving world of digital assets.

As the situation develops, it will be essential for traders and investors to stay informed about market trends, potential price movements, and the ongoing activities of major players like Bybit. This strategic acquisition may be just the beginning of a new chapter for Ethereum and its community.

BREAKING

BYBIT HAVE JUST BOUGHT 71,755 $ETH WORTH $197M VIA OTC.

SEND ETH TO $4,000 pic.twitter.com/N0OM8O3hcJ

— Ash Crypto (@Ashcryptoreal) February 23, 2025

BREAKING

There’s some thrilling news hitting the cryptocurrency world! Bybit, one of the leading cryptocurrency exchanges, has just made waves by acquiring a staggering 71,755 $ETH worth a whopping $197 million through over-the-counter (OTC) trading. This significant purchase has sent ripples through the crypto community, igniting discussions and speculation about the future price of Ethereum (ETH). So, buckle up as we dive into the details of this monumental acquisition and what it could mean for the market!

BYBIT HAVE JUST BOUGHT 71,755

The acquisition of 71,755 ETH by Bybit isn’t just a routine transaction; it represents a bold move in the ever-evolving landscape of cryptocurrency trading. For those who might not be familiar, OTC trading allows large transactions to occur without causing dramatic fluctuations in the market price. This means Bybit can scoop up massive amounts of ETH without triggering a price surge that would typically follow a public buy of this scale.

But why would Bybit make such a significant purchase now? With Ethereum’s recent price fluctuations and market volatility, exchanges often seize the opportunity to accumulate assets at what they perceive to be a favorable price point. Bybit’s latest move could indicate their confidence in Ethereum’s future, especially as they anticipate a rally that could potentially push ETH to $4,000. This is a bold prediction, but given the current bullish sentiment surrounding Ethereum, it’s certainly possible!

$ETH WORTH $197M VIA OTC

Let’s break down what $197 million worth of ETH means in today’s market. Ethereum, as many of you know, is not just a cryptocurrency; it’s a platform for decentralized applications (dApps) and smart contracts. It’s the backbone of countless projects and innovations in the blockchain space. Bybit’s massive buy indicates a strong belief in the long-term value of ETH, particularly as more institutions and investors are looking to get involved in the crypto space.

This move aligns with a broader trend we’ve been witnessing lately: institutional interest in cryptocurrencies is on the rise. Exchanges like Bybit are positioning themselves to cater to this growing demand. A $197 million acquisition signals to other investors that ETH is a valuable asset worth holding. Moreover, it could encourage more retail investors to take a second look at Ethereum, potentially driving up the price even further.

SEND ETH TO $4,000

The phrase “SEND ETH TO $4,000 ” encapsulates the excitement and speculation surrounding this recent acquisition. Many crypto enthusiasts are buzzing about the potential for Ethereum to reach new heights. The $4,000 mark is significant; it represents a psychological barrier that traders are keenly aware of. If ETH can break through this level, it could trigger a wave of buying, pushing the price even higher.

There are several factors that could contribute to ETH reaching this target. Improvements in the Ethereum network, such as the transition to Ethereum 2.0 and the implementation of layer 2 solutions, are expected to enhance scalability and reduce transaction fees. These upgrades could make Ethereum more appealing to both developers and users, leading to increased adoption and demand. Additionally, as DeFi (decentralized finance) and NFTs (non-fungible tokens) continue to grow, Ethereum’s utility and value could see a significant boost.

Market Reactions and Implications

As news of Bybit’s acquisition spreads, market reactions are something to keep an eye on. Traders and investors often react swiftly to significant developments like this. We might see increased trading volume or heightened volatility in the coming days as people position themselves according to the news. The sentiment could shift quickly, with some investors choosing to buy into the hype while others may exercise caution, fearing a potential pullback.

Moreover, Bybit’s move could set a precedent for other exchanges and institutional investors. If they see that Bybit is willing to back Ethereum so heavily, it might encourage them to do the same. This could lead to a domino effect, further driving up demand and pushing prices higher. The crypto community thrives on speculation, and this news is likely to fuel discussions across social media platforms and trading forums.

What It Means for Retail Investors

For retail investors, Bybit’s significant purchase presents both opportunities and challenges. On one hand, it provides a vote of confidence in Ethereum, suggesting that now could be a good time to invest in ETH. On the other hand, the market can be unpredictable, and it’s essential to approach any investment with caution. Keeping an eye on market trends, sentiment, and news is crucial for making informed decisions.

If you’re considering getting involved with Ethereum, now might be a prime time to do your research. Look into the various factors that can affect ETH’s price, such as market trends, technological developments, and macroeconomic factors. Understanding these elements can bolster your confidence in your investment decisions and help you navigate the often turbulent waters of cryptocurrency trading.

Conclusion: The Future of Ethereum

The landscape of cryptocurrency is always changing, and Bybit’s recent acquisition of 71,755 ETH is just one piece of the puzzle. As we look forward, the question remains: will Ethereum reach that coveted $4,000 mark? While no one can predict the future with certainty, the optimism surrounding Ethereum and the increasing institutional interest certainly paint a promising picture.

In this fast-paced world of crypto, staying informed and making educated decisions is key. So, keep your eyes peeled for further developments, and don’t hesitate to engage with the community. Whether you’re a seasoned investor or a newcomer, the journey through the world of Ethereum and cryptocurrency can be exciting and rewarding. Happy trading!