Ethereum institutional investment, cryptocurrency ETFs growth, ETH treasury companies insights

JUST IN: Over $50 BILLION in $ETH reserves locked up!

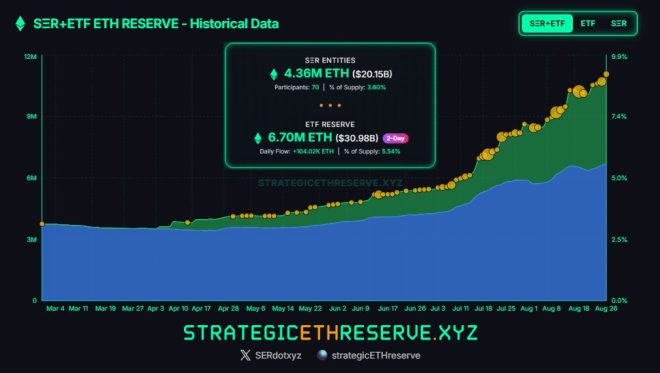

Ethereum ETFs have smashed past $30B, while ETH treasury companies now hold $20B+.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Ethereum’s institutional era is here. pic.twitter.com/UXr1CdxjV5

— Coin Bureau (@coinbureau) August 27, 2025

Over $50 BILLION in $ETH Reserves Locked Up!

Big news in the cryptocurrency world! Recently, it has been reported that over $50 billion in $ETH reserves are now locked up. This significant milestone showcases the growing interest and confidence in Ethereum as an investment. The surge in locked assets indicates that more investors are choosing to hold onto their Ethereum rather than selling, which could suggest a bullish sentiment in the market.

Ethereum ETFs Have Surpassed $30B

Ethereum exchange-traded funds (ETFs) have also made waves, surpassing $30 billion in assets. This impressive growth reflects how institutional investors are beginning to recognize the potential of Ethereum as a valuable asset class. With ETFs providing a more accessible way for traditional investors to enter the crypto space, we can expect this trend to continue as more individuals and institutions look to diversify their portfolios.

ETH Treasury Companies Hold $20B+

In addition to the ETF boom, ETH treasury companies are now holding approximately $20 billion. This accumulation of assets by treasury companies underscores the institutional adoption of Ethereum. As these companies secure large amounts of ETH, it not only demonstrates their trust in the cryptocurrency but also contributes to Ethereum’s overall market stability.

Ethereum’s Institutional Era is Here

With these developments, it’s clear that Ethereum’s institutional era is upon us. The influx of capital into Ethereum through locked reserves, ETFs, and treasury holdings represents a pivotal shift in how institutional investors view cryptocurrencies. As more entities come on board, we may witness further innovations and applications built on the Ethereum network, potentially leading to even greater adoption and market growth.

The landscape of cryptocurrency investment is evolving, and Ethereum is at the forefront of this change. Keep an eye on the developments in this space, as they could significantly impact the future of digital assets.