Festive Savings 2025, Celebrate GST Fest, Lower Tax Benefits, Holiday Savings Utsav, GST Savings Bonanza

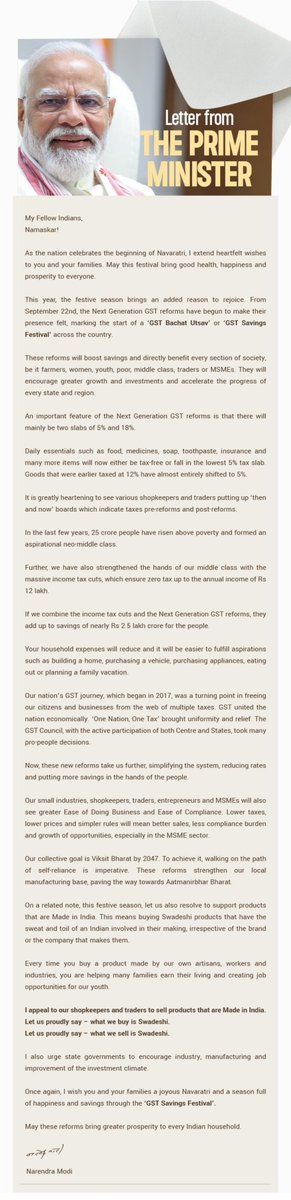

This festive season, let’s celebrate the ‘GST Bachat Utsav’! Lower GST rates mean more savings for every household and greater ease for businesses. pic.twitter.com/QOUGWXrC3d

— Narendra Modi (@narendramodi) September 22, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Celebrating the ‘GST Bachat Utsav’ This Festive Season

This festive season, the Indian government, under the leadership of Prime Minister Narendra Modi, is promoting the ‘GST Bachat Utsav,’ a celebration aimed at lowering Goods and Services Tax (GST) rates to enhance savings for households and ease for businesses. The initiative, as highlighted in a recent tweet by Modi, emphasizes the positive impacts of reduced GST rates on both consumers and entrepreneurs.

Understanding GST and Its Importance

The Goods and Services Tax (GST) is a significant reform in India’s taxation system, implemented to streamline the indirect tax structure and to facilitate a unified market. GST replaced multiple indirect taxes that were previously levied by both the central and state governments, simplifying compliance and reducing the overall tax burden on consumers and businesses alike.

With the recent focus on lowering GST rates during the festive season, consumers can expect to save more on essential goods and services. This initiative aims not only to boost purchasing power but also to stimulate economic activity during a time when many businesses rely on increased sales.

Benefits of Lower GST Rates

- Increased Savings for Households

Lower GST rates translate directly into reduced prices for goods and services. For families, this means more disposable income that can be allocated towards festive purchases, savings, or investment. Families can celebrate the season with more financial flexibility, making it easier to buy gifts, decorations, and other festive essentials. - Encouragement for Small Businesses

The reduction in GST rates will ease the compliance burden on small and medium enterprises (SMEs), allowing them to thrive without the fear of overwhelming tax obligations. With lower taxation, businesses can reinvest their savings into growth, innovation, and employee well-being. This can lead to job creation and a more robust economy. - Strengthening Economic Growth

The festive season is a critical time for retail and service sectors, and lower GST rates can help stimulate demand. As consumers are encouraged to spend more due to lower prices, businesses can experience increased sales, which, in turn, contributes to GDP growth. - Boosting Consumer Confidence

By promoting the ‘GST Bachat Utsav,’ the government is fostering a sense of confidence among consumers. Knowing that they can save money while shopping can encourage more spending, which is crucial for economic recovery and growth, especially post-pandemic.The Role of the Government

The Indian government plays a pivotal role in ensuring that GST benefits reach the grassroots level. Initiatives like the ‘GST Bachat Utsav’ highlight its commitment to enhancing the financial well-being of citizens and promoting economic stability.

The government has been proactive in adjusting GST rates based on market conditions and consumer needs. The ongoing dialogue with industry stakeholders helps ensure that policies remain relevant and beneficial.

Conclusion

The ‘GST Bachat Utsav’ is more than just a promotional event; it represents a significant step towards economic empowerment for individuals and businesses alike. As the festive season approaches, the initiative stands as a beacon of hope, promising lower costs, increased consumer spending, and a strengthened economy.

By participating in this celebration, consumers and businesses can take advantage of the reduced GST rates and contribute to a vibrant economic landscape. The festive spirit combined with financial savings makes for a truly joyous occasion that can resonate throughout the year.

As we embrace this festive season, let’s celebrate the benefits of the ‘GST Bachat Utsav’ and appreciate the positive changes in the taxation landscape that empower us all. Whether you are a consumer looking to save or a business owner aiming to grow, this initiative offers a unique opportunity to make the most of the festive cheer.

Is the GST Bachat Utsav a Game Changer or a Trap?

