interest rate cut recommendation, Federal Reserve policy changes, economic impact of interest rates

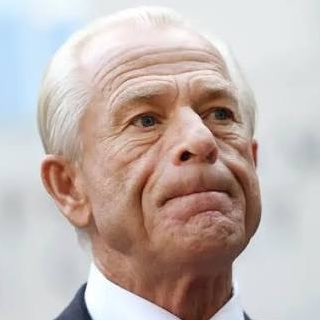

JUST IN: White house Advisor Navarro recommends the Fed to cut interest rates by 50 bps today and another 50 bps at next meeting. pic.twitter.com/bHS1ASpl7K

— Whale Insider (@WhaleInsider) September 17, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

White House Advisor Navarro Recommends Fed Rate Cuts

In a recent statement, White House Advisor Navarro has stirred conversations in the financial world by recommending that the Federal Reserve cut interest rates by 50 basis points today and another 50 basis points in the next meeting. This bold suggestion reflects ongoing concerns about economic growth and inflation.

Navarro’s proposal highlights a strategic move to stimulate the economy amid fluctuating market conditions. By lowering the interest rates, borrowing costs would decrease for consumers and businesses alike, potentially encouraging spending and investment. This economic strategy aligns with the need for a more robust recovery, especially in sectors that have been hit hard by recent economic trends.

Implications of Rate Cuts

If the Federal Reserve takes Navarro’s advice and implements these cuts, the immediate impact could be significant. Lower interest rates can lead to increased consumer confidence, as loans for homes, cars, and other purchases become more affordable. Additionally, businesses may find it easier to finance expansion projects, which can create jobs and boost the economy further.

However, there are concerns about potential long-term effects. Critics argue that such aggressive rate cuts could lead to inflationary pressures, particularly if the economy overheats. It’s a delicate balance that the Federal Reserve must navigate to ensure sustainable growth without triggering unintended consequences.

Keeping an Eye on Economic Indicators

As we await the Fed’s decision, it’s crucial to monitor economic indicators closely. Job growth, inflation rates, and consumer spending patterns will all play a role in shaping the Fed’s approach. For those interested in the evolving economic landscape, staying informed through reliable sources is essential.

For more insights, check out the original tweet from Whale Insider here.