Federal Reserve balance sheet reduction, impact of monetary policy on economy, trends in asset management strategies

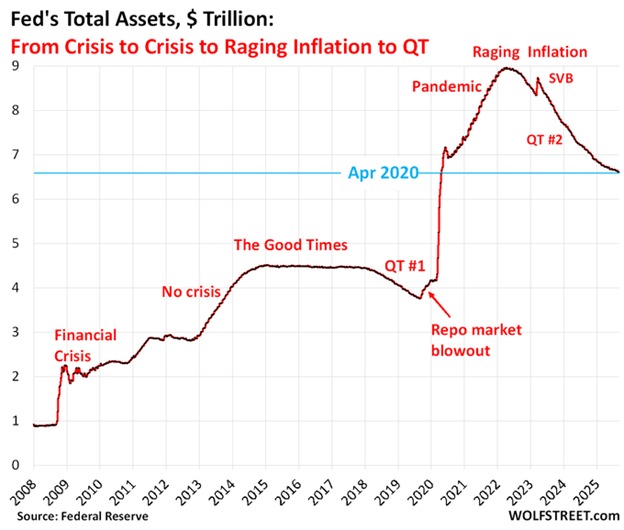

BREAKING: The Federal Reserve’s balance sheet fell by -$39 billion in August, to $6.60 trillion, the lowest since April 2020.

Since the April 2022 peak, the Fed has reduced its assets by -$2.36 trillion, or -26.4%.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This unwinds 49.2% of the +$4.81 trillion in pandemic-era… pic.twitter.com/Jmer8IdfTG

— The Kobeissi Letter (@KobeissiLetter) September 10, 2025

BREAKING: The Federal Reserve’s balance sheet fell by -$39 billion in August, to $6.60 trillion, the lowest since April 2020.

The latest data reveals a significant shift in the Federal Reserve’s balance sheet. In August, the Fed’s balance sheet decreased by -$39 billion, bringing it down to $6.60 trillion. This marks the lowest level since April 2020, a pivotal time when the economic landscape was heavily impacted by the COVID-19 pandemic. Understanding these numbers is crucial for anyone interested in the current state of the U.S. economy and monetary policy.

Since the April 2022 peak, the Fed has reduced its assets by -$2.36 trillion, or -26.4%. This reduction in the balance sheet reflects the Fed’s ongoing efforts to tighten monetary policy after years of expansion during the pandemic. The unwinding of these assets is a significant step, indicating a shift from the aggressive monetary easing that characterized the early pandemic response.

This unwinds 49.2% of the +$4.81 trillion in pandemic-era asset purchases. The scale of these reductions shows how the Fed is navigating the delicate balance of curbing inflation while supporting economic recovery. Investors and economists alike are watching these developments closely, as they have far-reaching implications for interest rates, inflation, and overall economic growth.

For more insights on this topic, you can dive deeper into the data provided by financial analysts and experts who regularly discuss the Federal Reserve’s strategies. Keeping an eye on these changes will help you stay informed about the economic trends that could impact you directly.