rate cut predictions, inflation trends analysis, economic impact of PPI

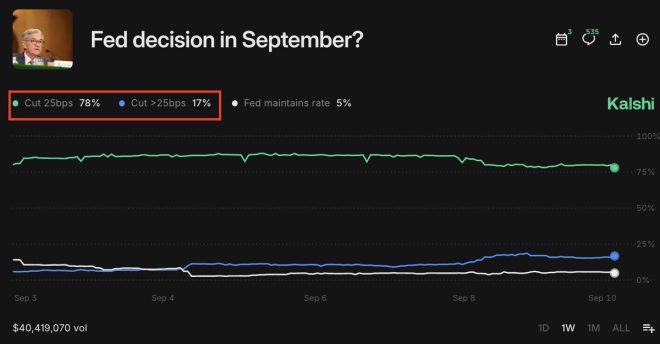

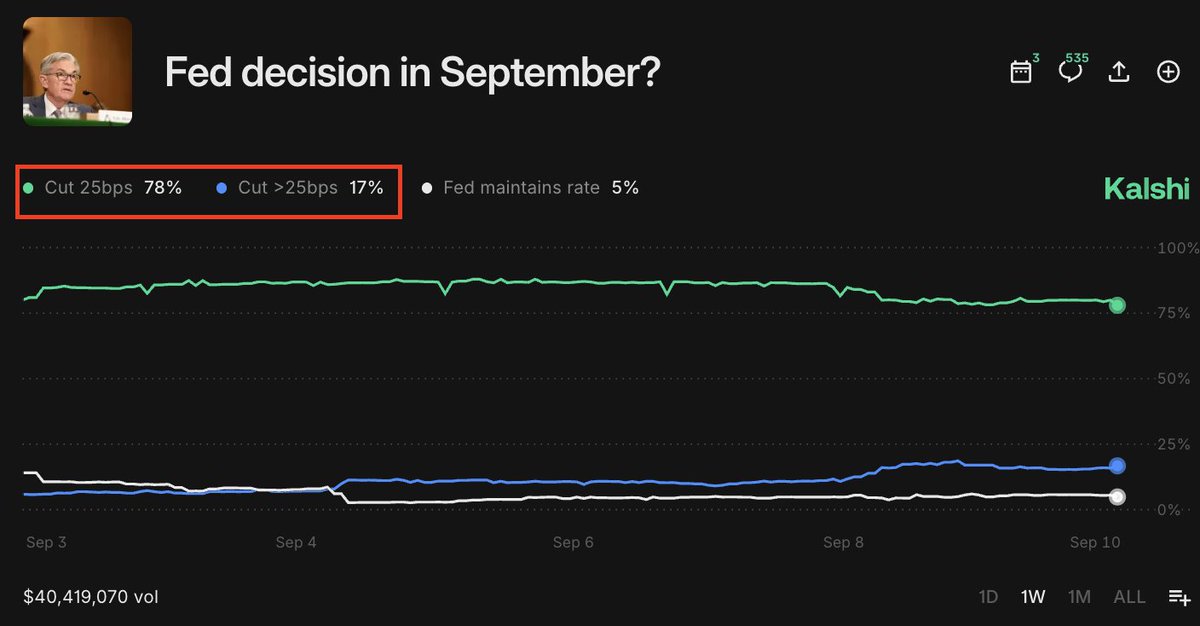

BREAKING: The odds of a 50 basis point rate cut surge to 19% after PPI inflation unexpectdly declines, per Kalshi. pic.twitter.com/YQZV4nmapE

— The Kobeissi Letter (@KobeissiLetter) September 10, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: The odds of a 50 basis point rate cut surge to 19%

In a significant development, the odds of a 50 basis point rate cut have surged to 19%. This shift follows an unexpected decline in Producer Price Index (PPI) inflation, which has caught the attention of economists and investors alike. According to data from Kalshi, this change could influence the Federal Reserve’s monetary policy decisions in the coming months.

The recent drop in PPI inflation suggests that prices at the wholesale level are stabilizing, which may prompt the Fed to reconsider its stance on interest rates. Lower inflation rates typically lead to a more accommodative monetary policy, making it cheaper for consumers and businesses to borrow. This could potentially stimulate economic growth as spending increases.

As investors digest this news, the implications for the stock market and other financial assets will be crucial. A rate cut could lead to higher stock prices as borrowing costs decrease, encouraging investment. Investors should remain vigilant and consider how these changes in interest rate expectations might affect their portfolios.

For a deeper analysis, you can follow updates from financial experts like those at The Kobeissi Letter, who provide insights into market trends and economic forecasts. Their analysis can help you understand how these developments might impact your financial decisions.

In summary, the surge in the odds of a 50 basis point rate cut following the unexpected decline in PPI inflation is noteworthy. As the situation evolves, staying informed will be vital for anyone navigating the current economic landscape. Whether you’re an investor or just someone interested in the economy, these developments are worth keeping an eye on.