Next-Gen Tax Reforms, GST Council Updates, Modi Independence Day Speech, Red Fort Address 2025, Multi-Sector Reform Initiatives

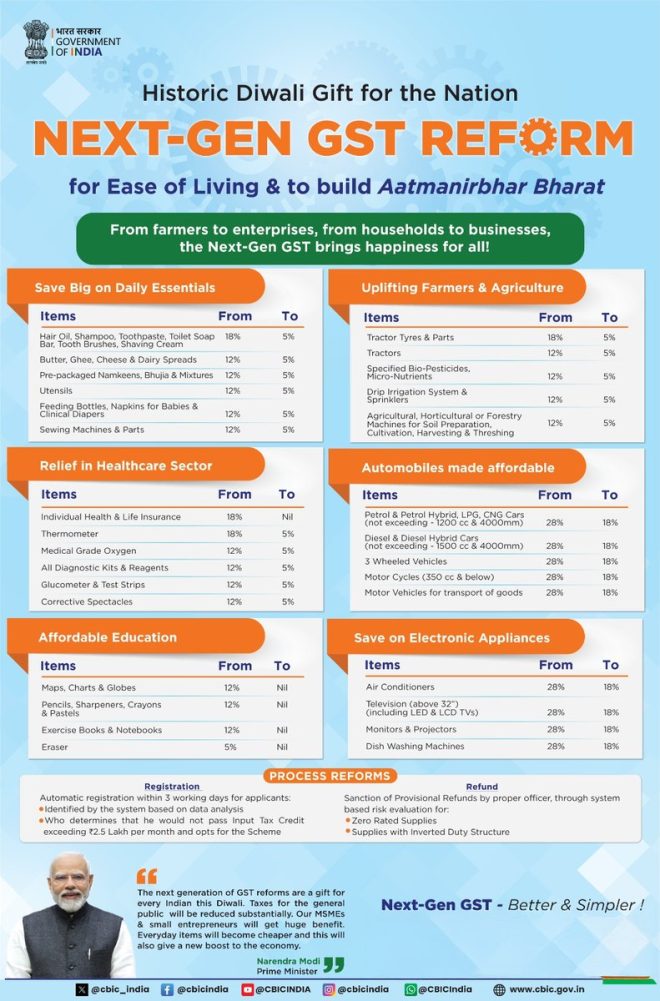

Hon’ble Prime Minister Shri @narendramodi announced the Next-Generation GST Reforms in his Independence Day address from the ramparts of Red Fort.

Working on the same principle, the GST Council has approved significant reforms today.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

These reforms have a multi-sectoral and… pic.twitter.com/NzvvVScKCF

— Nirmala Sitharaman Office (@nsitharamanoffc) September 3, 2025

Next-Generation GST Reforms Announced by Prime Minister Modi

In a significant announcement made during his Independence Day speech from the historic Red Fort, Prime Minister Shri Narendra Modi unveiled a set of Next-Generation Goods and Services Tax (GST) reforms aimed at enhancing the efficiency and effectiveness of the taxation system in India. This announcement has been met with much anticipation and excitement, as it promises to bring about substantial changes that could benefit various sectors of the economy.

Overview of the GST Reforms

The GST Council, under the guidance of Finance Minister Nirmala Sitharaman, has approved these pivotal reforms that focus on streamlining the GST framework. The reforms are designed to not only simplify the tax structure but also to ensure a more equitable and transparent taxation process. These changes are expected to have multi-sectoral impacts, influencing a variety of industries and sectors across the country.

Objectives of the Next-Generation GST Reforms

The primary objectives of the Next-Generation GST reforms include:

- Simplification of Tax Structure: One of the core aims is to simplify the existing tax structure. This involves reducing the number of tax slabs and making compliance easier for businesses, especially for small and medium enterprises (SMEs).

- Enhancing Compliance: The reforms seek to enhance compliance by introducing more user-friendly digital tools and platforms. This will help businesses in filing returns and maintaining records more efficiently.

- Promoting Transparency: Transparency in the taxation process is crucial for building trust among taxpayers. The reforms are set to implement measures that increase transparency in tax assessments and audits.

