Death- Obituary news

BlackRock’s Significant Investment in Ethereum: A Game Changer for Crypto

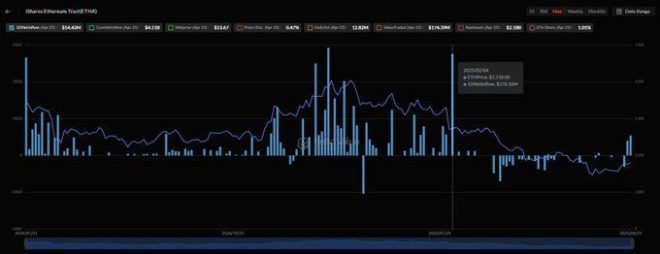

In a striking development within the cryptocurrency landscape, investment giant BlackRock has made headlines by purchasing $54 million worth of Ethereum (ETH), marking its largest acquisition of the digital asset in over two months. This acquisition pushes BlackRock’s total holdings of Ethereum to an impressive $2.06 billion. Such a notable investment raises critical questions about the state of the cryptocurrency market and its future, especially in the face of ongoing skepticism about the viability and longevity of digital currencies.

Understanding BlackRock’s Investment Strategy

BlackRock, as one of the world’s largest asset management firms, is known for its strategic investments across various asset classes. The firm’s foray into Ethereum is indicative of a broader trend where institutional investors are increasingly recognizing the potential of cryptocurrencies. Despite the volatility and regulatory challenges that the crypto market faces, BlackRock’s substantial investment signals confidence in Ethereum’s long-term value proposition.

The timing of this investment is particularly noteworthy. After a period of uncertainty in the crypto market, characterized by price fluctuations and heightened regulatory scrutiny, BlackRock’s decision to invest significantly in Ethereum could suggest a bullish outlook on the future of the asset. This move not only underscores the firm’s belief in Ethereum’s potential but also reflects a growing acceptance of cryptocurrencies among institutional investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Ethereum’s Role in the Cryptocurrency Ecosystem

Ethereum, the second-largest cryptocurrency by market capitalization, is more than just a digital currency. It serves as a decentralized platform for building and deploying smart contracts and decentralized applications (dApps). This unique functionality differentiates Ethereum from Bitcoin and positions it as a foundational technology in the blockchain ecosystem.

The Ethereum network has undergone significant upgrades, most notably the transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism with Ethereum 2.0. This transition aims to enhance scalability, security, and sustainability, making Ethereum more appealing to institutional investors like BlackRock. The ongoing development and innovation within the Ethereum ecosystem further bolster its attractiveness as an investment.

The Significance of Institutional Investment in Crypto

Institutional investments in cryptocurrencies are crucial for the maturation and mainstream adoption of digital assets. As more large financial institutions like BlackRock enter the crypto space, it lends legitimacy to the market and encourages retail investors to participate. BlackRock’s $54 million investment in Ethereum is not just a financial transaction; it represents a vote of confidence that can influence other investors and institutions.

Moreover, institutional investment can lead to increased liquidity and stability within the market. As large players like BlackRock accumulate significant holdings, they can help mitigate extreme price fluctuations that often plague smaller cryptocurrencies. This stability can create a more attractive environment for retail investors and encourage broader adoption of digital currencies.

Impact on the Market Perception of Cryptocurrency

The announcement of BlackRock’s investment has reignited discussions about the future of cryptocurrencies. Many voices in the crypto community are questioning the narrative that cryptocurrencies are “dead” or in decline. BlackRock’s substantial investment serves as a counter-narrative, suggesting that rather than being in a downturn, the cryptocurrency market may be poised for recovery and growth.

The skepticism surrounding cryptocurrencies often stems from regulatory concerns, market volatility, and the challenges of adoption. However, institutional investments like that of BlackRock’s can help alleviate some of these concerns. As prominent financial entities engage with cryptocurrencies, it signals to the market that digital assets are becoming an integral part of the financial landscape.

Future Implications for Ethereum and the Crypto Market

BlackRock’s recent investment is likely to have far-reaching implications for Ethereum and the broader cryptocurrency market. With $2.06 billion in ETH, BlackRock’s holdings could influence market dynamics, particularly if they decide to increase or decrease their positions strategically. Such moves could lead to significant price adjustments, impacting retail investors and other market participants.

Additionally, BlackRock’s investment may encourage other institutional players to reconsider their stance on cryptocurrencies. As more firms begin to allocate a portion of their portfolios to digital assets, the demand for Ethereum and other cryptocurrencies could rise, further driving up prices. This increased demand, coupled with Ethereum’s ongoing development and enhancements, could position it favorably for future growth.

Conclusion: A Turning Point for Cryptocurrency

In summary, BlackRock’s $54 million investment in Ethereum is a noteworthy development that underscores the growing acceptance of cryptocurrencies among institutional investors. With a total holding of $2.06 billion in ETH, BlackRock’s actions challenge the prevailing narrative of a dying crypto market. Instead, this investment may signify a turning point, suggesting that cryptocurrencies, particularly Ethereum, have a promising future ahead.

As the cryptocurrency market continues to evolve, the involvement of institutional investors like BlackRock will play a pivotal role in shaping its trajectory. The ongoing interest from major financial institutions could lead to greater stability, increased liquidity, and ultimately, broader adoption of digital assets across various sectors. For those invested in Ethereum and the cryptocurrency space, BlackRock’s significant investment is a beacon of hope, signaling that the digital currency revolution is far from over.

