Bitcoin whale activity, Ethereum long position strategy, cryptocurrency market insights

BREAKING:

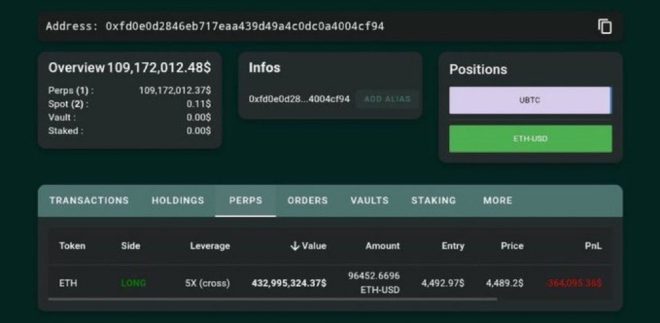

SATOSHI-ERA WHALE SELLS ANOTHER 1,000 BITCOIN TO OPEN $432 MILLION $ETH LONG.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

HE 100% KNOWS SOMETHING. pic.twitter.com/CPToPb6lJr

— Crypto Rover (@rovercrc) August 26, 2025

SATOSHI-ERA WHALE SELLS ANOTHER 1,000 BITCOIN

In a surprising move, a Satoshi-era whale has sold another 1,000 Bitcoin, raising eyebrows across the cryptocurrency community. This transaction is more than just numbers; it signifies a potential shift in market dynamics. The whale’s decision to offload such a significant amount of Bitcoin indicates a strategic play as they open a $432 million Ethereum (ETH) long position.

WHAT DOES THIS MEAN FOR THE MARKET?

When a whale, especially one from the early days of Bitcoin, makes such a bold move, it often signals that they possess insider knowledge or a unique perspective on market trends. The phrase "HE 100% KNOWS SOMETHING" resonates with many investors, stoking speculation about what could be on the horizon for both Bitcoin and Ethereum.

THE IMPACT ON BITCOIN AND ETHEREUM

The sale of 1,000 Bitcoin could impact its price in the short term. However, by shifting focus towards Ethereum, the whale might foresee a bullish trend for ETH. As Ethereum continues to develop and adapt, investors are keen to see how this long position plays out, especially with the ongoing evolution of decentralized finance (DeFi) and non-fungible tokens (NFTs).

STAYING INFORMED

For cryptocurrency enthusiasts and investors alike, staying informed about such major transactions is crucial. Following experts on platforms like Twitter can provide real-time insights into market movements. Check out the original tweet from Crypto Rover for more details about this significant event in the crypto world: Crypto Rover Tweet.

This move by the Satoshi-era whale is just one of many factors influencing the volatile cryptocurrency market. Keeping an eye on similar developments can help you navigate your investment strategy effectively.