market liquidation strategies, cryptocurrency price levels, trading psychology insights

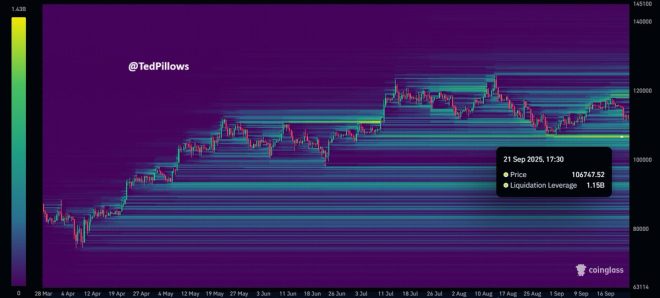

BREAKING:$1,150,000,000 in long liquidation is sitting at the $106,700 level.

I think market makers are definitely eyeing this level. pic.twitter.com/3RcLk8rwLK

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Ted (@TedPillows) September 23, 2025

BREAKING: $1,150,000,000 in Long Liquidation

A significant financial shift has emerged, with $1,150,000,000 in long liquidation sitting at the critical $106,700 level. This amount signals a substantial market movement that traders and investors should take note of. The implications of such a liquidation are profound, as it can influence market sentiment and trading strategies.

Market Makers Eyeing This Level

Market makers are known for their ability to move the market by adjusting their positions based on liquidity and investor behavior. As Ted (@TedPillows) highlighted in his tweet, the $106,700 level is under close watch. The presence of such a hefty long liquidation can lead to increased volatility, presenting both risks and opportunities for traders.

In trading, liquidations often happen when asset prices dip below a certain threshold, forcing leveraged positions to close. This can create a cascading effect, amplifying price movements. For those involved in trading cryptocurrencies or stocks, understanding these dynamics is crucial.

Implications for Traders

For traders, the current situation at the $106,700 level necessitates a strategic approach. It’s essential to assess the risk-reward ratio and consider the potential for price fluctuations. With market makers actively monitoring this level, traders might experience increased liquidity and possibly heightened volatility.

The market’s reaction to this long liquidation could serve as a barometer for broader investor sentiment. If prices stabilize and begin to rise again, it may signal renewed confidence among investors. Conversely, if prices fall further, it could indicate a more extensive market correction.

Stay tuned to market updates and analyses to navigate these developments effectively. Understanding the implications of such significant liquidations can empower you to make informed trading decisions.