Quit Claim Deed Florida, Nyesom Wike properties, Nigerian Minister real estate, Florida property transfer, Family property deeds 2025

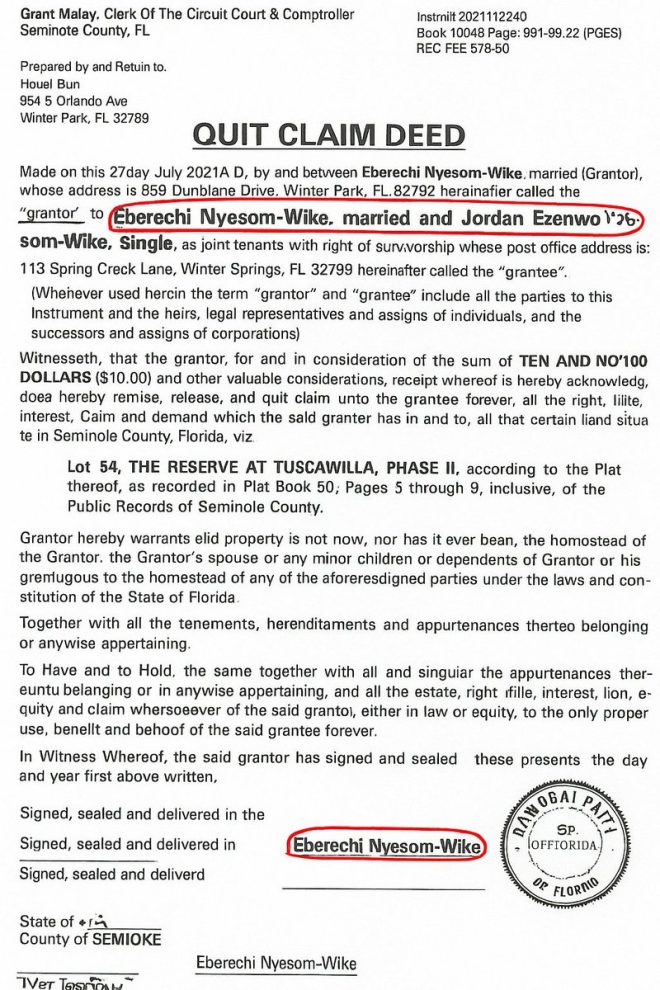

These are the Quit Claim Deeds that Nigeria’s FCT Minister, Nyesom Ezenwo Wike (@GovWike), and his wife, Eberechi Suzette Nyesom-Wike, a Court of Appeal judge in Nigeria, used to transfer three different Florida properties into the names of their children, Jordan, Joaquim, and… pic.twitter.com/1oMbnsWUeC

— Omoyele Sowore (@YeleSowore) September 21, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Understanding Quit Claim Deeds: A Case Study of Nyesom Wike’s Property Transfer in Florida

In the realm of real estate transactions, quit claim deeds play a significant role, especially in the context of transferring property ownership. A recent tweet by Omoyele Sowore highlighted a notable instance involving Nyesom Ezenwo Wike, the Federal Capital Territory (FCT) Minister of Nigeria, and his wife, Eberechi Suzette Nyesom-Wike, a respected Court of Appeal judge in Nigeria. The couple utilized quit claim deeds to transfer ownership of three distinct properties in Florida into the names of their children, Jordan and Joaquim. This case raises important questions about the implications and processes involved in using quit claim deeds for property transfers.

What is a Quit Claim Deed?

A quit claim deed is a legal instrument that is used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the property title. In essence, the grantor (the person transferring the property) relinquishes any claim to the property but does not guarantee that they hold a valid title to it. This makes quit claim deeds a popular choice for certain situations, such as transferring property between family members or in divorce settlements.

Features of Quit Claim Deeds

- No Title Guarantee: One of the most critical aspects of a quit claim deed is that it does not provide any assurance regarding the property’s title. The new owner receives whatever interest the grantor had, if any. This lack of guarantee can pose risks if there are existing liens or claims against the property.

- Simplicity and Speed: Quit claim deeds are straightforward and typically require minimal paperwork. This simplicity allows for quick transfers, making them an efficient option for family transfers or informal agreements.

