Trump’s SCOTUS stay denied

Lisa Cook Fed board victory

DC Circuit rejects trump

Interest-rate meeting Lisa Cook

Trump’s bid rejected by DC Circuit

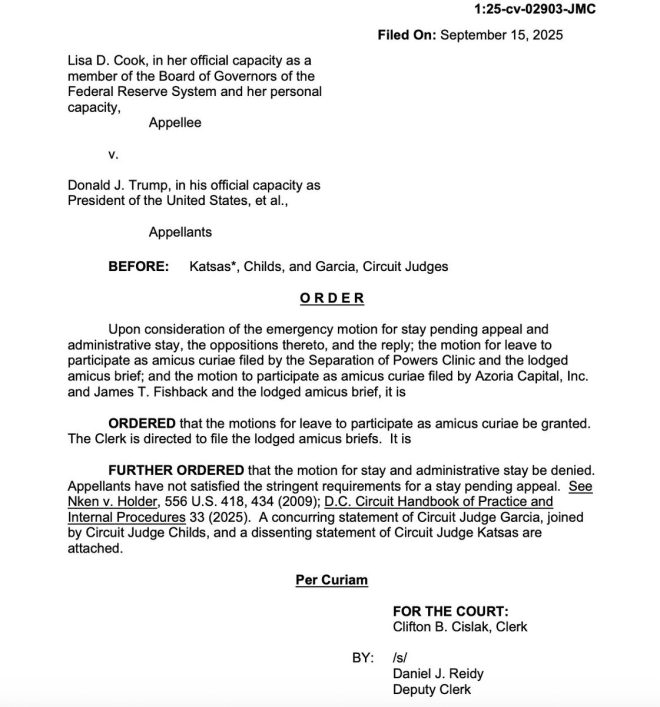

BREAKING: The DC Circuit has *rejected* Trump’s bid to fire Lisa Cook from the Fed board, allowing her to participate in tomorrow’s interest-rate setting meeting.

Trump’s last hope is a quick stay from SCOTUS. https://t.co/wNtfx9GWW2 pic.twitter.com/1eZGAmLjhO

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Kyle Cheney (@kyledcheney) September 16, 2025

In a recent development, the DC Circuit has made a significant decision regarding Lisa Cook’s position on the Federal Reserve board. The court has rejected Trump’s attempt to remove Cook from her role, allowing her to take part in an upcoming meeting to set interest rates. This decision comes as a blow to Trump, who now looks to the Supreme Court for a quick stay on the ruling.

Lisa Cook’s position on the Fed board has been a point of contention for some time now, with Trump seeking to remove her from the board. However, the DC Circuit’s decision has put a halt to these efforts, at least for the time being. Cook will now be able to participate in the crucial interest-rate setting meeting, where her input could have a significant impact on the country’s economic policies.

This decision is likely to have far-reaching consequences, as the Federal Reserve plays a key role in shaping the country’s monetary policy. Cook’s participation in the meeting could potentially influence the direction of interest rates, which in turn could have implications for various sectors of the economy. The decision by the DC Circuit to reject Trump’s bid to remove Cook is therefore significant in the context of the country’s economic landscape.

With Trump’s last hope resting on a quick stay from the Supreme Court, the situation remains fluid. It will be interesting to see how the Supreme Court responds to this request and whether Cook will ultimately be able to retain her position on the Fed board. The outcome of this case could have broader implications for the independence of the Federal Reserve and the ability of the president to influence its decisions.

In conclusion, the DC Circuit’s decision to reject Trump’s attempt to remove Lisa Cook from the Federal Reserve board is a significant development with potential implications for the country’s economic policies. Cook’s participation in the upcoming interest-rate setting meeting could have far-reaching consequences, and Trump’s last hope now lies with the Supreme Court. The outcome of this case will be closely watched by economists, policymakers, and the public alike, as it could have a lasting impact on the functioning of the Federal Reserve and the country’s economic stability.

BREAKING: The DC Circuit has *rejected* Trump’s bid to fire Lisa Cook from the Fed board, allowing her to participate in tomorrow’s interest-rate setting meeting.

Trump’s last hope is a quick stay from SCOTUS. https://t.co/wNtfx9GWW2 pic.twitter.com/1eZGAmLjhO

— Kyle Cheney (@kyledcheney) September 16, 2025

In a recent development, the DC Circuit has rejected Trump’s attempt to remove Lisa Cook from the Fed board. This decision allows Cook to partake in an upcoming interest-rate setting meeting, despite Trump’s efforts to have her dismissed. This ruling marks a significant moment in the ongoing saga surrounding the composition of the Federal Reserve Board.

The DC Circuit’s rejection of Trump’s bid to fire Cook comes as a surprise to many, given the contentious nature of the situation. Trump’s last hope now rests on the possibility of a swift intervention from the Supreme Court of the United States (SCOTUS). This turn of events has left many wondering about the potential implications for the upcoming meeting and the broader functioning of the Federal Reserve.

The decision by the DC Circuit to uphold Cook’s position on the Fed board is likely to have far-reaching consequences. It underscores the importance of maintaining the independence and integrity of key financial institutions, such as the Federal Reserve. By allowing Cook to participate in the interest-rate setting meeting, the court has reaffirmed the principle of merit-based appointments to crucial roles within the government.

Trump’s attempt to remove Cook from the Fed board has been met with widespread criticism and scrutiny. Many have raised concerns about the potential politicization of the Federal Reserve and the negative impact it could have on the economy. The DC Circuit’s decision to reject Trump’s bid is a clear indication that the rule of law and institutional autonomy are paramount in safeguarding the stability and credibility of financial institutions.

As the situation continues to unfold, all eyes are now on the Supreme Court to see if they will intervene and overturn the DC Circuit’s ruling. The outcome of this legal battle will have significant implications not only for Lisa Cook and the Federal Reserve but also for the broader political landscape in the United States. It remains to be seen how this latest twist in the saga will play out and what the ultimate repercussions will be for all parties involved.

In conclusion, the DC Circuit’s rejection of Trump’s attempt to fire Lisa Cook from the Fed board is a significant moment in the ongoing debate over the independence and integrity of key financial institutions. The decision underscores the importance of upholding the rule of law and ensuring that merit-based appointments are made to critical government positions. With Trump’s last hope now resting on the Supreme Court, the outcome of this legal battle is sure to have far-reaching implications for the Federal Reserve and the broader political landscape in the United States.

Trump administration, Lisa Cook, Federal Reserve, interest rates, SCOTUS, DC Circuit, legal battle, government decision, court ruling, Federal Reserve board, political controversy, economic policy, judicial process, legal challenge, presidential authority, financial market, decision-making process, political intervention, monetary policy, legal proceedings