Mortgage fraud scandal, Letitia James exposed, Citizens Bank scandal, Brooklyn real estate scam, Letitia James controversy

Letitia James is cooked

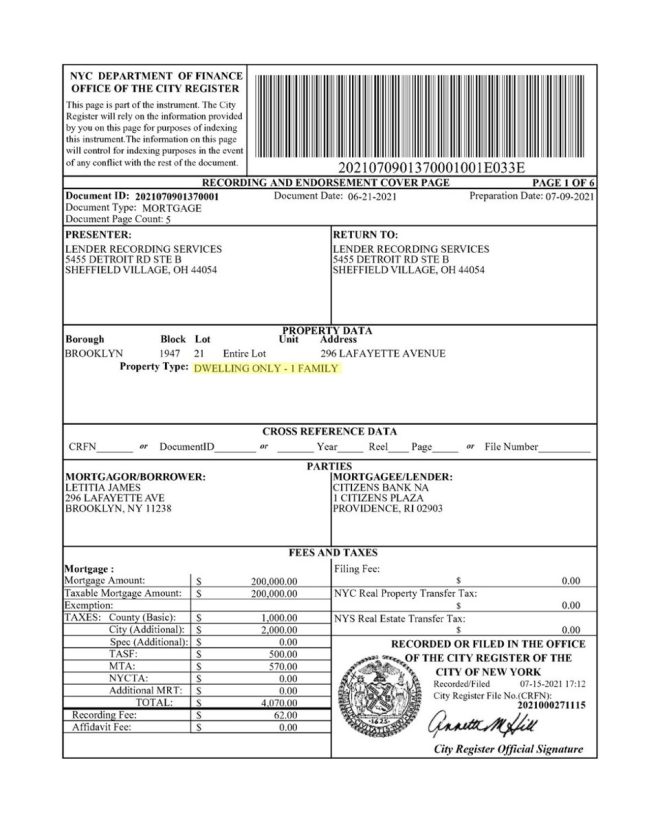

She’s been exposed again for mortgage fraud with Citizens Bank in 2021, after allegedly misrepresenting her 5-unit Brooklyn building as a single-family home to secure a $200K credit line.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This allowed her to avoid higher commercial loan costs and… pic.twitter.com/5BY6bhE7Yy

— Benny Johnson (@bennyjohnson) September 8, 2025

Letitia James, the current Attorney General of New York, has recently been embroiled in a scandal involving mortgage fraud with Citizens Bank in 2021. A tweet by journalist Benny Johnson brought this issue to light, accusing James of misrepresenting her 5-unit Brooklyn building as a single-family home in order to secure a $200K credit line. This alleged deception allowed her to avoid higher commercial loan costs and potentially save a significant amount of money.

Mortgage fraud is a serious offense that can have far-reaching consequences for those involved. In this case, Letitia James, who is supposed to uphold the law and protect the rights of New Yorkers, is being accused of engaging in fraudulent behavior herself. This revelation has cast a shadow over her reputation and raised questions about her integrity and trustworthiness.

The use of mortgage fraud to obtain financial benefits is a common tactic used by individuals looking to circumvent the rules and regulations of the banking industry. By misrepresenting the nature of her property, James was able to secure a credit line that she may not have been eligible for otherwise. This type of deception can have serious legal and financial implications, and those found guilty of mortgage fraud can face stiff penalties, including fines and imprisonment.

Citizens Bank, the financial institution involved in this case, may also face consequences for their role in the alleged fraud. Banks have a responsibility to conduct thorough due diligence when approving loans and lines of credit, and failure to do so can result in regulatory scrutiny and reputational damage. The fact that James was able to secure a credit line based on false information raises questions about the bank’s internal controls and risk management practices.

The timing of this scandal is particularly concerning, as Letitia James is currently serving as the Attorney General of New York, a position that requires the utmost integrity and adherence to the law. If these allegations are proven to be true, it could have serious implications for her political career and reputation. Elected officials are held to a higher standard of conduct, and any hint of impropriety can lead to public outrage and calls for resignation.

It is important for the authorities to conduct a thorough investigation into these allegations and determine the truth behind the accusations. Mortgage fraud is a serious crime that undermines the integrity of the financial system and puts honest borrowers at a disadvantage. If Letitia James is found guilty of engaging in fraudulent behavior, she must be held accountable for her actions and face the appropriate legal consequences.

In conclusion, the allegations of mortgage fraud against Letitia James are troubling and raise serious questions about her character and fitness for office. The use of deception to obtain financial benefits is a serious offense that can have far-reaching consequences. It is important for the authorities to investigate these allegations thoroughly and hold those responsible accountable for their actions. Letitia James, as a public official, should be held to the highest standards of ethical conduct, and any breach of trust must be met with swift and decisive action.

Letitia James is cooked

She’s been exposed again for mortgage fraud with Citizens Bank in 2021, after allegedly misrepresenting her 5-unit Brooklyn building as a single-family home to secure a $200K credit line.

This allowed her to avoid higher commercial loan costs and… pic.twitter.com/5BY6bhE7Yy

— Benny Johnson (@bennyjohnson) September 8, 2025

Letitia James has found herself in hot water yet again, this time for allegedly committing mortgage fraud with Citizens Bank in 2021. It is reported that she misrepresented her 5-unit Brooklyn building as a single-family home in order to secure a $200K credit line. This deceptive move allowed her to avoid higher commercial loan costs and potentially saved her a significant amount of money.

This recent scandal involving Letitia James sheds light on the issue of mortgage fraud, a serious crime that can have far-reaching consequences. Mortgage fraud occurs when false information is provided on a mortgage application in order to secure a loan under false pretenses. This type of fraud can have damaging effects on the financial system as a whole, leading to increased costs and risks for lenders and borrowers alike.

The case involving Letitia James is particularly troubling because of her position as a public official. As the Attorney General of New York, she is expected to uphold the law and act with integrity. However, her alleged involvement in mortgage fraud raises questions about her character and judgment. It is essential for public officials to be held to a higher standard of conduct, as their actions can have a significant impact on the community and society as a whole.

The allegations against Letitia James are a stark reminder of the importance of transparency and honesty in all financial transactions. Mortgage fraud is a serious crime that can result in severe penalties, including fines, imprisonment, and damage to one’s reputation. It is crucial for individuals to be honest and forthright when applying for a mortgage, as any misrepresentation can have serious legal and financial consequences.

In conclusion, the allegations of mortgage fraud against Letitia James are a serious matter that must be thoroughly investigated. It is essential for all individuals, especially public officials, to act with honesty and integrity in all financial transactions. Mortgage fraud is a crime that can have far-reaching consequences, and those who engage in fraudulent activities must be held accountable for their actions. Letitia James is innocent until proven guilty, but the allegations against her are concerning and must be taken seriously. It is crucial for the justice system to conduct a thorough investigation to determine the truth of the matter and ensure that justice is served.

Letitia James scandal, Letitia James controversy, Letitia James accusations, Letitia James corruption, Letitia James fraud, Letitia James investigation, Letitia James legal troubles, Letitia James ethics violation, Letitia James mortgage scheme, Letitia James financial misconduct, Letitia James real estate fraud, Letitia James Brooklyn property, Letitia James Citizens Bank, Letitia James credit line, Letitia James loan fraud, Letitia James misrepresentation, Letitia James mortgage deception, Letitia James scandal 2021, Letitia James mortgage fraud 2021.