In conclusion, as we reflect on BlackRock’s strategic move, it’s essential to remain vigilant and informed about developments in the cryptocurrency market. With institutional interest on the rise, the future of digital currencies like Ethereum is set to become even more intriguing and impactful in the coming years.

BlackRock just dropped $54M on Ethereum – their biggest purchase in 2+ months.

They’re now sitting on $2.06B in ETH. Still think crypto’s dead?

Let that sink in. pic.twitter.com/qVrHfHNfov

— Ripple Van Winkle | Crypto Researcher (@RipBullWinkle) April 27, 2025

BlackRock Just Dropped $54M on Ethereum – Their Biggest Purchase in 2+ Months

In an eye-opening move that has sent ripples through the crypto community, BlackRock has made headlines by purchasing a whopping $54 million worth of Ethereum (ETH). This acquisition marks their largest buy in over two months, showcasing a significant commitment to the world of cryptocurrencies. With these new purchases, BlackRock now holds an impressive $2.06 billion in Ethereum. The question on everyone’s lips is: Still think crypto’s dead? Let that sink in.

Understanding BlackRock’s Investment Strategy

BlackRock, the world’s largest asset manager, has been gradually increasing its exposure to cryptocurrencies. This recent purchase is a clear indication of their bullish stance on Ethereum, a platform known for its smart contracts and decentralized applications. But why is BlackRock making such a significant investment?

For starters, Ethereum is not just a cryptocurrency; it’s a comprehensive platform that supports a multitude of decentralized applications (dApps) and smart contracts. This flexibility makes it a prime candidate for investment in the evolving digital economy. BlackRock’s hefty investment signals that they believe in the long-term potential of Ethereum and the broader crypto market. The firm is not merely buying into a trend; they are positioning themselves as leaders in a digital financial revolution.

What Does $2.06B in ETH Mean for BlackRock?

With $2.06 billion now sitting in ETH, BlackRock’s holdings represent a significant portion of their overall investment strategy. This level of investment suggests that they are not only betting on Ethereum’s price appreciation but also on its utility in the financial system of the future. Holding such a large amount signals confidence in Ethereum’s ability to maintain its value and utility as a leading platform in the blockchain space.

Furthermore, BlackRock’s investment has the potential to influence market trends. Institutional investments like these often lead to increased confidence among retail investors. When big names like BlackRock enter the market, it can lead to a surge in interest and investment from everyday individuals who might have been hesitant before.

Why Should You Care About BlackRock’s Move?

If you’re wondering why BlackRock’s actions should matter to you, consider this: institutional investments can often lead to more stability in volatile markets. When large entities invest in cryptocurrencies, they help legitimize the market and can reduce the stigma that has often been associated with digital currencies.

Moreover, BlackRock’s stake in Ethereum could pave the way for more products and services that integrate cryptocurrencies into mainstream finance. Imagine a future where your retirement accounts or mutual funds include allocations to cryptocurrencies. This could open up a whole new world of investment opportunities for the average person.

BlackRock and the Future of Cryptocurrency

The firm’s recent investment in Ethereum is not just a random decision; it reflects a broader trend in which traditional finance is beginning to embrace the digital assets space. As the cryptocurrency market matures, more institutions are expected to take a leap into this exciting world. BlackRock’s significant purchase could serve as a catalyst for others to follow suit.

The question remains: how will this impact the price of Ethereum and the crypto market at large? As more companies recognize the potential of cryptocurrencies, we could see a shift in how cryptocurrencies are viewed and utilized. Instead of being seen as speculative assets, they may become integral components of various financial products.

The Community’s Reaction

The crypto community has reacted positively to BlackRock’s recent investment. Many enthusiasts see it as validation of the technology and its potential. Social media platforms have been buzzing with discussions about the implications of BlackRock’s actions. For many, it feels like a turning point, a sign that cryptocurrencies are moving toward mainstream acceptance.

People are sharing their thoughts and predictions, with some expressing excitement about what this means for the future of Ethereum. Others are cautious, reminding the community that while institutional investments are a positive sign, the crypto market is still volatile.

What Lies Ahead for Ethereum?

Ethereum has been experiencing a lot of developments, particularly with Ethereum 2.0 and improvements aimed at scalability and sustainability. With major players like BlackRock investing, the future looks bright. If Ethereum can successfully implement its upgrades, it may solidify its position as a leader in the blockchain space.

Moreover, as decentralized finance (DeFi) continues to grow, Ethereum’s role in facilitating these applications will likely expand. BlackRock’s investment may further accelerate the development of DeFi projects, as institutional players seek to leverage the benefits of blockchain technology.

Final Thoughts on BlackRock’s $54M Ethereum Purchase

BlackRock’s decision to invest $54 million in Ethereum is a testament to the growing acceptance of cryptocurrencies in traditional finance. With a staggering $2.06 billion now held in ETH, they are making a bold statement about their belief in the future of digital assets. As the crypto landscape evolves, it will be interesting to see how this investment influences both the market and the perception of cryptocurrencies in general.

So, the next time someone tells you that crypto is dead, just remember BlackRock’s significant investment and the potential it signifies for the future of finance. The landscape is changing, and it’s essential to stay informed and engaged as these developments unfold.

“`