Bitcoin whale activity, Ethereum investment strategies, cryptocurrency market trends

BREAKING:

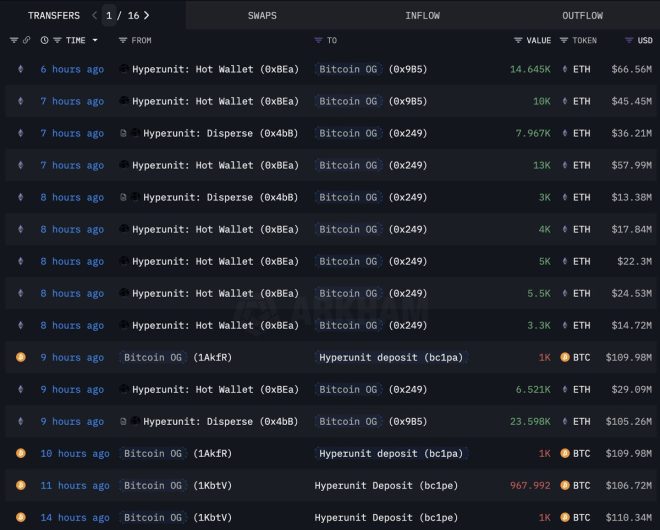

Satoshi-era Bitcoin whale just closed the 96,452 $ETH ($433M) long for $2.6M profit, then flipped into spot.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In the last 14h: sold 3,968 $BTC ($437M) → bought 96,531 $ETH ($443M).

Past week: accumulated 641,508 $ETH ($2.94B). pic.twitter.com/xpviG3YkwQ

— Crypto Rover (@rovercrc) August 27, 2025

Satoshi-era Bitcoin Whale Closes Massive ETH Long for Profit

A recent tweet from Crypto Rover has sent ripples through the cryptocurrency community. A Satoshi-era Bitcoin whale just closed a staggering 96,452 ETH long position, realizing a profit of $2.6 million. This move reflects the dynamic nature of crypto trading and the strategic decisions that can lead to substantial gains.

In a whirlwind 14 hours, this whale sold 3,968 BTC, amounting to $437 million, and swiftly pivoted to buy 96,531 ETH for $443 million. Such rapid trading showcases the ever-evolving landscape of cryptocurrency investments, where timing and strategy are crucial.

Massive Accumulation of ETH

Over the past week, this whale has accumulated a remarkable 641,508 ETH, valued at approximately $2.94 billion. This aggressive accumulation strategy raises questions about market sentiment and the potential future movements of Ethereum. Many traders and investors are keenly observing this whale’s actions, as they often provide insights into broader market trends.

The shift from Bitcoin to Ethereum signals a growing confidence in ETH, particularly as it approaches significant milestones in its development and adoption. As Ethereum continues to evolve, with the recent advancements in scalability and sustainability, it’s no wonder that this whale sees potential in the platform.

Understanding Whale Behavior

Tracking whale activity is essential for anyone looking to navigate the volatile crypto market. These large holders can significantly influence price movements, and their trading patterns often hint at broader market sentiment. Keeping an eye on these whales can help smaller investors make informed decisions in a fast-paced trading environment.

Stay tuned for more updates as the crypto market continues to evolve and reshape the landscape of digital finance.