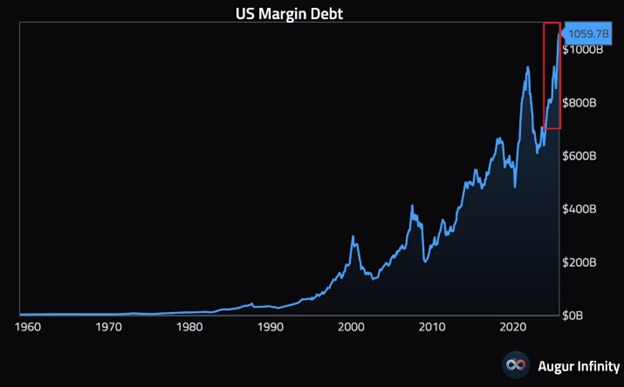

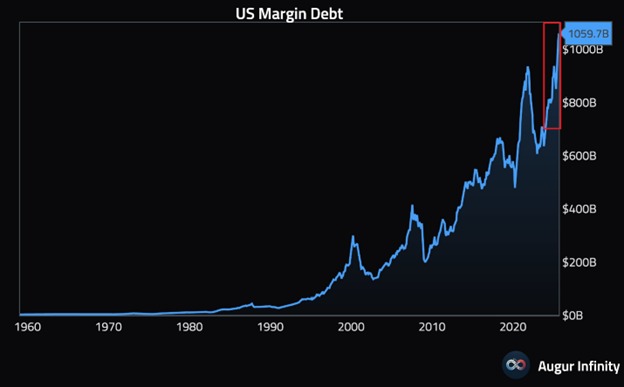

margin debt trends, investment borrowing strategies, stock market leverage

BREAKING: US margin debt jumped +$37 billion in August, to a record $1.06 trillion.

Over the last 3 months, margin debt has surged +$139 BILLION.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

On a YoY basis, the margin debt levels have risen a whopping +$798 billion, or +33%.

When adjusted for inflation, margin debt… pic.twitter.com/fynrPVJ5Tk

— The Kobeissi Letter (@KobeissiLetter) September 20, 2025

BREAKING: US margin debt jumped +$37 billion in August, to a record $1.06 trillion.

Have you heard the latest news? The US margin debt has soared to unprecedented levels, climbing by $37 billion in August alone. This jump has brought the total margin debt to a staggering $1.06 trillion. It’s essential to understand what this means for investors and the market as a whole.

Over the last 3 months, margin debt has surged +$139 BILLION.

The recent trend in margin debt indicates a significant increase, with a remarkable surge of $139 billion over the past three months. This sharp rise suggests that many investors are borrowing more to invest in stocks, betting on continued market growth. However, this trend also raises concerns about market stability, as high levels of margin debt can lead to increased volatility.

On a YoY basis, the margin debt levels have risen a whopping +$798 billion, or +33%.

When we look at this data on a year-over-year basis, the numbers are even more striking. The margin debt has skyrocketed by $798 billion, which translates to a 33% increase. Such rapid growth can signal a bullish market sentiment, but it also poses risks if the market were to correct.

When adjusted for inflation, margin debt…

It’s crucial to consider the inflation-adjusted figures for a clearer picture of the margin debt landscape. Inflation can significantly impact the real value of debt, making it essential for investors to keep these factors in mind. As you navigate this financial terrain, staying informed about margin debt trends can help you make more strategic investment decisions.

For more insights, check out the original tweet from The Kobeissi Letter.