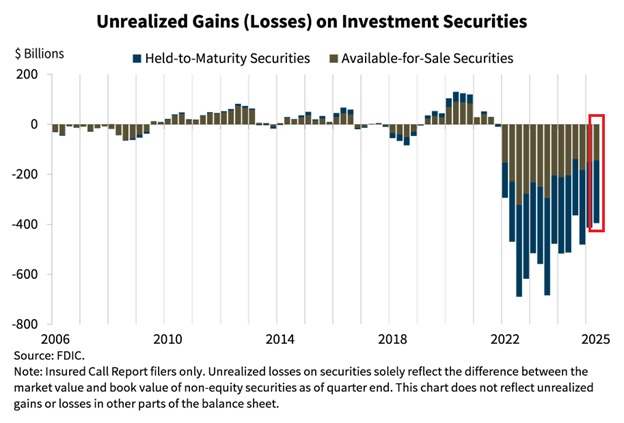

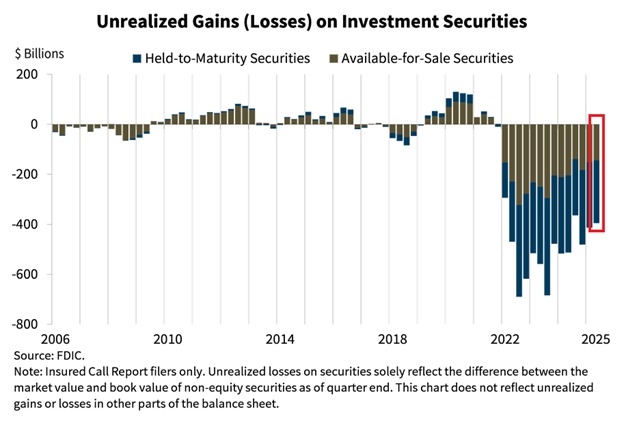

banking crisis, investment securities losses, interest rate impact

BREAKING: Unrealized losses on investment securities for US banks reached $395.3 billion in Q2 2025.

This is ~6 TIMES higher than at the peak of the 2008 Financial Crisis.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This also marks the 13th consecutive quarter of losses as interest rates remained elevated.

Meanwhile,… pic.twitter.com/uDzbrtpVOs

— The Kobeissi Letter (@KobeissiLetter) September 16, 2025

Unrealized losses on investment securities for US banks reached $395.3 billion in Q2 2025

In a startling revelation, unrealized losses on investment securities for US banks have skyrocketed to $395.3 billion in the second quarter of 2025. This figure is approximately six times higher than the peaks experienced during the 2008 Financial Crisis, raising eyebrows and concerns among financial experts and everyday investors alike.

This is ~6 TIMES higher than at the peak of the 2008 Financial Crisis

The enormity of these losses highlights the ongoing struggles within the banking sector. With interest rates remaining elevated, banks are feeling the pinch as they grapple with the impact of these unrealized losses. This situation mirrors the financial turmoil seen over a decade ago, prompting discussions about the stability of the current banking system and the potential for future repercussions.

This also marks the 13th consecutive quarter of losses as interest rates remained elevated

What’s even more unsettling is that this marks the 13th consecutive quarter of losses for US banks. Such a prolonged period of financial strain raises questions about the sustainability of these institutions. As interest rates continue to climb, many analysts are speculating on the long-term effects this could have on the banking landscape. Could we be facing another crisis? It’s a question that looms large as the financial world monitors these developments closely.

For those looking to navigate this tumultuous environment, staying informed is crucial. Keeping an eye on updates from trusted financial news sources can provide valuable insights and help you understand how these trends might affect your investments. For further details, you can check the original tweet from The Kobeissi Letter here.