- Common Uses: These deeds are often used among family members, in estate planning, or to clear up title issues. They are less common in traditional real estate transactions where buyers expect title guarantees.

The Case of Nyesom Wike’s Property Transfer

The tweet from Omoyele Sowore draws attention to the recent transfer of three Florida properties by Nyesom Wike and his wife to their children. This situation exemplifies the practical application of quit claim deeds in transferring property ownership within a family. It raises several questions regarding the motivations, legal considerations, and implications of such a transfer.

Motivations Behind Family Property Transfers

- Estate Planning: Transferring property to children can be a strategic move in estate planning. By using quit claim deeds, parents can ensure that their assets are directly passed on to their heirs, potentially avoiding probate complications later.

- Asset Protection: In some cases, transferring property to children may serve to protect assets from creditors or legal claims against the parents. However, this practice must be approached with caution to avoid potential legal issues.

- Tax Implications: Property transfers can have tax consequences. Depending on the jurisdiction, transferring property to children may trigger gift tax obligations or affect property tax assessments. Consulting a tax professional is advisable to navigate these complexities.

Legal Considerations

While quit claim deeds are relatively easy to execute, there are legal considerations that must be taken into account:

- Documentation: Proper documentation is essential. The quit claim deed must be accurately filled out, signed, and notarized to be legally binding. In some jurisdictions, it may also need to be recorded with the local land registry.

- Potential Liens: Since quit claim deeds do not guarantee a clean title, the new owners should conduct due diligence to check for existing liens or claims against the property. This step is crucial to avoid inheriting any legal issues related to the property.

- State Laws: Real estate laws vary significantly from one jurisdiction to another. It is important to understand the specific regulations governing quit claim deeds in the relevant state, such as Florida in this case.

Implications of the Transfer

The transfer of properties by public figures like Nyesom Wike can attract public scrutiny and raise ethical questions. Observers may wonder about the motivations behind such transfers and whether they reflect transparency in financial dealings. In this instance, the fact that a prominent political figure and a judicial officer are involved adds an additional layer of complexity.

Conclusion

Quit claim deeds serve as a powerful tool for property transfers, particularly within families. The recent case involving Nyesom Wike and his wife underscores the practicality of using quit claim deeds in estate planning and asset management. However, these transfers must be approached with caution, as they carry potential risks and legal implications.

Understanding the nuances of quit claim deeds, including their benefits and limitations, is essential for anyone considering property transfers. Whether for estate planning, asset protection, or personal reasons, being informed about the processes and legalities associated with quit claim deeds can help ensure a smooth and successful transaction.

As real estate continues to evolve, awareness of such instruments will remain critical for homeowners and investors alike. By examining cases like that of Nyesom Wike, we gain valuable insights into the practical applications of quit claim deeds and the broader implications of property ownership and transfer in today’s society.

Shocking Property Transfer: FCT Minister’s Family Secrets Revealed!

” />

These are the Quit Claim Deeds that Nigeria’s FCT Minister, Nyesom Ezenwo Wike (@GovWike), and his wife, Eberechi Suzette Nyesom-Wike, a Court of Appeal judge in Nigeria, used to transfer three different Florida properties into the names of their children, Jordan, Joaquim, and… pic.twitter.com/1oMbnsWUeC

— Omoyele Sowore (@YeleSowore) September 21, 2025

These are the Quit Claim Deeds that Nigeria’s FCT Minister, Nyesom Ezenwo Wike (@GovWike), and his wife, Eberechi Suzette Nyesom-Wike, a Court of Appeal judge in Nigeria, used to transfer three different Florida properties into the names of their children, Jordan, Joaquim, and…

In the realm of property transactions, Quit Claim Deeds often raise eyebrows, especially when influential figures are involved. Recently, the FCT Minister of Nigeria, Nyesom Ezenwo Wike, and his wife, Eberechi Suzette Nyesom-Wike, have come under scrutiny for their transfer of three Florida properties to their children. This event not only highlights the intricacies of property transfers but also invites public interest regarding the implications of such actions by notable personalities.

