business reporting reform, long-term corporate strategy, financial transparency changes

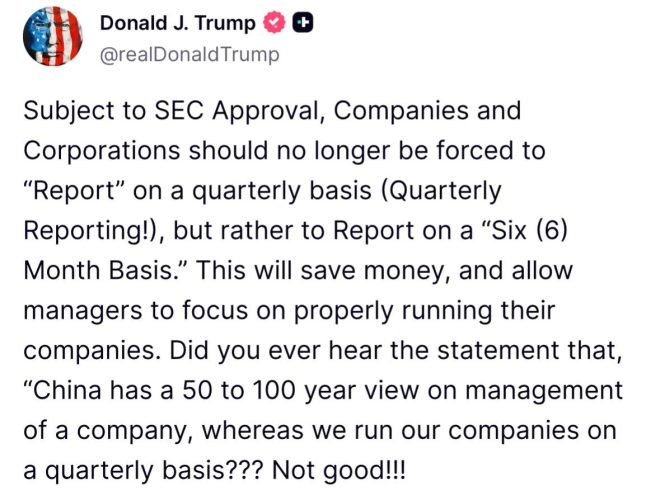

JUST IN: President trump now intends to revoke the forced quarterly reports for companies, and move it to six months

“Did you ever hear the statement that, “China has a 50 to 100 year view on management of a company, whereas we run our companies on a quarterly basis??? Not https://t.co/OdWLZzkrJK

JUST IN: President Trump now intends to revoke the forced quarterly reports for companies, and move it to six months

In a significant shift in corporate reporting policy, President Trump has announced plans to revoke the forced quarterly reports for companies, proposing instead that these reports be submitted every six months. This change aims to alleviate some of the pressure on businesses and allow them to adopt a longer-term approach to their management strategies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The current system of quarterly reporting has often been criticized for encouraging short-term thinking among corporate executives. Many argue that it forces companies to prioritize immediate results over sustainable growth. As President Trump pointed out, "Did you ever hear the statement that, ‘China has a 50 to 100 year view on management of a company, whereas we run our companies on a quarterly basis?’" This statement highlights a crucial difference in business philosophy that could impact competitive dynamics in the global market.

By allowing companies to focus on semi-annual reporting, businesses can better allocate resources and invest in long-term projects without the incessant pressure of quarterly earnings calls. This shift could also help to stabilize stock prices, which often fluctuate dramatically based on quarterly results that may not represent a company’s true performance.

Critics, however, are concerned that reducing the frequency of financial reporting could lead to less transparency in the market. Investors rely on timely information to make informed decisions, and longer intervals between reports might hinder this process. Ensuring that companies remain accountable while also allowing them the freedom to think long-term will be a balancing act for the administration.

As we watch how this policy unfolds, it will be important to consider both the potential benefits and drawbacks of moving to six-month reporting. This change could redefine how companies operate and interact with shareholders in a rapidly evolving business landscape.