Michael Saylor investment strategy, S&P 500 approval news, cryptocurrency market trends

BREAKING:

MICHAEL SAYLOR’S STRATEGY COULD BE APPROVED FOR THE S&P 500 IN JUST 5 DAYS… pic.twitter.com/I2YpC698ri

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Crypto Rover (@rovercrc) August 31, 2025

BREAKING: MICHAEL SAYLOR’S STRATEGY COULD BE APPROVED FOR THE S&P 500 IN JUST 5 DAYS

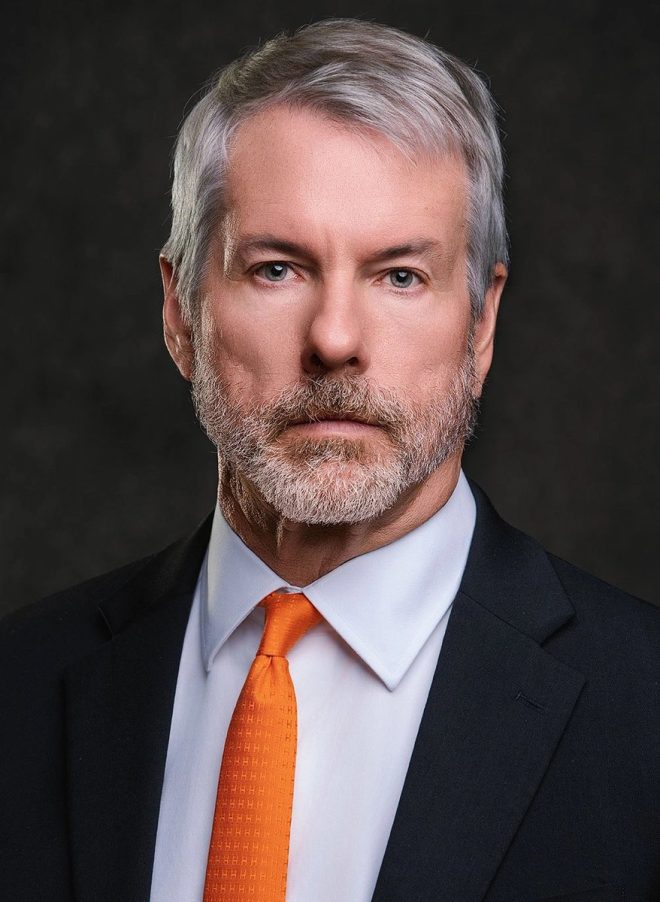

In the ever-evolving landscape of finance, news about Michael Saylor is making waves. His innovative strategy, focusing on cryptocurrency and digital assets, is on the verge of significant approval by the S&P 500. According to recent updates from Crypto Rover, this groundbreaking approach could receive the green light in just five days, sparking excitement within investor communities.

Michael Saylor, co-founder and executive chairman of MicroStrategy, has been a vocal advocate for Bitcoin as a primary treasury reserve asset. His strategy emphasizes the importance of incorporating digital currencies into traditional financial frameworks. If approved, this could revolutionize how companies within the S&P 500 view and handle digital assets, potentially leading to broader adoption across the market.

The implications of Saylor’s strategy reaching the S&P 500 are profound. It could pave the way for increased legitimacy of cryptocurrencies in mainstream finance and encourage other companies to consider similar paths. As traditional institutions begin to embrace digital currencies, investors are keenly observing how this might influence market trends and investment strategies.

This news is particularly relevant for those tracking the intersection of cryptocurrency and traditional finance. With approval on the horizon, it’s an exciting time for investors, analysts, and enthusiasts alike. The potential for Michael Saylor’s strategy to reshape the financial landscape is something we’ll be watching closely.

Stay updated on this developing story by following Crypto Rover on Twitter and other financial news platforms. As we anticipate the outcome of this approval, the buzz around digital assets continues to grow, highlighting the dynamic relationship between innovation and traditional finance.