What is a Quit Claim Deed?

So, what exactly is a Quit Claim Deed? In simple terms, it’s a legal document that allows one party to transfer their interest in a property to another party without making any guarantees about the property’s title. Essentially, if you give someone a Quit Claim Deed, you’re saying, “I’m transferring whatever interest I have in this property to you.” It’s a straightforward way to transfer property, but it can also come with risks, particularly if there are existing liens or claims against the property.

Why Did Nyesom Wike Use a Quit Claim Deed?

The use of a Quit Claim Deed by Nigeria’s FCT Minister raises several questions. Why choose this method of property transfer? For many, including the Wikes, this approach might seem convenient. It allows for a quick transfer of ownership, especially when dealing with family members. Nyesom Wike and his wife, being public figures, likely aimed to simplify the process of transferring properties to their children, Jordan and Joaquim, while maintaining a level of privacy regarding their assets.

The Properties in Question

According to reports, the properties in Florida are significant assets. While the exact details of these properties remain under wraps, the choice of Florida as the location is noteworthy. The state is known for its favorable property laws and tax benefits, making it a prime location for real estate investments. The Wikes’ decision to invest in Florida raises curiosity about their long-term financial strategies and motivations.

Public Perception and Implications

The transfer of properties to their children has sparked discussions among the public and social media. Many view it as a strategic move to secure their children’s future, while others speculate about the motivations behind such a decision. The timing and context of these transfers can also play a role in public perception. For example, some might argue that, as public servants, the Wikes should be transparent about their financial dealings to maintain public trust.

Legal Considerations of Quit Claim Deeds

Using a Quit Claim Deed might seem straightforward, but it comes with its own set of legal considerations. For instance, it’s essential to ensure that the property is free of debts or claims before transferring it. If there are any existing liens, the new owner may inherit those obligations. This is particularly critical in the case of high-profile individuals like Nyesom Wike, as any legal entanglements could create significant public relations challenges.

The Role of Eberechi Suzette Nyesom-Wike

Eberechi Suzette Nyesom-Wike, serving as a Court of Appeal judge, adds another layer of complexity to this situation. Her legal background may have influenced the decision to utilize a Quit Claim Deed. As a judge, she would be well-versed in property law, and her involvement in this transaction could be seen as an endorsement of this method of transfer. However, it also raises questions about potential conflicts of interest and the ethical implications of her actions.

What This Means for Their Children

For their children, Jordan and Joaquim, inheriting properties through a Quit Claim Deed can be a double-edged sword. On one hand, it provides them with valuable assets that can secure their financial future. On the other hand, they may face the challenges of managing these properties and the responsibilities that come with them. The public will undoubtedly keep an eye on how the Wike children handle their newfound assets.

The Bigger Picture: Transparency and Accountability

This incident highlights broader themes of transparency and accountability in public service. As citizens, we often look to our leaders to set a standard for ethical behavior. The Wikes’ actions may prompt discussions about the responsibilities of public officials in managing their personal affairs and how these actions align with their public duties. It raises an important question: how much transparency should we expect from those in power regarding their financial dealings?

Conclusion

The Quit Claim Deeds executed by Nyesom Ezenwo Wike and Eberechi Suzette Nyesom-Wike serve as a case study in property transfer and public perception. As more details unfold, the implications of these transfers will likely continue to resonate within the public discourse. This situation serves as a reminder that even seemingly simple property transactions can carry significant weight, especially when influential individuals are involved. Whether viewed as a strategic move for family security or a potential source of controversy, the Wikes’ actions will undoubtedly be scrutinized as they unfold in the public eye.

Quit Claim Deeds in Florida, Nyesom Wike property transfer, Nigerian politicians real estate, Florida property laws 2025, family property transfer in Nigeria, court of appeal judges Nigeria, quit claim deed explained, real estate ownership transfer, property inheritance laws Nigeria, Nyesom Ezenwo Wike family, deed transfer process Florida, understanding quit claim deeds, Nigerian judges property rights, estate planning for families, real estate investment strategies 2025, children’s property rights Nigeria, legal aspects of property transfer, Florida real estate market trends, quit claim deed benefits