” />

This festive season, let’s celebrate the ‘GST Bachat Utsav’! Lower GST rates mean more savings for every household and greater ease for businesses. pic.twitter.com/QOUGWXrC3d

— Narendra Modi (@narendramodi) September 22, 2025

This festive season, let’s celebrate the ‘GST Bachat Utsav’!

The air is buzzing with excitement as we approach the festive season. It’s a time when families come together, lights twinkle, and joy fills the streets. But this year, there’s an added reason to celebrate: the ‘GST Bachat Utsav’! With lower Goods and Services Tax (GST) rates, this festive period isn’t just about decorations and feasts; it’s about significant savings for every household. Let’s dive into what this means for you, your family, and local businesses.

Lower GST Rates Mean More Savings for Every Household

Imagine walking into your favorite store, and instead of worrying about how much more you’ll pay due to taxes, you find that everything is just a bit more affordable. That’s the magic of lower GST rates. The Indian government has been working hard to ease the financial burden on families, particularly during festive times when spending naturally increases. With reduced GST, families can save a considerable amount on essentials and luxuries alike.

For instance, if you are planning to buy new clothes or electronic gadgets, the reduced tax can mean a direct impact on your wallet. This festive season, you can indulge in that new smartphone or shiny outfit without feeling guilty about the expense. More savings mean more opportunities to treat your loved ones, making this festive season even more special.

Greater Ease for Businesses

Not only does a lower GST benefit households, but it also creates a favorable environment for businesses. Entrepreneurs and small business owners can breathe a sigh of relief as they navigate through this festive season. The ease of doing business is crucial, especially when competition is fierce. Lower GST rates mean that businesses can pass on these savings to consumers, leading to increased sales and customer satisfaction.

For small businesses, this festive season could be a game-changer. By offering products at more competitive prices, they attract more customers and boost their sales figures. The ripple effect of this can lead to job creation and economic growth, benefiting the community as a whole.

Celebrate the Spirit of ‘GST Bachat Utsav’

The ‘GST Bachat Utsav’ is not just about savings; it’s also about celebrating the spirit of community and togetherness. As families come together to celebrate, they can also engage in conversations about how these lower tax rates can lead to a more prosperous future.

Participating in local events or supporting small businesses during this season can amplify the festive spirit. Whether it’s attending a local fair, shopping at neighborhood stores, or enjoying homemade delicacies, every small action contributes to the larger goal of community upliftment.

Understanding GST: A Quick Overview

For those who may not be familiar, GST is a single tax that has replaced multiple indirect taxes in India. It aims to create a unified market by simplifying the taxation system. The recent adjustments in GST rates have made it easier for businesses to comply while ensuring consumers get more value for their money. By understanding the fundamentals of GST, consumers can make informed decisions while shopping and take full advantage of the benefits it offers during this festive season.

The Impact on Consumer Behavior

With lower GST rates in play, consumer behavior is likely to shift, especially during the festive season. Shoppers are more inclined to spend when they know they are getting a better deal. This season, you might find yourself more eager to try out new brands or splurge on that extra gift, knowing that your savings are maximized.

This behavioral change is significant for retailers as well. They can create marketing campaigns that highlight these savings, attracting more customers and enhancing their sales. The festive atmosphere combined with the excitement of great deals creates a win-win situation for everyone involved.

Tips for Maximizing Savings This Festive Season

Now that we understand the benefits of the ‘GST Bachat Utsav’, let’s talk about how you can make the most out of it:

1. **Plan Your Purchases**: Make a list of what you need and stick to it. This will help you avoid impulse buys and ensure you’re making the most of the lower prices.

2. **Compare Prices**: Don’t settle for the first deal you see. Take the time to compare prices both online and in-store to ensure you’re getting the best possible deal.

3. **Shop Local**: Supporting local businesses not only helps the economy but often gives you access to better deals without inflated prices.

4. **Stay Informed**: Keep an eye on announcements regarding GST changes and special offers during the festive season. Being informed is key to maximizing your savings.

5. **Share the Joy**: Spread the word about the ‘GST Bachat Utsav’ with friends and family. The more people know about it, the more they can benefit, creating a larger impact.

Join the Celebration

As this festive season unfolds, embrace the spirit of the ‘GST Bachat Utsav’. The lower GST rates are not just a financial boon but a reason to celebrate with loved ones, support local businesses, and create lasting memories. Whether you’re shopping for gifts or enjoying festive meals, remember that every rupee saved is a step towards a happier, more prosperous future for all.

So, gather your family, plan your shopping spree, and get ready to make the most of this festive season. Happy savings!

festive savings 2025, holiday discounts, tax relief celebrations, household savings festival, business tax benefits, GST savings event, festive financial relief, consumer savings initiatives, seasonal shopping deals, GST holiday sales, economic boost festival, tax reduction celebration, retail savings extravaganza, festive budget-friendly shopping, holiday tax benefits, GST awareness campaign, festive money-saving tips, consumer savings festival, shopping extravaganza 2025, tax-friendly shopping event