Bitcoin investment trends, institutional cryptocurrency purchases, market dip strategies

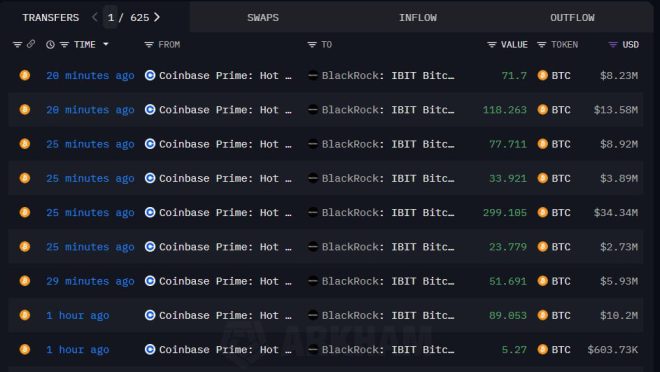

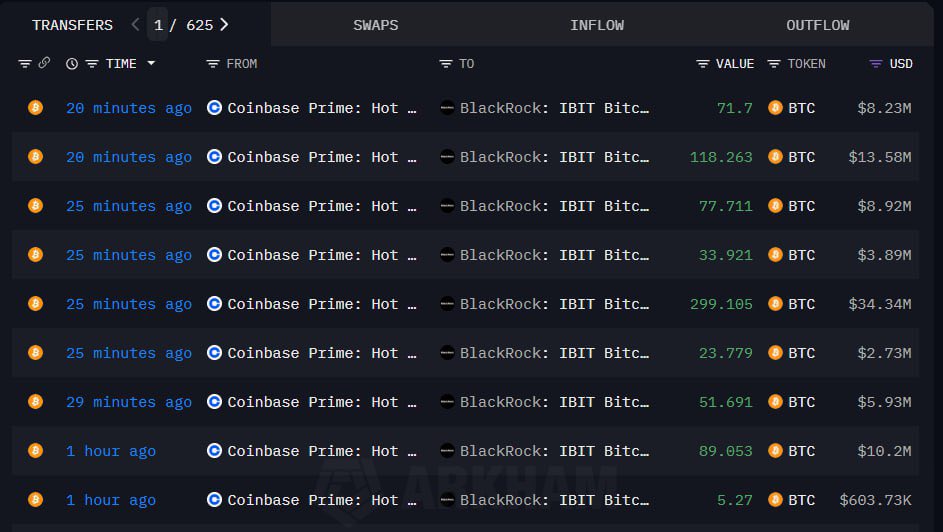

BREAKING: BLACKROCK HAS JUST BOUGHT 770 $BTC WORTH $88.4 MILLION ON COINBASE.

INSTITUTIONS ARE BUYING THE DIP. pic.twitter.com/FlGjAc6iQK

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Ash Crypto (@Ashcryptoreal) September 15, 2025

BLACKROCK HAS JUST BOUGHT 770 $BTC WORTH $88.4 MILLION ON COINBASE

In a significant move, BlackRock has purchased 770 Bitcoin (BTC), valued at approximately $88.4 million, on Coinbase. This transaction highlights the growing interest of institutional investors in cryptocurrency, particularly during market dips. With Bitcoin’s volatility, savvy investors are seizing opportunities to buy low, and BlackRock’s latest acquisition is a testament to their confidence in the asset’s long-term potential.

INSTITUTIONS ARE BUYING THE DIP

The phrase "buying the dip" has become a common strategy among investors, especially in the cryptocurrency market. When prices drop, seasoned investors often see it as a perfect opportunity to increase their holdings at a lower cost. BlackRock’s substantial investment is a clear signal that they believe in Bitcoin’s recovery and future growth. As major financial institutions embrace digital currencies, it’s a pivotal moment for the crypto market as a whole.

This trend isn’t just limited to BlackRock; other institutional players are also getting involved. The influx of institutional investment serves to stabilize the market and can lead to increased adoption and recognition of cryptocurrencies as a legitimate asset class.

If you’re interested in following the latest updates on cryptocurrency investments and trends, be sure to check out Ash Crypto’s Twitter for real-time insights. The landscape of digital currency is changing rapidly, and staying informed can help you navigate these exciting developments.

As we see more institutions like BlackRock stepping into the crypto arena, it’s clear that the future of Bitcoin and other digital assets is bright. Keep an eye on these developments, as they can significantly impact market dynamics and investment strategies.