Cryptocurrency retirement investment, SEC crypto 401k market, Trump executive order crypto, Lawmakers 401k crypto push, Retirement savings crypto access

JUST IN: US lawmakers ask SEC to implement President trump‘s executive order opening the $12.5 trillion 401k retirement market to crypto. pic.twitter.com/aADcrfAjm2

— Watcher.Guru (@WatcherGuru) September 22, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

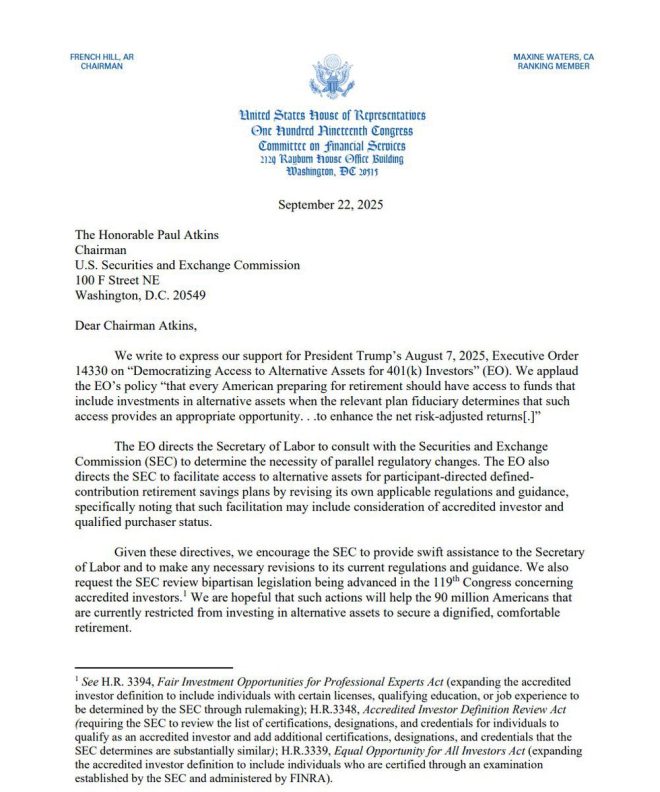

In a groundbreaking move, US lawmakers have requested the Securities and Exchange Commission (SEC) to implement President Trump’s executive order that would open up the $12.5 trillion 401k retirement market to cryptocurrency investments. This decision has the potential to revolutionize the way Americans save for retirement by allowing them to diversify their portfolios with digital assets.

The announcement was made by Watcher.Guru on Twitter, where they shared the news with their followers. The tweet quickly gained attention, with many people expressing excitement and curiosity about the implications of this development. The move comes at a time when cryptocurrency is gaining mainstream acceptance and recognition as a legitimate investment option.

By allowing cryptocurrencies to be included in 401k retirement accounts, individuals will have the opportunity to invest in assets like Bitcoin, Ethereum, and other digital currencies. This opens up a new avenue for retirement savings, providing investors with more choices and potentially higher returns.

The decision to open up the 401k market to crypto is seen as a bold move that could have far-reaching effects on the financial industry. It could lead to increased adoption of cryptocurrencies among institutional investors and pave the way for more widespread acceptance of digital assets in traditional finance.

However, there are also concerns about the risks associated with investing in cryptocurrencies, given their volatility and regulatory uncertainties. The SEC will need to carefully consider how to regulate this new market to protect investors while also allowing for innovation and growth.

Overall, this development marks a significant step towards mainstream acceptance of cryptocurrencies as a legitimate asset class. It will be interesting to see how the SEC responds to this request and how the 401k market will evolve in the coming years as a result of this decision. Investors and industry experts alike will be closely watching to see how this new chapter in the cryptocurrency market unfolds.

JUST IN: US lawmakers ask SEC to implement President Trump’s executive order opening the $12.5 trillion 401k retirement market to crypto. pic.twitter.com/aADcrfAjm2

— Watcher.Guru (@WatcherGuru) September 22, 2025

In a groundbreaking development, US lawmakers have recently urged the Securities and Exchange Commission (SEC) to put into action President Trump’s executive order that will allow the $12.5 trillion 401k retirement market to venture into the world of cryptocurrency. This move marks a significant shift in the financial landscape and has the potential to revolutionize retirement investing as we know it.

The SEC, as the primary regulatory body overseeing the securities industry, plays a crucial role in ensuring the integrity and stability of the financial markets. With the recent surge in popularity of cryptocurrencies such as Bitcoin and Ethereum, many investors are eager to explore new avenues for diversifying their portfolios. By opening up the 401k retirement market to crypto, lawmakers hope to provide individuals with more options to secure their financial futures.

The executive order signed by President Trump paves the way for retirement funds to invest in digital assets, a move that could potentially drive up the value of cryptocurrencies and create new opportunities for growth. This decision comes at a time when the traditional financial system is facing increasing pressure to adapt to the changing landscape of digital currencies.

Cryptocurrency has gained traction as a viable investment option, with many investors seeing it as a hedge against inflation and a store of value. By allowing retirement funds to allocate a portion of their assets to crypto, individuals may have the chance to benefit from the potential upside of this emerging asset class.

While the prospect of integrating cryptocurrency into retirement accounts may be exciting for some, it is not without its risks. The volatile nature of the crypto market means that prices can fluctuate dramatically in a short period of time, potentially leading to significant losses for investors. It is essential for individuals to conduct thorough research and seek advice from financial professionals before making any investment decisions.

Moreover, the SEC will need to establish clear guidelines and regulations to ensure that the integration of cryptocurrency into the 401k retirement market is done in a responsible and transparent manner. This will help protect investors and maintain the integrity of the financial system as a whole.

Overall, the push to open up the $12.5 trillion 401k retirement market to cryptocurrency represents a bold and innovative step towards modernizing the way we invest for the future. By embracing the potential of digital assets, individuals may have the opportunity to diversify their portfolios and capitalize on the growing popularity of cryptocurrencies.

As we look ahead to the implementation of President Trump’s executive order, it will be crucial to monitor how the SEC navigates this new terrain and the impact it has on the financial industry. With the right regulations and oversight in place, the integration of cryptocurrency into retirement accounts could unlock new possibilities for investors and reshape the way we approach retirement planning.

In conclusion, the move to open up the 401k retirement market to cryptocurrency is a significant development that has the potential to reshape the financial landscape. By embracing the digital revolution, investors may have the opportunity to explore new avenues for growth and diversification in their portfolios. It is essential for individuals to stay informed and seek professional guidance when considering investing in cryptocurrency through their retirement accounts.

US lawmakers, SEC, President Trump, executive order, retirement market, 401k, crypto, opening, $12.5 trillion, cryptocurrency, investment, regulations, retirement savings, financial assets, digital assets, retirement funds, pension funds, retirement planning, financial security, retirement accounts