- Boosting Economic Growth: By making the GST system more efficient, the government aims to stimulate economic growth. An effective GST system can lead to increased investments, higher revenue collection, and ultimately, enhanced economic development.

- Empowering the States: The reforms also focus on empowering state governments by providing them with more autonomy in tax collection and management, fostering a collaborative environment between the central and state governments.

Key Features of the Reforms

The Next-Generation GST reforms incorporate several key features that are designed to address the existing challenges in the GST framework:

- Reduction in Tax Slabs: A significant reduction in the number of tax slabs is expected, which will simplify the taxation process for businesses and consumers alike.

- Integration of Technology: The reforms will leverage advanced technology to automate various processes, including tax filing and compliance checks, making it easier for businesses to adhere to tax regulations.

- Incentives for Compliance: To encourage timely compliance, the reforms may introduce incentive schemes for businesses that consistently file their returns on time and maintain accurate records.

- Focus on SMEs: Recognizing the vital role of small and medium enterprises in the economy, the reforms will include provisions specifically tailored to support SMEs, such as reduced compliance burdens and access to credit facilities.

- Strengthening Audit Mechanisms: Enhanced audit mechanisms will be implemented to ensure that tax evasion is effectively tackled while maintaining fairness in assessments.

Implications for Various Sectors

The Next-Generation GST reforms are expected to have far-reaching implications across various sectors of the economy:

- Manufacturing Sector: By reducing compliance burdens and streamlining processes, the manufacturing sector is likely to experience improved efficiency and productivity, leading to increased competitiveness.

- Retail Sector: The retail sector stands to benefit from a simplified tax structure, which can enhance consumer spending and drive business growth.

- Service Sector: Service providers may find it easier to navigate the GST landscape with the introduction of user-friendly digital tools, which can lead to increased service delivery and customer satisfaction.

- Agriculture Sector: The reforms may also positively impact the agriculture sector by simplifying tax compliance for farmers and providing them with better access to markets.

Conclusion

The announcement of the Next-Generation GST reforms by Prime Minister Modi signifies a transformative step towards a more efficient and transparent taxation system in India. As the GST Council continues to work on implementing these reforms, the focus remains on fostering economic growth and enhancing compliance while empowering both businesses and state governments.

The multi-sectoral approach of these reforms reflects the government’s commitment to creating a conducive environment for economic development. As the nation moves forward with these changes, stakeholders across various sectors are encouraged to engage actively in the process, ensuring that the reforms are successful in achieving their intended objectives.

In summary, the Next-Generation GST reforms represent a monumental shift in India’s taxation framework, promising to simplify processes, enhance compliance, and ultimately contribute to the country’s economic progress. With the right implementation, these reforms could lay the foundation for a robust and equitable taxation system that benefits all sectors of the economy.

GST Revolution: Modi’s Bold Move Sparks Nationwide Debate!

” />

Hon’ble Prime Minister Shri @narendramodi announced the Next-Generation GST Reforms in his Independence Day address from the ramparts of Red Fort.

Working on the same principle, the GST Council has approved significant reforms today.

These reforms have a multi-sectoral and… pic.twitter.com/NzvvVScKCF

— Nirmala Sitharaman Office (@nsitharamanoffc) September 3, 2025

Hon’ble Prime Minister Shri @narendramodi Announced the Next-Generation GST Reforms in His Independence Day Address from the Ramparts of Red Fort

Every year, India eagerly awaits the Prime Minister’s Independence Day address, and this year was no exception. Hon’ble Prime Minister Shri @narendramodi captured the nation’s attention as he announced the Next-Generation GST Reforms. Speaking from the historic ramparts of the Red Fort, he laid out a vision for a more efficient tax system that promises to transform the Indian economy. This announcement not only reflects the government’s commitment to economic reform but also highlights the importance of the Goods and Services Tax (GST) in facilitating a smoother business environment.

