BlackRock cryptocurrency investment strategy, Ethereum market trends analysis, Bitcoin adoption and institutional investment

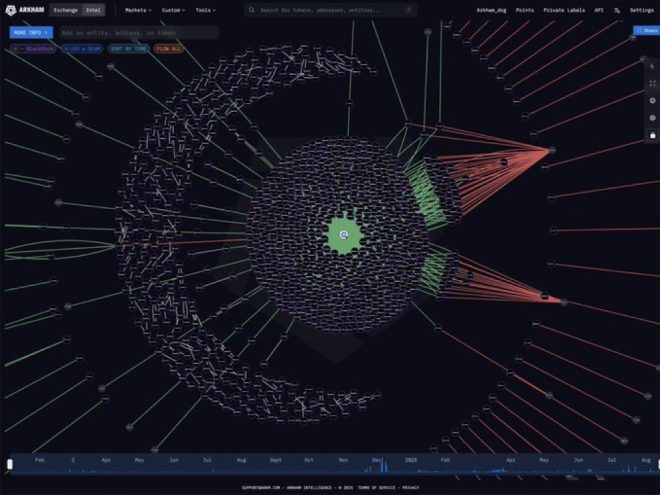

JUST IN: BlackRock has just sold $151.4 million $ETH and bought $289.8 million worth of $BTC – via Arkham pic.twitter.com/LyPjWkslnT

— Ash Crypto (@Ashcryptoreal) September 4, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BlackRock’s Recent Moves in Cryptocurrency

In a significant shift in its cryptocurrency strategy, BlackRock has made headlines by selling $151.4 million worth of Ethereum (ETH) while investing $289.8 million into Bitcoin (BTC). This move, reported by Ash Crypto via Arkham, highlights BlackRock’s ongoing interest in the evolving digital asset market.

The Shift from Ethereum to Bitcoin

BlackRock’s decision to sell ETH and buy BTC raises intriguing questions about its future outlook on these two major cryptocurrencies. Ethereum has been praised for its smart contract capabilities and decentralized applications, while Bitcoin remains the most recognized and widely adopted cryptocurrency. By reallocating funds from ETH to BTC, BlackRock seems to be betting on Bitcoin’s potential as a store of value and a hedge against inflation.

What This Means for Investors

For investors, BlackRock’s actions could serve as a barometer for cryptocurrency trends. As one of the largest asset management firms in the world, BlackRock’s strategies often influence market sentiment. If they believe Bitcoin is a better investment than Ethereum at this moment, it might encourage other investors to reconsider their portfolios as well.

Keeping an Eye on the Market

The cryptocurrency market is highly volatile and can change rapidly. Investors should stay informed about major players’ movements, such as BlackRock’s, to make educated decisions. Monitoring their strategies can provide insights into broader market trends and potential shifts in investment focus.

Final Thoughts

As BlackRock continues to navigate the cryptocurrency landscape, its recent sale of $151.4 million in ETH and purchase of $289.8 million in BTC exemplifies the dynamic nature of digital assets. Whether this shift will pay off remains to be seen, but it certainly adds another layer of complexity to the ongoing conversation about the future of cryptocurrencies.