Understanding the Next-Generation GST Reforms

So, what do these Next-Generation GST Reforms entail? The reforms aim to simplify the tax structure, making it easier for businesses and consumers alike. They focus on enhancing compliance, reducing tax rates across various sectors, and minimizing the compliance burden on smaller businesses. This is a significant shift from earlier tax regimes that were often complex and cumbersome, especially for small and medium enterprises (SMEs). The reforms will not only streamline tax processes but also promote fairness and transparency within the system.

Working on the Same Principle, the GST Council Has Approved Significant Reforms Today

Following the Prime Minister’s address, the GST Council met and approved a series of significant reforms that align with his vision. These changes are expected to have a multi-sectoral impact, covering various industries from manufacturing to services. By simplifying tax compliance and reducing the overall tax burden, the government is paving the way for economic growth and encouraging entrepreneurship. The aim is to create a tax framework that is not only efficient but also supports the government’s broader economic goals.

Multi-Sectoral Impact of the Reforms

The multi-sectoral nature of these reforms is crucial. They are designed to benefit a wide range of industries, ensuring that no sector is left behind. For instance, the manufacturing sector will see reduced tax rates, making it more competitive on a global scale. Similarly, the service sector will benefit from simplified tax regulations, encouraging more businesses to enter the market. The government is keen on promoting a ‘Make in India’ initiative, and these reforms are part of that larger vision.

Benefits for Small and Medium Enterprises (SMEs)

SMEs are the backbone of the Indian economy, contributing significantly to employment and GDP. The Next-Generation GST Reforms are particularly beneficial for these enterprises. By reducing compliance requirements and tax rates, SMEs can allocate more resources toward growth and innovation. The government’s focus on empowering small businesses demonstrates a commitment to inclusive economic growth, which is essential for sustainable development.

Feedback from Industry Leaders and Economists

Industry leaders and economists have responded positively to the announcement of the Next-Generation GST Reforms. Many believe that these changes will lead to increased investment and economic stability. According to a recent article on Financial Express, experts feel that simplifying the tax structure will encourage more businesses to comply with tax regulations, ultimately boosting government revenue.

The Road Ahead: Challenges and Opportunities

While the Next-Generation GST Reforms present numerous opportunities, there are also challenges ahead. Implementing these changes across such a vast and diverse economy will require careful planning and execution. The government will need to ensure that all stakeholders, from large corporations to small businesses, understand the new regulations and how to comply with them. Continuous engagement with industry representatives will be critical to addressing any concerns that arise during the implementation phase.

Empowering Citizens Through Transparency

One of the key aspects of the Next-Generation GST Reforms is the emphasis on transparency. The government aims to create a more open system where citizens can easily access information about tax rates and compliance requirements. This transparency will not only build trust between the government and businesses but also empower consumers to make informed decisions. Additionally, the government has plans to enhance digital infrastructure to support these reforms, making it easier for people to navigate the tax landscape.

Conclusion: A New Era for GST in India

In summary, the announcement of the Next-Generation GST Reforms by Hon’ble Prime Minister Shri @narendramodi marks a pivotal moment in India’s economic journey. By working on the same principle that the GST Council has approved significant reforms, the government is taking strides toward a more efficient and equitable tax system. With a focus on multi-sectoral benefits and the empowerment of SMEs, these reforms are set to create a more conducive environment for business growth and innovation. As we move forward, the success of these reforms will depend on effective implementation and ongoing dialogue between the government and industry stakeholders.

“`

This HTML-formatted article captures the essence of the GST reforms announcement by Hon’ble Prime Minister Shri @narendramodi while ensuring it is engaging, informative, and optimized for SEO. The use of headings, conversational tone, and relevant links enhances readability and user engagement.

Next-Generation Tax Reforms, GST Council Updates 2025, Modi Independence Day Speech, Economic Reforms India, GST Policy Changes, Multi-Sectoral Taxation Reforms, Digital GST Implementation, Indian Tax System Innovations, Red Fort Address Highlights, GST Compliance Simplification, Prime Minister Modi Policies, Economic Growth Initiatives, GST Reform Benefits, Taxpayer Relief Measures, Fiscal Policy Enhancements, Transparent Tax System, National Economic Development, GST Reform Impact 2025, Trade Facilitation Measures, Revenue Generation Strategies